Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 31 January 2020 00:05 - - {{hitsCtrl.values.hits}}

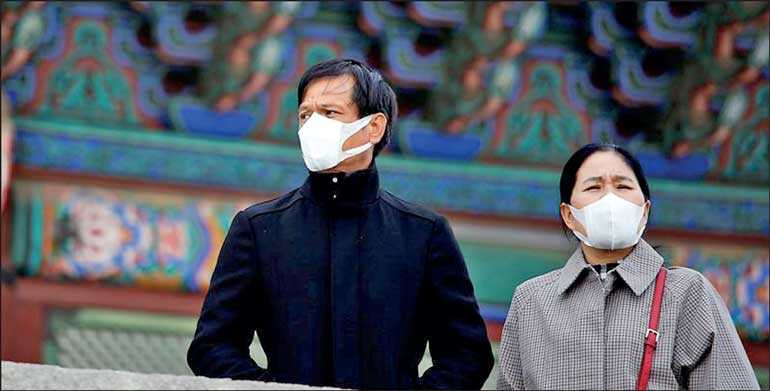

A couple wear masks to prevent contracting coronavirus in Seoul

WASHINGTON, (REUTERS): A rapidly spreading virus outbreak in China is emerging as a potentially major new risk to the global economy and leaving policymakers, still grappling with the impact of the Sino-US trade war, fretting over the widening fallout.

The potential effects of the spread of the coronavirus, which has killed 170 in China since its detection early last month, took centre stage in US Federal Reserve Chair Jerome Powell’s news conference on Wednesday.

“China’s economy is very important in the global economy now, and when China’s economy slows down we do feel that – not as much though as countries that are near China, or that trade more actively with China, like some of the Western European countries,” Powell said.

Japanese Prime Minister Shinzo Abe also voiced concern on Thursday over the potential damage to Japan’s economy, which is heavily reliant on China as a production and market base. “I would like to scrutinise the economic impact, including that from the hit to tourism,” Abe told parliament.

Zhang Ming, an economist at the Chinese Academy of Social Sciences, a top government think tank, projected the outbreak would cut China’s first-quarter growth by one percentage point to 5% or lower.

China has imposed travel restrictions and shut businesses to contain the outbreak, but has not quelled rising concern among companies and governments across the world, some of whom are taking swift action.

A plane of Japanese evacuees from the Chinese city of Wuhan, the epicentre of the outbreak, arrived in Tokyo on Thursday. New Zealand and Indonesia are also preparing to evacuate their citizens.

Airlines including British Airways, United Airlines and Lufthansa are cutting or suspending flights. Starbucks has closed more than half its cafes in China and Walt Disney shut its resorts and theme parks in Shanghai and Hong Kong.

“Apart from the risk to human lives, it is likely to hit travel and consumption activities. In a scenario of widespread infection, it could materially weaken economic growth and fiscal positions of governments in Asia,” S&P said on Thursday.

Asian stocks sank on Thursday as the death toll from the virus rose and more cases were reported around the world. Yields on benchmark 10-year US Treasuries also hit a three-month low of 1.5600% as investors sought the safety of government bonds.

“We expect the risk of potential negative spillovers to domestic tourism in neighbouring countries to be higher than during SARS because Chinese nationals now make up the largest share of visitors to other Asia-Pacific economies,” Moody’s said on Wednesday.

“The timing is particularly bad for Japan as it seeks to rebound from the dip in consumption, and presumably real GDP growth, in the last quarter of 2019 following a sales tax hike. Analysts are comparing the current coronavirus outbreak to the 2002-2003 Severe Acute Respiratory Syndrome (SARS) epidemic, which led to about 800 deaths and slowed Asia’s economic growth. Many say the impact on global growth could be bigger this time, as China now accounts for a larger share of the world economy.

The fallout from the epidemic casts a shadow over the Bank of Japan’s projection that global growth will pick up around mid-year and help Japan’s economy sustain a moderate recovery.

China is Japan’s second-largest export destination. The Chinese make up 30% of all tourists visiting Japan and nearly 40% of the total sum foreign tourists spent last year, an industry survey showed.