Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 19 October 2020 02:21 - - {{hitsCtrl.values.hits}}

Since the COVID-19 outbreak, the demand for Personal Protective Equipment (PPE) has spiked globally. Demand for PPE, such as surgical masks, goggles, gloves, and gowns has overwhelmed production capacity and depleted stockpiles, leading to significant price increases. Prices of surgical masks have increased six-fold while prices of respirators and gowns have increased by threefold and doubled, respectively.

The World Health Organization (WHO) estimates that the PPE industry must increase manufacturing by 40% in response to COVID-19, and urges governments to act quickly to boost supply. Countries are urgently implementing various measures to help firms expand production capacity while manufacturers of nonmedical devices are reorienting towards PPE production to address shortages.

Over the past few years, healthcare systems in many countries have encouraged or forced the offshoring of PPE production to low-cost providers. Abrupt supply disruptions in major PPE producer countries and trade restrictions and export bans on PPE in more than 20 economies have resulted in worsening the problem.

Pivot to export of PPE by Sri Lanka

The apparel industry is an important sector of the Sri Lankan economy, generating substantial foreign exchange (44% of total export revenues) and supporting the livelihoods of almost one million workers. It has been adversely affected by the COVID-19 pandemic, first on the supply side and then on the demand side as the epicenter of the outbreak shifted from China to the rest of the world, including to Sri Lanka’s main export markets in the US and EU. Sri Lanka’s $ 5 b apparel export business is expected to lose $ 1.5 b between March to June 2020.

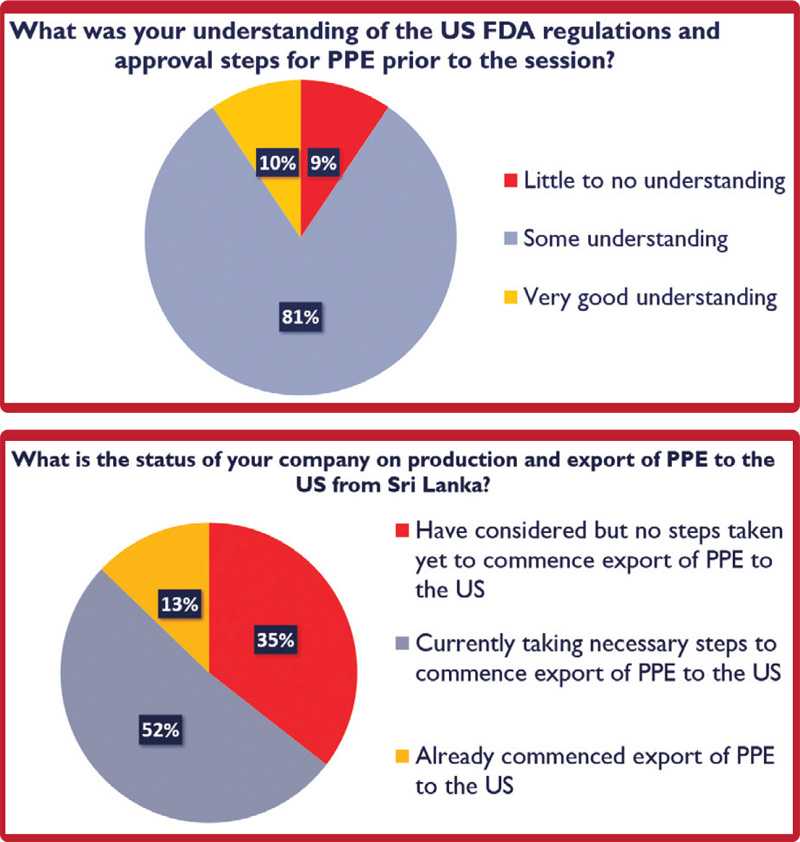

In order to mitigate the situation, apparel exporters as well as the apex industry association (the Joint Apparel Association Forum - JAAF) are looking to re-position its exports, with some exporters already exporting PPE while others are seriously thinking of making this switch, if not already in the process of taking the necessary action (Chart 1).

Brandix – one of Sri Lanka’s largest apparel exporters – has shipped 200 million non-surgical face masks to the US, and have ramped up factory production. However, the understanding of the industry regarding the PPE market, and regulations and standards in relations to exporting PPE to the US is low, especially in the context of an extremely complex regulatory environment governing PPE supply to the market (Chart 2).

Although Sri Lanka’s apparel industry is very familiar with complying with various quality standards and certifications – given its integration with prominent brands with high compliance requirements – the medical devices space (and its associated regulations) is entirely new to the industry.

Understanding the US market for PPE: Guidance for Sri Lankan producers

A recent initiative by the United States, the PARTNER Activity (Partnership for Accelerated Results in Trade, National Expenditure and Revenue) has helped Sri Lanka’s apparel manufacturers understand both the FDA regulatory environment and the US commercial and federal market for PPE, in order to give them a higher chance of export success.

Two webinar and Q&A sessions, as well as complete guidebooks were provided to over 100 representatives from the apparel industry, to help them better plan their entry into the US PPE market. Three key areas are highlighted here for the benefit of a wider audience, drawing from the insights delivered in those sessions. PARTNER is funded via the US Government’s Agency for International Development, USAID.

Mind the surge: According to past experiences, demand for PPE was immediate and dramatic during an outbreak followed by rapid return to sale figures prior to the crisis. The current situation remains unpredictable while the duration is unknown. There is no slowing down of demand for PPE at the moment. Also, it is important to note that the non-medical PPE market is bigger in size than the medical market and might be easier to supply to. As such, Sri Lankan producers should understand which PPE products are likely to have sustained demand in the US.

Understand the supply chain: The US market for PPE is complex with its own rules/norms and key players. There are a number of manufacturers, some of which are specialising in medical devices who in turn supply to distributors/suppliers.

Some companies are vertically integrated and are involved not only in the manufacturing but also in the distribution of the medical devices. PPE sold to the commercial market are routed through Group Purchasing Organisations (GPOs), which helps hospitals, nursing homes, etc. realise savings and efficiencies by aggregating purchasing volume and using that leverage to negotiate discounts. Manufacturers also sell to the alternative end market, to the federal market directly or through federal resellers - but this is a comparatively smaller market. Major distributors also sell to the federal system directly. Clearly, the PPE value chain in the US is dominated by strong players with established relationships. As such, it would be important for Sri Lankan producers to engage a representative/agent to navigate the system and to work with the manufacturers/distributors to assess the opportunities. For instance, a recent shipment of 6.5 million PPE gowns to the US by a Bangladesh apparel producer (Beximco) was enabled by their partnership with Hanes, an American clothing company. Moreover, the fact that Beximco Pharmaceuticals already had an FDA-certified production facility, would have helped in obtaining the necessary regulatory certifications to US market.

Federal procurement landscape: The US Government is a unique and a niche market even for companies already doing business in the US. Each Federal agency buys its own supplies, and so marketing and sales are best targeted to a small number of large Federal consumers which include: Department of Homeland Security (buys in response to emergencies), Veterans Administration (purchases for federal hospitals for veterans), and the Department of Health and Human Service (oversees the national stockpile). Not all opportunities to sell PPE to them are advertised because much PPE is acquired through standing distributor contracts or under existing programs/agreements. Federal buyers are governed by complicated regulations, and these make it challenging for suppliers. In comparison, the commercial market for PPE is not only less restricted but also bigger than the federal procurement market. As such, Sri Lankan producers need to consider focusing on the commercial market as their entry point.

Regulatory compliance: Last but not least, selling a medical device in the US comes with many responsibilities including completing technical documents, maintaining and following a quality system, inspection by the regulator (Federal Drug Administration – FDA) and an on-going commitment to quality compliance, which the apparel industry in Sri Lanka should be mindful when exporting PPE to the US. Sri Lanka’s apparel industry can, during this period, look to develop its product portfolio and obtain necessary regulatory compliances in line, so it can access the US market for PPE even beyond the current effects of the Covid-19 pandemic.

[This article is based on two webinars on PPE exports to the US hosted by JAAF (with EDB) supported by the USAID PARTNER project, on 2 June and 8 July. PARTNER (Partnership for Accelerating Results in Trade, National Expenditure and Revenue) Activity is a USAID-funded, Deloitte-implemented five-year project aimed at improving public financial resources and trade facilitation in Sri Lanka. For the full presentations from the webinar, visit https://bit.ly/3iBctYi and https://bit.ly/31JYqdb.]