Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 28 December 2023 00:00 - - {{hitsCtrl.values.hits}}

Executive summary

Sri Lanka is currently facing one of its most challenging economic crises since independence in 1948. The beginning of this can be traced back to the Easter Sunday attacks in 2019, which was further exacerbated by the COVID-19 pandemic. In the face of this economic uncertainty, the Sri Lankan Government undertook a series of measures aimed at stabilising the situation. The economic downturn trickled down to households, where the real impact of the crisis became most evident.

Many Sri Lankan households found themselves grappling with a range of challenges in managing their daily activities. These challenges extended to income management, fulfilment of commitments, and ensuring the well-being of family members.

Recognising the importance of understanding how households were coping with the crisis, the Department of Census and Statistics (DCS) initiated a comprehensive survey. This survey aims to provide a detailed account of the strategies adopted by households to navigate economic challenges. The data collected through this survey will be invaluable in informing Government policies, social interventions, and support mechanisms to alleviate the hardships faced by households across the country.

Overview

The Department of Census and Statistics (DCS) carries out a household survey aimed at understanding how the economic crisis is affecting individuals within the country. This survey is specifically designed to gauge how households are responding to this crisis. Its findings help evaluate the various strategies households are using to cope with the situation.

Additionally, it assesses the alterations in access to crucial services like healthcare, education, and overall living standards brought about by the crisis. By shedding light on the effects of the economic downturn on households, the survey provides insights into the coping mechanisms employed by these households and the shifts in their access to essential services.

1.The impact of the economic crisis on the education sector

Human capital is one of the critical factors in the economic development of a country. It is important to confirm the quality of human capital or the workforce in accelerating economic growth. Since education is a profitable investment for economic and social well-being, the accumulation of human capital through education has been given priority in Sri Lanka’s national policies. Since Sri Lanka is a country that provides free education from kindergarten to university, Sri Lanka has a leading position in terms of literacy in South Asia.

The recent economic crisis has directly and indirectly affected both the country’s economy and the daily lives of its citizens, including its impact on the education sector.

This survey specifically examines how children within the school-going age range (between 3 and 21 years old) have been impacted educationally by the crisis. It explores into understanding the effects on their education and analyses the various strategies these children have employed to mitigate the adverse impacts caused by the economic downturn.

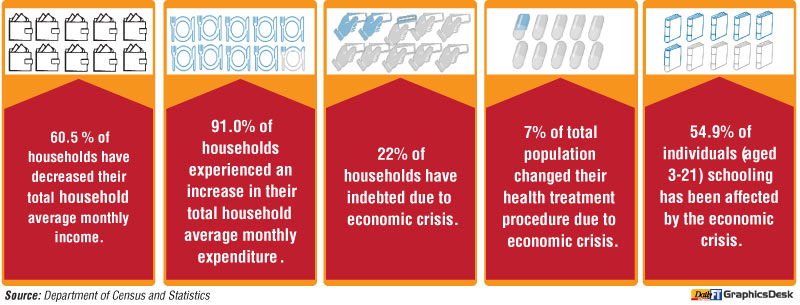

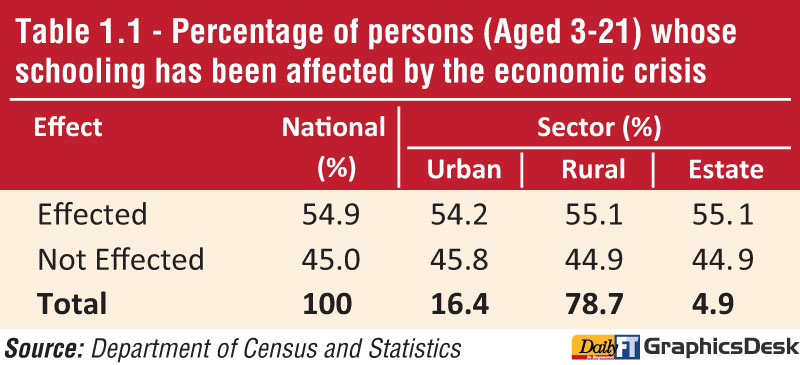

According to Table 1.1 persons (aged 3-21) whose schooling has been affected by the economic crisis is 54.9% at national level and, the rate for the Urban, Rural and Estate sectors are 54.2, 55.1 and 55.1% respectively.

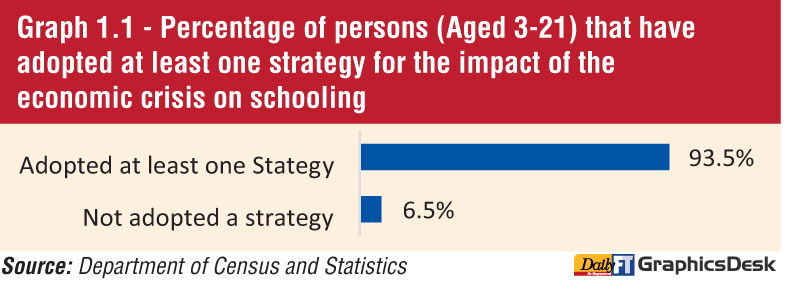

Graph 1.1 illustrates that 93.5% of individuals aged 3 to 21, whose schooling was affected by the economic crisis, employed at least one strategy to alleviate the impact at the national level.

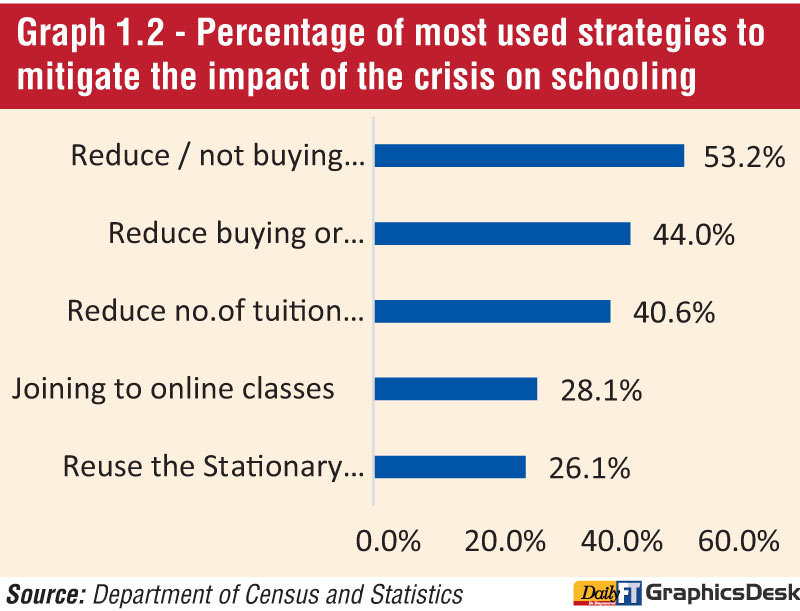

According to the data presented in Graph 1.2, the primary strategy adopted by the majority of individuals affected by the economic crisis (53.2%) was to either reduce their expenditure on new stationery or completely not purchase it. Following closely behind, 44.0% of individuals have decided to cut down on buying new uniforms or stopped purchasing them altogether as the second most prevalent strategy. Additionally, reducing the frequency of attending tuition classes or shifting to online classes emerged as the third and fourth most commonly adopted strategies, with 40.6% and 28.1% of respondents opting for these measures, respectively.

2. The impact of the economic crisis on employment

The economic crisis has significantly affected employment across multiple sectors within the country. As a result, this section of the survey is dedicated to gathering detailed information about the primary and secondary occupations of individuals aged 15 years and above. The data collected in this section aims to capture information about the employed population, following the definitions outlined in the Sri Lanka Labour Force Survey. According to these definitions, individuals are classified as employed if they have participated in any economic activity for at least one hour in the week prior to the survey.

This section of the survey is designed to find the effects of the economic crisis on individuals of working age since March 2022. It specifically aims to capture two main impacts:

Job loss: Gathering information on individuals who lost their jobs as a consequence of the economic crisis.

Changes in current job due to the economic crisis: Reporting any alterations or changes individuals have experienced in their current jobs directly linked to the ongoing economic crisis.

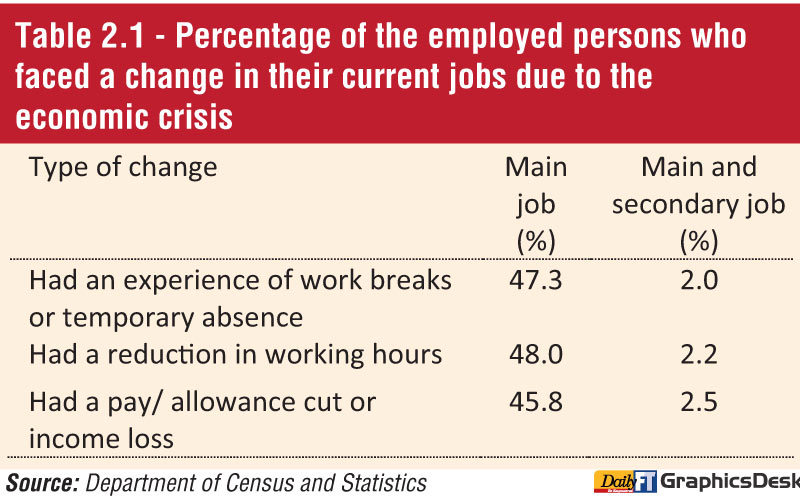

According to the data presented in Table 2.1, nearly half of the employed individuals have encountered changes in their main job currently engaged due to the economic crisis. These changes primarily include experiences such as work breaks or temporary absences, reductions in working hours, cuts in pay or allowances, and income loss.

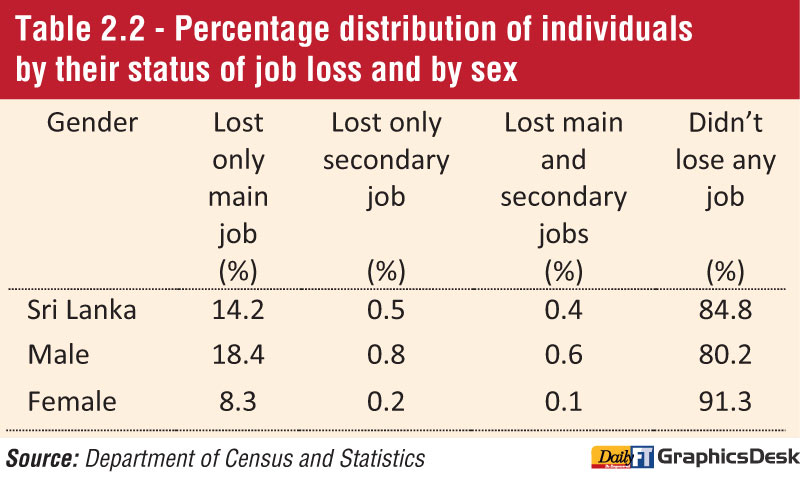

The percentage distribution in Table 2.2 illustrates individuals aged 15 years and older who were involved in economic activities during the economic crisis, categorised by their job loss status and gender. The table highlights that 14.2% of individuals engaged in economic activities experienced job loss due to the impact of the economic crisis.

Moreover, the data indicates a higher percentage of males who lost either their primary or secondary jobs due to the economic crisis compared to females. Additionally, the results demonstrate that 84.8% of individuals did not face any job loss during the crisis period and maintained their engagement in the jobs they held.

3. The impact of economic crisis on persons’ income

The analysis involved a thorough examination to assess the repercussions of the recent economic crisis on various sources of income. The table presented below provides significant insights into the fluctuations of income amidst the economic crisis. It illuminates the diverse array of factors that impact financial stability and people’s means of living when confronted with economic hardships. To measure the effects of the economic crisis on income, the survey involved asking each household member regarding alterations in their income related to their employment, agricultural engagements, or non-agricultural activities. Specifically, participants were asked to indicate whether their income had undergone any changes since March 2022.

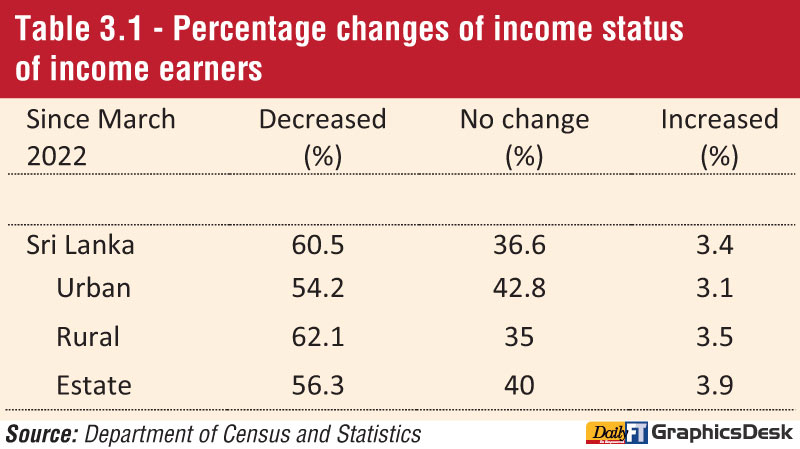

Table 3.1 shows that 36.6% of income earners reported that there was no change in income, whereas nearly 60% reported a decrease in at least one income source. Only a minor 3.4% of income activities reported increases of at least one of their incomes since March 2022. The Table also shows the incidence of change according to the sector level. Across all three sectors behave the same as the country level behaviour in income changes as high percentage of income activities reports decrease of income and very low percentage reports an increase in their income sources.

4.Impact of economic crisis on household income and expenditure and its coping

The impact of the economic crisis on household finances, including both income and expenditure, is significant. This crisis has led to significant changes in how households manage their finances. Many households have experienced a decrease in their income due to various economic factors, which has subsequently affected their spending pattern.

The economic crisis has significantly impacted household income and expenditure patterns, compelling households to make strategic adjustments and implement coping mechanisms to manage their financial stability in these challenging times.

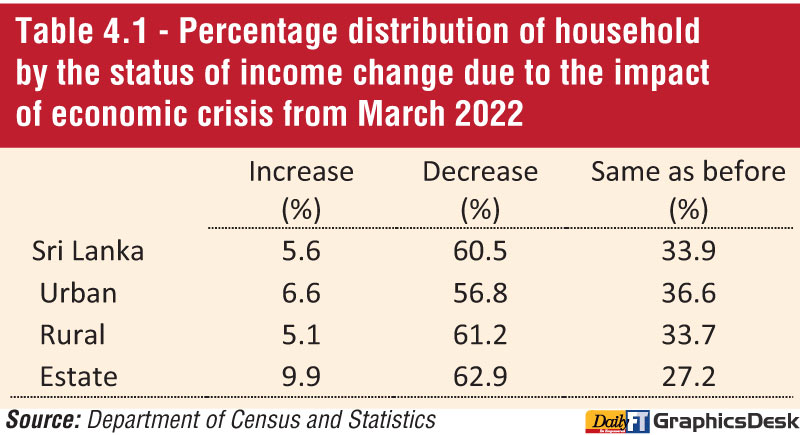

A majority, comprising 60.5% of households, have experienced a decrease in their total income as a result of the economic crisis. Conversely, a small percentage, specifically 5.6% of households, reported an increase in their income within these economic challenges. For approximately 33.9% of households, the aggregate income has remained unchanged despite the crisis.

The economic crisis has brought about diverse effects on household income and expenditure, prompting the adoption of various coping strategies to mitigate its impact.

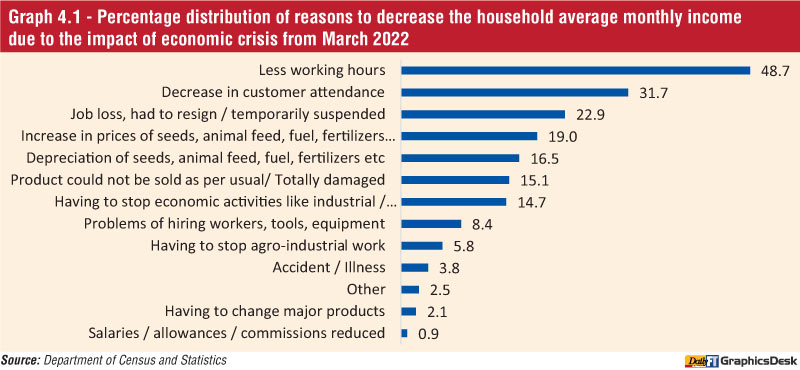

The survey has identified and categorised these impacts and coping mechanisms (Graph 4.1).

Within the economic crisis, numerous households cited various reasons contributing to the reduction in their average monthly income.

According to Graph 4.1, the most frequently reported cause, accounting for 48.7% of respondents, was “Less working hours,” signifying a significant impact on household income. Conversely, “Salaries/allowances/commissions reduced” emerged as the least reported reason among households for the decline in their average monthly income.

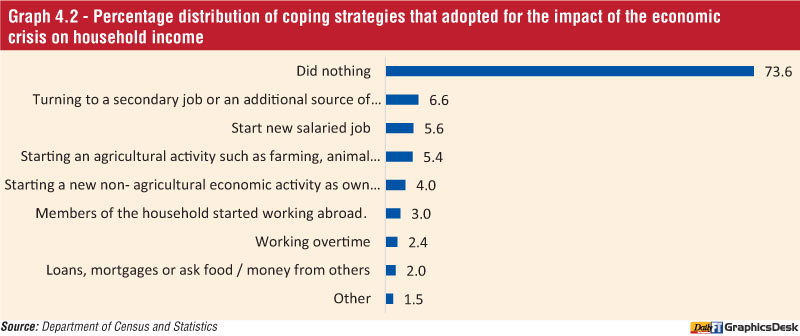

During the income decline, households employed various coping strategies to mitigate the impact of the economic crisis. As indicated in Graph 4.2, the most commonly reported coping strategy, utilised by 6.6% of households experiencing reduced income, was “Turning to a secondary job or an additional source of income.”

Conversely, the least reported coping strategy among these households was “Loans, mortgages, or seeking food/money from others.” It’s noteworthy that a substantial majority, comprising 73.6% of households facing reduced income, did not adopt any specific coping strategy during this period.

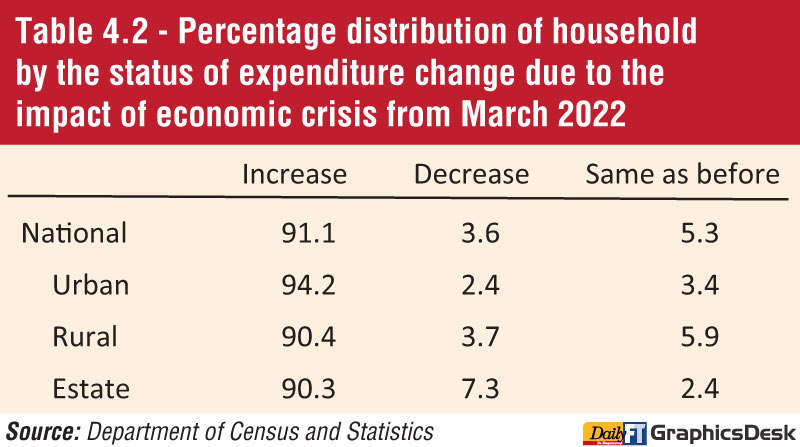

The household expenditure changes due to the impact of the economic crisis. The survey findings offer a detailed overview of how the economic crisis has influenced household spending patterns. The data reveals distinct variations in household expenditure, broadly classified into three primary categories: increase, decrease, and no change.

According to the data presented in Table 4.2, the breakdown of household expenditure changes due to the economic crisis, only 3.6% of households reported a decrease in their total expenditure while a significant majority, founding 91.1% of households, indicated that their expenditure had increased. Approximately 5.3% of households reported that their aggregate expenditure remained unchanged despite the impact of the economic crisis.

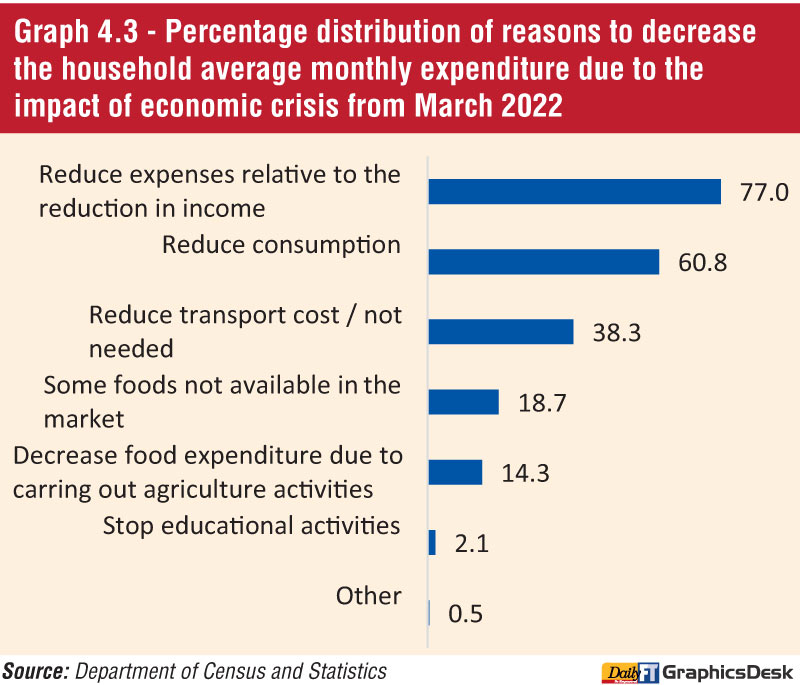

The Graph 4.3 illustrates the categorised reasons contributing to the decrease in household average monthly expenditure due to the impact of the economic crisis since March 2022. This distribution of reasons helps in understanding the factors influencing the reductions in spending and provides insights into the strategies employed by households to manage their finances during these challenging times. The graph displays the percentage distribution of each categorised reason, showing the relative significance of various factors influencing reduced monthly expenditure.

The primary reason reported by households for reducing their average monthly expenditure, accounting for 77.0% of responses, was to align their expenses with the decrease in income. This means that households adjusted their spending habits to match the reduction in their overall income. It’s worth noting that many households provided multiple reasons for decreasing their expenses, as depicted in Graph 4.3.

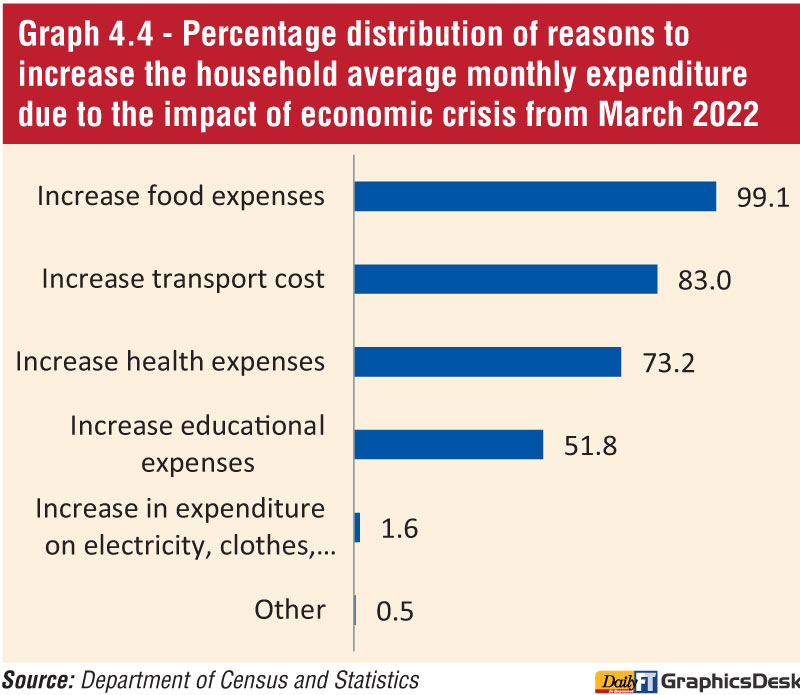

Among households that reported an increase in their average monthly expenditure, the most commonly reported reason, accounting for 99.1% of responses, was the increase in food expenses. This indicates that the majority of these households experienced a rise in their spending specifically on food items. Additionally, it’s important to note that multiple reasons were reported by these households, as shown in Graph 4.4.

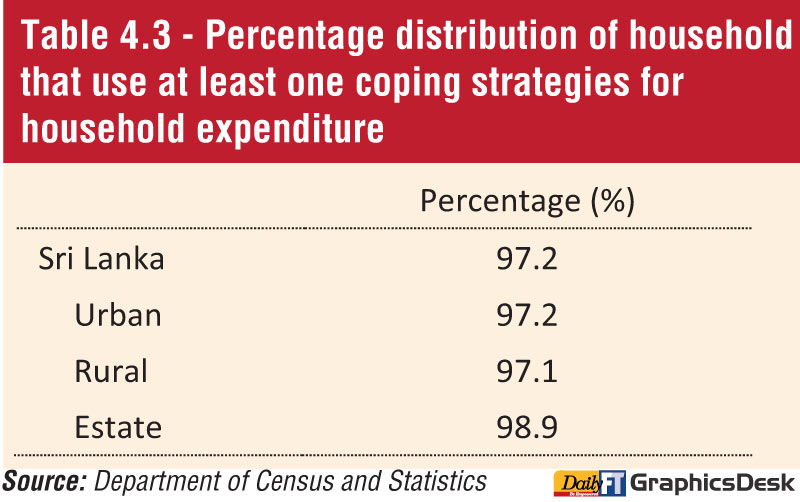

A significantly high proportion, approximately 97.2% of households, employed at least one coping strategy to manage their household expenditure. Many of these households utilised multiple coping strategies, as highlighted in Table 4.3. This suggests that the vast majority of households employed various methods to address and handle their expenses, indicating a diverse range of approaches taken by these households to manage their financial situation.

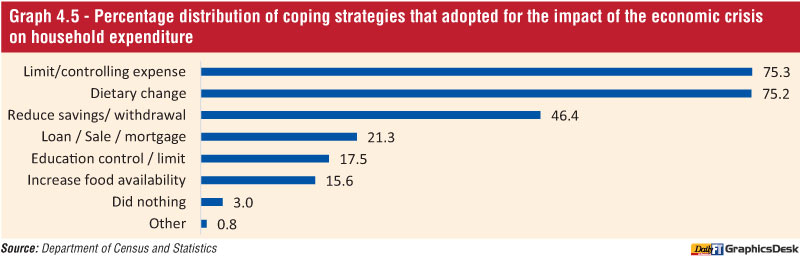

The Graph 4.5 provides a breakdown showing the percentage distribution of households that have implemented these strategies. Notably, the data underscores that “Limiting or controlling expenses” emerges as the most prevalent coping strategy, reported by 75.3% of respondents. It’s essential to note that households often employ multiple strategies simultaneously to cope with the economic downturn and its repercussions on their households’ expenditure.

5.The impact of the economic crisis on health

Economic crises significantly impact people’s health by affecting their access to healthcare. Individuals facing unemployment or reduced incomes often encounter challenges in accessing necessary medical treatments and preventive care, leading to delays or unavoidable gaps in healthcare. Financial barriers may exacerbate pre-existing health conditions by limiting access to essential medications and treatments.

This survey collected information aims to provide a comprehensive understanding of how people’s health is affected during economic crises, supporting policymakers in formulating strategies to address healthcare challenges arising from financial hardships.

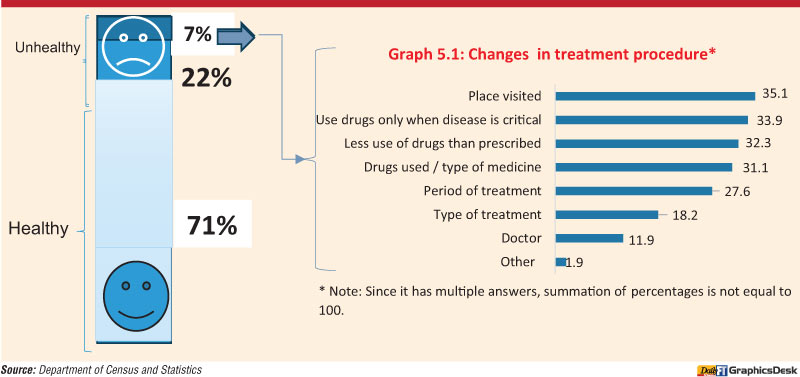

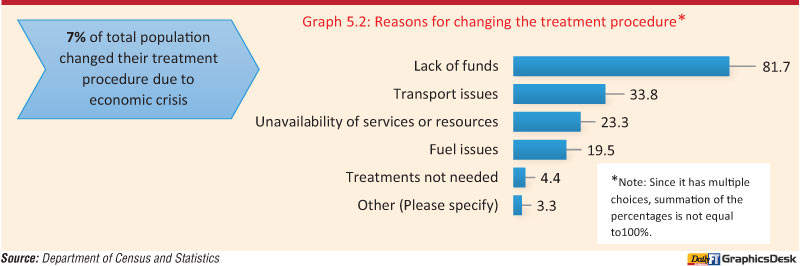

The survey findings reported that approximately 29% of individuals have experienced some form of illness. Among these individuals, 7% of patients have changed their treatment procedures as a direct result of the ongoing economic crisis. This data highlights a significant portion of the population being affected by health issues during this period, with a noteworthy portion adjusting their treatment due to the economic challenges they’re facing.

Among the patients who altered their treatment procedures due to the economic crisis, 35.1% have changed their treatment location and 33.9% resorted to using drugs only when their illness reached a critical stage. These statistics showcase the diverse ways in which patients adjusted their treatment approaches in response to the economic challenges they encountered, encompassing changes in treatment settings, medications, and usage patterns based on necessity.

Patients facing challenges due to the crisis have employed multiple strategies to manage their healthcare needs effectively. These strategies encompass various approaches aimed at mitigating the issues caused by the economic downturn. The combination of approaches allows individuals to adapt to their specific circumstances, ensuring they receive necessary care while managing the financial constraints imposed by the crisis.

Among patients who altered their treatment procedures, a significant majority (81.7%) reported insufficient funds as the primary reason for this change. Following closely, the second and third most reported reasons for changing treatment procedures were transportation issues and the unavailability of services or resources.

6.The impact of the economic crisis on the indebtedness of the households

During an economic crisis, household indebtedness can sharply rise due to the hardship experienced by households facing income reductions, job losses, and financial uncertainties. This often compels households to borrow more to cover essential expenses, leading to increased debt burdens. Repayment challenges emerge due to the inability to meet financial obligations, potentially resulting in late payments, defaults, or reliance on credit. High levels of household debt induce stress and financial strain, impacting mental well-being. The crisis might also lead to adverse consequences such as foreclosures or bankruptcy filings as households struggle to manage their debts. Efforts to manage this situation typically involve policies aimed at debt relief, financial education, and economic stimulus measures to mitigate the impact on households and support for economic recovery.

The survey findings indicate that currently, 54.9% of households in Sri Lanka are currently indebted. This statistic highlights that over half of the households in Sri Lanka have some financial obligations or outstanding debts that they are managing or repaying. This level of indebtedness can have implications for household finances, budgeting, and financial stability, especially during periods of economic challenges or uncertainties.

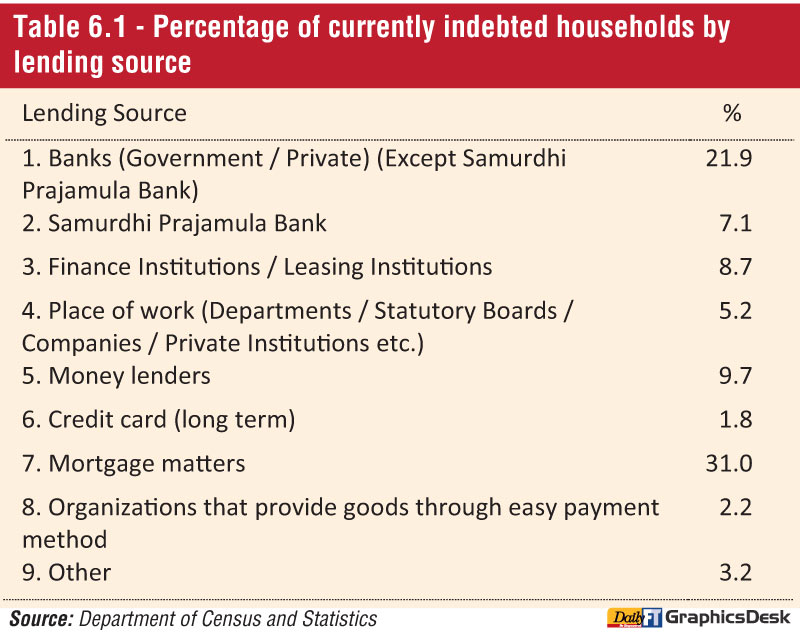

Table 6.1 shows the percentage distribution of currently indebted households in Sri Lanka based on different lending sources. The table explains the diverse lending sources through which currently indebted households in Sri Lanka have acquired financial obligations. It shows the percentage breakdown of indebtedness attributed to each lending source. For instance, the highest proportion of indebtedness is from mortgage matters (31.0%), followed by banks (21.9%) and money lenders (9.7%). Each category represents the share of indebted households based on the specific lending source they have utilised, offering insight into the variety of financial institutions and channels that contribute to household indebtedness in Sri Lanka.

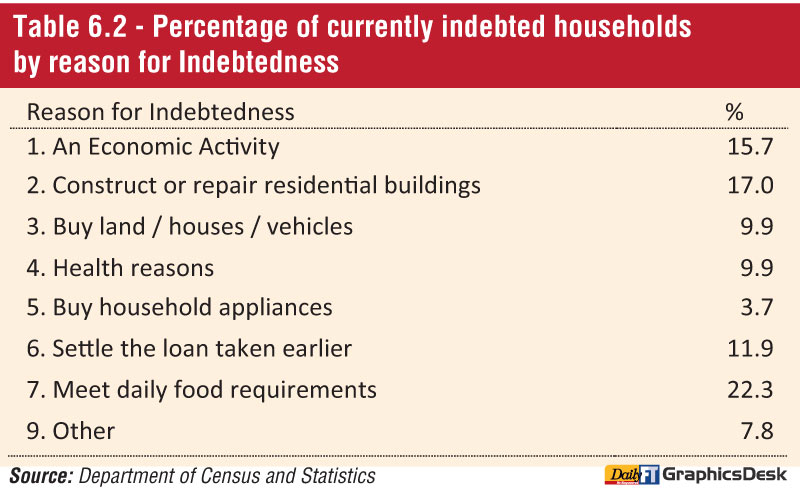

Table 6.2 provides a detailed breakdown of household indebtedness in Sri Lanka, showing various reasons for financial obligations. Notably, 22.3% of indebtedness arises from loans taken to meet daily food needs, highlighting severe financial constraints in fulfilling basic necessities.

Additionally, 17.0% of indebted households acquired loans for constructing or repairing residences. Understanding these factors is vital for policymakers and financial institutions to address these challenges and create interventions to ease economic burdens.

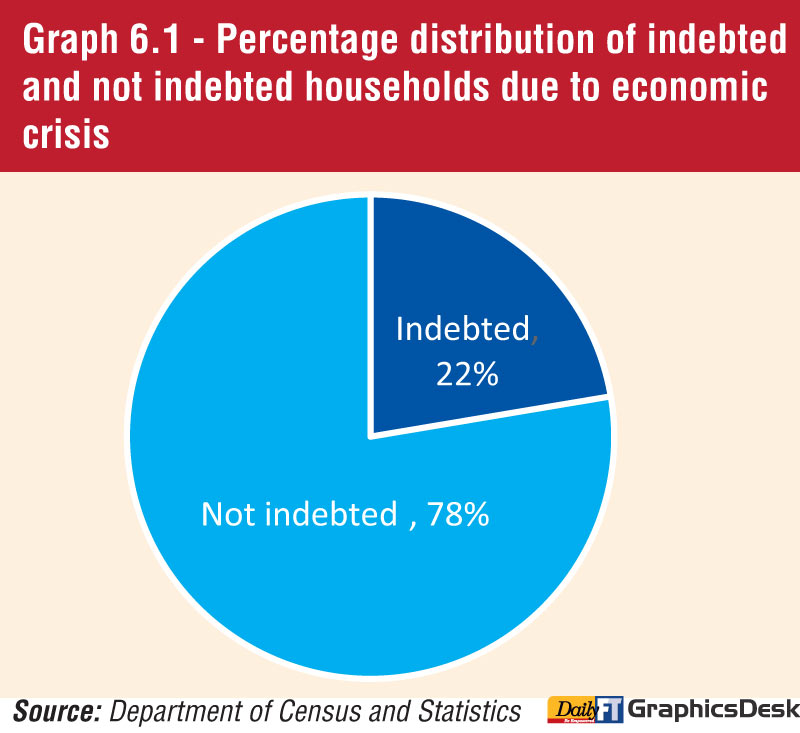

The pie chart represents the percentage distribution of households affected by the economic crisis in terms of their debt status. In this case, 22% of households are shown as indebted, while the larger percentage, 78%, are depicted as not indebted.

7.Household food consumption

The Food Consumption Score (FCS) is a measure used to evaluate a household’s current status of food consumption. It serves as a proxy indicator for assessing how easily households can access food and is a standard indicator used by the World Food Programme (WFP) to categorise households into various groups based on the sufficiency and quality of the foods they consumed in the prior to being surveyed.

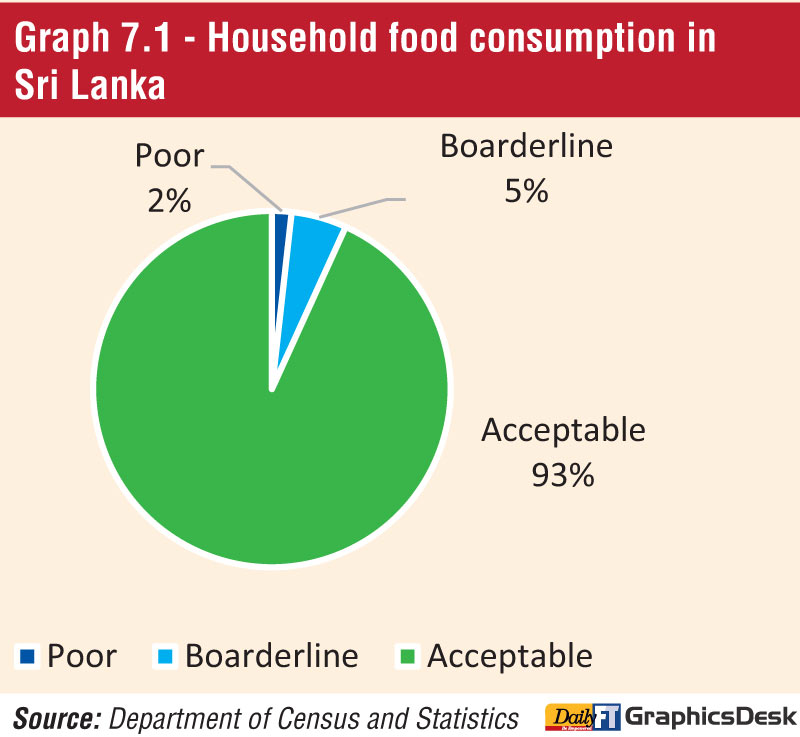

Nationally, the average Food Consumption Score (FCS) was found to be 70.2. FCS is a composite indicator that considers the dietary diversity, frequency and nutritional importance of the food groups consumed by the households. Based on this indicator, 93% of the households were categorised as having acceptable food consumption while 7% had borderline or poor consumption.

Reduced Coping Strategy Index (rCSI) of Sri Lanka

According to the World Food Program (WFP), reduced Coping Strategy Index (rCSI) is an indicator used to compare the hardship faced by households due to shortage of food. Results of the survey indicate that rCSI of Sri Lanka is 7.48. It is 6.48, 7.66 and 8.05 for Urban, Rural and Estate sectors respectively.

Higher rCSI values signify more acute challenges in dealing with food shortages and meeting basic nutritional needs within each specific sector. A higher rCSI score indicates that households are employing more severe coping mechanisms due to food shortages. It can include actions like relying on less preferred and less expensive food options, borrowing food or seeking assistance from relatives or other sources, reducing the number of meals consumed in a day and taking drastic measures like restricting the consumption of adults so that small children can eat adequately. These measures often involve compromises in the quality, quantity, and regularity of meals, highlighting the need for interventions and support to alleviate food shortages in these areas.

Livelihood-based coping strategies

Households not only adapted their food consumption habits but also employed diverse livelihood-based coping strategies to address the challenges of inadequate food access and availability. Some of these strategies may have adverse effects on their income generation and ability to respond to future shocks. The survey revealed that 21.9% of the households nationwide had implemented crisis strategies to address the scarcity of food or financial constraints. This was followed by stress strategies, and it is about 19.2%. Notably, in the rural sector, this crisis strategy used proportion rose to 22.8% of households.