Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 18 July 2023 00:31 - - {{hitsCtrl.values.hits}}

By Reliance Capital

The Employees’ Provident Fund (EPF) was established under Act No. 15 of 1958 and is currently the largest and most widespread Social Security Scheme in Sri Lanka.

With an asset base of Rs. 3,492 billion as of the end of 2022, the EPF is a little ‘Peace of Mind’ for the employees of private sector firms, state sponsored corporations, statutory boards, and private businesses.

The aim of the EPF is to assure financial stability to the employee in the retirement stage of life and to reward the employee for his or her role in the economic growth of the country.

EPF administered by

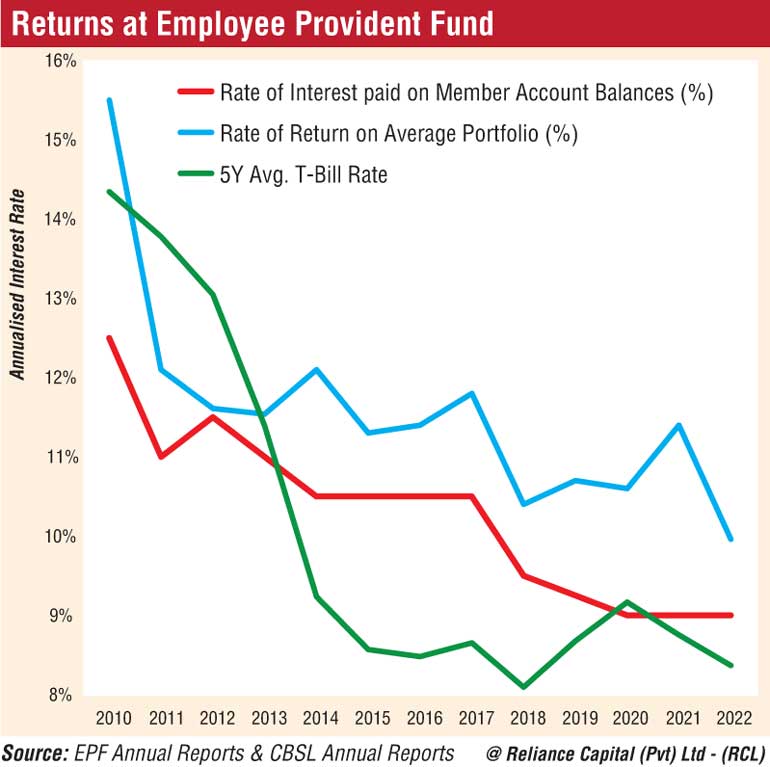

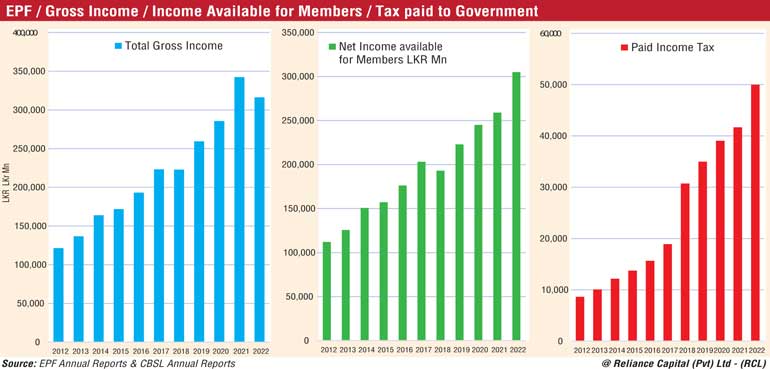

Returns at Employee Provident Fund

In terms of Section 5 (1) e. of the EPF Act, the Monetary Board may invest much of the money of the Fund as are not immediately required for the purposes of this Act in such securities as the Board may consider fit and may sell such securities.

Accordingly, on behalf of the Monetary Board, EPF Department of the Central Bank of Sri Lanka manages EPF funds with the view of providing maximum retirement benefits to members through prudent and innovative management of the fund.

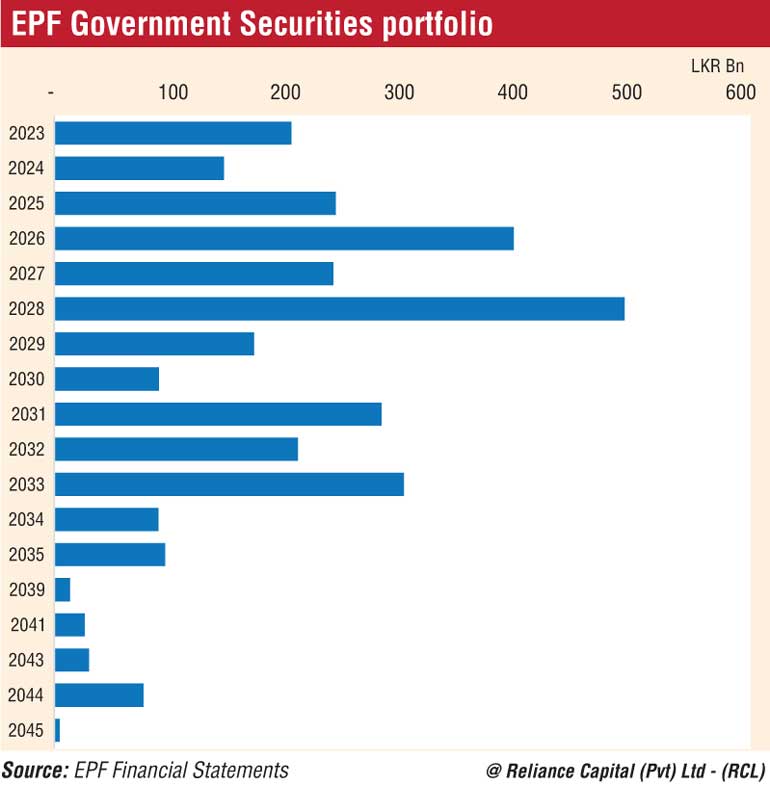

EPF Government Securities portfolio

The investment policy of the Fund continued its focus on providing a long-term ‘positive real rate’ of return to the members while ensuring the safety of the Fund and maintaining a sufficient level of liquidity to meet refund payments and other expenses of the Fund.

The Monetary Board (MB) of the CBSL as the custodian of the Fund is overseeing the risk management of the EPF. Accordingly, the risk management activities of EPF are also considered as an integral part of the Risk Governance structure of the CBSL which focuses on both financial and non-financial risks pertaining to all its activities including EPF’s activities.

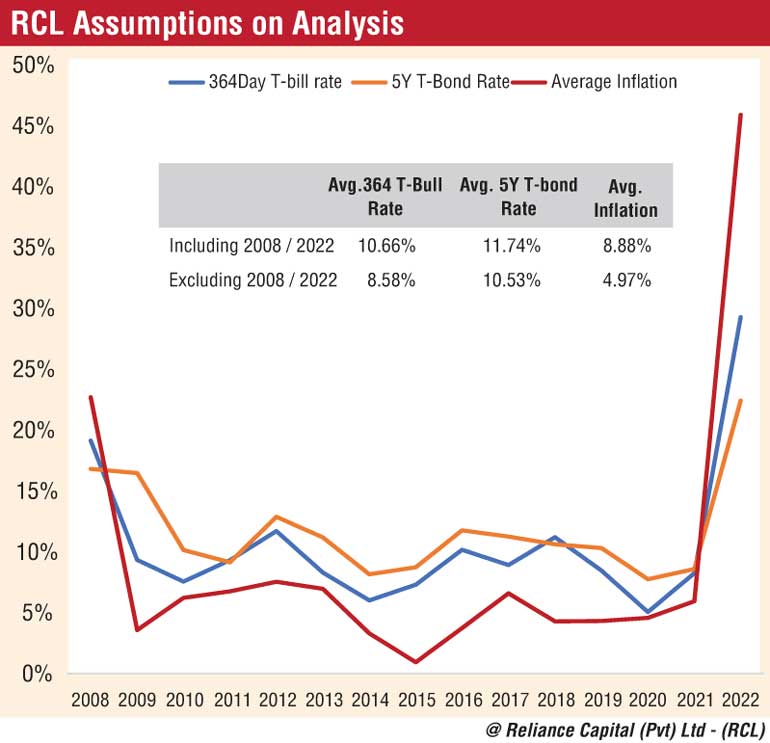

RCL assumptions on analysis

To calculate the loss, we considered only coupon income, which is the biggest portion of the total income to EPF. Since the new Bond is to be swapped at face value – to – face value, only the coupon income will change and the accrual of discount or premium of the existing portfolio will not be affected.

The entire analysis is based on the future cash flows generated from coupons and principal maturities since the portfolio is held to maturity portfolio (HTM).

Face value indicated by each year in financial (EPF 2022) is assumed to be maturing at the end of the year (usually it matures during the year on different dates).

The coupon rate of EPF portfolio for each bond was assumed in parallel with CBSL’s issued bonds to market (e.g. EPF’s coupon rate for the bond maturing in 2024 is derived from simple average coupons issued by CBSL to the entire market for 2024.

Cashflows were compared for the period of 2023 to 2038, but the cash flows of the current EPF bonds that mature after 2038 to 2045 were also considered to calculate the income for the current status.

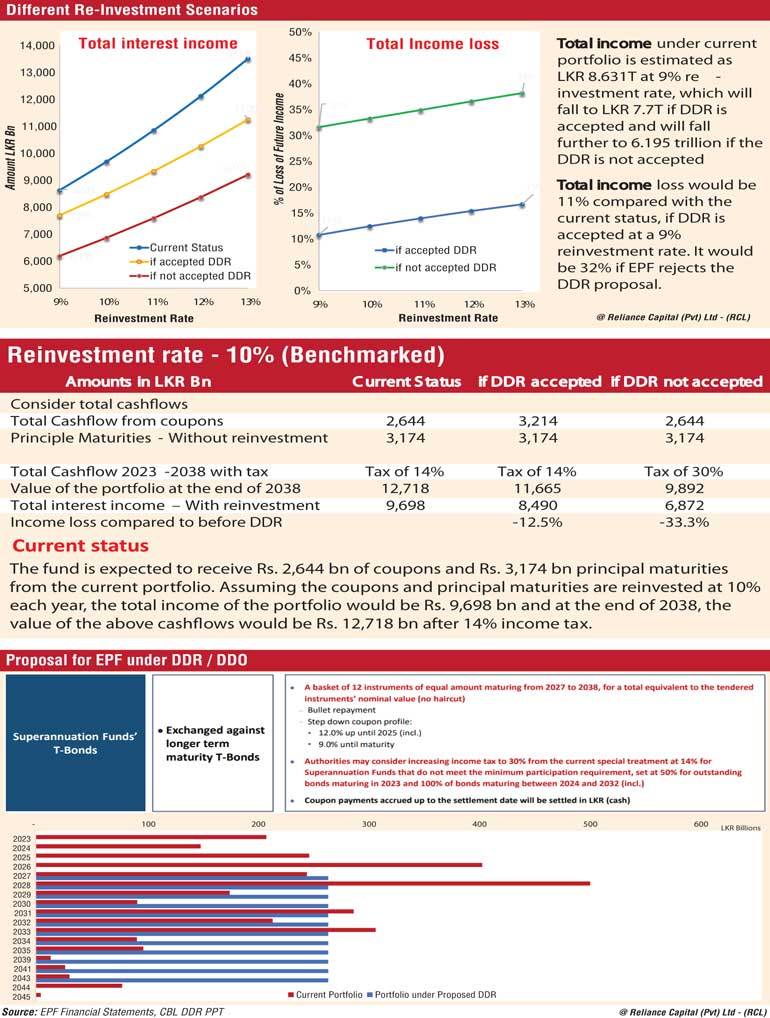

Loss or the profit to EPF due to DDO/DDR will significantly be dependent on the reinvestment rate for coupon and maturity receipts in the period up to 2038. Since forming an opinion on the future interest rate is very subjective, we considered re-investment rates ranging from 9% to 14% for our analysis. Each year cash flow of Coupons and principal maturities are assumed to be reinvested at the reinvestment rate for another year and thereafter accounting compounding impact of interest rates. Coupon income will also be taxed at the current 14% if DDR is accepted and otherwise at 30%. DDR/DDO is planned for the next 15 years (2023-2038).

CBSL expects inflation to be averaged around mid-single digit.

The two extreme years (2008 & 2022) are excluded in arriving at the average rate calculation.

If the proposed DDR is accepted

If the proposed DDR is accepted

The fund is expected to receive Rs. 3,214 billion of coupons and Rs. 3,174 billion principal maturities from the restructured portfolio. Assuming the coupons and principal maturities are reinvested at 10% each year, the total income of the portfolio would be Rs. 8,490 billion and at the end of 2038, the value of the above cash flows would be Rs. 11,665 billion after 14% income tax. Total income would be less compared to the current scenario as principal payments of nearly Rs. 1,009 billion which should mature during 2023-2027 have been deferred.

If the proposed DDR is not accepted

If the fund does not accept the DDR, a 30% tax rate will be applicable. That would reduce the total income from the current Rs. 9,698 billion to Rs. 6,872 billion and the portfolio would fall to Rs. 9,892 billion.

Different re-investment scenarios

Total income under current portfolio is estimated as Rs. 8.631T at 9% re[1]investment rate, which will fall to Rs. 7.7T if DDR is accepted and will fall further to 6.195 trillion if the DDR is not accepted Total income loss would be 11% compared with the current status, if DDR is accepted at a 9% reinvestment rate. It would be 32% if EPF rejects the DDR proposal.