Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 9 November 2017 00:00 - - {{hitsCtrl.values.hits}}

Reference article of ‘TEA brews toxic blend for its own survival’ by Merrill J. Fernando, Chairman of Dilmah Tea Company published under the guest column of Daily FT of 31 October 2017.

Tea Exporters Association (TEA) as a responsible tea industry stakeholder welcomes views and opinion expressed by others on its’ suggestions on teaindustry matterseven if it comes from a company thataccounts for less than 3.0% of the Sri Lanka annual tea export volume. However, the association is concerned over the misrepresentation of facts to suit the interests of Mr. Fernando and would like to clarify its position as follows for the greater interest of tea trade and general public.

1. Sri Lanka exports approximately 300 million kgs of tea annually and TEA members account for about 85% of the annual tea export volume and revenue of the country. The proposal for liberalisation of tea imports was submitted to relevant State agencies with the consent of majority of the association.Hence, it should be considered as a request by majority of tea exporters in the country.

2. The importation of tea to Sri Lanka is not something new. Until 1981 the importation of all types of tea was allowed after paying the applicable customs duty. In 1981, SLTB introduced tea import regulations for import of orthodox and CTC black tea, green tea, etc.,duty free for blending and re-export purpose. This scheme was amended in 1992 (after the plantations were handed over to private sector) due to the objections raised by tea producers. Since 1992 only CTC, green and specialty teas are allowed to import under the duty free scheme for re-export purposes. As per SLTB records the country imports between five to six million kg of tea annually under this scheme for value addition. All leading brands including Dilmahenjoy this facility and import tea for enhancing the position of their brands. The importation of CTC and green tea has in fact enhanced the price of similar local teas and also helped to expand the export of tea bags from Sri Lanka.

3. Some companies always talk of cheap teas when the subject of liberalisation of tea imports comes up. This could be due to their past experience of packing Ceylon tea mixed with cheap foreign teas in foreign countries like Poland, Indonesia, etc., or reluctance to accept the changing consumer behaviour in tea importing countries.

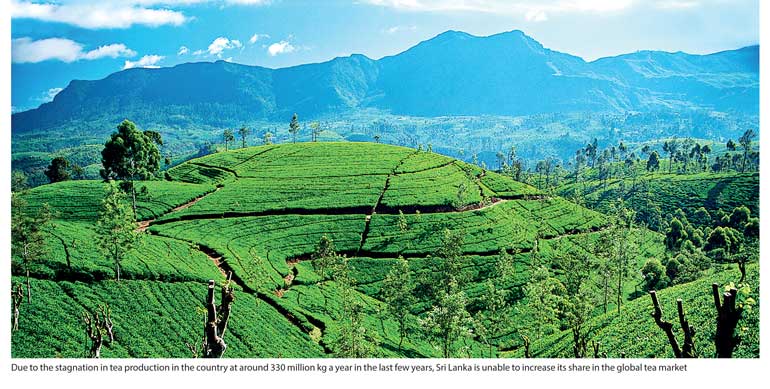

4. The size of the global tea market is about 5.4 billion kg per annum. Sri Lanka’s share in the world tea production has come down from 10.5% in 2000 to 6.0% by 2016 while its share in world tea export volume of 1.8 billion kg too has declined from 21.0% in 2000 to 16.0% by 2016. Due to the stagnation in tea production in the country at around 330 million kg a year in the last few years, Sri Lanka is unable to increase its share in the global tea market. It is estimated that share of Ceylon Tea in the global tea market would go down further and the country will not be able to achieve the expected foreign exchange revenue targets.In the absence of anyaccepted plan by the producers to increase the tea production in the medium to long terms, the growth of the export sector is restricted by non-availability of adequate quantities of tea.In this background TEA has proposed toliberalise tea imports to address this declining trend in country’s tea export share in the world tea market.

5.It appears that Mr. Fernando has not fully understood the TEA proposal to establish a tea hub in Sri Lanka. The present Government is actively promoting Sri Lanka as a trading hub due to its strategic location to serve the global trade. The logistic hub, tourism hub, IT hub, financial hub, etc., are some of the trading hubs proposed by both previous and present governments. In our opinion what is missing in the Government proposal is the tea hub. However, TEA realised the potential of the country to establish a tea hub around two decades ago as the industry possess the required knowhow, technology and resources.What TEA has proposed is to have two segments – pureCeylon Tea and Ceylon Tea blended with other origins as in the case of current SLTB scheme.The proposal submitted by TEA under the concept of ‘Sri Lanka – TeaNation of the World’ is more than importing tea from one place and shipping it to another country. The proposal covers a much bigger area and includes developing Colombo as a World Tea Centre, where international tea companies can establish tea business operations that would create additional demand for Ceylon Tea. Once in full operation, this would enhance the prices of Ceylon Tea rather than declining, as international tea brands that hardly use Ceylon Tea in their blends now may start using more Ceylon Tea in their blends due to their presence in the country. The investment from foreign tea companies will generate more business opportunities to the economy and will benefit other sectors such as banking, shipping, freight forwarding, etc. as well.In fact a number of international tea brands approached theGovernment recently to establish their operations in Colombo but due to the objections from certain influential stake holders the required approval was not granted. The loser was not the two to three companies who opposed but the entire country and its people.

6. The single origin tea is becoming a niche product in the global tea market. The share of single origin tea in tea importing countries is fewer than 20%. The brand marketers need multi origin teas to serve different consumer segments, increase product portfolio and ensure long-term stability of the brand. Even the local companies who oppose liberalisation, import tea under the SLTB scheme for use in their brands for value addition and re-export.

7. The delay in liberalising tea imports in Sri Lanka has allowed countries like UAE (Dubai) to establish tea hubs. Today, Dubai has become the leading re-export centre of tea in the world which could have achieved by Sri Lanka with liberalisation a long time ago.Further, as per SLTB statistics about 65% of Sri Lanka tea is exported in bulk form for blending and use in foreign brands. The value addition in fact takes place outside the country. If the liberalisation is allowed a good part of this volume will remain in the country for value addition locally and generate more revenue.

8.We are glad to notice that Mr. Fernando has realised the stagnation in domestic tea production, rising cost of production and diminishing of Ceylon Tea share in global tea brands, etc. However, we are disappointed that, those who oppose liberalisation have not been able to put forward any alternate proposal to address these issues to increase the Ceylon Tea share in the global tea market. TEA is fully aware that the tea industry consists of a number of stakeholders and its strong impact on the social and economic aspects of the country. It has organised workshops and had meetings with other stakeholders to discuss the liberalisation of tea imports and any other alternate proposals for enhancement of Sri Lanka tea share in the global tea market.If the country is to continue with the current status of tea industry without making any significant changes to the existing model, it will not be able to meet the challenges in the global tea market in the coming years.

9. We are rather surprised to note the commentsmade by Mr. Fernando that the export sector is not the most important segment in value chain of tea industry. Being a brand marketer, he should know more than others that marketing is the most important aspect of an industry unless you have a monopoly in the respective product or service sector where the customers have no choice other than buying your product or service. With a share of 6.0% in the world tea production, Sri Lanka cannot dictate terms to foreign buyers as they have so many other options to source their tea. It is a common knowledge that the exporters play the most difficult and important role in the value chain of tea industry. If exporters are unable to sell what is manufactured by the producers, the entire tea industry would come to a halt in no time.

10. It is true that, the total quantity of tea produced by the country is sold. The reason is that, Sri Lanka is the largest supplier of orthodox tea in the world and there is still a strong demand for such teas from Russia and Middle East. However, it has been observed that, the consumer tea drinking habit is shifting from loose tea to tea bags even in traditional tea markets. The good examples are Saudi Arabia, Jordan and UAE where the tea bag share has now over taken the loose tea market share. Sri Lanka has lost its share in these markets as CTC tea is the preferred type of tea for tea bag. The trend is slowly happening in Russia and Iran also. It is a matter of time that, these two important markets also goes for more tea bag consumption reducing its intake of orthodox tea.

11. The price of Ceylon Tea has been above other tea producing countries due to a number of reasons- shortages of orthodox black tea in world market, high cost of production in Sri Lanka, etc. It is a cost push situation rather than demand pull position. However, what he has failed to mention is that most internationalbrands reduce the Ceylon Tea component in their blends due to high prices which would be detrimental to local tea industry in the long run.

12. TEA has never sought political patronage to get the tea hub proposal implemented. It is the producer segment including large plantation companies that get Government supportfor various things including subsidies for fertiliser, re-planting, etc. However, it is a known fact that in the past, some companies got political support to get a large part of the tea promotional budget to build their brands.

13. Dilmah is not the only Sri Lankan-owned international tea brand. There is a number of Sri Lankan owned tea brands marketed all over the world.They are bigger than the so-called international brand and pay better prices to the local producers. As per the available information, the so-called saviourof Ceylon Tea pays much lower prices at the Colombo Tea Auction compared to other leading local tea brands.

14.The Colombo Tea Traders Association (CTTA) was formed in 1894 when the entire tea sector was in the hands of British companies. However, with the nationalisation of the plantation sector and emerge of local tea exporting companies, private tea factories, tea small holder farmers the need for specific associations to look after their respective interests was inevitable. As a result, the Sri Lanka Tea Factory Owners Association, Tea Exporters Association, The Federation of Small Holder Tea Growers Societies, etc. were established in the last two decades. Hence, no one can find fault with the establishment of other associations in the tea industry.

TEA would be happy for a public debate with Mr. Merrill J. Fernando on the subject of liberalisation of tea imports to clear any other misconceptions.

Tea Exporters Association