Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 28 January 2019 01:03 - - {{hitsCtrl.values.hits}}

For the eighth consecutive year, MTI Consulting (via its Corporate Finance practice), in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI CEO Business Outlook Study, collectively outlining the Sri Lankan business community’s perception for the state of business in 2019.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 100 Sri Lankan business leaders with regard to their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2019, and the main challenges that they believe Sri Lanka and Sri Lankan companies will face in 2019.

The results of the survey, including its supplementary analysis, will assist organisations in streamlining their strategic decision-making for 2019, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers.

2018 businesses performance below expectations

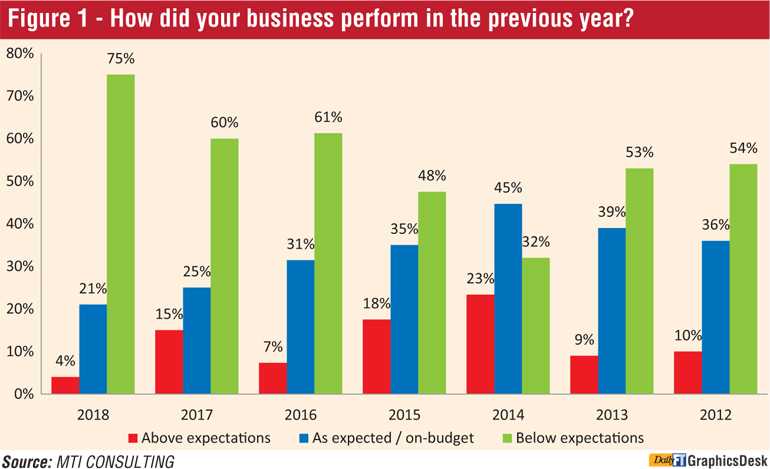

Since the inception of CEO Survey in 2012, a record high of 75% of the surveyed CEOs conclude that their businesses have performed below expectations in 2018.

In contrast, only 4% of the chief executives felt that their businesses performed above expectations, indicating a drop in the positive sentiment from 15% to 4% in 2018. This is the lowest surveyed total for above expectations since 2012.

Macroeconomic performance

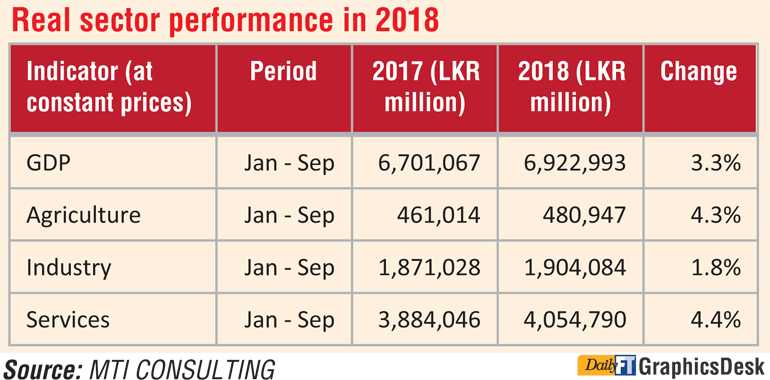

To supplement the CEO perceptions in 2018, MTI analysed the key macroeconomic indicators of Sri Lanka for 2018.

The agriculture sector grew by 4.3% during the first nine months of 2018 as a result of favourable weather conditions in most districts leading to a moderate harvest and a positive turnaround in the sectoral contribution to the GDP. The industry sector expanded only by 1.8% owing to a decline in construction by 4.7%. Services sector recorded the highest contribution to GDP with an impressive growth of 4.4% compared to 4.2% during the first three quarters of 2017. The top three service sector contributors were telecommunication, financial and insurance service activities recording a contribution of 14.8%, 12.4% and 8.3% respectively.

GDP for Q3 of 2018 slowed to 2.9% YOY per Department of Census and Statistics estimates. This is the weakest performance recorded for a third quarter and lower in comparison to 3.6% achieved in Q2 and 3.4% in Q1 of 2018. When comparing the GDP of Sri Lanka with that of its region – South Asia, the country is one of the poorest performers for the year! South Asia is dominated by Bangladesh with a GDP of 7.9% and India following close behind with an economic growth of 7.3%.

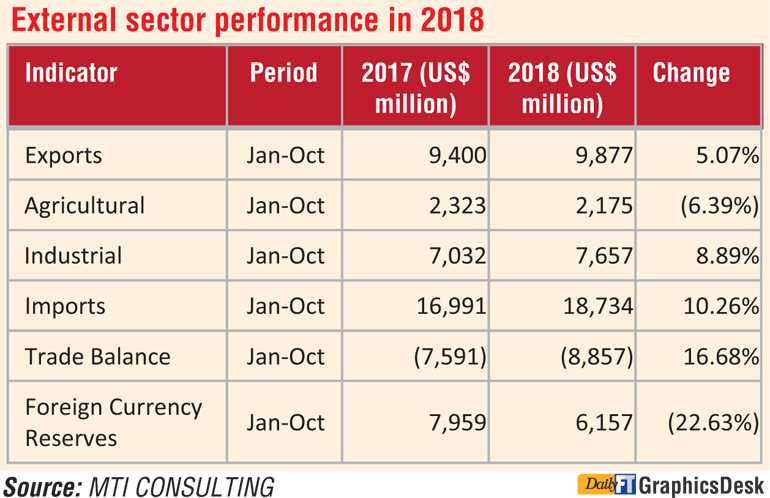

The trade deficit widened during the first ten months of 2018 as a result of the expansion in import expenditure by 10.26% which outpaced the 5.07% growth in exports. Tourism was the key performer of the external sector up until the third quarter. However the industry took a hit during the political instability that occurred during the last quarter of 2018

Sri Lanka’s foreign reserves stood at $ 6.2 billion as at October 2018, a decline of 22.6% on the back of CBSL interventions made to manage liquidity in the market, in addition to the foreign debt repayments made during the year.

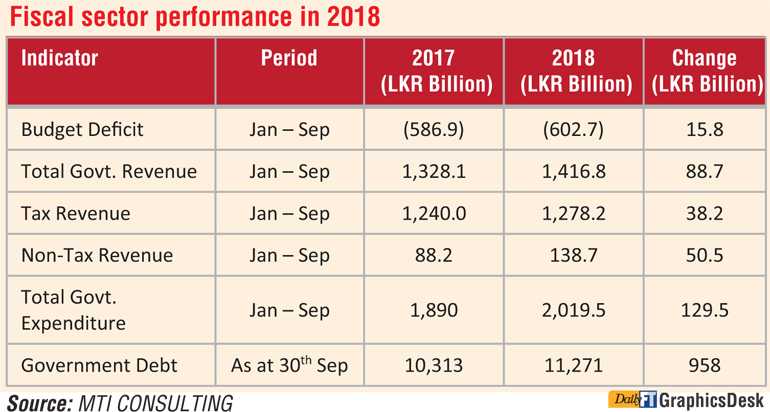

The first nine months of 2018, saw the budget deficit narrow down to 3.5% of the estimated GDP, surpassing the Central Bank target as expected through the Government’s fiscal consolidation efforts. However, due to flood and drought relief, the budget deficit is expected to stand at 5.3% of GDP for the year 2018 per CBSL estimates.

Policy measures such as the introduction of the new Inland Revenue Act is expected to simplify tax structures and increase direct tax revenue. The fuel pricing formula was also introduced during the year in a move to reduce the budget deficit.

However spending pressure brought in with the end of the IMF programme and the likely increase in government spending for early elections during the latter part of the year can further hamper fiscal consolidation in 2019.

Amidst mounting pressure, the CBSL has taken several measures to raise funds to meet $5.9 billion in debt repayments in 2019, of which $2.6 billion needs to be met in Q1 of 2019.

Monetary sector performance in 2018

In Q1 of 2018, pressure on balance of payments was generated as CBSL cut key policy rates and actively printed new money in April as a measure to manage market liquidity.

Headline inflation, as measured by the National Consumer Price Index (NCPI) and the Colombo Consumer Price Index (CCPI), remained in low single digit levels in 2018 on the back of a slowdown in food inflation and low money supply.

In November 2018, the Central Bank raised policy rates and reduced the Statutory Reserve Ratio from 7.5% to 6.0%, resulting in approx. Rs. 90 billion of rupee liquidity in the banking system. Despite this move, liquidity shortages still remained as expressed by the Central Bank.

Despite the increased cost of funds and tight liquidity in the market, domestic credit as at 30th November 2018 grew 22% YoY. Credit to the private sector grew 16.2% YoY in the same period compared to the 15.4% in 2017, on the back of the private sector expediting its activities in anticipation of the Central Bank and Government curbing excessive import growth.

The IMF suspended its three-year $ 1.5 billion Extended Fund Facility which was due to end in June 2019, as the Central Bank failed to meet foreign reserve targets in addition to the political crisis that arose in October 2018. However program discussions are expected to resume in February 2019.

How have the major industries performed?

Stock market performance in 2018

The Colombo Stock Index declined approx. 5.0% to 6052 points at the end of 2018 with turnover reported at Rs. 289 million, less than half of the year’s daily average of Rs. 834 million. This was a reversal from the positive 2.3% recorded by the index in 2017.

Net foreign inflows were negative at Rs. 28 billion, reversing the positive trend of inflows that was witnessed in 2016 and 2017. The decline in net foreign outflows was mainly attributable to political uncertainty and outflow of investments in emerging markets in light of the Fed’s monetary policy tightening. Notably, more than 62% of the net foreign outflows recorded in 2018 was in Q4 of 2018 following the constitutional deadlock that occurred in the country, recording Rs. 14 billion of net foreign outflow in the nine weeks post 26 October.

In 2018, the Colombo Stock Exchange and the Securities and Exchange Commission of Sri Lanka launched a new SME Board in a move to increase listings and empower SMEs.

World in 2018

Year 2018 started with a positive outlook in the face of the rapid growth in trade which hovered above 5% in 2017. However, by November 2018, trade as measured through Industrial production, World trade volumes and Manufacturing Purchasing Managers' Index (PMI) stood at growth levels below 4% as reported by the IMF. International trade was mainly affected by trade tensions, notably between the United States and China.

The United States witnessed steadfast growth in 2018, especially in the second quarter as tax cuts by the Trump Administration fuelled consumption demand. Meanwhile, the Chinese economy posted weak results as consumer spending slowed.

Supported by the US Federal Reserve rising interest rates, the USD appreciated strongly in 2018, triggering an outflow of equities from emerging markets and resulting in a volatile financial situation affected by rising borrowing costs and depreciating currencies in these markets. Notably, countries such as Argentina and Turkey fell into recession in this background.

Further during the year, the Eurozone was plagued with political uncertainty while investors focusing on the UK continued to remain doubtful on the likely consequences of Brexit, given that an exit deal was yet to be finalised.

Global Economy: Negative Sentiments for 2019

According to the World Bank, global economic growth is expected to slow down in 2019, mainly on account of trade tensions, increased borrowing costs, pressure on financial markets and a slowdown in manufacturing activity that was also witnessed in 2018.

Emerging markets and developing countries are forecasted by to grow at 4.2% in 2019, unchanged from the same growth level recorded in 2019 while advanced economies are expected to drop to 2.9% in 2019 from the 3.0% growth witnessed in 2018.

Financial markets in emerging market nations, notably suffered in 2018 on the back of the interest rate tightening that was carried out by the US Federal Reserve; however the tightening cycle is expected to end in 2019.

The World Economic Forum expects oil prices to average at approximately $ 70 per barrel in 2019, compared with the average price of $ 71 recorded in 2018 as supply is expected to outstrip demand.

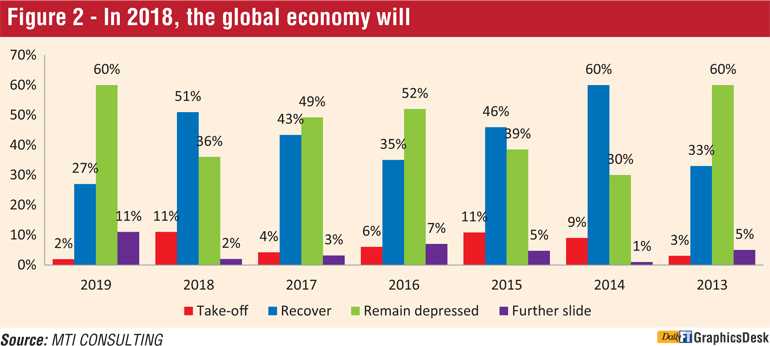

An aggregate of 71% of the surveyed CEOs have noted a negative sentiment towards global economic growth in 2019, recording the highest collective response for a decline in the global economy since the launch of the survey.

Only 29% of the chief executives have taken an optimistic view that the global economy is expected to recover or take off in 2019.

2019 expected to be a challenging year for the Sri Lankan economy

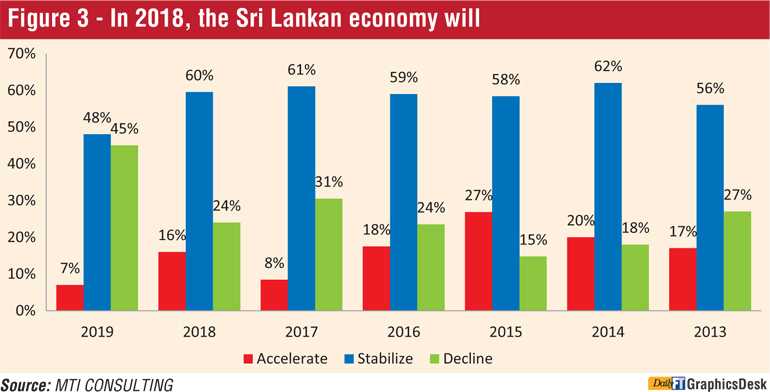

More than 80% of the CEOs expect the Sri Lankan economy to display a downfall in 2019, with 48% of the CEOs stating the local economy will stabilise while 45% believed that it would decline. The statistics supporting decline of the Sri Lankan economy is at its highest when analysing survey results over the past seven years.

Only 7% of the surveyed CEOs expect the local economy to accelerate, compared to 16% in 2018, which demonstrates a less confident outlook among business leaders for the Sri Lankan economy in 2019.

Sri Lanka in 2019

The ADB downgraded Sri Lanka’s growth forecasts from 4.2% to 3.8% in 2018, and from 4.8% to 4.5% in 2019 owing to lower investment and higher government expenditure in 2018.

In order to combat development challenges, ADB recently signed three loan agreements totalling $ 455 million with the Government of Sri Lanka, for projects in higher education and transport as well as a technical assistance loan in the urban sector.

The World Bank expects the Sri Lankan economy to grow at a level slightly close to 4%, cautioning that the country is susceptible to external vulnerabilities that could have an impact on business as usual in the months ahead.

Political, legal and governance – the main challenges for Sri Lanka in 2019

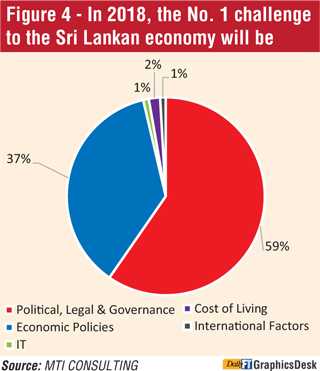

Almost 60% of the CEOs have identified that political, legal and governance issues will be the biggest challenge to their businesses in 2019, followed by economic policies – which were a concern for 37% of the respondents.

The concern political, legal and governance issues as well as economic policies in 2019 remain unchanged when compared to the previous year as political and economic tensions witnessed in 2018 continued to hinder business and investor sentiment in 2019.

Other issues cited as business challenges in 2019 were IT, cost of living and international factors which amounted to 3% of the overall challenges.

Political stability concerns continue in 2019

Concern for the lack of political stability (86%) has more than doubled for 2019 compared to 2018 and is the key political challenge that is cited by CEOs for 2019 on the back of key political events such as the Constitutional Crisis which occurred in the latter part of 2018.

Policy inconsistency and other factors such as bureaucracy and lack of decision making accounted for 14% of the political challenges for 2019. Corruption and Good Governance (3%) were the least of the political challenges expected for 2019; however the need to regenerate business confidence was highlighted by CEOs.

Lack of policy consistency (23%) was cited as the key economic challenge for businesses in 2019 as tensions existing in the coalition government is expected to negatively affect policy making.

Exchange rate stability (19%) and economic stability and growth (16%) are seen as the second and third most challenging economic factors for 2019, respectively. This is mainly attributable to the depreciation of the Rupee that was witnessed in the course of 2018 that resulted in the increased cost of imports and foreign outflows.

Improving net trade (9%), National debt (9%) and Inflation (9%) were other key challenges cited by CEOs as approx. $ 5-6 billion of loan repayments are to be paid in 2019 while exports are seen as a driver behind exchange rate stability by some CEOs. Monetary policy, business confidence, global economic downturn were less cited economic challenges for businesses in 2019.

Exchange rate: Sri Lankan Rupee (LKR) depreciated 3.5% during the first six months of 2018 and 14.7% in the second half of the year. It commenced at the Rs. 153 range in January and ended at Rs. 183 per $ 1 at the end of the year, leading to nearly 19.6% depreciation, a large impact compared to 2017 where the currency witnessed a 2% depreciation in the same period.

Interest rates: The Central Bank of Sri Lanka raised the standing lending facility rate from 8.75% to 9.00% and the standing deposit facility rate from 7.25% to 8.00% in 2018. Likewise, the prime lending rate of commercial banks increased 1.17% YoY to 12.09% as at 29 December 2018.

Depressed business sentiments for 2019

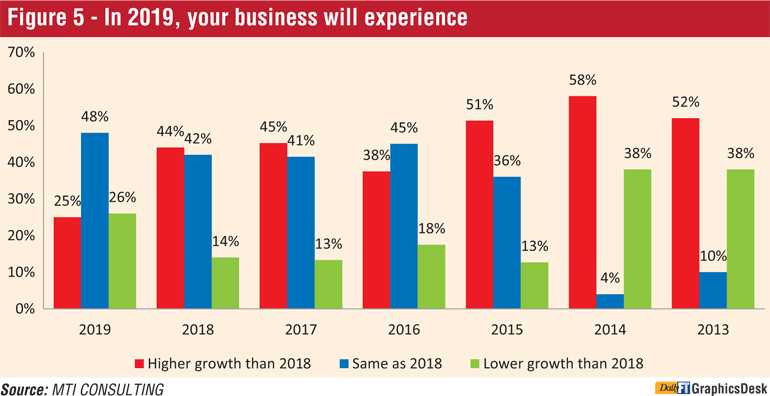

The optimistic trend for higher growth cited by surveyed CEOs during the past few years has drastically fallen from a high of 44% to 25% in 2019.

A majority of the CEOs (48%) believe that their businesses will achieve the same level of growth in 2019 as in 2018, while one-fourth of the respondents are expecting a lower growth in their business in comparison to 2018. This sentiment continues to be on the rise since 2015.

As a whole, there appears to be a pessimistic outlook for business performance with the expectancy for the global economy to recover and the stabilisation of the local economy in 2019.

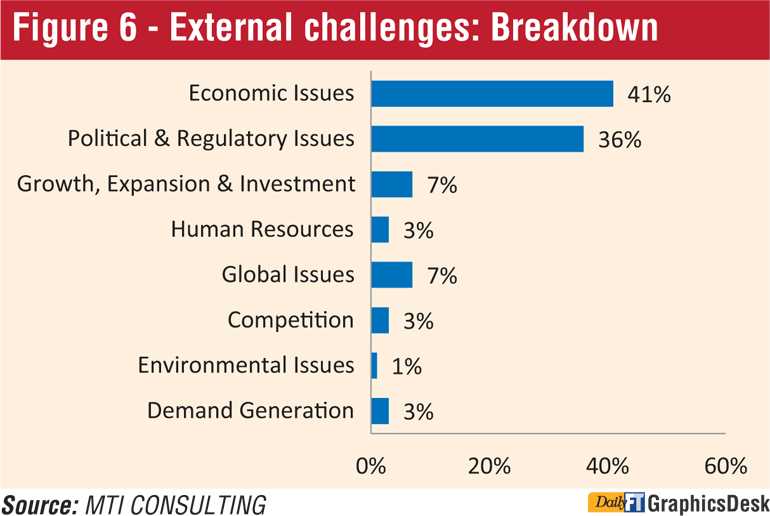

External challenges dominate

Sixty-nine per cent of the CEOs believe that the success of their businesses in 2019 will mainly be affected by factors external to their business.

However, 31% of the CEOs identified internal factors to be the key determinant of their business performance in 2019 compared to the 22% of CEOs who attributed controllable factors as determinants of business performance in 2018.

The main external challenge cited by CEOs were economic issues (41%) where many CEOs expressed concern over currency depreciation that would lead to a rise in import costs and thus increased costs of living.

Political and regulatory concerns (36%) was another key external challenge that was identified due to inconsistent government policies that has been implemented in 2018, the effects of which is expected to continue on to 2019.

Global issues (7%) were seen as an external challenge to businesses on account of issues such as slowing consumer demand and political and economic uncertainty brought about by countries such as the US.

CEOs also pointed out that growth, expansion and investment (7%) would pose challenges to their businesses as consumption growth is likely to be affected as a result.

In addition, the surveyed chief executives found competition, environmental issues and demand generation to be external challenges that will affect their businesses in 2019, although at a much lower frequency than economic and political issues that are expected to arise in the same period.

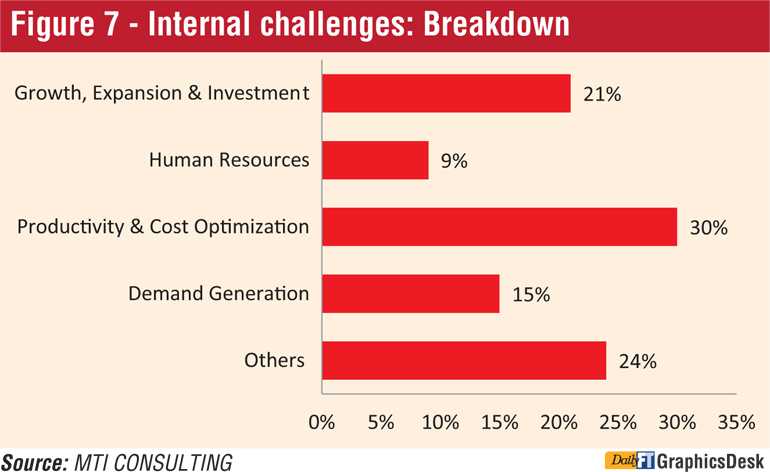

Internal challenges

The main internal challenge that CEOs expect to face in 2019 is productivity and cost optimisation (30%), especially considering the challenge of keeping costs of operations at a feasible level with the rising cost of imports.

Another key challenge that was discussed is growth, expansion and investment (21%) where safeguarding market share and keeping minimum pressure on company bottom lines were considered as risks.

Human resources (9%) and demand generation (15%) were considered as key internal challenges that would affect business performance. CEOs also cited other challenges such as competition, investor sentiment and debt as key issues they are likely to face in 2019.

Conclusion

Since the launch of the MTI CEO Business Outlook Survey in 2012, 2019 marks the year in which the most number of surveyed CEOs expect a negative outlook on the Sri Lankan and the global economy with an aggregate of 71% and 45% of the respondents being pessimist about the global and local economy respectively. The last time a similar result was recorded was in 2012, when 65% of the CEOs expressed a negative outlook for the local economy and in 2016, when 31% of the CEOs expressed similar sentiments on the global economy.

The long term trend (since 2012) of the businesses environment performing below expectations recorded its highest peak this year, with 75% of the CEOs expressing dissatisfaction on the performance of their industry in 2018, a result surpassing the previous peak of 61% recorded in 2016. The lacklustre performance was no doubt on the back of a weak economy and a turbulent political environment, notably the constitutional crisis and sharp decline in the external value of the rupee that erupted in the latter part of 2018.

Hence, it was no surprise that external factors continued to challenge CEOs in operating their businesses in 2018 as evidenced by the survey results. However, considering the continuing trend of businesses citing external factors as their number one challenge, this will be the opportune time for CEOs to ensure that reasonable firewalls are in place to mitigate the impact that unexpected challenges can create in the long term.

In addition, robust and effective action by industry stakeholders including the government may result in opportunities for the business sector to capitalise on in the coming year, despite the political and economic headwinds that could arise in 2019.

MTI Corporate Finance

MTI Corporate Finance is the corporate finance arm of MTI Consulting, a boutique strategy consultancy with a network of associates across Asia, Africa and Middle East. MTI Corporate Finance provides a comprehensive range of services, including due diligence, feasibility studies, funding new businesses or capitalisation of existing ones – from IPOs to private placement facilitation, M&A facilitation, and advisory on governance, compliances and risk management.