Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 15 November 2024 00:02 - - {{hitsCtrl.values.hits}}

Dr Asanka Wijesinghe

Dr Asanka Wijesinghe

Now that the United States (US) election has concluded, what direction will the US’s trade policy be headed? This is one of the burning questions that many of its trading partners are asking in the aftermath of the Presidential election. A costly trade war was the outcome of the tariff hikes in 2018 – under the first term of President Trump – which was followed by retaliatory tariffs from the US’s trade partners. Elected for a second term, he is once again proposing significant tariff increases as trade policy measures.

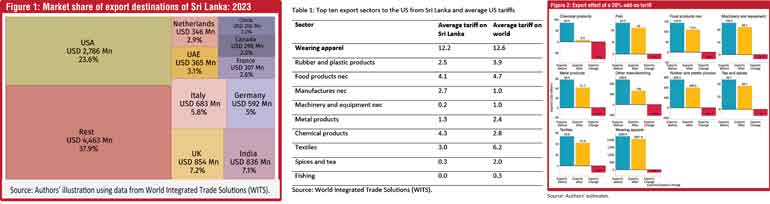

These potential changes in US tariff policies will have a direct impact on Sri Lanka’s export industries. The US is the top individual export destination of Sri Lanka, accounting for 23.6% of its total exports (Figure 1).

The economic justification for a global tariff on imports and its efficacy in achieving the expected results – such as the reshoring of manufacturing employment to the US and price reduction – remains uncertain. This article mainly focuses on the adverse impacts of a potential tariff increase on Sri Lanka’s exports to the US.

Future of US trade policy

The consumer subsidy-based industrial policy, introduced under the Inflation Reduction Act by the incumbent US administration is expected to continue.

However, the effect of a tariff is more direct than a consumer subsidy. On the campaign trail, the US president-elect proposed 10 percentage points on US imports. This is understood as an additional 10% tariff, rather than a new minimum tariff. It implies that there will be an additional 10 percentage point tariff on the existing average tariff rate of 12.6% on the wearing apparel sector, for instance, if the proposed tariff is implemented (Table 1).

The precise rate of the tariff increase remains ambiguous, as a proposal for a 20% additional tariff was suggested later instead of the 10%. In addition, a 60% to 100% tariff is proposed on imports from China. Also, a more complex, country-specific retaliatory tariff schedule has been proposed to align US tariffs with the rates that the US products face in each country.

Effect of a US global tariff on Sri Lankan exports

An increase in the US tariffs is likely to reduce consumer demand for imported goods. Additionally, an economic downturn in the European Union (EU), triggered by a trade conflict between the US and its trading partners, could further suppress demand for Sri Lanka’s exports. If an additional 20% tariff is applied on top of the existing average tariffs for all countries, estimates show that Sri Lanka’s exports to the US are expected to suffer a significant negative impact (Figure 2). For example, wearing apparel, Sri Lanka’s major export sector will experience a loss of $ 187.9 million. As a percentage, this is a contraction of 8.1% from the base year, 2022.

According to the estimates, the proposed tariffs will severely impact Sri Lanka’s exports of rubber and plastic products, as well as other manufactured products like Christmas decorations, brooms and brushes (Figure 2). As a percentage, about 90% of export loss can be expected in the chemical products sector which includes activated carbon, and essential oil.

If the US imposes a 60% to 100% tariff on imports from China, relatively high pricing on Chinese products could benefit countries like Sri Lanka from trade diversion. However, the overall rise in import prices resulting from a broader trade war will drastically reduce the US demand for imports, limiting the gains from this trade diversion.

The US trade partners will retaliate with tariffs, similar to the China-US trade war in 2018. The proposed tariff is estimated to cost an average US household more than $ 2,600 a year, once retaliatory tariffs are factored into the analysis. Additionally, the slowdown of US growth, as a possible consequence of a tariff war, will further reduce the country’s import demand.

The spillover effects of tariff wars will also negatively affect Sri Lanka as the EU countries are expected to experience a substantial economic setback. It is estimated that the EU may see its GDP erode by 1.5%, or about Euro 260 billion. An economic contraction in the EU will reduce the EU imports from Sri Lanka significantly. Thus, the estimated effects in this article can be considered only as the first-round effects.

Campaign rhetoric or a credible threat? The likelihood of tariff hikes and Sri Lanka’s options

A blanket tariff increase and an intense trade war between China and the US will drive up the domestic prices in the US, fuelling fear of inflationary pressure. Accordingly, it is unlikely that the proposed tariffs will be fully implemented given the significant impact of inflation on elections in the US. As the protectionist measures target the US’s manufacturing sector, sub-sectors like light household equipment, decorations, metal products, and machinery may become more vulnerable to future tariff shocks. These non-traditional exports of Sri Lanka play a major role in export diversification and are generally more complex and technologically sophisticated.

As a small exporting economy, Sri Lanka is susceptible to external factors that are beyond its control. Additionally, Sri Lanka’s limited role as a purchaser of US commodities limits its ability to negotiate lower tariffs. As a result, the toolbox of responses to future US tariff shocks contains only marginal adjustments. These may include offering import tariff relief for raw materials and providing production subsidies, such as electricity subsidies, to support domestic producers in maintaining their competitiveness. A consultation with the producers in this regard will enable the Government to determine the most effective policy measures.

In the medium term, given the global rise of protectionist and industrial policy measures in major export destinations, Sri Lanka will need to maintain preferential tariffs in other regions like the EU. It will be vital for Sri Lanka to maintain the GSP+ preference and renewed attempts for increased cumulation to increase the GSP+ utilisation will benefit Sri Lanka. As the expected high tariffs and the technical barriers in the US and the EU are probable in the future, Sri Lanka should maintain the trade policy reforms aiming to join regional trading blocs like the Regional Comprehensive Economic Partnership (RCEP).

(The writer is a Research Fellow at IPS with research interests in macroeconomic policy, international trade, labour and health economics. He holds a BSc in Agricultural Technology and Management from the University of Peradeniya, an MS in Agribusiness and Applied Economics from North Dakota State University, and an MS and PhD in Agricultural, Environmental and Development Economics from The Ohio State University. He can be contacted via [email protected].)