Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 3 June 2022 00:00 - - {{hitsCtrl.values.hits}}

By Sarah Afker

By Sarah Afker

Much has been discussed about the 2019 tax cuts and its contribution to the ongoing economic crisis, with many explaining that a reinstatement of the pre-2020 status quo is imperative towards revenue growth. It is perhaps timely to refresh one’s knowledge on what these cuts were and what we could perhaps envisage if it were to be reinstated either wholly or in part.

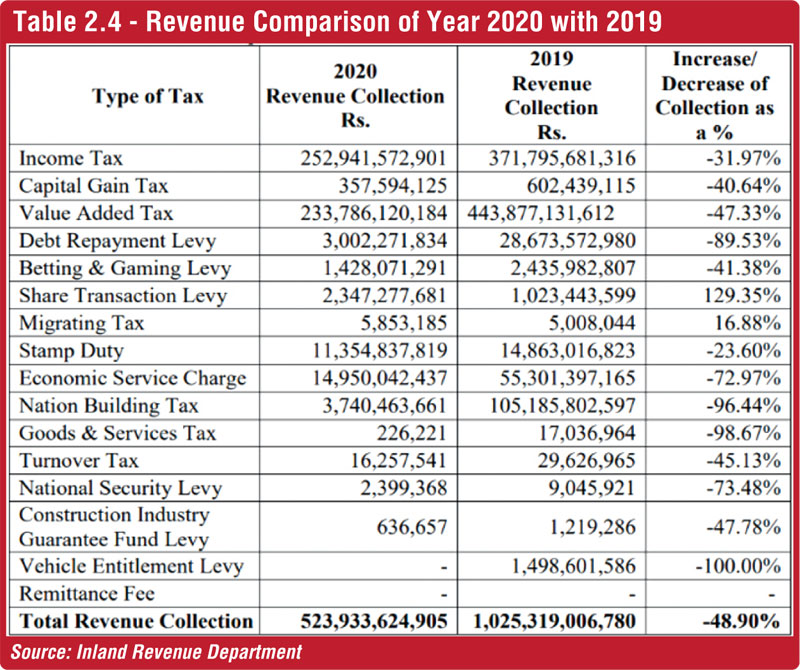

The 2019 tax cuts were implemented phase wide and included removal of certain taxes, reduction of tax rates and introduction of exemptions in a bid to propel long-term economic growth via spending. Unfortunately, the timing didn’t quite sync too well, the pandemic struck two months after the tax cuts were affected; curtailing taxpayers’ earnings, spending power and the revenue prospects that were envisaged from same. As a result of the tax cuts and the pandemic, revenue collection from Inland Revenue taxation halved from Rs. 1,025,319,006,780 in 2019 to Rs. 523,933,624,905 in 2020 according to Inland Revenue Department performance report 2020 (refer extract – Table 2.4).

Removal of taxes

In a bid to simplify the tax system, certain taxes were abolished, namely, Nation Building Tax (NBT) with effect from 1 December 2019, Economic Service Charge (ESC), and the Debt Repayment Levy (DRL), effective 1 January 2020.

NBT which was introduced in 2009, served as a cousin to VAT and was chargeable on imports, manufacturers, and service providers (subject to exceptions) at 2% of turnover. The removal of NBT has vastly contributed towards the drop in revenue, with tax collection from NBT dropping by 96.44% year on year.

ESC had been around since 2004 and served as an early payment of income tax, in that the ESC payment could be recouped as tax credits against one’s income taxes within a limited frame of time, which was three years at the time the tax was abolished. The removal of ESC would therefore cost the state revenue loss only where the taxpayers reported tax losses and do not have the avenues to claim the credits.

DRL was relatively new to the tax arena. Initially enacted as a three-year levy, it was repealed within one year of its introduction. The levy was charged on financial institutions at 7% of Value Addition from Financial Services. The loss of revenue from the removal of DRL amounted to Rs. 25 million of the collection for taxes by the Inland Revenue Department.

Tax threshold and rate revisions

Value Added Tax (VAT)

Historically, VAT has been one of the key contributors towards Government revenue; while this article focuses on inland revenue taxation, it is noteworthy of mention that VAT was also charged at the point of importation. VAT experienced some of the major revisions as part of the 2019 tax cuts. A significant change was made to the VAT rate where the rate was reduced from 15% to 8% on imports and/or supply of goods or supply of services with effect from 1 December 2019; while this was applicable across the board, a month later, a major change to the registration threshold was also effected.

The registration threshold for VAT which was Rs. 3 million per quarter or Rs. 12 million per annum in December 2019, was increased to Rs. 75 million per quarter or Rs. 300 million per annum with effect from 1 January 2020, pushing tens of thousands of VAT payers out of the tax net. Voluntary Tax Registrations were introduced to allow taxpayers to voluntarily register for VAT upon a written request to remain within the VAT scheme if they didn’t meet the threshold. These collective revisions halved the annual tax collection from VAT between 2019 and 2020.

In addition to the significant changes above, several key exemptions were also introduced in the Act. The sale of Condominium housing units other than any lease or rent of residential accommodation and information technology and enabling services (prescribed in gazette notification 2234-07 dated 29 June 2021) were among the key exemptions introduced as part of the 2019 tax cuts. Subsequently, certain relief measures were also introduced for facilitation of supplies during the pandemic.

Income Tax

Similar to VAT, Income Taxation was revamped with a series of exemptions, rate and threshold revisions together with some fundamental changes to the point of collection of taxation where tax deduction at source (withholding taxes) were significantly revamped.

The Inland Revenue (Amendment) Act, No. 10 of 2021, which was certified on 13 May 2021, incorporated several important changes pertaining to Company, Partnership, and Individual Taxation which were pronounced in 2019 and administratively enforced thereafter. Given below are some noteworthy exemptions introduced as a result of 2019 pronouncements:

Exemptions on business income

The gains and profits earned by any person from providing information technology and enabled services and the profits earned by any person from the sale of produce from agro farming qualified for tax exemption. Moreover, a host of exemptions were granted to foreign currency income. This included any foreign sourced income to be exempted so long as it was routed via the banking system or in the case of service provision to any person to be utilised outside Sri Lanka if the payment for such services is received in foreign currency via a bank to Sri Lanka.

Exemptions on investment income

In a bid to attract debt investments, returns on any loan granted by a person outside Sri Lanka to any person in Sri Lanka or to the GoSL was freed from the 5% WHT retrospectively from 2018 as was the return on SLDBs. Notwithstanding the exemptions on foreign currency income related to business, several exemptions were given to interest income earned in foreign currency as well. Exemptions were granted to any foreign currency account in any commercial bank or in any specialised bank with the approval of the CBSL on or after 1 January 2020, and to the interest earned from the “Special Deposit Account” opened and maintained with an authorised dealer in Sri Lanka in any foreign currency or in Sri Lanka Rupees on or after 8 April 2020.

As regards equity investments, the dividend payments to non-resident shareholders qualify for tax exemption. This was previously liable for WHT at 14% or the relevant rate as per the Double Tax Avoidance (DTA) Agreements entered between Sri Lanka and the recipient’s country of residence. At present, Sri Lanka has over 45 DTA agreements. Additionally, foreign dividend income of any person who holds substantial participation in such non-resident company, dividends paid by a company engaged in any businesses in accordance with the provisions of Part IV of the Finance Act, No. 12 of 2012 and which has entered into an agreement with the Board of Investment of Sri Lanka (BOI) was regarded exempted.

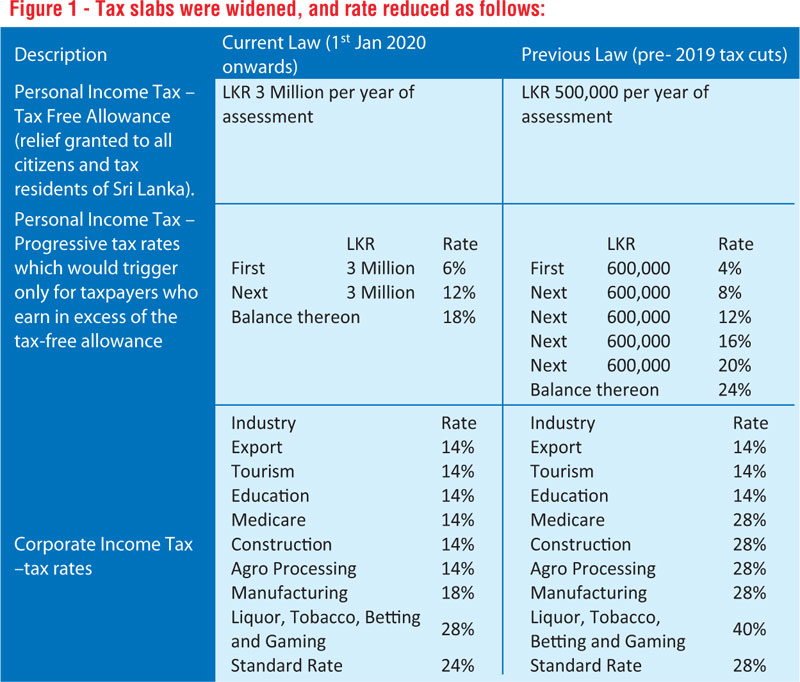

Beside these exemptions, considerable concessions were granted on Income Tax on Corporate and Individual Taxation. A snapshot of rate revisions is tabulated in Figure 1.

Withholding Tax (Wht)

The mandatory obligation to withhold tax on dividend, interest, discount, charge, natural resource payment, rent, royalty, premium or retirement payment was removed with effect from 1 January 2020. Likewise, WHT on service fee with a source in Sri Lanka paid to resident individual has been removed with effect from 1 January 2020. However, the payments made as interest on deposits, discount, charge, natural resource payment, rent, royalty, premium service fee or an insurance premium with a source in Sri Lanka will have an exposure to WHT if paid to a non-resident person. The relevant WHT rates are as follows:

Interest or discharge – 5%

All other payments – 14%

Certain income which was subjected to WHT was considered as final withholding payments. Such as the amounts paid as winnings from a lottery, reward, betting or gambling (other than amounts received in conducting a business consisting of betting and gaming), payments made to a non-resident person who is not a citizen of Sri Lanka or to a non-resident entity that is subject to withholding (other than payments derived through a Sri Lankan Permanent Establishment) and the interest paid or treated as being derived by a non-resident individual who is a citizen of Sri Lanka (other than conditions mentioned in the act) were considered at final withholding payments and was not subject to further taxation.

This ease of compliance and collection at source was dispensed with since the recipient is now liable to the tax and tax files must be opened and compliance obligations are the onus of the recipient where a tax file was not previously required (due to finality of taxation).

Withholding taxation on partnerships

The Amended Act re-introduced income taxation on partnership replacing the 8% WHT on partnership which existed since 2018. It specifies that the first million rupees be taxed at 0% and the excess be taxed at 6%.

Removal of PAYE

WHT on employment income (colloquially referred to as Pay As You Earn “PAYE” Tax) was mandatory under the pre 2020 rules. Accordingly, every employee who earned a monthly remuneration in excess of Rs. 100,000 was liable to PAYE and the tax was deducted by the employer on payment and remitted to the authorities. With the increase in the threshold to Rs. 3 million, PAYE was abolished. Thereafter employment income is liable to income in the hands of the employee instead of deduction at source. However, considering certain issues that stemmed from the removal of PAYE, the Advance Personal Income Tax (A.P.I.T) was introduced where employers are required to deduct Advance Personal Income Tax with effect from 1 April 2020, on any employment payment made to his employee:

a) if such employee is a non-resident or non-citizen of Sri Lanka; or

b) if a resident and citizen of Sri Lanka gives his consent to deduct the tax.

It merits mention that the APIT unlike PAYE does not ward off an employee from the obligation to file a tax return, hence anyone with a monthly income of over Rs. 250,000 (i.e. 3 m annual income) is required to consolidate the income and file tax returns in their individual capacity.

The 2021 numbers are yet to be announced, between the 2019 tax cuts and now, there were two Budget readings introducing both investment stimulus and new taxes to bridge the gap. Among the new taxes that were proposed. The Special GST to consolidate taxes for certain industries such as alcohol, tobacco, motor vehicle etc. was dispensed. Surcharge Tax which is a one-off tax of 25% of the Y/A 2020/21 taxable income on taxpayers who reported over Rs. 2 billion Taxable Income either individually or part of a group of companies, was implemented and the first instalment was collected on 20 April 2022, with another half due on 20 July 2022. The Social Security Contribution which is to be levied at 2.5% on any person with a turnover exceeding Rs. 120 million is yet to be signed into law; the Budget estimated this to be its single largest revenue proposal anticipating Rs. 140 million.

Taxation is a key source of government revenue; the economy has experienced quite a setback because of the concessions afforded in the past. The need of the hour, therefore, is meaningful reform. Sustainable policies and stakeholder engagement are key facets in this process to help stabilise the economy.

(The writer serves as the Partner – Tax Services of BDO Partners and Heads the firm’s Tax Practice. She is a Chartered Accountant, an Associate Member of the Chartered Institute of Management Accountants (UK), Member of the Chartered Institute for Securities and Investment (UK) and a Chartered Global Management Accountant.)