Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 7 October 2024 01:00 - - {{hitsCtrl.values.hits}}

Treasury Secretary Mahinda Siriwardena

On 19 September 2024, the Democratic Socialist Republic of Sri Lanka (the “Republic”) announced agreements in principle on the restructuring of approximately $ 14.2 billion of sovereign debt (as of end 2023) with the holders of its International Sovereign Bonds (the “Bonds”), following negotiations with the Ad Hoc Group of Bondholders (“AHGB”), a representative group of international investors, and the Local Consortium of Sri Lanka (“LCSL”), a representative group of domestic financial institutions.

The Agreement in Principle with the AHGB features a state-contingent debt treatment, with varying levels of debt relief depending on the future economic performance of the country, while the Local Option agreed with the LCSL has been designed to meet the preferences of domestic institutions. The implementation of these agreements will almost bring to a close Sri Lanka’s debt restructuring exercise with the aim of restoring long-term sovereign debt sustainability. Only a handful of smaller creditors, representing a residual of approximately $ 0.9 billion of external sovereign debt yet to be restructured.

Q: What is a Macro-Linked Bond and what are the features of a “state-contingent debt treatment”?

A: A Macro-Linked Bond (MLB) is a debt instrument for which payments are tied to the economic performance of the issuer—in this case, Sri Lanka. These innovative instruments feature payments which are contingent on a set of future macro-economic variables. For Sri Lanka, the agreed treatment with the AHGB links repayments to the country’s GDP performance during the IMF-supported program, which extends until 2027.

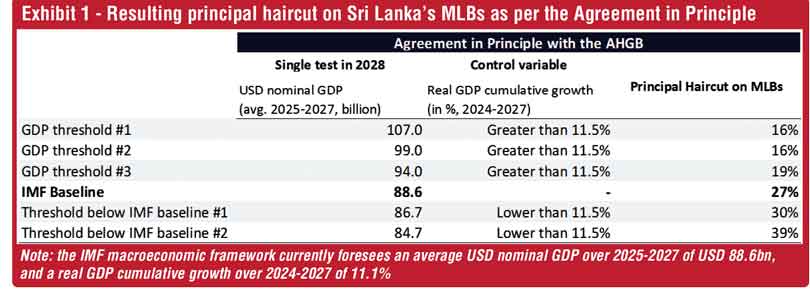

The headline terms of Sri Lanka’s new bonds are based on economic projections made by IMF staff. In 2028, a test will be conducted measuring the average USD nominal GDP from 2025 to 2027, along with an additional control variable measuring cumulative real GDP growth from 2024 to 2027. This test ensures that the MLBs are linked not only to nominal GDP growth but also to real GDP growth, thus preventing higher repayments to bondholders solely due to an appreciated Sri Lankan rupee (LKR), and protecting the country in case of a recession by providing automatic additional debt relief.

If Sri Lanka’s economy performs better than expected by the IMF staff in both USD nominal and real GDP terms, payments linked to the MLBs after 2028 will increase through a combination of capital reinstatement and higher coupons. Conversely, if Sri Lanka’s economy underperforms, payments will be reduced through additional haircuts and lower coupons. This structure ensures that Sri Lanka’s payments are aligned with the country’s debt repayment capacity, safeguarding long-term sovereign debt sustainability while assuring bondholders that payments will accurately reflect the country’s actual economic performance. This is particularly important given the bondholders’ stated belief that the IMF’s macroeconomic framework underpinning the Debt Sustainability Analysis (DSA) may be overly pessimistic.

Q: Why did Sri Lanka have to change the terms agreed with bondholders in July’s Joint Working Framework achieved with the Ad Hoc Group? What are the consequences for Sri Lanka?

A: Further to the preliminary agreement reached with the AHGB under the July’s Joint Working Framework1 (“JWF”), the Authorities of Sri Lanka submitted the terms of the contemplated debt treatment to the IMF staff and to Sri Lanka’s Official Creditor Committee (“OCC”) to obtain their evaluation with regards to compliance under the IMF DSA parameters and the OCC’s Comparability of Treatment (“CoT”) principles2. In their respective assessments provided in July 2024, both the IMF staff and the OCC indicated that further adjustments to the terms were necessary in order to ensure full compliance with the IMF program targets and the CoT principles.

Consequently, the terms were revised during the September negotiations3 to ensure that the agreements reached with both international and local bondholders align with the IMF DSA targets and the CoT principles committed to by Sri Lankan Authorities. The Authorities are now seeking formal confirmation of these assessments from the IMF staff and the OCC, respectively.

The adjustments made since the July Joint Working Framework provide Sri Lanka with additional relief. Compared to July’s JWF, coupon adjustments for the highest threshold were reduced by approximately 160 basis points. Similarly, the coupon adjustments for the second highest threshold were reduced by approximately 60 basis points. Additionally, the average USD nominal GDP thresholds triggering additional payments were shifted upwards, decreasing the likelihood of these additional payments being triggered.

Q: Why does the ISBs exchange envisage two options, one for international and one for local bondholders?

A: Since the outset of Sri Lanka’s restructuring process, bondholders organised themselves into two groups to negotiate the restructuring of the ISBs. A group representing international bondholders, the AHGB, and a group representing local financial institutions, the LCSL. Following the achievement of the July’s Joint Working Framework, the LCSL expressed their preference for instruments which do not include a state contingent feature, and which include a portion of outstanding ISBs exchanged for LKR instruments. This was primarily driven by the need to minimise losses incurred upfront by domestic financial institutions and therefore preserve stability in the domestic financial markets.

Accordingly, agreement in principle on a Local Option for members of the LCSL was also agreed on 19 September after negotiations over more than a year, contemplating the exchange of ISBs held by local holders for a mix of new plain vanilla USD and LKR denominated instruments with a reduced aggregate principal amount (“haircut”). It was further agreed that the Local Option would be offered to all bondholders, subject to a cap set at 25% of the aggregate outstanding amount of the ISBs, with priority given to local bondholders, and pro-rata allocation of the balance between consenting international bondholders who have opted for the Local Option.

Q: What are the advantages of this ISBs exchange for Sri Lanka?

A: Under the agreements in principle reached with the AHGB and the LCSL, it is expected that Sri Lanka will benefit from an upfront debt stock reduction of approximately $ 3.2 billion, which could increase up to a maximum of $ 4.6 billion in case of an economic downturn or decrease to a minimum of $ 2.0 billion if Sri Lanka’s economic performance exceeds DSA expectations by a significant margin.

In addition, under the baseline debt treatment scenario, Sri Lanka’s debt service payments over the IMF program period will be reduced by approximately $ 9.5 billion, the average maturity of the Bonds extended by over five years and interest rates reduced from 6.4% to 4.4% on average.

Under the agreements, holders of the ISBs will be consenting to a present value concession of 40.3% in the baseline scenario, calculated with a discount factor of 11%. In respect of the highest MLB threshold (resulting from the most significant economic outperformance), bondholders’ present value concession relative to the JWF has increased from 27% to 33%.

These agreements will help Sri Lanka to achieve sovereign debt sustainability and hasten the country’s economic recovery and return to international capital markets. This is also a condition for Sri Lanka to unlock additional disbursements from the IMF under the IMF-supported Program and other development partners in the next few years.

Q: What are the next steps towards the implementation of the ISBs exchange?

A: The agreements in principle achieved with bondholders were approved by the Cabinet of Ministers of Sri Lanka on 19 September 2024. Ahead of proceeding with the implementation of the exchange, Sri Lanka now expects to receive formal confirmation from IMF staff that the Agreement in Principle and the Local Option, taken together, are fully consistent with the parameters of Sri Lanka’s IMF-supported Program (having received informal confirmation from IMF staff of the compliance of the agreements during the negotiations with bondholders). Additionally, Sri Lanka will continue to work with its OCC to secure confirmation of compliance of the agreements achieved with the bondholders with the CoT criteria. We expect both confirmations to be delivered in the coming days, following which Sri Lanka’s debt advisors will start working on all documentation necessary to formally launch the debt exchange, which is expected to happen within approximately 10 weeks.

Q: How will the ISBs exchange be implemented?

A: The process of executing the ISB exchange requires Sri Lanka to prepare an exchange offer memorandum which will be made available to all holders of ISBs during a formal offer period, during which holders will consider the proposal in full and vote on its approval. Approval and execution of the restructuring requires certain voting thresholds set out in the terms of the ISBs to be met.

Q: What are the next steps in Sri Lanka’s sovereign debt restructuring?

A: The next step is to begin the implementation work with the advisors to the bondholders, with the aim of completing the ISBs exchange in Q4 2024. Additionally, the Sri Lankan Authorities will continue discussions with China Development Bank (with which agreement in principle was also reached on 19 September 2024 after months long discussions) to draft and finalise the restructuring agreements as early as possible.

Sri Lanka will also pursue discussions with its remaining official creditors and other commercial creditors (holding approximately $ 0.9 billion in total claims as of end 2023) to finalise negotiations and achieve restructuring agreements.

These next steps, which the Sri Lanka aims to expedite promptly enabling to finalise the restructuring of its external debt and advance its economic reform agenda to build a stronger economy.

Footnotes:

1July’s Joint Working Framework is available at: https://www.treasury.gov.lk/api/file/0773484a-ac92-4bb1-8878-babfc7946c79

2Sri Lanka has committed to its creditors at the start of the restructuring process that it would ensure Comparability of Treatment between different groups of external creditors. Comparability is assessed by the Official Creditor Committee under a set of criteria measuring creditors’ Net Present Value contribution, duration extension and efforts in reducing debt service payments during the IMF-supported program period.

3The revised terms are available at: Sri Lanka - Announcement of Agreement in Principle - 19_09_2024.ashx (sgx.com)