Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 6 May 2020 00:07 - - {{hitsCtrl.values.hits}}

The fight against COVID-19 has put most countries in the world in various forms of lockdown for more than a month. This effort has led to a disruption in global supply chains and demand drivers. In Sri Lanka, key economic centres were placed under curfew bringing economic activity to a halt. While countries are looking to re-establish some form of economic activity, it is unlikely to resume to normal levels immediately.

Asia Securities’ latest Macroeconomic Update notes that the pandemic’s impact on the global economy as well as the ongoing economic disruption locally point to a recession in Sri Lanka. Successfully navigating this period will be a make or break for many companies. A Harvard Business School study on the effectiveness of various strategies deployed by companies during economic downturns, noted that approximately 15-20% of companies do not survive a global recession, while ≈70-80% do not regain their pre-recession growth rates for three years. Only ≈10% of companies flourish. Companies that deploy multi-pronged strategies balancing different priorities, are the most likely – in fact almost 40% more likely – to succeed in the post-recession environment.

In this article, Asia Securities’ Investment Banking team highlights a number of corporate restructuring strategies, along with defensive and offensive strategies, that companies have successfully used to navigate previous global crises, and draw lessons that can be applicable to this unique event.

Learnings brought forward

The post WW-II era of globalisation holds many examples of crises that shocked corporates. Over the years numerous pandemics, epidemics, acts of terrorism, natural catastrophes, and financial crises have reshaped global supply chains and consumer demand. We looked at four key events—SARS (2003), Swine Flu (2009), the global financial crisis (2008), and Tōhoku earthquake and tsunami which led to the Fukushima meltdown (2011)—to understand how survivors of these crises weathered and responded to these shocks.

While the COVID-19 crisis is unique, in scale and impact, lessons from how corporate handled past crises can provide some insight on how to navigate this crisis. A clear lesson is that Sri Lankan businesses will have to devise multi-faceted strategies that protect their businesses during the crisis, while building a platform for post-crisis growth. They may also need to strategically evaluate corporate restructuring options to re-focus business lines and optimise their balance sheet and P&L. The insights highlighted in this article will provide a starting point for businesses to accomplish this.

Corporate restructuring

Rethinking the financial structure of a business, as well as its balance sheet structure is an essential tool to mitigate the impacts of a crisis and create value. There are a number of different strategies a business can deploy, which we broadly categorise as portfolio restructuring and financial restructuring.

Portfolio restructuring

A crisis can stretch the financial and management resources of any company. In order to concentrate resources and effort on a few core areas, companies with multiple business lines often look at restructuring their business portfolio during periods of crisis. For example, during and after the Global Financial Crisis (GFC), Samsung divested non-core, low-performing subsidiaries in order to reinvest capital back into its core businesses. This strategy enabled Samsung to invest heavily in R&D and marketing campaigns. Samsung now holds the sixth place on Interbrand’s list of most valuable brands globally, a significant boost from its pre-GFC rank of 21.

In order to carry out a portfolio restructuring, a company needs to evaluate all business lines in the context of the transformed environment. We suggest beginning the analysis by asking a few simple questions:

Based on this analysis, a company may decide to focus resources and effort on a few business lines. In this situation, a trusted financial advisor can provide guidance on the best strategy to reduce exposure to non-core business lines—sell-offs, spin-offs, equity carve-outs, management buyouts, leveraged buyouts, and asset sales are all potential options. A financial advisor will also be able to provide market insights on investor interest for each business.

Financial restructuring

A deteriorating business environment generally immediately impacts a firm’s liquidity position and depresses earnings. In order to manage the immediate situation, businesses often seek out short-term borrowings, which results in increased interest expenses while also adding to cash flow and liquidity pressure as debt repayment obligations come due.

In this situation, a business can undertake a financial restructuring to adjust its debt structure and build liquidity levels that position it for long-term sustainability and success. In order to do this, a firm will need to optimise its balance sheet structure to achieve the right mix of debt and equity, as well as short and long-term financing. This, in turn, will enhance its earnings and ultimately, its valuation.

Successfully developing a restructuring strategy requires deep financial expertise as well as an understanding of capital markets. Businesses can either build this team internally or lean on trusted financial advisors during this crisis period to develop clear, fact-based restructuring strategies. A couple of questions can help begin the analysis:

Defensive strategies

I. Proactively take steps to build liquidity

Managing a business’ liquidity is a critical aspect of successfully navigating a crisis. The disruption in demand caused by COVID-19 is leaving firms with scant revenues, yet still having to pay salaries, bills and debts. This will inevitably lead to liquidity and working capital constraints. A preliminary analysis of 187 publicly listed non-financial companies in Sri Lanka revealed that ≈24% of the companies do not hold sufficient cash and cash equivalents to finance their operating expenses over the next month, while ≈41% of the companies do not hold cash to finance their operating expenses over the next quarter.

Proactively taking steps to improve their liquidity position will be critical for a number of Sri Lankan companies. This can be done by (1) prioritising short-term liquidity requirements over discretionary expenditure; (2) pre-emptively securing financing options; and (3) postponing strategic capital expenditure. Relying solely on banks for financing during this time may be risky as not all businesses will be able to successfully negotiate customised financing plans with their banking partners.

Several global corporates have already begun to do this. Ford recently announced that it will prioritise financial flexibility during this period and drew down USD 15.4 billion from two credit lines to improve its cash position. It also suspended dividends to ensure sufficient liquidity. AT&T cancelled a USD 4 billion accelerated stock buyback program scheduled for the second quarter in order to maintain sufficient liquidity to navigate through the crisis period.

Deloitte suggests successfully managing liquidity during a crisis will require a specialised internal or external team to take on the constant evaluation of a few key questions:

II. Mitigate supply chain disruptions by monitoring risk levels of direct and indirect suppliers

The increasingly complex nature of global supply chains means that supply chain-related risks are not limited to a business’ direct suppliers but extend to indirect suppliers as well. A McKinsey framework for supply chain recovery planning indicates it is important for businesses to evaluate their supply chain to determine the origin of supply and assess disruption risk at both direct and indirect supplier levels. If suppliers are located in affected regions, immediately consider alternative sources.

III. Rationalise organisation’s cost structure strategically

Managing costs becomes one of the top priorities during a crisis and businesses should take a strategic approach to this. The cost-cutting strategy should not only aim to help the business survive the crisis, but also set it on a path to greater success post-crisis. In order to do so, businesses need to have a clear idea of the activities that are truly critical to the company’s sustainability, and then take necessary measures to slash costs around non-critical activities.

Even though staff lay-offs is the most common way of cutting costs, businesses may instead be able to achieve cost reductions by increasing operational efficiency. For example, a company can close down underperforming facilities during the crisis period while retaining their employees. Alternatively, they could restructure salary payment methods from a fixed payment plan to an incentive plan based on the firm’s revenue.

During the SARS outbreak in 2003, some hotels in Hong Kong closed their restaurants and several others stopped serving buffets. Due to low occupancy level, hotels reduced the number of elevators in operation, suspended business travel, and superfluous business entertainment.

Offensive strategies

I. Develop strategies to supplement revenue

These types of strategies will enable businesses to generate revenue, while building customer loyalty and minimising inventory write-offs, thereby, setting the stage for a faster recovery post-crisis.

II. Actively communicate with both internal and external stakeholders

Communication plays a critical role in stakeholder management during a crisis. Well-planned, consistent and transparent communication strategies support the morale of employees, while enabling rapid execution of response strategies. Regular communication will also help strengthen relationships with suppliers, capital providers and customers, while playing a catalytic role in the post-crisis recovery.

III. Opportunistic Acquisitions

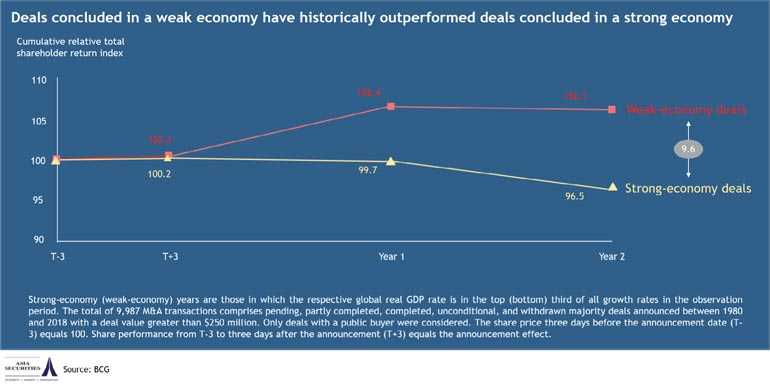

A difficult economic environment should not, by itself, put a stop to strategic acquisitions. According to the Boston Consulting Group, M&A transactions concluded during downturns have a higher chance of creating shareholder value, by taking advantage of attractive valuations to (1) increase the scale of the business; (2) transform the business to adapt to the change; and (3) expand market share by acquiring competitors.

There are many examples of opportunistic acquisitions that took place in the aftermath of crises. A few prominent examples took place shortly after the global financial crisis.

1. Adding scale: Kraft acquired Cadbury following a hostile takeover bid in 2009, with the goal of increasing the scale of its snacks business, especially in emerging markets. The acquisition gave Kraft’s snacks business enough scale to thrive in the competitive environment on a standalone basis. Since the acquisition, Kraft’s shares outperformed the broader S&P500 index by 16%.

2. Re-positioning product offering: Through its acquisition of Barclays Global Investors in 2009, BlackRock expanded from its core business of active management into passive-investment management. Since then, BlackRock has grown to become the world’s largest fund manager.

3. Consolidating geographically: Wells Fargo, which was already one of the most profitable banks, acquired Wachovia in 2008 in order to expand into the Eastern and Southern states. Since this deal, Wells Fargo has grown into one of the largest US banks in terms of market capitalisation.

Conclusion

COVID-19 and the measures taken to contain its spread have created an unprecedented social and economic impact. While every business will be affected in some way, those in external-facing sectors, will see a more substantial impact than others. While there is no single playbook of how to navigate this crisis, we encourage Sri Lankan businesses to take a multi-pronged approach; one that protects your business and positions it for long term growth. This will involve deploying the right balance of offensive and defensive operational strategies. Most importantly, it will also involve taking a proactive approach to corporate restructuring, looking at ways to optimise the business portfolio and/or balance sheet, to ensure that your business has the financial strength to weather this storm.