Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 22 October 2024 00:05 - - {{hitsCtrl.values.hits}}

By Chandula Idirisinghe and Nishamini Ihalagedara

By Chandula Idirisinghe and Nishamini Ihalagedara

In 2023, Sri Lanka’s goods and services exports made up nearly 20.4% of GDP, with manufacturing exports contributing 14%. However, the country’s merchandise export mix remains highly concentrated, with 77% of export income coming from industrial goods, mainly apparel, and just 22% from agricultural exports. This lack of sufficient diversification leaves Sri Lanka’s export economy vulnerable, heavily dependent on the apparel sector and traditional sectors like tea and rubber.

These challenges facing Sri Lanka’s economy raise a crucial question: can targeted reforms in trade, energy, and agriculture provide the boost needed for recovery? This was the focus of the third session of the IPS annual report launch, Sri Lanka: State of the Economy 2024 under the theme “Economic Scars of Multiple Crises: From Data to Policy”. The session, titled ‘Regulatory Policies: Will They Help to Successfully Compete Globally?’, explored how regulatory policies in these critical sectors can help the country improve its global competitiveness.

IPS Research Fellow Dr. Manoj Thibbotuwawa, the panel’s chair, kicked off the conversation by describing the connections between trade, energy, and agricultural regulations and how they can affect Sri Lanka’s ability to compete internationally.

Sri Lanka in RCEP: An export-led future?

Sri Lanka in RCEP: An export-led future?

“Sri Lanka has the potential to shift its focus toward more complex products, such as electronics,” remarked IPS Research Fellow Dr. Asanka Wijesinghe as he discussed the potential benefits of Sri Lanka’s accession to the Regional Comprehensive Economic Partnership (RCEP). According to Dr. Wijesinghe, joining the RCEP could pave the way for an export-led economy by gradually phasing out tariffs and opening doors to lucrative regional markets.

Although widening trade deficit with RCEP member countries is a valid short-term concern, RCEP provides important economic benefits such as increased exports, joining regional manufacturing value chains, and generating public goods like efficient custom procedures. For example, a Sri Lanka-China trade partnership could raise exports to China by 42%, while a free trade agreement with Indonesia could see an 85% rise in Sri Lanka’s exports to Indonesia, contingent upon the full liberalisation of 155 identified offensive products.

A change in the current incentive structure for domestic production could reallocate domestic resources toward export-oriented goods. But, there can also be impacts on the domestic labour market. Simulations to gauge the labour market impact of tariff liberalisation with the RCEP suggest domestic employment in carpentry, consumer electronics, and motor vehicle parts will be vulnerable to import competition from large exporters like China. To mitigate these effects, Dr. Wijesinghe suggested that Sri Lanka’s accession to RCEP be coupled with trade adjustment packages, mirroring successful models from the EU. He also highlighted the need for a forward-thinking industrial policy that targets complex products capable of generating high-quality jobs for tariff concessions under RCEP.

Energy pricing and export competitiveness: Evidence from key export sectors

As Sri Lanka looks to secure its next IMF Extended Fund Facility (EFF) concession, discussions around energy pricing and export competitiveness have become hot topics of discussion. Fossil fuel subsidies (FFS) and electricity tariff reforms aim to ease Sri Lanka’s fiscal burden and align with emission reduction targets. IPS Research Fellow Dr. Erandathie Pathiraja offered a data-driven analysis with a close look at the effects of rising energy costs on Sri Lanka’s export sectors, particularly apparel and tea.

The comparative advantage of Sri Lanka’s apparel sector is vulnerable to regional competitiveness, especially the low-cost producers and trade conditions, while the tea sector is mainly vulnerable to climatic conditions and domestic policies.

Textiles account for the largest share of costs in the apparel sector, followed by utilities. Given this context, the average share of electricity costs has increased from 3.38% in 2019 to 5.58% in 2023, resulting in a 2.2% rise in overall costs and shrinking profit margins. As Sri Lanka competes with other countries to attract investments and orders, its position is becoming less competitive due to rising electricity prices. Similarly, in the tea industry, the average cost share of electricity has risen from 10% to 13%, representing a nearly 3% rise in costs that shrinks profit margins.

“While the main export industries in Sri Lanka are primarily labour-intensive rather than energy-intensive, with comparatively low energy cost shares, they are still impacted by price shocks that affect short-term profits to some extent,” Dr. Pathiraja pointed out, emphasising how the export sector is, heavily reliant on the labour-intensive apparel sector and traditional plantation crops.

The discussion highlighted that energy-related policies should be complemented with assistance schemes to help relevant industries adapt to the new policy environment. For instance, to compensate for short-term losses, it is recommended to provide technical and financial support for renewable energy installations, small grant programs, and temporary tax relief for vulnerable industries. Additionally, the literature on cross-country ex-post analyses of FFS reforms underscore the importance of addressing associated political economy issues for successful implementation. Price reforms should also be accompanied by institutional, informational, and complementary reforms to ensure a comprehensive approach to policy adaptation.

Transforming agriculture for export

With growing global recognition for their unique quality and taste profile, Sri Lankan minor export crops have the potential to transform the economy while providing farmers with sustainable livelihoods. Given this context, IPS Research Economist Dilani Hirimuthugodage highlighted the need for investment and policy support to unlock this potential.

The agriculture sector has fallen within the overall economy over the past years. “Structural weaknesses amplify the effects of short-term crises, which can worsen the underlying problems,” Hirimuthugodage noted, calling for increased investment to address immediate and long-term challenges.

Hirimuthugodage also suggested diversifying beyond traditional major export crops to support minor export crop sectors: “Optimising existing investments by reallocating resources to emerging priorities is key.” She highlighted the need to dismantle barriers to agricultural exports to unlock untapped global market potential.

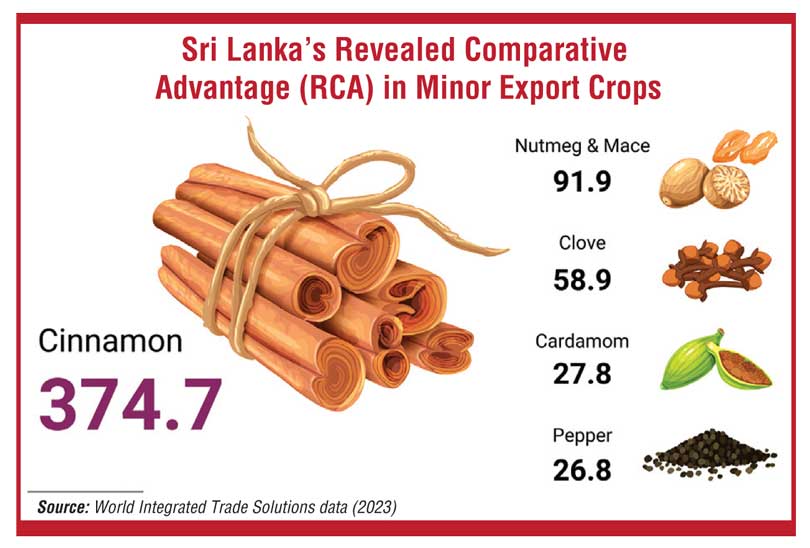

Sri Lanka has a strong comparative advantage in certain crops—Ceylon cinnamon, with a Revealed Comparative Advantage (RCA) of 375, followed by Ceylon tea at 295 and coconut at 241. Black tea holds an untapped potential of $ 550 million, and cinnamon offers an opportunity of $ 105 million, with key potential markets including the United States, India, and Vietnam.

Hirimuthugodage proposed a strategic approach to unlock the untapped potential by enhancing farm productivity, improving fertiliser use efficiency and elevating product quality through a Geographical Indication (GI) certification system. She also stressed the importance of promoting the ‘Ceylon’ brand, similar to the ‘Made in Sri Lanka’ brand, strengthening value chains via the ‘Geo Goviya’ database while fostering public-private-producer partnerships.

During the Q&A session, participants discussed how Sri Lanka’s agricultural export performance, particularly cinnamon, lags behind competitors like Mexico. Hirimuthugodage underscored the need for local and foreign investments to move up the value chain and secure higher margins.

Strengthening regulatory measures is crucial for Sri Lanka’s economic stability, as poorly implemented policies have historically disrupted key sectors like trade, energy and agriculture. By focusing on sound regulations in energy pricing, trade liberalisation, and export diversification, Sri Lanka can enhance its global competitiveness and achieve long-term economic resilience.

The IPS report is available for sale at IPS, No. 100/20, Independence Avenue, Colombo 07, and at leading bookshops island-wide. For more details, visit: https://www.ips.lk/sri-lanka-state-of-the-economy-2024-economic-scars-of-multiple-crises-from-data-to-policy/.

(Chandula Idirisinghe is a Research Assistant working on Agriculture and Agribusiness Development at the Institute of Policy Studies of Sri Lanka (IPS). He holds a BSc (Hons) in Agricultural Technology and Management, specialising in Applied Economics and Business Management from the Faculty of Agriculture, University of Peradeniya. His research interests include agricultural policies and institutions; agricultural productivity; agribusiness value chains; food security and environmental and natural resource policies.)

(Nishamini Ihalagedara is a Research Assistant at the Institute of Policy Studies of Sri Lanka (IPS). She holds a B.Sc. (Hons) in Agricultural Technology and Management specialising in Applied Economics and Business Management from the Faculty of Agriculture, University of Peradeniya. Her research interests are environment and natural resource policies, sustainable energy, food security and agriculture policies and institutions.)