Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 26 February 2019 00:06 - - {{hitsCtrl.values.hits}}

We grew up watching Robin Hood, the saviour of poor. The poor were innocent and the rich were evil. Medieval times. Robin Hood was our hero too.

Times have changed. All rich may not be evil and all poor may not be innocent. There are plenty who have worked hard and got their way from poor to rich. There are others who remain poor due to their lack of determination or hard work. In today’s democracies, where masses decide the fortunes of politicians, Robin Hood is played by politicians to appeal to the masses and gain political power.

Nowadays Robin Hood steals from the poor as well

In any economy, especially in a developing economy, welfare measures are expected to be in place. However this should be done carefully and selectively.

Welfare measures, whether it’s providing free houses or free computer tablets for students, are paid by taxpayers’ contributions. Even if it’s borrowed, such borrowings should be eventually repaid by taxpayers’ money, while politicians may claim credit (there was an interesting debate recently as to which politician provided more free housing for masses).

Tax payer in today’s terms is not only the rich. In fact, everybody is a taxpayer. Actually, as a proportion of income, the middle class probably pays more taxes. The dominance of indirect taxes (VAT, etc.) means that even if you buy a packet of dhal, you pay quite a bit of taxes.

So do small and medium scale strategic businesses, whose viability itself could be affected due to excessive taxes. For instance, even a small export-oriented service company has to pay VAT, Stamp Duty, and Withholding Tax on rent, interest income (a business needs to maintain some excess cash to be operational) and dividends, etc.

Apart from the tax amount itself, the time spent on addressing these cumbersome administrative tasks, fees paid to tax consultants, could be a significant distraction for a small company that needs to focus on international competition for growth and survival.

Therefore it is essential that every welfare measure should be selected prudently.

Theoreticians lack practicality

Then there are the theoreticians and arm chair critics. The ones that always say that we need to reduce welfare measures, shrink public sector and so on. These theories are too theoretical and not practical at all in today’s democracy. How can one expect any political party to implement such measures and get elected to power?

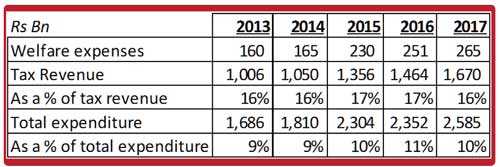

Hence I wouldn’t recommend it at all. In fact, the current annual allocation by the Government for welfare expenses of around Rs. 250 b should be maintained and the annual average increase of around 5-10% should also be maintained (the jump in 2015 should be ignored considering it was an exception). This is quite a substantial allocation considering it is over 15% of the total tax revenue and around 10% of total Government expenditure.

Finding middle ground

The key to welfare measures is to find the middle ground. Welfare measures shouldn’t be too excessive to expand the Government’s budget deficit too much, which would increase borrowings to an unbearable level.

On the other hand, the taxes to finance such measures shouldn’t be excessive which would affect the lifestyles of middle class and the viability of small and medium scale strategic businesses.

Justifiable welfare measures

What kind of welfare measures should be in place? The focus should be on the ones that would help a sustainable development of the country, or ones that need not be in place forever and can be taken out eventually. Therefore it should predominantly be in the form of providing tools for individuals and businesses to develop so that they will be able to stand on their own without any assistance from the Government. In that light, support should be for individuals and SMEs to start their own businesses – whether it’s providing technology, training, raw materials etc. The case of free education is very much a part of it.

Strategic sectors, such as food security would also need such support. In that light, subsidising fertiliser prices, particularly during times of high global prices is sensible. Also, such measures are not pure welfare measures, as it drives economic activity such as farming which effectively provides employment.

Need precise focus for pure welfare measures

As for pure welfare measures such as Samurdhi, free houses, etc., such measures should be confined to the ones that are in the dire need of such support. For instance, elderly who have no support, orphans, widows with children, disabled etc. Therefore a data gathering should be conducted at each Grama Niladhari Division to identify the needy. The provision of free houses could be in the form of a few for each Division (mostly for the backward Divisions). Alternatively they could build villages with many houses, but the recipients should be from many regions as per the above data.

The proposal to provide free tablets should also be evaluated in that manner. Aren’t there better ways to develop education? Providing a tablet doesn’t ensure that it would be used for educational purposes anyway. Providing a few computers to each school and developing computer libraries with supervision could be a much better way to ensure a development in education.

Whether it’s Samurdhi or free houses, it should be provided for the absolutely needy, although it is doubtful whether it’s practised that way.

Beware of bogus Robin Hoods

It is easy for masses to be impressed by Robin Hoods. We all like that character. However the masses should understand whether the wealth is taken from the “not so rich” and redistributed to the “not so poor”. Do they encourage “protest and get” rather than “work hard and get”? Do they actually penalise the hard working individuals and small businesses by taxing them out of business?

The bogus Robin Hoods would emerge to boost their own images and for their own political agendas at significant cost to the economy.

(The writers can be contacted via [email protected])