Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 23 June 2020 00:32 - - {{hitsCtrl.values.hits}}

Japanese firms investing in Sri Lanka are able to capitalise on its locational advantage on the east-west shipping route, connecting much of Asia with the Middle East and Europe and providing access to a broad maritime network. As a major maritime hub in the region, Sri Lanka has invested heavily in the development of its port infrastructure and is thus able to accommodate growing volumes of trade – Pic by Shehan Gunasekara

By Angela Huettemann, Pabasara Kannangara, Chathuni Pabasara and Sandunika Hasangani

COVID-19 has come as a sudden external shock, which has the potential to reshape existing economic and diplomatic relationships around the globe. As a response to recent supply chain disruptions and following a near 50%1 decline in Chinese imports to Japan in February, Japan is seeking to diversify its manufacturing base to reduce its reliance on Chinese production.

Prime Minister Abe has called on Japanese businesses to relocate their high-end manufacturing from China back to Japan and other manufacturing activities to South East Asian, allocating a total of $ 2.3 billion to these efforts.2 The relocation of FDI depicts an important opportunity for Sri Lanka to attract Japanese investor interest, and for both countries to mutually benefit from strengthened bilateral ties.

This blog seeks to look at Sri Lanka’s economic ties with Japan. It further assesses Sri Lanka’s strengths, weaknesses, opportunities, and threats to foster stronger bilateral ties, laying the foundation for increased investor interest from Japan.

Japan-Sri Lanka relations: An overview

Built upon the legacy of the San Francisco Peace Treaty in 1951, where Sri Lanka voluntarily waived the right to receive war reparations from Japan, the two nations have been maintaining friendly bilateral relations for nearly 70 years.

During the post-2002 period, Japan actively played a key political role in Sri Lanka’s peace process with a keen interest to establish peace in the island. The two countries have been strongly linked together on shared religious values and increasing public diplomacy. While Japan is a favoured destination among Sri Lankan labour migrants,3 many of the natural and cultural heritage sites in Sri Lanka are relished by Japanese tourists.4 In addition to the above landmark political ties, healthy cultural connectivity and people-to-people contacts, both countries share important economic links.

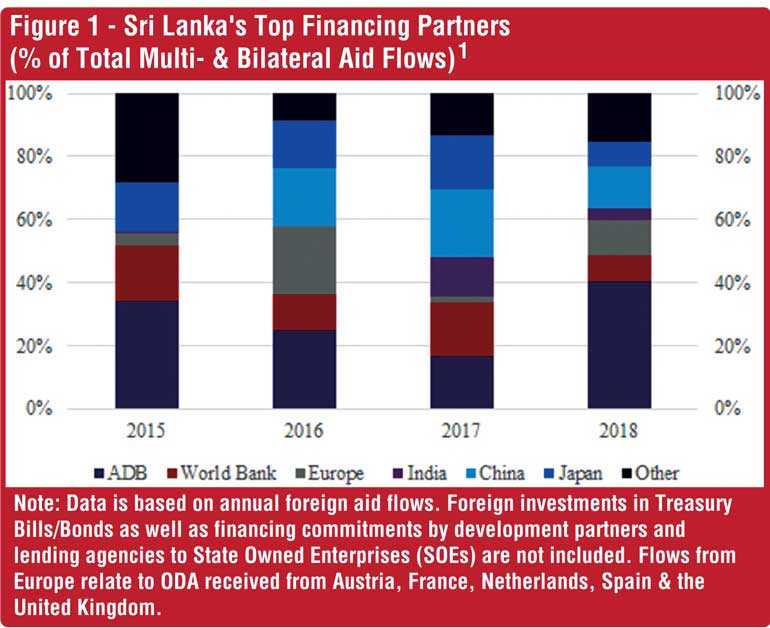

Historically, Japan has provided Overseas Development Assistance (ODA) to Sri Lanka in the form of capacity building and financial aid, totalling approximately $10,200 million between 1965 to 2018.5 Examples of such assistance include the extension of Colombo Port and the Mahaweli development project.6 Between 2015 and 2019 Japan’s contributions on average accounted for 14% of total multi- and bilateral aid flows, highlighting Japan’s importance as a development partner (Figure 1).

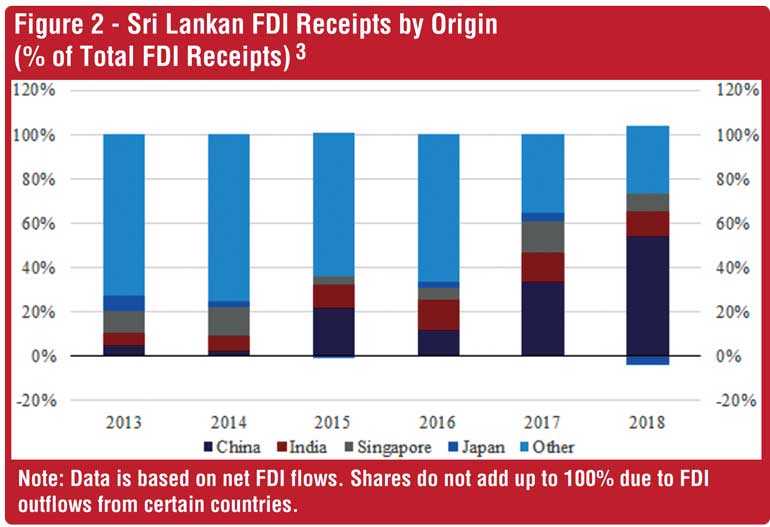

Whereas Sri Lanka has benefitted from large-scale ODA over time, Japanese FDI interest in Sri Lanka has been limited. Sri Lanka’s share in Japanese outward FDI flows to South Asia have historically lagged regional neighbours accounting for only 0.01% of Japanese FDI flows into South Asia between 2013-2018. Similarly, Japan’s FDI to Sri Lanka has accounted for only 2% of total FDI received between 2013 and 2018.8 (Figure 2).

Sri Lanka has historically shared a trade deficit with Japan, highlighting Sri Lanka’s potential to widen its export base with Japan. Total trade of goods with Japan currently stands at $964 million10, with a $300 million trade surplus in favour of Japan.

In total, 3% of Sri Lankan merchandise exports went to Japan in 2019. Sri Lanka’s top export products to Japan are centred round ships and boats as well as coffee, tea, maté and spices. In contrast, Sri Lanka mainly imports vehicles (and parts thereof) as well as machinery and mechanical appliances from Japan.11

Opportunities for deeper bilateral relations post COVID-19: Policy implications

Sri Lanka’s strong diplomatic ties with Japan could facilitate the promotion of trade and investment opportunities in Sri Lanka through its Embassy in Japan and foster dialogue with local industry players and industrial chambers (in key economic hubs such as Osaka and Nagoya) as part of Sri Lanka’s Economic Diplomacy Program.

Japanese firms, such as FDK, Toyota and Noritake have made significant investments in Sri Lanka over the past few years, reflecting the transformation of Sri Lanka’s aid relationship with Japan, to an FDI-oriented one. Going forward, this transformation can gain further traction through attractive investment opportunities such as Port City and Hambantota Port.

Port City is designed to be a Special Economic Zone (SEZ) with the potential to become Asia’s most advanced smart city. Port City aims to attract global investors in high-tech and financial services sectors and facilitate Sri Lanka’s transformation towards a services-led economy. The development of the Hambantota Port has supplemented Sri Lanka’s ability to handle greater volumes of trade while its accompanying industrial zone provides an attractive investment opportunity to industries looking to capitalise on Hambantota’s strategic location and its connectivity to regional markets.

In 2019, Hambantota International Port Group (HIPG) signed a terminal service agreement (TSA) with Japanese shipping firm Nippon Yusen Kaisha (NYK) to provide vehicle transhipment via the port.12 Potentially, Japanese FDI could expand this operation further, and invest in value added services such as vehicle repairs and car assembly plants.

Japanese firms investing in Sri Lanka are able to capitalise on its locational advantage on the east-west shipping route, connecting much of Asia with the Middle East and Europe and providing access to a broad maritime network. As a major maritime hub in the region, Sri Lanka has invested heavily in the development of its port infrastructure and is thus able to accommodate growing volumes of trade.

Sri Lanka’s strategic position in South Asia is bolstered by its Free Trade Agreements with India and Pakistan, which facilitates bilateral trade in goods through the elimination of trade barriers, presenting Japanese investors with the opportunity to manufacture goods in Sri Lanka for export to neighbouring markets.

However, Sri Lanka should aim towards gaining greater access to the vast Indian market by pursuing more comprehensive and beneficial trade terms that target the shortcomings of the SL-India FTA. One such area is the elimination of non-tariff barriers, which would provide Japanese manufacturers based in Sri Lanka with enhanced access to the Indian market, by facilitating the export of higher volumes of goods manufactured in Sri Lanka.

Sri Lanka’s IT sector has been growing over the years and has become increasingly globally competitive. In 2019, export earnings from IT, reached US$ 900 million and grew at a rate of 6% (YoY). Sri Lanka’s business process outsourcing (BPO) is built around agility, a niche talent base and superior quality. Despite COVID-19, industry experts are confident that the industry will remain resilient. In addition, as the post-pandemic world is likely to be more technologically dependent, there is potential for this sector to grow.

Japan showed keen interest in these services back in 2014, when JETRO facilitated a delegation visit and invited representatives from the Sri Lankan IT/BPO industry to visit Japan.13 In 2019, the EDB facilitated a visit to Japan during IT week, where up to $ 1 million was secured in contracts.14 Given the keen interest in the sector and the likely rise in demand for these services post-crisis, Sri Lanka could work toward attracting FDI from Japan to these innovative firms, through the promotion of the ‘Island of Ingenuity’ brand.

Conclusion

The current bilateral ties between Sri Lanka and Japan leave room for deeper cooperation. The spread of COVID-19 forces countries to rethink their current diplomatic and economic linkages, which provides an excellent opportunity for Sri Lanka to strengthen existing bilateral ties. Sri Lanka’s success in attracting Japanese FDI hinges on Sri Lanka’s ability to foster economic diplomacy with Japan and highlight attractive domestic investment opportunities.

A well-coordinated approach by the Sri Lankan Government and targeted initiatives of Sri Lanka’s mission in Japan, supplemented by focused marketing strategies, are imperative to capitalise on the opportunities presented through the reshaping of Japan’s bilateral relations.

[Angela Huettemann is a Research Fellow at the Lakshman Kadirgamar Institute of International Relations and Strategic Studies (LKI) in Colombo. Sandunika Hasangani is a Research Fellow at LKI. Pabasara Kannangara is a Research Associate at LKI. Chathuni Pabasara is a Research Assistant at LKI. The opinions expressed in this article are those of the authors. They are not the institutional views of LKI, and do not necessarily represent or reflect the position of any other institution or individual with which the author is affiliated.]

Footnotes

1 The Japan Times. (2020). Japan sets aside ¥243.5 billion to help firms shift production out of China. [Online]. Available at: https://www.japantimes.co.jp/news/2020/04/09/business/japan-sets-aside-%C2%A5243-5-billion-help-firms-shift-production-china/#.XqrQ9qgzY2w [Accessed 30 April 2020].

2 Saavedra, R. (2020). IT BEGINS: Japan Pays Billions To Firms To Leave China, Relocate Production Elsewhere. The Daily Wire. [Online]. Available at: https://www.dailywire.com/news/it-begins-japan-pays-billions-to-firms-to-leave-china-relocate-production-elsewhere/ [Accessed 30 April 2020].

3 Daily FT. (2019). “Japan opens job market for skilled Sri lankan labour via new agreement.” [Online] Available at: http://www.ft.lk/news/Japan-opens-job-market-for-skilled-Sri-Lankan-labour-via-new-agreement/56-680355 [Accessed 20 May 2020].

4 TBS TV -Japan. (2020). “Feature: The Ancient City of Sigiriya.” [Online] Available at: http://www.tbs.co.jp/heritage/feature/2020/202005_01.html [Accessed 20 May 2020].

5 Department of External Resources Sri Lanka. Performance Report 2018. Ministry of Finance. [Online]. Available at: https://www.parliament.lk/uploads/documents/paperspresented/performance-report-department-of-external-resources-2018.pdf [Accessed 19 May 2020].

6 Kelegama, S. (2012). Japan – Sri Lanka Economic Relations: Trends and Opportunities. Presentation to the Joint Committee Meeting of the Sri Lanka-Japan Business Committee. Institute of Policy Studies of Sri Lanka. [Online]. Available at: http://www.ips.lk/wp-content/uploads/2017/09/japan_sl_sk.pdf [Accessed 27 April 2020].

7 Supra Note 5

8 Central Bank of Sri Lanka. (2019). Central Bank Annual Report 2018. [ONLINE]. Available at: https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports/annual-report-2018. [Accessed 23 April 2020].

9 Central Bank of Sri Lanka. (2019). Central Bank Annual Report 2018. [ONLINE]. Available at: https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports/annual-report-2018. [Accessed 23 April 2020].

10 TradeMap. (2019). Bilateral trade between Sri Lanka and Japan – Product: TOTAL all products. [ONLINE]. Available at: https://www.trademap.org/Bilateral.aspx?nvpm=1%7c144%7c%7c392%7c%7cTOTAL%7c%7c%7c2%7c1%7c2%7c1%7c1%7c%7c1%7c1%7c [Accessed 5 May 2020].

11 Ibid.

12 Ship Technology. (2019). Sri Lanka’s Hambantota Port and NYK partner for vehicle transhipment. [Online] Available at: https://www.ship-technology.com/news/sri-lanka-hambantota-port-nyk-transhipment/ [Accessed 20 May 2020].

13 Asian Tribune. (2014). Asia’s hi-tech powerhouse officially calls Lankan IT for the first time. [Online] Available at: http://asiantribune.com/node/85443 [Accessed 21 May 2020].

14 Colombo Page. (2019). Sri Lanka EDB's ICT/BPM delegation participates in Japan IT Week 2019. [Online] Available at: http://www.colombopage.com/archive_19A/May16_1558016412CH.php [Accessed 20 May 2020].