Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 31 January 2023 02:35 - - {{hitsCtrl.values.hits}}

We write in response to multiple false allegations raised in the article titled: ‘Misleading Responses by JAAF, TEA and Other Exporters on Illegal Foreign Exchange Transfers’ published in the Daily FT on 23 January 2023.

The following claims made by the author are explicitly or implicitly false, inaccurate and misleading:

1. Apparel exporters ‘repatriated’ only 14% of the export income

2. Apparel firms are “stashing” more than 80% of their export proceeds overseas

3. Apparel exporters have asserted that approximately 41% of their export income was utilised for petroleum payments

4. “It is general knowledge that apparel exporters procure only a few inputs from local suppliers and the rest is all imported”

5.“Garments constitute a technologically backward process resulting in low wages and physically destructive lengths and intensities of the workday” and apparel producers have not invested sufficiently in technology

6. Apparel producers have not invested sufficiently in vertical integration and domestic production of yarn and machinery

7. Apparel manufacturing in Sri Lanka operates on an exploitative model

The author has also relied extensively on a report produced by Global Financial Integrity to falsely imply that Sri Lankan apparel firms are responsible for some $ 40 billion being “stashed away through non-repatriation and trade misinvoicing” between 2009-2018.

JAAF notes that the author neglected to mention the GFI report’s own admissions that:

By the author’s own admission, the report also “limits analysis to trade based on Open Accounts and did not consider services and trade based on Letters of Credit which have greater traceability. The latter accounts for a large share of Sri Lanka’s total international trade.” The author assumes that GFI’s findings would be consistent in LoCs as well, however no evidence is provided to support that assumption.

JAAF reiterates that its membership has always maintained strict compliance with all applicable legal requirements, particularly related to requirements imposed by the Central Bank of Sri Lanka to repatriate export proceeds within 180 days of the date of export.

Companies have to notify their bankers of the amount of foreign currency required for authorised payments and the balance has to be converted on the seventh day of the following month, after accounting for approved foreign currency payments including payments to raw material suppliers both locally and overseas.

Compliance by apparel exporters has been confirmed by both the continuous CBSL Audits of export proceeds and import costs of apparel producers, and the explicit statements made again last week, by CBSL Governor.

Prior to the implementation of these regulations in 2021, the industry was making compulsory disclosures under the Gazette No. 2184/21 of July 2020 which mandated that the “total value of goods exported in a quarter and the foreign remittance received” should be lodged with the BOI every quarter.

1. False claim: CBSL Governor declared that apparel exporters ‘repatriated’ only 14% of the export income

This is factually incorrect in that the Governor explicitly referred to the conversion of export proceeds, not repatriation. The author shows a lack of basic knowledge by conflating the two functions.

This is a significant error given that ‘repatriation’ refers to remittances into the country as against the value of exports indicated on a Customs Declaration (CUSDEC) whereas conversion refers to the balance foreign currency, that is converted into LKR after the exporter has made the permitted foreign currency payments.

Contrary to what the author has claimed, the CBSL Governor never raised an issue with the industry’s compliance on repatriating these earnings. This has solely been the creation of the author.

The same was reconfirmed by the Governor of the CBSL during the Monetary Policy review on the 25 January 2023, and again at the CoPF meeting the same day. At the latter, the Governor made explicit reference to the article as a “misinterpretation” and provided a detailed explanation on the process, monitoring mechanisms and the requirements for both inward remittances and for conversions.

The Governor’s response offered a clear rebuttal to the author and clarifies allegations over the Global Financial Integrity report and his views on this report, and the ability of an exporter to keep money overseas.

Given that merchandise exports – unlike services – must be shipped against a CUSDEC, there is a clear and credible record of the value of these exports. Moreover, all relevant records of these transactions have been provided to both the BOI – which maintains direct oversight over a majority of Sri Lankan apparel firms – as well as the CBSL. Hence the author’s claim that apparel firms are failing to repatriate export proceeds is provably false.

JAAF reiterates its position that our membership abides by the regulations on repatriation of export proceed and conversions thereafter. This process is strictly monitored through the banking system and as the Governor has confirmed, is being adhered to.

2. False claim: Apparel firms are “stashing” more than 80% of their export proceeds overseas

It is inconceivable from purely a logistical standpoint for export proceeds in the quantities claimed by the author to practically be held overseas.

Sri Lankan apparel firms in particular are linked to some of the world’s largest brands. These brands require producers they work with maintain strict compliance with their internal standards and utilise automated Enterprise Resource Planning (ERP) systems for managing purchasing and maintaining real-time visibility across the supply chain.

Apparel firms also operate on thin margins and tight deadlines. All parties in the supply chain – from the fabric producers who provide the raw materials for Sri Lankan apparel firms to the final buyers and retailers –have a strong incentive to ensure that every single dollar in the cost structure in their supply chain is carefully monitored and accounted for.

Typically, buyers even nominate which raw material suppliers which can be utilised. Such nomination is decided based on considerations of cost and quality, and are regularly evaluated to ensure that the best margins are obtained.

Systematic misinvoicing – particularly in the manner and scale alleged by the author – would therefore be impossible to conceal from supply chain partners and relevant authorities. Given that Sri Lanka is in competition with nations that have the advantage of economies of scale and significantly lower costs of production, firms that deceptively inflate their raw material costs through intentional misinvoicing would obviously lose market share to those that producers that demonstrated lower raw material costs.

Given also that Sri Lankan apparel firms import approximately half of their raw material inputs and that these purchases need to happen at a high frequency in a flexible and agile manner in order to keep pace with fluctuations in global demand, without compromising efficiency and avoiding wastage of raw materials, the author’s allegations of 80% of foreign income being kept overseas is a logistical impossibility – especially relative to drastic fluctuations in cost of operations over the past three years.

Basic cash flow requirements make it necessary to have export funds available for use. To suggest that the majority of export proceeds can be left overseas and that businesses presumably are then borrowing locally at Sri Lanka’s high-interest rates to keep the business operational, simply shows a lack of understanding about finance and business management.

3. False Claim: Apparel exporters have asserted that approximately 41% of their export income was utilised for petroleum payments

Apparel firms have never stated this. While fuel is a significant component, there were numerous other domestic suppliers which also had to be settled in foreign currency. These include foreign currency payments for raw materials supplied by indirect exporters for conversion into direct exports and payments to companies engaged in processes such as printing, washing dyeing and other subcontracting to name a few.

4. False claim: “it is general knowledge” that apparel exporters procure only a few inputs from local suppliers and everything else is imported

The author’s general knowledge is significantly out of date. Sri Lankan apparel firms generate $ 5 billion in export revenue, while procuring the equivalent of $ 1.5 billion in raw materials locally. This includes a range of raw materials, including fabrics, laces, elastics, bra cups, hooks and eyes, labels, buttons, threads, etc. These deemed exporters in turn convert a certain percentage of their foreign currency payments. To get a complete picture of the value of exports converted, it’s necessary to look also at the data from these companies. As noted by the CBSL Governor, this process is currently underway.

Describing the apparel industry’s local inputs like knitted fabric as being “few” also shows a lack of understanding of basic industry dynamics, given that fabric tends to account for one of the largest value-added components in apparel supply chains.

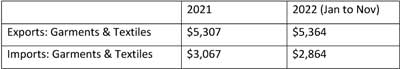

Had the author done her research she would have noticed that per the CBSL data, whilst exports of textiles and apparel have grown over the last year, the value of imports has dropped as below:

This clearly indicates increased purchasing of local raw materials in line with the strategy of JAAF to invest in greater vertical integration and establish value-adding capacity within Sri Lanka to maximise utilisation of GSP+. The establishment of the Eravur Textile Zone is the latest in a long series of investments by domestic apparel firms in that regard.

5. “Garments constitute a technologically backward process resulting in low wages and physically destructive lengths and intensities of the workday” and that apparel producers have not invested sufficiently in technology

Sri Lankan apparel manufacturers have been first movers in investment and uptake of technology. Investments in automation have already yielded significant returns, enabling Sri Lankan apparel to compete globally with a fraction of the labour intensity seen across Asia. These include multiple facets from automation of fabric cutting to sewing line attachments that eliminates manual trimming of threads.

Sri Lanka is also on the forefront of 3D and virtual development enabling shorter lead times and increased value addition. This has also created an influx of high-end service jobs leveraging on Sri Lanka’s expertise in apparel manufacturing. In many instances, front-end apparel jobs previously done in the USA and Hong Kong are shifting to Sri Lanka due to knowledge and expertise of the sector locally.

Investments that leverage technology to channel greater productivity are only a part of Sri Lanka’s powerful apparel value proposition. Sri Lanka also leads the world in sustainable apparel including the development of more sustainable fabrics, and dyes, and the establishment of some of the most stringent environmental standards in the world.

Regarding the author’s broader argument that Sri Lanka should prioritize the development of other (undefined) industries over apparel, JAAF wishes to state only that such a decision needs to be taken at a national level, and supported by affirmative policy decisions, Free Trade Agreements, capacity building, and of course, investment and infrastructure development.

At present, no other industry that has emerged on the scale and success of the apparel industry in its contribution to the Sri Lankan economy. Successive governments have expressed their commitment to driving such a development agenda, but none have been able to even articulate how such a model would operate.

In the interim or the absence of such actions, JAAF reiterates that our membership remains committed to manufacturing the highest quality products at the best price. Crucially we will do this without compromising our obligations to provide fair wages and safe and healthy working conditions for employees, especially considering that the upholding of those obligations forms a core component of Sri Lankan apparel’s value proposition.

JAAF further notes that the apparel industry already pays its employees well above the national minimum wage, above most other formal or informal employment categories, and well in excess of peers across Asia.

6. Apparel producers have not re-invested surpluses sufficiently, including investing in the domestic production of yarn and machinery for the apparel sector

Domestic production of yarn would require the establishment of cotton plantations. This would be unviable as Sri Lanka does not have the land, water, or labour resources necessary to produce cotton on even a moderately commercial scale, let alone in the quantities required to competitively substitute imports of yarn.

Similar limitations are at play with regard to machinery fabrication capacity, which together with Sri Lanka’s increasingly unreliable energy supply, makes commercial-scale production of machinery for the industry non-viable as well.

However, JAAF reiterates that wherever possible, Sri Lankan firms have invested heavily in fabric and textile manufacturing to feed the domestic industry. The vast majority of that production is utilised by local apparel firms, while approximately $ 500 million in innovative high-value fabrics are also exported directly as well.

Sri Lankan firms focused instead on strategically reinvesting surpluses into state-of-the-art facilities in Mullativu, Kilinochchi, Batticaloa and Vavuniya to name a few, as part of a broader national commitment to supporting growth in post-conflict areas.

7. Apparel manufacturing in Sri Lanka operates an exploitative model

Working conditions in Sri Lankan apparel firms are among the best in the world. However, JAAF and its members are aware of and deeply concerned by the extreme hardship faced by all Sri Lankans, including many in the apparel sector, and particularly those in the apparel SME sector as a result of the unprecedented economic upheavals that have taken place in the wake of the COVID pandemic.

While Sri Lankan apparel has made outstanding progress in terms of enhancing earnings, productivity, quality of life, and quality of work for our employees, JAAF reiterates that all its members remain committed to exploring all possible opportunities to drive further improvement.

It was due to that continuous commitment to leading global practices that Sri Lankan apparel firms signed initiatives by the ILO and IFCs ‘Better Work Sri Lanka’ initiatives. Such efforts further enhance occupational safety, gender diversity and inclusion – providing leadership skills training and career development for female workers, implementation of the ILO C190 toolkit addressing harassment and violence in the workplace, and facilitating access to pregnancy-related healthcare, childcare and maternity protection.

In light of the above facts and the extreme volatility now emerging in the global apparel industry, JAAF urges all stakeholders to exercise greater care, and substantiate their claims with credible evidence, especially when attempting to level criticism at the industry as a whole.

However, JAAF also wishes to reiterate that it requires all its members to strictly comply with all relevant domestic and global legal regulations, including all applicable laws on environmental, social and governance standards. If any individual, group or organisation can provide clear and credible evidence of wrongdoing among our membership, then our Association will provide its fullest cooperation to the relevant authorities to enforce and uphold the law.