Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 2 November 2017 00:00 - - {{hitsCtrl.values.hits}}

As part of the ongoing series of articles focused on developing a sustainable policy framework for the tobacco industry in Sri Lanka, RIU herein looks at the shortcomings of recent Government intervention and shares some of the findings from a recently completed high-level study amongst the key stakeholders of this industry, including current and former ministers

By the Research

Intelligence Unit (RIU)

Keeping a Perspective

According to the World Health Organization (WHO), more than 1.8 million adults and 13,000 children in Sri Lanka continue to use tobacco every day. However, fewer men and women on average die in Sri Lanka due to smoking as compared to other mid-income countries in the world.

Sri Lanka signed the Framework Convention on Tobacco Control (FCTC) in 2003 in order to give priority towards protecting public health and address the demand and supply of tobacco through the international best practice WHO strategies. These strategies include monitoring tobacco use and prevention policies, protecting people from tobacco smoke, offering help to quit tobacco use, warning about the dangers of tobacco use, enforcing bans on tobacco advertising, promotion and sponsorship, and raising taxes on tobacco.

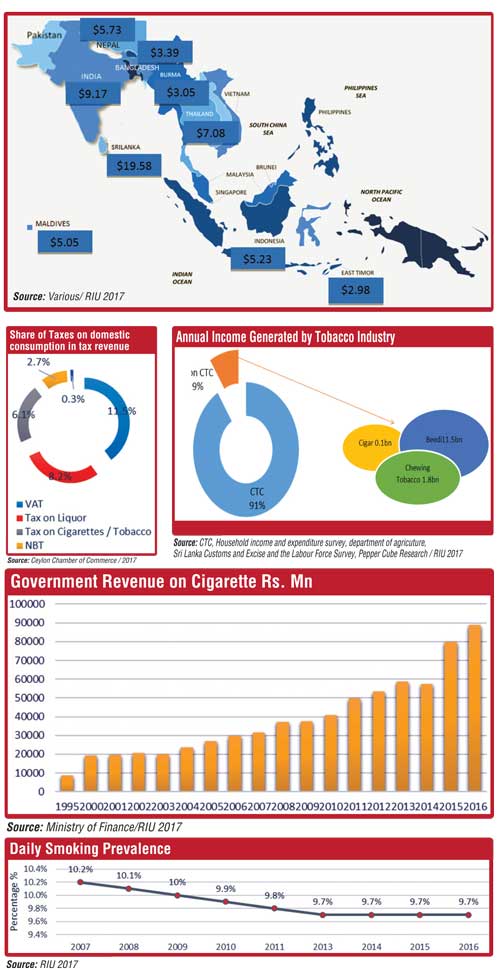

Where taxes are concerned, in the Sri Lankan context, the legal cigarette industry pays Excise, NBT and VAT and contributes 6.1% of the total domestic consumption revenue to the Government. In 2016, just over Rs. 88 billion in cigarette excise and taxes was collected by the Government.

Industry overview

The annual income generated by the domestic tobacco industry (2016) is estimated at Rs. 144 billion ($ 960,000,000). Of this amount, the CTC is said to account for Rs. 131 billion ($ 873,000,000) and the other industry segments (beedi, cigars and chewing tobacco) account for the remaining $ 83 million.

Where employment and livelihoods are concerned, there are large discrepancies between different agencies on the contribution of this industry. Given available data, we have estimated the tobacco industry in Sri Lanka as employing around 70,000 workers.

An estimated 45,000 of the employees are engaged in the cigarette sector where the Ceylon Tobacco Company (CTC), owned by British American Tobacco (BAT), has a monopoly as the only licenced player in the market. Of these, the CTC has 320 direct employees working from Colombo and Kandy. The remaining 25,000 workers are employed by the Beedi industry (20,000), cigar industry (9,000) and chewing tobacco (4,400). There are also an estimated 20,000 farmers engaged in the industry.

In the Beedi industry, the supply chain starts with the purchase of tobacco leaves, which includes the purchase of refuse leaves that are rejected by the CTC. This tobacco is then wrapped in a Tendu leaf that is imported from the state of Orissa in India. The wrapping process is almost exclusively a cottage industry that employs a considerable number of village level house-holds on a casual basis.

There are 600-700 registered/licensed Beedi producers in Sri Lanka along with many more small players that operate “below the radar” at the cottage industry levels. The cost of acquiring a Beedi license is said to be very low. Of those who are registered, around 50 are well established and pay ETF and EPF to their workers according to industry sources.

The contribution of the Beedi industry to Government revenue was Rs. 2.8 billion in 2016. According to the Tobacco Tax Act No. 8 of 1999, all the manufacturers and importers of Beedi only had to register under the Commissioner General of Excise and did not actually have to pay any taxes. This industry only started paying taxes in 2010 (Gazette Number 1625/1 October 26 2009, brought into effect from 1 March 2010).

Efficacy of recent tax hikes

By most accounts, Sri Lanka has made great progress in meeting the challenge of reducing the health harm of smoking. As per the WHO report, Sri Lanka has a high compliance of smoke-free policies and record adult daily smoking prevalence at 10% parallel to India, whilst Indonesia recorded 34%.

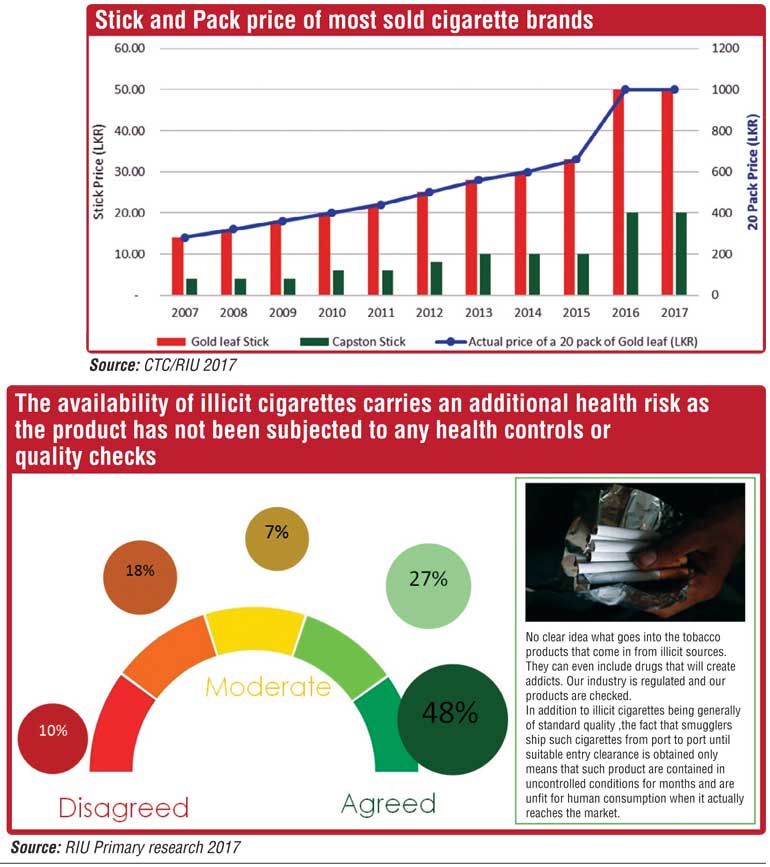

The international agencies, including the World Bank, have suggested that a 10% rise in taxes will result in an 8% fall in smoking in low and middle-income countries. However, in Sri Lanka’s case, we can note that the availability of much cheaper alternatives including the locally produced Beedi, along with a growing choice of illicit cigarettes that are priced competitively lower in the market, serves to illustrate that a ‘cut and paste’ approach to tobacco policy across international markets cannot work. In essence, taxation-driven price hikes alone have proved that they are insufficient policy measures for delivering the reductions in smoking prevalence despite the claims made by international agencies.

A 20-pack John Player Gold Leaf, which is the most commonly sold brand of legal cigarettes in the country, cost Rs. 280 in 2007 and by 2016 was priced at Rs. 1,000. Yet the smoking prevalence in Sri Lanka only moved from 10.2% to 9.7% over the same period. Clearly, the evidence shows that price alone is not a decisive factor in the overall smoking prevalence in Sri Lanka.

Regional disparities spur smuggling

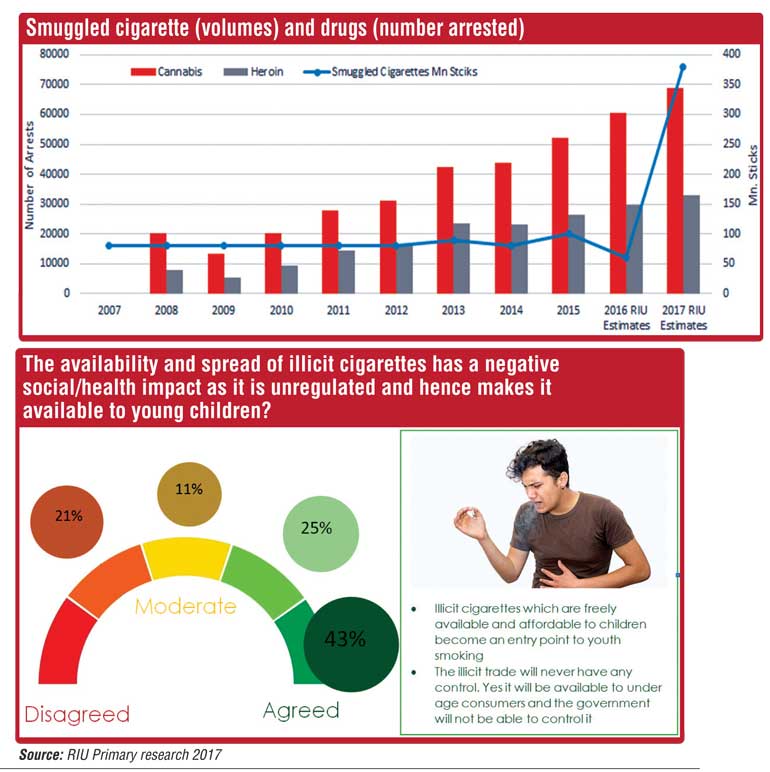

Whilst the debate on the efficacy of tax increases as one of the tools for reducing smoking prevalence continues, the link between cigarette prices and the recent alarming rise in smuggling is much more evident. By regional comparisons, Sri Lanka has the highest rates of Excise taxation and as a result is the most expensive country in which to purchase cigarettes. This situation has in fact triggered a rapid rise in smuggling in Sri Lanka this year, which seems to be gathering momentum with more and more international smugglers targeting the island.

According to the authorities and other sources met during the RIU research, a 40-foot container of smuggled cigarettes can generate a profit of between Rs. 250-400 million. Customs officials say that most of the brands of illicit cigarettes detected have been smuggled from Dubai, China, Vietnam and Turkey.

However, in Sri Lanka the fine for smuggling in a big container load of illicit cigarettes can be as low as just Rs. 1 million. Consequently, smugglers exploit a system that is soft on punishment and lucrative in terms of financial returns. According the law enforcement officers that RIU spoke with, large amounts of illicit cigarettes reach the hands of youth and under-aged smokers as it is a completely unregulated environment.

Unfortunately, the Customs authorities are successful in detecting only one in 10 sticks smuggled into the country according to multiple sources. A very senior official at the Finance Ministry claimed that 40 million illicit cigarettes have so far been detected which would translate to 360 million illicit sticks in the market this year. In terms of loss of Government revenue, this would give us a figure of Rs. 18 billion in losses so far in 2017.

Meanwhile, a senior officer in charge of the Anti-Organised Crimes Unit of the STF told RIU that that his unit had detected around 270 million illicit cigarettes so far in 2017. An alternative estimate given by CTC places the total number of illicit cigarettes at 400 million sticks so far this year.

In addition to smuggling cigarettes, there is also a worry connecting to a rise in trafficking of more dangerous drugs. The Department of Prisons’ statistics show that in 2015, nearly half or 46.4% of prisoners convicted were drug offenders. This means that, of the 24,086 who were sentenced, a massive 11,171 went to jail for narcotics crimes. The previous year, the percentage of total convicts that were drug offenders was 43.5%. In 2013 it was 34%. The data shows an upward trend in the number of those getting sentenced for trafficking and taking narcotics.

According to the Dangerous Drugs Control Board, cannabis and heroin are the narcotics of choice, in that order. The Western Province is the most afflicted followed by the South. The total number of drug related arrests was 82,482 in 2015, up 23% from the previous year. Of this total, 32% was for heroin and 63% was for cannabis.

Cross-country analysis and lessons to learn

The illegal cigarette trade is not just a local phenomenon but a serious global issue, which occurs on every continent and is prevalent in both high and low-income countries. According to multiple sources, an estimated 11.6% of the global cigarette market is illicit, equivalent to 657 billion cigarettes a year and $ 40.5 billion in lost revenue for governments. If the global illicit trade were eliminated, governments would gain at least $ 31 billion dollars.

The phenomenon that Sri Lanka is currently experiencing post the Budget 2016 cigarette tax hike is nothing new in the international context. For example, in 2015 the Malaysian Government increased taxes by 40% which represented a 110% hike over five years. However, this policy has failed to deliver on both the health and government finance levels.

According to Malaysia’s Health Ministry, the actual number of smokers in the country had increased from 4.3 million in 2011 to 4.4 by 2015. However, the reverse was seen in the industry’s volume where the number of legal cigarettes purchased in 2015 had reduced to 10.5 billion sticks versus 13.2 billion sticks in 2011. This translates to about 8.8 billion (or 40%) of illicit cigarettes in 2011 and 13.8 billion sticks (or 56.7%) in 2015.

Similarly, the German Government in the early part of the new millennium attempted to achieve a significant revenue boost with sharp ad-hoc tax hikes on cigarettes and found that it back-fired in terms of achieving the desired health and budgetary outcomes. Within a short time, Germany emerged as a major retail market for contraband cigarettes within the EU. On the black market, cigarettes from tax-free or low-tax sources were supplied at a price below legal retail prices, providing significant savings on the consumer side and lucrative profits for suppliers.

The illicit cigarette trade has received increasing political attention in the light of substantial losses of revenue and growing concerns that the cigarette black market is linked to “organised crime”. Germany was faced with a similar situation to that faced by Sri Lanka at the present time whereby its immediate neighbours along Eastern Europe were all retailing cigarettes at much lower prices.

Since 2006 the German Government has changed its approach to tobacco excise with the emphasis firmly placed on tackling the illicit trade and preventing further market erosion. From early 2006 until May 2011, tobacco excise rates were adjusted moderately. During this period pricing stability reduced the growth of cross-border and illicit consumption – the share of such products in total cigarette consumption remained flat at 21% over the whole period of five years.

Key recommendations of study: A holistic approach

According to the high-level RIU industry stakeholder study, tax increase alone will not deliver the required outcomes at the national level. Moreover, the findings indicate that tax increases are in fact the least significant of the policy tools that are at the disposal of law makers.

According to the RIU study that included one-on-one meetings with former finance ministers, ministers currently serving in the Government, senior heads of Customs, Excise, Ceylon Tobacco Company (the monopoly cigarette manufacturer in the country), the Beedi Association, WHO, IPS, the Police, the Special Task Force, Sri Lanka Tourism Development Authority (SLTDA) and multifarious think-tanks, NGOs and other Government agencies, a much more holistic and multi-faceted approach is needed to address the dual Government objectives of reducing the health harm from smoking whilst securing the taxation revenue that is due to the Government Treasury.

The RIU research findings suggest that the Government needs to establish a task force of industry stakeholders and Government agencies led by those representing Finance, Customs and Heath. The most important strategy according to the stakeholders is to focus on education and warnings to the youth on the dangers of smoking.

This approach needs to be supported by bans on tobacco promotion and monitoring the overall prevention policy. Offering smokers some support to help quit their habit was also cited as a key component of any future policy framework. Finally, the stakeholders confirmed that raising taxes needs to be included in the overall navigation of the strategy.

However, the findings of research suggest that tax rises need to be part of the long-term plan with stakeholder participation that secures a level-playing field for the legal industry. In fact, some players in the Beedi industry even went as far as to say that they would be ready to work with the Government on a total ban on Beedi so long as it was part of a long-term plan made in consultation with all the stakeholders, giving them time to adjust and giving those workers in engaged in farming and manufacturing a chance to find an alternative source of livelihood.

De-politicising the issue of tobacco taxes is also critical to ensuring that the legal and regulated industry has a predictable and level-playing-field that generates the forecasted amounts of revenue for the Treasury. Whilst the Government will want to balance the Health Ministry perspective with that of the Finance Ministry, it is essential that all stakeholders are included in the discussion.

Unpredictable and ad-hoc tax hikes that are made sans consultation with those who represent various points of view in the industry only seem to spur the illegal business of smuggling which is connected to an overall rise in criminality that includes drug trafficking in Sri Lanka. In such a situation, not only do we lose the objectives of preserving the nation’s health and well-being along with the nation’s financial health, but we have also witnessed the rise of criminality, which has its own financial (loss of revenue from taxation) and social costs which are potentially far worse.

(For more information: [email protected]/www.riunit.com.)