Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 10 September 2018 00:08 - - {{hitsCtrl.values.hits}}

Cigarettes are one of the most smuggled ‘legal’ products in the world, and cigarette smuggling is a form of transnational organised crime (US Department of State, 2015). Evidence shows many high-profile terrorist organisations such as Al-Qaida, etc. operate smuggling rings due to higher profit margins and relatively lower risk (US Department of State, 2015).

With Sri Lanka having one of the highest cigarette prices in the region it has led the country into the hands of illegal cigarette smugglers who make huge profits. This trend consistent tax hikes from 2009-2015 have since given way to large and unprecedented hike in 2016 which hampered the objectives of both the Ministry of Health and the Ministry of Finance.

High taxes play a significant role in incentivising the smuggling of cigarettes, the Research Intelligence Unit’s 2018 report on Towards Sensible Policy Reforms to Combat Illicit Tobacco Markets said.

“In the context of Sri Lanka, the price differential between legal and illicit is about Rs. 25 per stick for cigarettes and about Rs. 2 per stick for beedi,” it says while the distribution of illicit cigarettes is much easier and organised than drugs such as Heroine.

Illicit tobacco market

Estimating the size of the current illicit tobacco market is a crucial step towards benchmarking and assessing the effectiveness of actions to curb the growth of the market. Since the illicit market is not directly observable for multifarious reasons, an indirect approach was required to estimate the size of the market. As per the analysis, the illicit market share is around 14 to 18% for cigarettes and 26 to 29% for beedi, which translate to 500 to 700 million sticks of cigarettes and 1,400 to 1,700 million sticks of beedi in 2018.

In other words, the illicit cigarette market turnover could be anywhere between Rs. 15 to 20 billion, which is about 11 to 15% of the legitimate market size while illicit beedi market is worth Rs. 4 to 5 billion, which is about 5 to 6% of the legitimate market. This massive size of the illicit market means loss of revenue for the government, to the industry, and for those whose livelihoods are connected with tobacco industry such as tobacco farmers and beedi rollers.

In addition to the above, it can be observed that the size of the illicit market has risen to 14% or more by 2017. This calls into question the Government’s policy towards the industry and the efficiency of the enforcement agencies.

RIU says there is strong evidence to suggest higher taxes are a key reason for increased smuggling levels in Sri Lanka. Over the years there is a reduction in legitimate cigarette sales while the consumption of beedi has been going up. This indicates the consumers are switching to beedi as a cheaper alternative to cigarettes. This took place in the backdrop of a continually increasing excise tax environment. Therefore, it can be concluded that high taxes have a strong connection with the illicit tobacco trade.

According to the authorities and other sources met during this research, a 40-foot container of smuggled cigarettes can add up to a profit of between Rs. 250-400 million (RIU, 2018). This softer penalty makes the risks associated with smuggling highly acceptable to criminals.

However, the WHO (2012) refutes the claim that higher taxes lead to higher smuggling and states that “The link between price and tax differences and large-scale illicit trade is weak, rather the evidence shows that other “enabling factors” are more important”

The enabling factors according to WHO are:

nweak governance/lack of high-level commitment;

nineffective customs and excise administration;

ncorruption and complicity of cigarette manufacturers; and

npresence of informal sectors/distribution channels

Population perceptions and social economic status

However, a recent study done in US found that there is a correlation between the illicit market share and the tax rates (Tax Foundation, 2015).The study further states;

Public policies often have unintended consequences that outweigh their benefits. One consequence of high state cigarette tax rates has been increased smuggling as people procure discounted packs from low-tax states to sell in high-tax states. Growing cigarette tax differentials have made cigarette smuggling both a national problem and in some cases, a lucrative criminal enterprise.

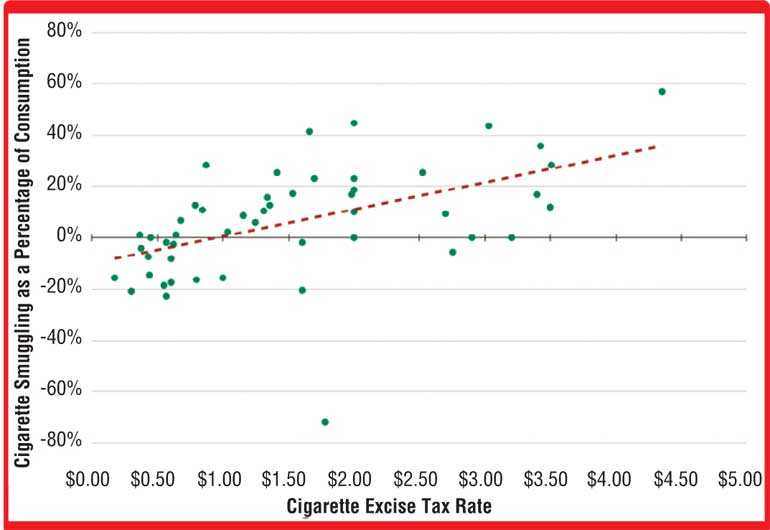

Figure 1 illustrates how smuggled cigarettes move from low tax jurisdictions to high tax jurisdictions in the US. The data points (green dots) represent the illicit share in each state. Negative data points indicate outflows while positive data points indicate inflows. When a trend line (dotted red line) is drawn it is trending upwards. Therefore, it is evident that as the cigarette excise tax rate increases (horizontal axis) the cigarette smuggling as a percentage of consumption rises (vertical axis).

The illicit tobacco trade has resulted in huge losses to the governments in the form of loss of taxes. Building on the analysis in figure1, RIU calculated the revenue loss to the Government from illicit tobacco. The loss figures were arrived at by using the extrapolation of income from legitimate tobacco sales. To put things into perspective, the Government has spent close to Rs.40billion for the Samurdhi programme last year. The loss of tax revenue from illicit tobacco is equivalent to 27 to 40% of the annual Samurdhi spending. Therefore, if converted to legitimate sales, the Government could have spent this revenue on productive economic or social activities.

For more information: [email protected].