Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 12 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Dr. Anil J Vitarana

Prime Minister Ranil Wickremesinghe in his message in the publication ‘National Export Strategy (NES) of Sri Lanka 2018-2022’ commented: “In addition to the mature export sectors of apparel, tea, rubber and coconut, exports of services such as ICT, tourism and logistics have grown significantly in the last decade. These sectors have proven their ability to diversify and access new market destinations.”

In identifying the growth in the logistics sector, the Prime Minister’s comments would have included reference to the critical ocean freight components that is the backbone of the export supply chain.

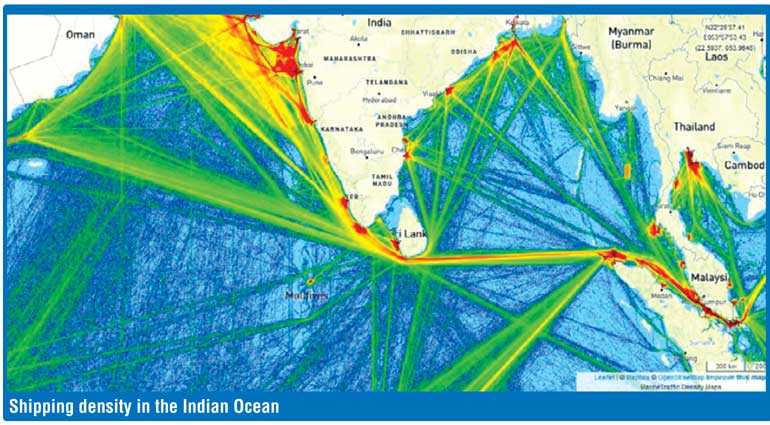

The NES Report recognises Sri Lanka’s advantageous geographical location and the beneficial impact of shipping density in the map depicted in its report.

On 31 December 2018, the Port of Colombo handled its seven millionth twenty-foot equivalent container unit (TEU). The total for the year was 7,047,486 TEUs of which 5,602,358 TEUs or 79.49% of the total containers handled were transshipment cargo. Local exports were 290,223 TEUs and imports were 648,478 TEUs. Sri Lanka’s local exports represented a meagre 4.12% of the total containers handled at the Port of Colombo.

Local exporters are, therefore, beneficiaries of the Port of Colombo’s transshipment business that has attracted all the major container carriers to the port with a multitude of shipping services. A review of the weekly shipping list reveals that the number of services available to exporters are plentiful, allowing a broad choice and presenting a highly competitive environment.

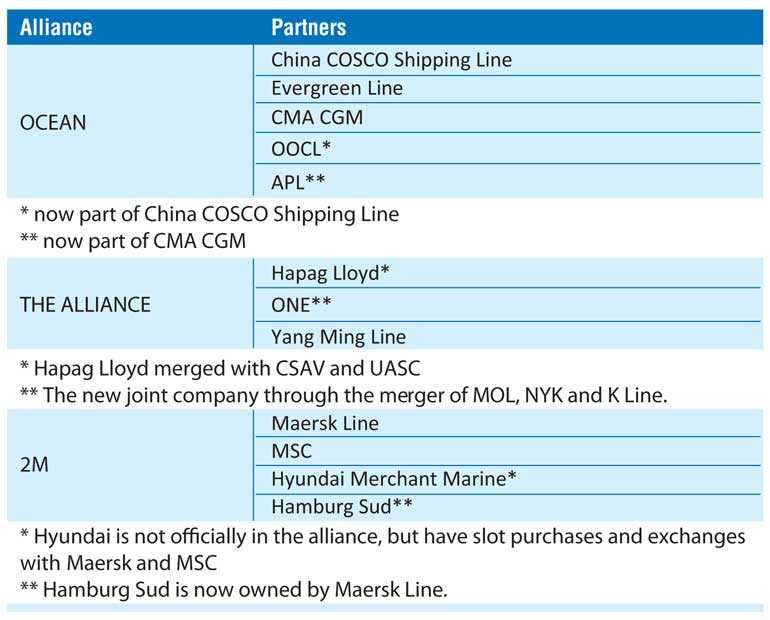

The three major carrier alliances have a strong presence in Colombo. Since the constituent partners in the alliances compete fiercely with each other, the choice of carriers available to exporters are greatly in excess of the weekly sailing opportunities.

The alliances and its constituent partners are listed below for easy reference.

The classification of the major ocean carriers (see chart) demonstrates the concentration and consolidation that has occurred during the past five years in the liner shipping industry. The alliances service the majority of the trade lanes through the deployment of Ultra Large Container Ships (container ships with a nominal container capacity of 10,000 TEU or more).

The Colombo International Container Terminal (CICT), which handled 38% of the Port of Colombo’s cargo volume in 2018, accommodated mega container vessels from all three major shipping alliances. With the geographical coverage of these services and the high frequency of mainline sailings, the port of Colombo now ranks as the 11th best connected port in the world as per Drewry’s Port Connectivity Index – a great benefit to Sri Lanka’s exporters and importers and a key supporting factor in Sri Lanka’s aspirations to achieve $ 28 billion in export earnings by the year 2022, as set out in the NES Policy.

Sri Lankan exporters have also been the beneficiary of competitive freight rates for many decades. When the Central Freight Bureau (CFB) and the national shipping line-the Ceylon Shipping Corporation (CSC) was formed in the early ’70s, one of the primary objectives were to make competitive freight rates available to Sri Lankan exporters who were at the time captive to the then powerful shipping conferences.

The CFB opened up shipping space to all exporters and introduced promotional freight rates for value added and non-traditional exports. Both organisations served a national need at the time (’70s and ’80s). Thankfully, ocean carriers are no longer permitted to collectively fix ocean freight rates and shippers have benefitted from the supply/demand ratio that has been in the shipper’s favour.

Bosting export volumes as envisaged in the NES policy would have a long-term beneficial impact on freight rates. In 2018 export volumes handled at the Port of Colombo were only 44.75% of imports, the imbalance had to be loaded as empty containers, adding to carrier’s costs. A more balanced trade could influence the carrier’s approach to formulating freight rates.

Sri Lanka’s logistical advantage is not confined to the Port of Colombo. Recently, Hayleys Advantis unveiled the country’s largest distribution hub-Advantis 3PL Logistics City in Kotugoda, Ja-Ela. The completed Phase I of the facility has 335,000 sq.ft of space which would expand to 500,000 sq.ft when Phase II is completed. Other companies that have added or are in the process of introducing critical warehouse and distribution capacity are Expolanka, OVIKLO, Dart Global Logistics, Scanwell Logistics and McLarens.

Meanwhile, the Port of Hambantota which is expected to play an important part in China’s One Belt One Road initiative, aimed at improving connectivity and cooperation between Eurasian countries, would further enhance the availability of ocean shipping services and accessibility to competitive ocean freight rates to the country’s exporters and importers.

Hence, one critical area that policymakers need not have concerns about in terms of meeting NES goals and objectives is the availability of high-quality ocean freight services at competitive freight rates.

[The writer, Principal, Cranford Consulting Inc., is former President, United Arab Shipping Company (USA); General Manager, Ceylon Shipping Corporation; and General Manager, Central Freight Bureau of Sri Lanka.]