Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 14 August 2024 00:45 - - {{hitsCtrl.values.hits}}

Sri Lanka Government’s resorting to increased taxes created insurmountable hardships to its people

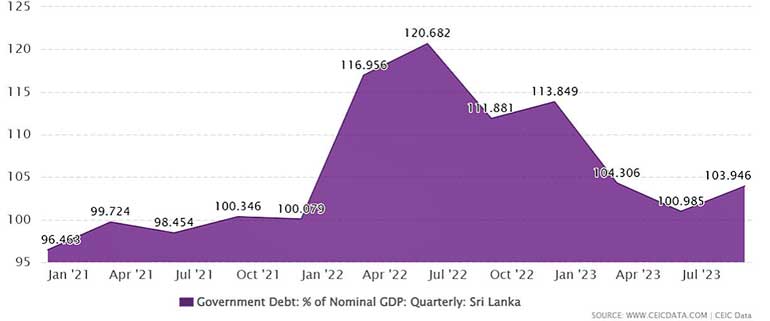

Figure 1

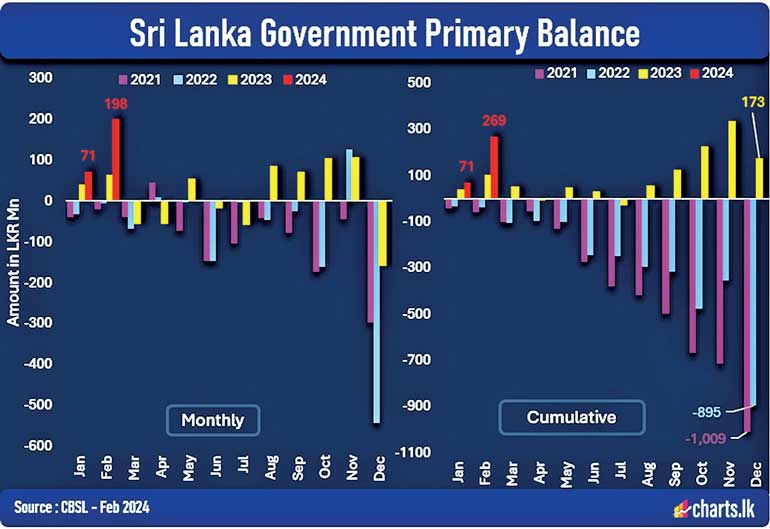

Figure 2

Recently, I have been fortunate to attend a Q & A session of one of the Sydney University Business Schools where I was an alumnus. The theme was the economic revival in the event of future Global Financial Crisis (GFC) and comparison to year 2008 GFC. The panel consisted of eminent professionals of state public sector and academics. This article was aimed to discuss current Sri Lanka economy and the revival process that Government had taken in the context of information gathered at the aforementioned Q & A.

Recently, I have been fortunate to attend a Q & A session of one of the Sydney University Business Schools where I was an alumnus. The theme was the economic revival in the event of future Global Financial Crisis (GFC) and comparison to year 2008 GFC. The panel consisted of eminent professionals of state public sector and academics. This article was aimed to discuss current Sri Lanka economy and the revival process that Government had taken in the context of information gathered at the aforementioned Q & A.

Financial risks

Assessment of financial risks is an important subject to focus. Risks must be assessed and based on the likelihood of occurring, i.e. striking probability and the impact and consequences. Things to be considered in the future are Climate Change, similar to COVID-19 pandemics, influence of geopolitics and trade, wars between nations (Russia-Ukraine, Israel-Palestine), Tsunami, etc. The recent global events show the need to factor and high possibility of occurrences. Therefore, it is imperative not only to allocate contingency funding but to strengthen and build the State machineries to monitor and minimise impacts if they strike, such as cost of living, manage interest rates, social security net.

Geopolitics and nationalised policies

The general consensus was that the 2008 GFC was managed swiftly and with no major consequences due to coordinated effort and participation of nations and states. However, in the event of future GFC(s) as the change of stances of nations i.e. inclination to geo-politicisation, nationalised mindsets have grown since 2008 GFC, will strongly affect and could become major barriers for a genuine participation of nation. Therefore, especially for Sri Lanka, it is better to rethink and reassess inflows of FDIs (not ghost FDIs) and also selecting trading partners with a diversified approach across continents, thus creating independency as opposed to aligned with few friendly neighbourhood countries who have offered aid and assistance at the critical juncture of economic recovery. This subject was discussed in the parliament by opposition that the investments and partnerships hitherto were highly geopolitics.

Debt to GDP ratio

In the present era it was opined that the higher Debt to GDP ratio over 90% is not a major concern provided the primary account balance is maintained positive. This was evident from the Sri Lanka IMF package that IMF agreed to fund more debts in four instalments subjected to one of the conditions stipulating a positive primary account balance. To this effect, SL Government increased both direct and indirect taxes, which was the easy path to camouflage IMF getting the four funding instalments. This further exposed to obtain more funding through multilateral loan arrangements with low interest rates. Sri Lanka Government’s resorting to increased taxes created insurmountable hardships to its people having no empathy.

Figure 1 shows the debt has crossed over 100% in August-September 2021 and continuing, this was quite alarming and Figure 2 shows the decline of primary account balance growing in the negative direction. However, with the introduction of heavy taxes, direct and indirect have seen positive growth. Despite financially showing some positive results, this outcome put massive burden on day to day life of most marginalised, vulnerable communities. Is this the way governments should act completely neglecting the social responsibility?

Law and order

Especially in Sri Lanka context, law and order plays a crucial role for the healthy functioning of all sectors, should be independent and not to be driven, maneuverer by political power. The recent events seen were testimony to political interference and how political power overrides the law and order. The absence of law and order will adversely affect for example, tourism, foreign investments, local industries exposed to foreign markets and the general health of the state. In the absence of law and order the corruptions create headway.

Media

It was also highlighted the role of media including social media. The dissemination of facts should be accurate rather than attracting readers or viewers. In a situation viz: GFC, people get panic and withdraw deposits, selling shares which will further add to the economic destruction. In respect of social media, it is hard to control reporting of news therefore, regulatory and control framework is vital in all media sectors with fact check mechanism in place.

With respect to Sri Lankan media, online, YouTubers, etc., the headlines/thumbnails depict a complete opposite to the content thus misleading viewers and attract more viewers for financial benefits.

Sri Lanka financial crisis

The current state of Sri Lanka economy could be named as a Local FC where it was declared in 2022 as bankrupt by the Central Bank. Prior to declaration, the then government hidden the severity and said on the path of home-grown recovery model. Several named experts of the government vehemently opposed approaching IMF for assistance despite opposition advocating against the home-grown model. As a result of not going for IMF assistance when looming economic destruction was apparent, the resultant led to severe consequences and hit hard the most marginalised and vulnerable of the communities.

Free Trade Agreements (FTA)

As highlighted previously, FTAs play a key role in the recovery and earning foreign reserves. FTAs shouldn’t be based on the influence of geopolitics but need be constructed to have win-win situation and prevent exploiting the other party or nations leveraging current SL economic crisis for their benefits. The recent news item appeared in Daily Mirror 04/08/2024 where India seeks duty concessions on cars, commercial vehicles and machinery under FTA with Sri Lanka. If SL agreed, it has long term consequences binding for importation of parts, maintenance and servicing and more importantly flooding the market with Indian origin machineries.

In such situation’s SL needs to rethink and avoid disastrous consequences thus not favouring a particular country. As the public has low level exposure to SL FTAs contents it is hard to assess pros and cons rather than believing government saying they have successfully signed off so many, in numbers, FTAs, MOUs with dollar value, etc.

Debt Restructuring (DR)

Debt restructuring is a widely spoken subject in the recent days. Government has been accused of giving more pain to the locals in terms of their EPF and ETF haircuts whereas soft pedalling with foreign sovereign debt holders. Although the Sovereign debt holders agreed to 28% haircut on principle value, this agreement is further attached to Macro-Link Bonds (MLB) where it linked to economic growth, GDP. If Sri Lanka achieved higher GDP than at present (as agreed on year 2028) the original 28% haircut may further trim to approx. 15%. The irony of this agreement being negotiated was asymmetric ill-treated Sri Lankan ETF/EPF holders as no such conditions have been incorporated during restructuring local debts. It is also said that once agreed with sovereign debt holders, no future Governments have no provisions for renegotiation and if violated, Sri Lanka become bankrupt second time in a matter of 2-3 years.

Conclusion

As 2024 is an election year the respective parties in their manifestos and economic blueprints should not only explain the path of recovery under the prevailing conditions but must provide and address in the event of future world-wide disasters; pandemics, climate change, geopolitics, recessions, etc.

It is noteworthy to mention the three Supreme Court rulings (a) FR petitions, one against the IGP (b) against the e-Visa deal and recently, expulsion of two SJBs who crossed over to support President. People now tend to believe in the absence of democracy with the two institutions Legislator and Executive, the Judiciary carries out the people power thus making a fertile ground for attract FTAs.

SL needs entrepreneurs who can bring foreign exchange having higher local content rather than for example garment industry hitherto supported the economy. In this industry only the labour component is local and clothing material, machinery and technology contain massive foreign components, although the earned revenue was promising but it had significant outflow of foreign reserves. With the change of government in September, hopefully such anomalies will be addressed effectively.

Digitisation is important arm of the economy to increase efficiency, productivity and curb corruption which is rooted in every sector of the society. On the flip side, for example, Artificial Intelligence redefine humans as ‘not mysterious souls’ anymore, but hackable animals, once hacked easily be engineered without of being aware. In the educational sphere once people get used to IT-applications they become drivers of IT-programs which result blunt intellectuals, thinking capacity. In multiple times it has been said the education system is a house of “parrot learning” but the programs written by few, make a transformational change to be slaves and path in a different dimension to parrot learning. An effective regulatory framework is urgently required to balance the adaptation to AI driven applications and also grow of top-grade intellectuals.

Finally, Sri Lanka should follow a non-aligned pathway in all dealings with nations preventing unfavourable outcomes being selective and aligned with group of countries who are economically strong and powerful. Recently, certain politicians have been advocating to build bridges and open the economy to benefit from those growing economies. Have they identified financial trading risks, haven’t heard such being discussed? My fervent belief is that Sri Lanka with the installation of new government after 21 September will assess benefits and challenges, against risks, short to long term, over a considerable period of 10-20-year horizon.