Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 23 January 2025 02:54 - - {{hitsCtrl.values.hits}}

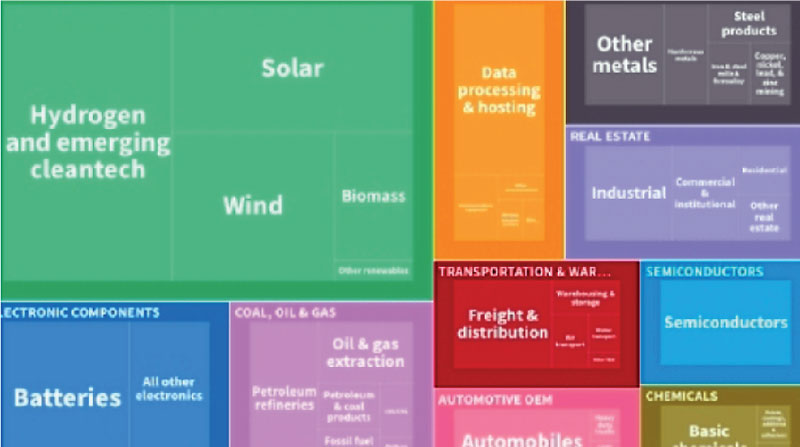

Top 10 FDI charts of 2024

Potential sectors for quality investment. Our Missions abroad needs to deliver. https://www.fdiintelligence.com/content/data-trends/top-10-fdi-charts-of-2024-84489

Sri Lanka’s Ministry of Energy and Sinopec recently signed a landmark $ 3.7 billion agreement to construct a state-of-the-art oil refinery in the Hambantota region with a capacity of 200,000 barrels per day. According to the President’s Media Division (PMD), a significant portion of the refinery’s output is planned for export, boosting the nation’s foreign exchange earnings. This project had been under consideration for over 12 months, with delays caused by issues related to water, land, and investment incentives. It is noteworthy that the AKD Government has finalised the agreement, marking a critical step forward in closing this project.

Sri Lanka’s Ministry of Energy and Sinopec recently signed a landmark $ 3.7 billion agreement to construct a state-of-the-art oil refinery in the Hambantota region with a capacity of 200,000 barrels per day. According to the President’s Media Division (PMD), a significant portion of the refinery’s output is planned for export, boosting the nation’s foreign exchange earnings. This project had been under consideration for over 12 months, with delays caused by issues related to water, land, and investment incentives. It is noteworthy that the AKD Government has finalised the agreement, marking a critical step forward in closing this project.

Open-minded approach

In a globalised economy, countries seeking economic growth must focus on attracting investments that provide net value addition to their economies, rather than fixating on the origin or “colour” of those investments. For Sri Lanka, which urgently needs economic recovery, adopting a pragmatic, open, and inclusive approach to foreign direct investment (FDI) is critical.

Given Sri Lanka’s current financial situation, with the nation expected to remain in default until 2027, attracting foreign investments becomes even more vital. This period offers a crucial window to rebuild the economy and prepare for re-entry into international financial markets to raise funds and resume debt repayments.

Economic realities vs. geopolitical concerns

Sri Lanka faces immense challenges, including high debt levels, a balance of payments crisis, and the urgent need for infrastructure and industrial development. Investments—regardless of their source—can provide the capital, technology, and expertise necessary to rejuvenate key sectors.

Whether funds come from China, India, the Middle East, the United States, or Europe, what truly matters is their contribution to economic growth, job creation, and infrastructure development. While geopolitical considerations may sometimes influence investment decisions, Sri Lanka must prioritise its national interests over external pressures.

Countries like Singapore, the UAE, and Vietnam have successfully attracted investments from diverse sources by maintaining neutral and business-friendly environments. Sri Lanka can emulate this model to secure investments that align with its development goals.

Focus on social, economic, and environmental impact

The evaluation of investments should prioritise their quality and net impact over their origin. Key parameters to consider include:

Value addition: Investments that introduce advanced technology, improve productivity, and enhance export capacity should be prioritised.

Productive jobs: Projects that generate employment opportunities contribute directly to social stability and economic growth.

Sustainability: Environmentally friendly and socially responsible investments provide long-term benefits and attract investors mindful of their ESG (Environmental, Social, and Governance) obligations.

Forex impact: Investments should contribute to sustaining foreign exchange flows, thereby strengthening the country’s external financial position.

Impact on the Sri Lankan brand: Investments that enhance the country’s image and attract the attention of other global investors should be encouraged, as they position Sri Lanka as a competitive destination for FDI.

By focusing on these objectives, Sri Lanka can maximise the benefits of FDI while staying focused on economic priorities without being swayed by geopolitical or political concerns.

Lessons from other countries

Several countries have demonstrated the advantages of welcoming diverse investments:

Vietnam: By opening its economy to both Western and Eastern investors, Vietnam has become a global manufacturing hub. From January to November 2024, FDI into Vietnam increased by 7.1% year-on-year, totalling $ 21.68 billion.

Singapore: attracts investments from the US, China, India, and others, leveraging its position as a global financial centre and a place to live.

India: Balances strategic interests by securing investments from the US, Japan, and other nations while maintaining trade ties with China. In the fiscal year 2022-2023, India received total FDI inflows amounting to $ 70.9 billion.

Emerging markets: In 2024, the top FDI recipients included China, the UAE, Saudi Arabia, India, Brazil, Mexico, Poland, and Argentina.

Sri Lanka, with its strategic location, key ports, and natural resources, selective skills can adopt a similar strategy to transform its challenges into opportunities.

Transparency

Concerns about the political or strategic implications of investments can be addressed through robust governance and a skilled, motivated bureaucracy. Transparent regulatory frameworks, thorough due diligence, and accountability mechanisms can mitigate risks while ensuring that foreign investments contribute to long-term development without compromising sovereignty or security.

Way forward

Sri Lanka’s economic recovery hinges on its ability to attract and retain diverse investments, increase exports, and boost tourism numbers. The “colour” of investment is secondary to its capacity to drive growth, create jobs, strengthen foreign exchange reserves, and foster sustainable development. By prioritising the economic and environmental impact of investments and cultivating a welcoming business environment (ease of doing business), Sri Lanka can unlock its potential and ensure a brighter future for its citizens.

In today’s interconnected world, neutrality, competence, and pragmatism are essential for success. Sri Lanka was ranked 99th out of 190 countries in the World Bank’s 2020 Ease of Doing Business Index. According to sources, the World Bank is keen to assist Sri Lanka in developing the new Business Ready index, which aims to provide a more comprehensive framework for assessing the business climate.

References:

Sri Lanka committed to repaying debt within the 2027-2042 schedule, President says

Sri Lanka’s ambitious governance macro-linked bonds

Video Reference