Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 10 March 2025 00:00 - - {{hitsCtrl.values.hits}}

More frequent reporting of current account statistics can provide valuable insights for policymakers in formulating monetary and fiscal policies

The Central Bank of Sri Lanka (CBSL) commenced publishing monthly current account statistics for the first time, with the publication of the ‘External Sector Performance – January 2025’1 press release along with new ‘External Sector Statistical Bulletin’.2 Readers are invited to visit the CBSL website to view these publications, which provide valuable macroeconomic insights into Sri Lanka’s external sector.

The Central Bank of Sri Lanka (CBSL) commenced publishing monthly current account statistics for the first time, with the publication of the ‘External Sector Performance – January 2025’1 press release along with new ‘External Sector Statistical Bulletin’.2 Readers are invited to visit the CBSL website to view these publications, which provide valuable macroeconomic insights into Sri Lanka’s external sector.

The latest improvement to external sector related data is the dissemination of statistics related to all components of Sri Lanka’s current account on a provisional basis and with a lag of only one month. For example, statistics for January 2025 were disseminated on the last business day of February 2025, as per the CBSL’s Advanced Release Calendar3 for dissemination of macroeconomic statistics. The complete Balance of Payments (BOP) statistics, including the current account and financial account data, are generally published with a lag of three months on a quarterly basis.

For instance, BOP statistics for the first quarter of 2025 will be published on 30 June 2025. Although the new monthly publication does not include comprehensive BOP statistics, particularly the financial account of the BOP, publishing monthly current account statistics is a significant milestone, as only a handful of Asian countries adhere to such standards.

Sri Lanka’s BOP statistics are compiled and disseminated by the CBSL, following international standards and best practices. The BOP framework consists of key components of the current account, capital account, and financial account, providing a comprehensive view of the country’s cross border transactions. The CBSL adheres to the guidelines set out in the sixth edition of the BOP and International Investment Position Manual (BPM6) and reports data under the International Monetary Fund’s (IMF) Special Data Dissemination Standard (SDDS).

Sri Lanka is among 80 countries that comply with SDDS, emphasising its commitment to transparency and timely reporting of macroeconomic statistics. Additionally, the International Transactions Reporting System (ITRS) plays a crucial role in the CBSL’s data collection, supporting the CBSL’s efforts to compile and disseminate accurate and reliable BOP statistics in line with global standards.

Improvements to the monthly current account statistics compilation were introduced with the publication of services trade statistics in 2024

The services account is one of the four key accounts of the current account of the BOP, the others being the merchandise trade account, primary income account, and secondary income account. The CBSL commenced disseminating monthly services sector statistics from January 2024 along with historical monthly data from 2023. This was made possible with the implementation of ITRS. ITRS captures, via the banking system, all cross-border transactions made by Sri Lankan resident individuals, corporates and other entities. The dissemination of services trade statistics based on ITRS, in comparison to estimates-based dissemination, was a key milestone and a welcome development for many stakeholders. For example, prior to the implementation of ITRS, Sri Lanka was unable to ascertain the amount of foreign exchange spent by Sri Lankan nationals on overseas education or outward travel.

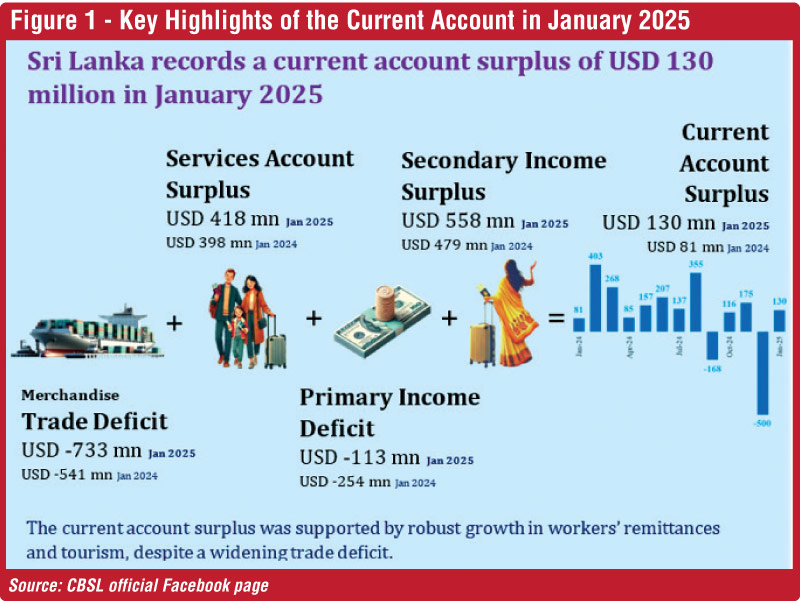

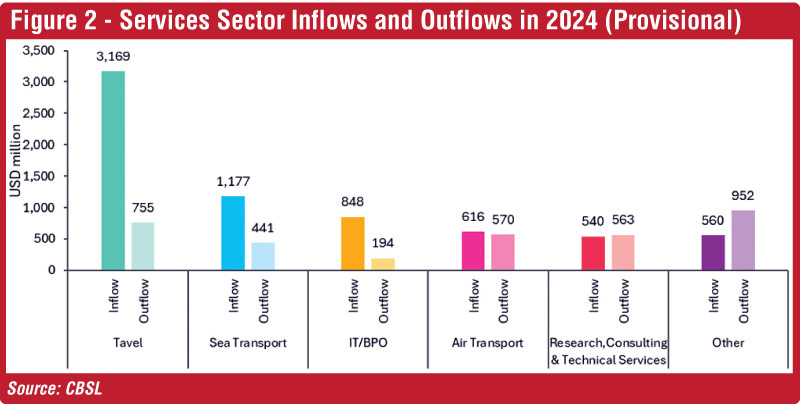

Also, the amount of foreign exchange earned by some sectors, such as research and development, management and consultancy services, and architectural and engineering services, etc., was not captured to a great extent. The author wrote an article for the Central Banking Column in this newspaper last year on this development.4 As per Figure 2, the largest contributor to services sector inflows in 2024 was tourism followed by sea transport services, and computer and IT/BPO related services. On the other hand, major contributors to outflows related to the services sector in 2024 were overseas travel and air transport services.

Compilation of the primary income account was possible after the finalisation of the debt restructuring process

In spite of these favourable developments in the services trade statistics, the primary income account statistics were not compiled and disseminated on a monthly basis. The primary income account records cross-border income flows related to the compensation of employees and investment income. Compensation of employees are wages earned by workers who work outside Sri Lanka for typically less than a year, hence considered Sri Lankan residents for BOP compilation purposes. Investment income refers to earnings from foreign investments abroad or similar payments to foreign investors. These include dividends and reinvested earnings from profits of foreign investment holdings in Sri Lanka and similar income received by Sri Lankans who have invested abroad.

The primary income account also records payment of interest on loans and debt securities to non-residents by Sri Lankan residents. In the Sri Lankan context, interest payment is a key element in the BOP as the Government and the CBSL incur a significant amount of interest. However, due to the debt standstill that prevailed from 2022 until late December 2024, the primary income account of the BOP had a large element of accrued interest. Hence, commencement of monthly dissemination of primary income account data was delayed until debt servicing obligations could be clearly known.

The secondary income account captures government transfers and personal transfers outflows in addition to workers’ remittances inflows

The secondary income account, which captures cross border transfers of money, was also not completely published on a monthly basis. However, the CBSL publishes statistics on monthly workers’ remittances, which account for more than 95% of inflows to the secondary income account. Grants received by the government account for the rest of the inflows to the secondary income account. In addition, ITRS captures outflows of personal transfers. With these additions, compilation of a complete secondary income account was also possible.

Overall, the trade deficit and the primary account deficit are cushioned by workers’ remittances and the services account surplus

With the capacity to compile both the primary income account and the secondary income account, the CBSL is able to compile the full provisional current account statistics to be disseminated on a monthly frequency and with a lag of a month.

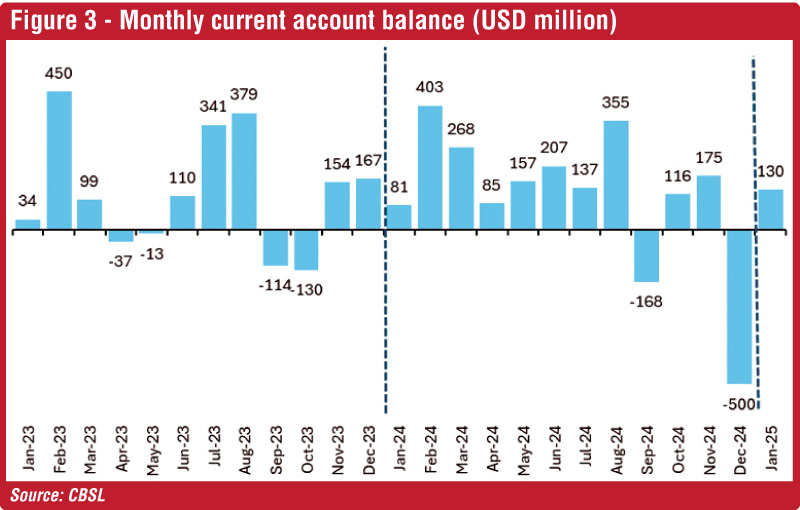

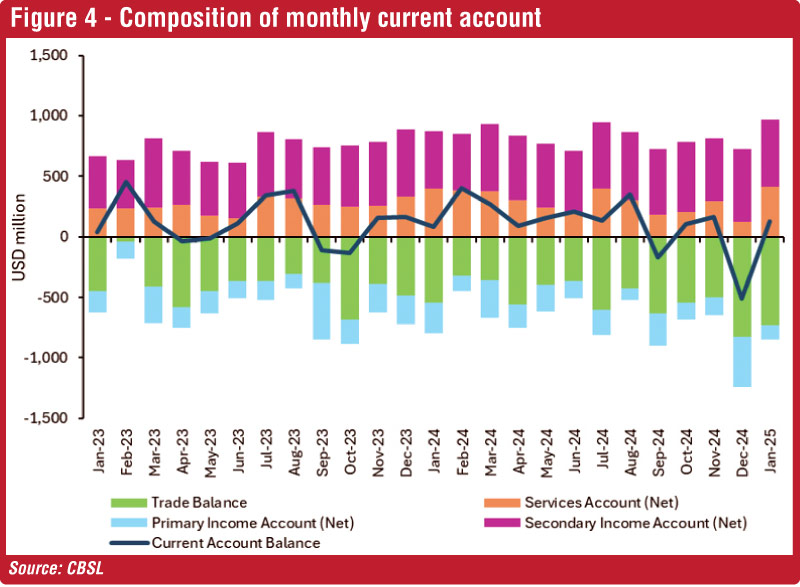

As illustrated in Figure 3, the current account balance in most months was positive, resulting in an annual current account surplus in both 2023 and 2024. However, the current account balance was in deficit for two months in 2024 (September and December). The compositional breakdown of the current account in Figure 4 explains the drivers of these deficits and surpluses. In September 2024, the services account surplus was unusually low, as tourism was affected by visa issues. In December 2024, there was a significant outflow from the primary income account as interest payments and from the services account as government expenditure, both related to the restructuring of Sri Lanka’s International Sovereign Bonds.

Monthly current account statistics will provide signals on future dynamics of the external sector

The current account balance, as a value or especially relative to the size of the economy, is widely considered as a gauge that signals whether a country might run into BOP difficulties in the future. If there are continuous current account deficits, such deficits will have to be financed either by inflows to the financial account or by drawing down of reserves. During periods of economic uncertainty, external sector vulnerabilities can escalate due to disruptions in key foreign exchange inflows. A combination of external shocks and policy choices can create imbalances in the current account and the foreign exchange market, exerting pressure on the exchange rate, which can lead to reserve depletion. In such situations, timely policy interventions, including measures to enhance foreign exchange liquidity and strengthen external sector resilience, are essential to prevent severe BOP stress.

If more frequent current account statistics are available, these emerging issues in the external sector will be visible to the general public and other local and foreign stakeholders in a timely manner. Similarly, more frequent current account statistics may also show signs of stability in the external sector, improving market sentiments and stakeholder confidence. For example, in recent times, since early 2023, current account surpluses have contributed to the stability in the exchange rate as well as the CBSL’s ability to purchase foreign exchange from the domestic market to build up reserves. Statistical dissemination of such developments will convince the stakeholders of greater stability in the external sector and the economy as a whole.

More frequent current account statistics will provide useful information for formulation of monetary and fiscal policies

More frequent reporting of current account statistics can provide valuable insights for policymakers in formulating monetary and fiscal policies. For monetary policy, central banks closely monitor the developments in the current account to assess possible external pressures and spillovers to inflation, among a multitude of factors. A widening current account deficit may signal increased reliance on foreign capital, raising concerns about external sector stability and external debt accumulation. Conversely, a persistent current account surplus might indicate weak domestic demand, prompting appropriate policies.

For fiscal policy, frequent current account updates help governments make timely adjustments to fiscal management and debt financing. A growing deficit may indicate that the economy is consuming more than its affordability. This suggests the need for policies that enhance export competitiveness or discourage excessive imports and prudent debt mobilisation.

Current account statistics should not be confused with the actual cash flow

It is pertinent to mention that the current account statistics should not be confused with the actual cash flow, as they represent recorded economic transactions rather than real-time financial flow movements. For instance, exports and imports recorded in the current account are sourced from Sri Lanka Customs data that is based on the date of shipment, rather than when the payment is received or made. Similarly, income from foreign investments, such as dividends and interest, is recorded when it is earned, even if the cash payment occurs at a later date. Also, some non-cash transactions are recorded in the current account. For instance, reinvested earnings are retained earnings out of profit owed to non-residents that is just a book entry and does not involve an actual cash flow.

Further, tourist earnings are based on a survey on departing foreign tourists conducted by Sri Lanka Tourist Development Authority (SLTDA). Based on ITRS data, only a part of such tourist earnings occurs via the cross-border banking system, insinuating that most tourists spend by using cash in hand.

Where to find Sri Lanka’s key current account statistics

With the latest publication of monthly current account statistics, the CBSL now produces a gamut of statistics related to the external sector in a user-friendly manner. The latest data can be downloaded from the CBSL website in Excel spreadsheet format, under ‘Statistics>>External Sector’ tab and in the ‘SDDS National Summary Data Page’6 as well as in latest issuances of ‘Weekly Indicators’ among others. In addition, the CBSL began publishing a new ‘External Sector Statistical Bulletin’ with granular information and graphical analysis of the newly published current account statistics.

Revision policy of monthly current account statistics

Like all statistics, monthly current account statistics are also provisional and subject to adjustments in future when further information is available. The current revision policy is to revise monthly statistics with each regular quarterly publication of BOP data. A full revision of two consecutive years is done with each annual publication of data. The aim is to have monthly, quarterly and annual data published on the CBSL website that are consistent with each other at all times.

Footnotes:

1Link to the CBSL External Sector Performance- January 2025: https://www.cbsl.gov.lk/en/press/press-releases/external-sector-performance

2Link to the CBSL External Sector Statistical Bulletin: https://www.cbsl.gov.lk/en/external-sector-bulletin

3Link to CBSL’s Advanced Release Calendar: https://www.cbsl.gov.lk/advance-release-calendar-2025

4https://www.ft.lk/columns/Capturing-services-sector-cross-border-transactions/4-759366

5https://www.cbsl.gov.lk/en/statistics/statistical-tables/external-sector

6http://erd.cbsl.gov.lk/presentation/htm/english/erd/sdds/rpt_sdds.aspx

(The author is a Senior Economist and Head of the Balance of Payments Division of the Economic Research Department of the CBSL. He is also a short-term expert on external sector statistics of the IMF. The views presented in the article are those of the author and do not necessarily indicate the views of the CBSL.)