Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 5 July 2024 00:53 - - {{hitsCtrl.values.hits}}

|

|

A well-designed MLB with appropriate thresholds and adjustments would provide a mechanism for sharing of upside whilst ensuring the country’s long term debt sustainability is maintained

|

Background

Following successive credit rating downgrades and the loss of access to global capital markets in early 2020, Sri Lanka’s foreign currency reserves steadily declined until by April 2022, usable reserves had declined to near zero levels. On 12 April 2022 the Government implemented a temporary moratorium on the service of Sri Lanka’s official bilateral debt and external commercial debt.

The Government commenced discussions with the International Monetary Fund (IMF) in April 2022 with a view to implementing an IMF-supported macroeconomic reform program to address the root causes of the economic crisis. The IMF’s lending rules require that a country’s debt sustainability is restored, and therefore Sri Lanka simultaneously commenced the process of restructuring its public debt. In accordance with the norms of the global sovereign debt restructuring architecture, Sri Lanka hired globally renowned financial advisors Lazard Frères and legal advisors Clifford Chance to support the process of restructuring the debt.

International Sovereign Bonds (ISBs) account for $ 12.5 billion of face amount of debt, out of total central Government external face amount of debt of $ 37 billion as of end 2023. Accordingly, these bonds were included in the perimeter of debt restructuring. The holders of ISBs organised themselves into two groups to negotiate the restructuring of the ISBs. The larger group, controlling approximately 50% of the aggregate outstanding amount, comprised some of the largest international holders of ISBs, which formed the Ad-Hoc Group, represented by a steering committee advised by financial advisors Rothschild & Co, and legal advisors White & Case. The second group comprised Sri Lankan domestic financial market holders of ISBs, controlling approximately 12% of the aggregate outstanding amount. The local consortium is advised by Newstate Partners and Baker McKenzie.

Process of debt restructuring

The first step in the process of debt restructuring is the preparation of the Debt Sustainability Analysis (DSA) by the IMF. The DSA informs the level of debt relief to be obtained through the process of debt restructuring with the goal of restoring debt sustainability. Sri Lanka is among the first countries where debt restructuring was based on the IMF’s new DSA framework, the Sovereign Risk and Debt Sustainability for Market Access Countries (MAC SRDSF). According to Sri Lanka’s DSA as per the MAC SRDSF model, the following targets would need to be achieved in order to restore debt sustainability in the country.

i. Public Debt to GDP should reduce from 128% of GDP in 2022 to less than 95% of GDP by 2032

ii. Gross Financing Needs (GFN) as a percentage of GDP should reduce from 34.6% in 2022 to less than 13% on average during the period 2027-2032

iii. Foreign currency debt service as a percentage of GDP should reduce from 9.2% of GDP in 2022 to no higher than 4.5% of GDP per annum during the period 2027-2032

Accordingly, in order to restore debt sustainability, Sri Lanka would need to negotiate with its various groups of creditors in order to obtain debt relief in a manner that would enable the above targets to be met.

It is also necessary for Sri Lanka, in line with the commitment made by Sri Lanka to its creditors at the start of this process, to ensure comparability of treatment (COT) between different groups of external creditors. This is a complex process since different creditors provide debt relief through different adjustments.

Official creditors for instance typically provide debt relief in the form of grace periods, maturity extensions, and interest rate reductions without providing a nominal haircut on principal. Most bondholders on the other hand prefer to include some nominal haircut on principal, whilst typically having shorter maturity periods and a market compatible interest rate structure. The magnitude of debt relief is therefore decided on the collective cashflow relief provided through the combination of grace periods, interest rate reductions, maturity extensions, and nominal haircut, if any. Sri Lanka’s debt restructuring has to ensure that the present value of the cashflow relief provided through these different methods of restructuring, is largely comparable between the different external creditors. The Paris Club Secretariat plays a key role in assessing comparability of treatment in different debt restructuring scenarios1.

Sri Lanka’s external debt restructuring process includes the following creditor groups, each of which required separate negotiations whilst ensuring comparable treatment amongst them all;

i) Official Creditor Committee of official bilateral lenders (Co-chaired by France, India, and Japan): $ 5.8 billion (as of end-2023)

ii) China Exim Bank: $ 4.2 billion

iii) Other Official Creditors (Kuwait, Saudi Arabia, Iran, Pakistan): $ 0.3 billion

iv) International Sovereign Bonds: $ 14.2 billion2

a. International sovereign bondholders: Ad-Hoc Group

b. Domestic sovereign bondholders: Local Banking Consortium

v) China Development Bank:

$ 3.2 billion3

vi) Other Commercial Creditors: Under $ 0.2 billion

Any debt restructuring agreement reached by Sri Lanka, including the ISB restructuring, would need to pass two tests:

i) Ability to meet the debt relief targets as set out in the DSA in order to restore debt sustainability, as assessed by the IMF

ii) Ensure comparability of treatment between different groups of creditors, as assessed by the Paris Club Secretariat

The restructuring of Sri Lanka’s official bilateral debt has been addressed in a separate press release4.

Negotiations with the Ad-Hoc Group of Bondholders: Macro-linked Bonds

Technical negotiations on debt restructuring began once the IMF’s DSA was published with the IMF Board’s approval of the program in March 2023. Subsequently, Sri Lanka through its debt advisors shared indicative restructuring treatments with each of its different external creditor groups. These indicative restructuring terms proposed a basis for restructuring debt in a manner that would reach the DSA targets and also address any concerns regarding Comparability of Treatment.

The Ad-Hoc Group (AHG) responded to Sri Lanka’s indicative treatment with a counter-proposal that was subsequently published in the public domain in October 20235. This proposal introduced for the first time the concept of Macro-Linked Bonds (MLB). The AHG took the view that the IMF’s macroeconomic framework, including the GDP estimations that underpin the DSA targets, were overly pessimistic.

The AHG position remains that Sri Lanka will outperform the IMF framework, primarily through a less depreciated FX rate trajectory, and such outperformance will create additional debt service payment capacity, which should be shared between the creditor(s) and debtor. The MLB is designed as an instrument that enables such sharing of upside without compromising debt sustainability, whilst also sharing the downside risk.

The AHG’s view is that in reality, Sri Lanka’s USD GDP will be higher than projected by the IMF, and thereby the DSA targets to restore debt sustainability could in their opinion be reached with a lower level of debt relief. For example, with a higher than anticipated USD GDP figure, the denominator in the public debt/GDP would be higher, thereby enabling the DSA target to be reached with a smaller downward adjustment to outstanding debt (the numerator).

A well-designed MLB with appropriate thresholds and adjustments would provide a mechanism for sharing of upside whilst ensuring the country’s long term debt sustainability is maintained. However, as in many cases, it is the details of such thresholds and adjustments that matter. Sri Lanka rejected the AHG’s October 2023 proposal6 due to concerns regarding the ability of the proposal to meet the DSA targets, concerns regarding asymmetry of sharing of upside but not downside, and concerns regarding the nature of the test which determines any adjustment. Subsequently, Sri Lanka, through its advisors, shared further counter-proposals with the advisors of the AHG, which did not meet their requirements.

Restricted discussions in March 2024

On 27-28 March 2024, the Government of Sri Lanka and the Steering Committee members of the AHG held restricted discussions in London on the restructuring of ISBs7. At such meetings, the parties discussed a fresh proposal submitted by the AHG in March 2024 and a counter-proposal submitted by Sri Lanka, which also included GDP-linked instruments. Sri Lanka’s March proposal was found to be compliant with the DSA as assessed by the IMF, whilst the AHG proposal was not.

Whilst the London negotiations failed to reach a consensus, it was possible to distil four outstanding areas that required resolution;

i. The choice of baseline parameter: Sri Lanka insisted on using the IMF macro baseline as the baseline whereas the AHG used its more optimistic “alternative baseline”.

ii. Inclusion of downside risk: Whilst the AHG only included one downside scenario (where there would be a larger debt relief in case Sri Lanka’s actual macroeconomic performance was below the baseline), Sri Lanka proposed to include additional downside scenarios to ensure appropriate balance of risks

iii. Choice of trigger: The AHG insisted on a single trigger (nominal GDP in USD terms), Sri Lanka preferred to have a dual test which would give Sri Lanka protection in case GDP growth was purely due to currency over-valuation. The AHG did however agree to Sri Lanka’s request to increase the period of the trigger from 2 years to 3 years, giving Sri Lanka more protection.

iv. Share of upside: The AHG proposal saw most of any potential upside being allocated to bondholders, whereas Sri Lanka suggested a more even share of upside.

Joint Working Framework June 2024

Immediately following the finalisation of a Memorandum of Understanding (MoU) with the Official Creditor Committee (OCC) and restructuring agreements with Exim Bank of China on 26th June 2024, the AHG and Sri Lanka resumed restricted negotiations on 27-28 June in Paris. The AHG had submitted a new proposal which made further adjustments to address Sri Lanka’s concerns on the four outstanding points. During the negotiations in Paris, further adjustments were agreed in a Joint Working Framework, as follows:

i. Choice of baseline parameter: The IMF baseline from the June 2024 second review of the IMF- supported program would be applied.

ii. Inclusion of downside risk: Additional downside scenarios were included, providing Sri Lanka with further debt relief in case of an adverse macroeconomic outcome.

iii. Choice of trigger: Sri Lanka had concerns regarding the AHG’s preference for a single trigger due to a perceived risk of nominal USD GDP increasing only based on currency appreciation as opposed to real GDP growth. In the absence of real GDP growth, there could be a risk of higher payouts being triggered without concomitant increase in Government payment capacity. Therefore, a “control variable” which captures real GDP growth as well, was agreed.

iv. Share of upside: The upside thresholds and payouts were adjusted to ensure a more balanced share of upside between creditor and debtor.

The upside/downside trigger is calculated based on average USD GDP during the years 2025-2027. In 2023, USD nominal GDP was $ 84.4 billion. Taking Sri Lanka’s nominal USD GDP average annual growth in the last 10 years, it was 1.5% per year. Taking the last five years pre-pandemic (i.e. 2015-2019), it was 2.4% per year (in 2015 GDP was $ 79.4 b and in 2019 it was

$ 89 b).

Hypothetically, if USD GDP were to grow by 4% each year during the period 2024-2027, the resulting upside trigger, average USD GDP during 2025-2027, would be $ 95 billion.

At a trigger of $ 95 billion, according to the Joint Working Scenario in June and subject to the control variable being satisfied, threshold 3 would be triggered, resulting in a nominal principal haircut reduced from 28% to 20%. At this threshold, the NPV effort at an 11% discount rate would be of 35%.

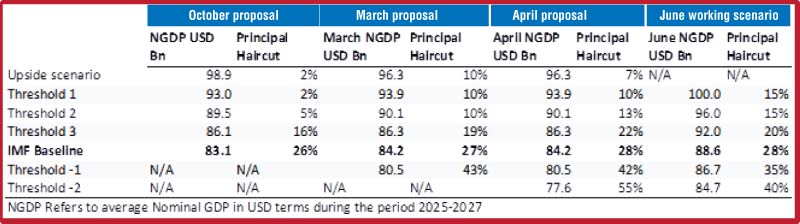

A comparison of the evolution of the principal haircut outcomes for a hypothetical annual nominal USD GDP growth of 4% as the MLB proposal evolved is as in Table 2.

Conclusion

The Joint Working Framework negotiated with the AHG provides a fair balance of risk sharing and sufficiently addresses the concerns of Sri Lanka and the requirements of bondholders. The MLB structure, following the adjustments made through the evolution of the proposed instrument, enables the appropriate sharing of upside between creditors and the debtor, whilst also ensuring that in this process, the debt sustainability of the debtor sovereign is not compromised.

These terms require formal confirmation by the Secretariat of the Official Creditor Committee and the IMF staff in order to confirm conformity with comparability of treatment requirements and compliance with Sri Lanka’s IMF program debt sustainability targets.

Footnotes:

1https://clubdeparis.org/en/communications/page/comparability-of-treatment

2Includes arrears.

3Includes arrears.

4https://www.treasury.gov.lk/api/file/191d21b7-003e-4c94-90e9-8fe1f33d0260

5https://www.prnewswire.com/news-releases/ad-hoc-group-of-sri-lanka-bondholders-submits-restructuring-proposal-301956251.html

6https://www.treasury.gov.lk/api/file/8b9cf8b4-e22d-4e9a-9008-3a0065469692

7https://www.treasury.gov.lk/api/file/bdfd5073-3639-4c0b-bcda-a52d85e33daa