Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 10 October 2017 00:00 - - {{hitsCtrl.values.hits}}

By Tatiana Nenova

Sri Lanka experienced strong growth at the end of its 26-year conflict. This was to be expected as post-war reconstruction tends to bring new hope and energy to a country.

And Sri Lanka has done well—5% growth is nothing to scoff at.

However, Sri Lanka needs to create an environment that fosters private-sector growth and creates more and better jobs. To that end, the country should address these six pressing challenges:

1. The easy economic wins are almost exhausted

For a long time, the public-sector has been pouring funds into everything from infrastructure to healthcare. Unfortunately, Sri Lanka’s public sector is facing serious budget constraints. The island’s tax to growth domestic product (GDP) ratio is one of the lowest in the world, falling from 24.2% in 1978 to 10.1% in 2014. Sri Lanka should look for more sustainable sources of growth. As in many other countries, the answer lies with the private sector.

2. Sri Lanka has isolated itself from global and regional value chains

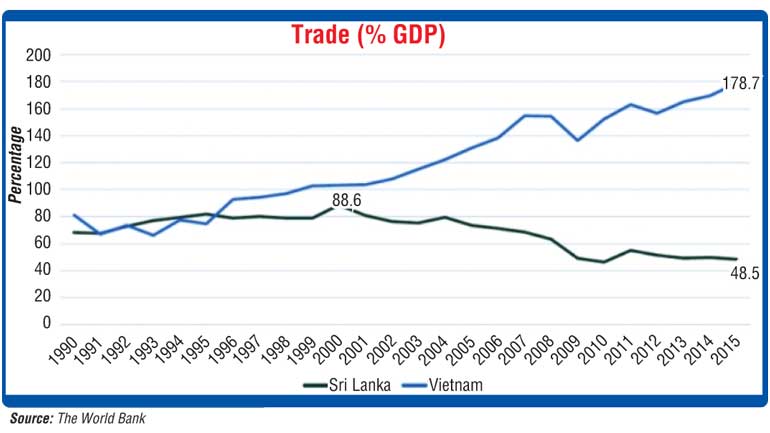

Over the past decades, Sri Lanka has lost its trade competitiveness. As illustrated in the graph below, Sri Lanka outperformed Vietnam in the early 1990s on how much of its trade contributed to its growth domestic product. Vietnam has now overtaken Sri Lanka where trade has been harmed by high tariffs and para-tariffs and trade interventions on agriculture.

3. The system inhibits private sector growth

Sri Lanka’s private sector is ailing. Sri Lankan companies are entrepreneurial and the country’s young people are smart, inquisitive, and dynamic. Yet, this does not translate into a vibrant private sector. Instead, public enterprises are the ones carrying the whole weight of development in this country.

The question is, why is the private sector not shouldering its burden of growth?

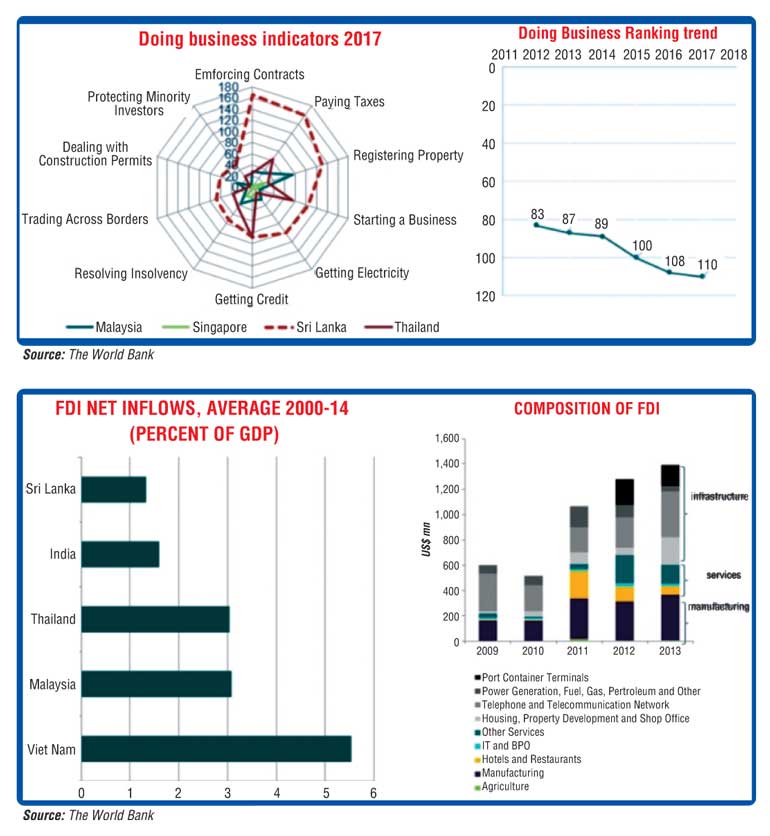

From the chart, you can see how difficult it is to set up and operate a business in Sri Lanka. From paying taxes to enforcing contracts to registering property, entrepreneurs have the deck stacked against them.

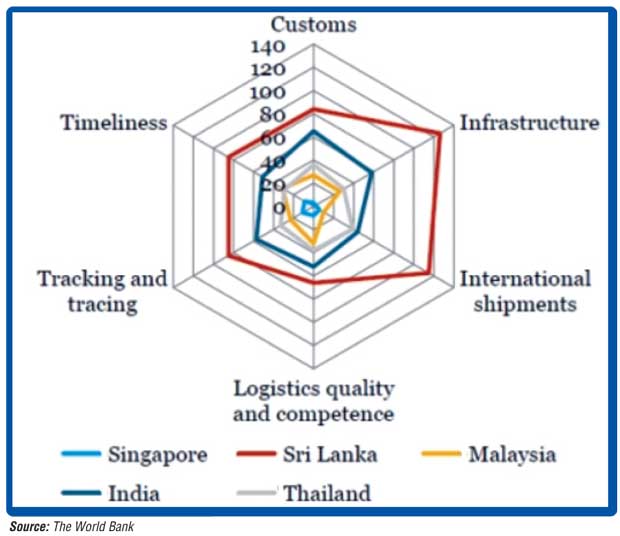

Trading across borders is particularly challenging for Sri Lankan businesses. Trade facilitation is inadequate to the point of stunting growth and linkages to regional value chains. The chart explains just why Sri Lanka is considered one of the hardest countries in the world to run a trading business. Compare it to Singapore–you could even import a live tiger there without a problem.

4. The right kind of foreign investment isn’t coming in

Another concern is the need for investment. When you drive around Colombo, you can see all these construction trucks and sites creating traffic jams—even on the weekend.

Construction has been the sector attracting the largest share of foreign investment in the last 5 years. But this is not the kind of investment Sri Lanka needs—the country needs foreign companies to set up shop here, bringing jobs and access to international markets.

The truth is, foreign investment to Sri Lanka has been lower than in peer countries despite its prime location. And only a relatively small proportion of foreign investment reaches sectors of the economy that are associated with global production networks.

5. Small and Medium Enterprises are hitting a glass ceiling

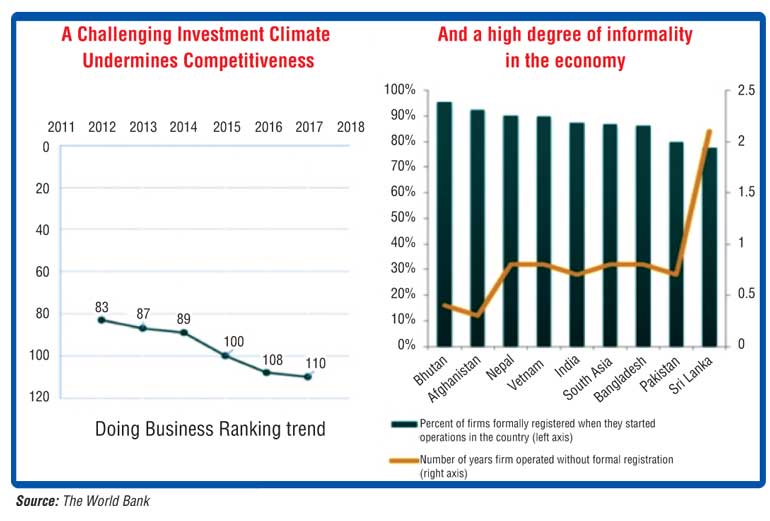

We look around and wonder why local companies are hitting a glass ceiling. Are small and medium enterprises staying that way because business registration, taxes, and bureaucratic headaches make it difficult to expand?

Currently, Sri Lanka ranks 110 in the Ease of Doing Business index. The recent ‘Vision 2025: A Country Enriched’ document articulates the country’s ambition of improving its rank to the 70th position through legislative and regulatory changes.

We can see there is a high degree of informality in the Sri Lankan economy. There are a bunch of small and medium-sized enterprises out there, and they could be the unicorns and gazelles, the most successful companies, of the future. To get there, the state needs to champion these companies as they pay taxes, create jobs, generate profits and bolster the economy. Improvements in trade policy and facilitation, investment policy and an environment that supports business are critical to this happening.

6. Trade facilitation reform and private sector growth in Sri Lanka are linked

Going forward, Sri Lanka needs growth that is driven by better productivity. Trade is the answer, offering a sustainable, viable solution. Trade can actively promote technology absorption, skill upgrading, and increased competitiveness—all crucial to Sri Lanka right now. Currently, Sri Lanka ranks 90th in Trading Across Borders (Doing Business Ranking) and 89 out of 160 in Logistics Performance.

For workers, more trade can mean more, and most crucially, better jobs. Consumers will benefit from lower prices, better quality goods and more choice. Producers can expect world-class inputs at competitive prices. And the government will benefit from higher revenues and an improved trade balance. By integrating into regional and global value chains, Sri Lanka can leverage its unique location to overcome the economic disadvantage generated by its small size.

By supporting the growth of its private sector, Sri Lanka has a better chance of realizing its ambitions of becoming a high-income country.

[The writer is a Program Leader for Sri Lanka and Maldives at the World Bank, responsible for Financial Markets, Trade and Competitiveness, Macro and Fiscal, Governance, and Poverty. Her operational work has focused on several financial sector areas of work (capital markets, access to finance for the poor, housing finance, and infrastructure finance and PPPs) as well as Investment climate and institutions, Trade policy and facilitation, and public sector institutions strengthening, and macro/fiscal policy. Before Sri Lanka, she has worked as Program Leader in Indonesia, with the World Bank CFO, as operational staff in South Asia, in the International Finance Corporation and in academia. Dr. Nenova has also published in leading US and international journals and co-created several innovative World Bank publications such as the Doing Business Report. She holds a Ph.D. in Economics from Harvard University.]

(https://blogs.worldbank.org/endpovertyinsouthasia/six-reasons-why-sri-lanka-needs-boost-its-ailing-private-sector)