Friday Mar 06, 2026

Friday Mar 06, 2026

Thursday, 26 October 2017 00:00 - - {{hitsCtrl.values.hits}}

By Research Intelligence Unit (RIU), Colombo

The critical thrust of any Government policy on tobacco should be a focus on achieving two important objectives. Firstly, it is to reduce the negative health impact of tobacco consumption on the population. Secondly, it is to secure Government taxation revenues where this industry is typically one of the largest contributors. Failure on the part of national policy to balance these two objectives can result in deterioration in both the people’s health as well as the health of the national treasury.

A balanced approach

Sri Lanka has had no clear policy with regard to the tobacco industry resulting in ad-hoc fluctuations in price and Government tax revenue over recent years. Consequently, we have witnessed governments introducing unpredictable and drastic tax increases to this industry and at times reversing these polices due to the negative impact such policies have on the Government’s ability to generate revenue.

The need of the hour is a sensible and balanced approach to an industry that contributes significantly to the national economy in terms of jobs, livelihoods and tax revenues.

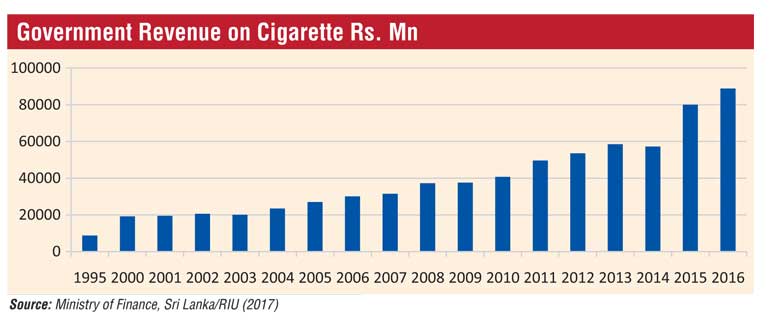

Taxation from tobacco is a very important source of revenue for governments in both the developing and developed world. In Sri Lanka, the Government tax revenue from cigarettes was Rs. 80 billion in 2015. In 2016, it was nearly Rs. 90 billion.

However, as the island still lacks clear tax policies for this sector, many industry specialists say there should be a transparent formula to decide the amount of tax on tobacco, as is the case with many other commodities that are in the market. Not only will such policies result in narrowing the gap between forecasted and actual Government revenue, a well-thought-out policy can also result in achieving the two critical objectives as outlined above.

A worrying trend

Cross-country analysis of national tobacco policy suggests that in instances where governments have introduced extreme and unpredictable tax hikes, tobacco consumers have in fact simply switched from buying their factory manufactured cigarettes to cheaper alternatives like roll-your-own cigarettes or products that have been smuggled in illegally. In the Sri Lankan context, we can also note the availability of the beedi which is a raw tobacco product made from imported tendu leaves.

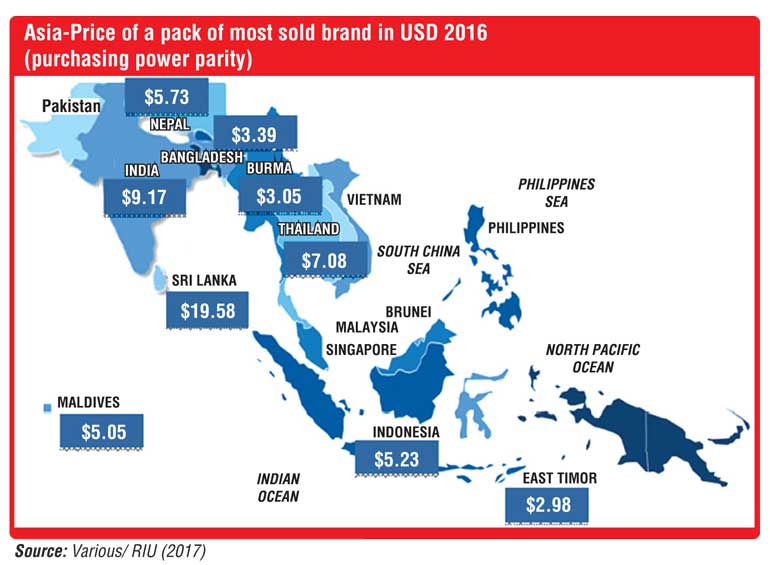

With Sri Lanka currently having the highest cigarette prices in the Asia Pacific region (PPP) and the second highest prices in the world, the island is also rapidly turning into a smugglers’ paradise. According to Sri Lanka Customs, only one out of 10 smuggled cigarettes of illicit cigarettes are detected by law enforcement agencies. Even in cases where large quantities of smuggled products are detected and the perpetrators apprehended, the fines imposed are not substantial enough to act as a deterrent for the criminal elements involved.

For an example, the fine for smuggling a 40 foot container of cigarettes, which could fetch up to Rs. 450 million in profits, is as low as Rs. 1 million. With this rise in illegal cross border activity, we have also observed a recent upward trend in the incidence illegal drug smuggling of more dangerous substances. This connection is also the subject of the ongoing RIU research into this industry.

The public health related aspects of this worrying recent trend also needs to be considered in the context that if making the legal product more expensive simply results in smokers switching to cheaper and illegal alternatives, the overall health policy objective of reducing cigarette consumption is also meeting with failure.

In fact, recent industry data indicate that smoking rates have not declined, and that while the legal cigarette industry volumes have certainly declined, there has been an increase in illicit cigarettes being smoked in the country. Moreover, when smoking illicit cigarettes, people are exposed to products that have not complied with quality or safety standards and are sold with no monitoring of the buyers in terms of age, etc.

Over to the Finance Ministry

Tobacco excises, and excises on alcoholic beverages and petroleum products, are a significant revenue source in most countries. Some low-income and middle-income countries raise more than 20% of their total revenues by excise taxes, particularly those countries that have not adopted a broad-based Value-Added Tax (VAT) through the retail stage.

The share of all excise taxes attributable to tobacco excise is substantial in most Asian countries. A clear advantage of tobacco excise is that they are easier to administer than broad-based consumption taxes or direct taxes on income.

Sri Lanka has one of the highest cigarette prices in the region and as a result, the island is rapidly turning into a haven for illegal cigarette smugglers who make huge profits and for the most part evade any serious punishment by the law enforcement authorities. This trend essentially contradicts the objective of reducing smoking related illness and certainly does nothing to help the Government in its quest to improve the health of Sri Lanka’s national finances.

(For more information: [email protected]/

www.riunit.com.)