Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 22 April 2025 01:51 - - {{hitsCtrl.values.hits}}

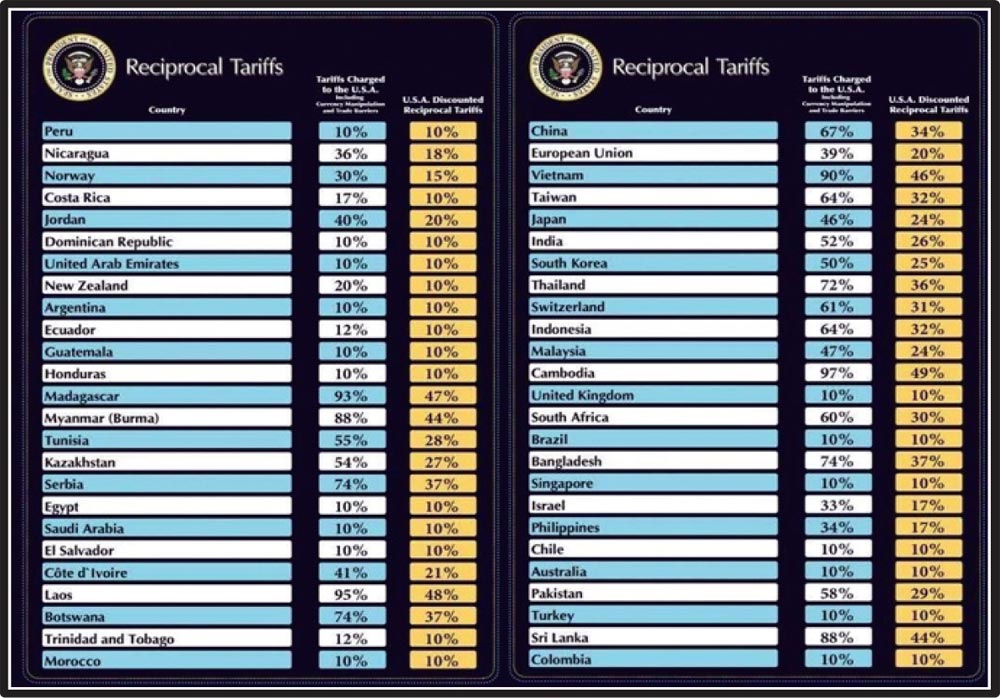

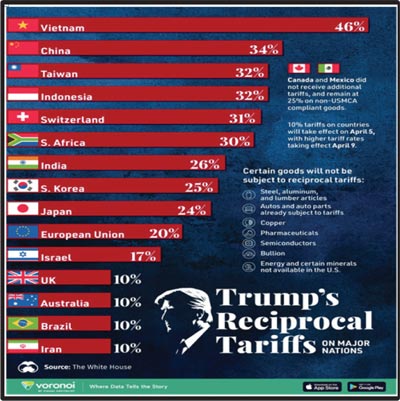

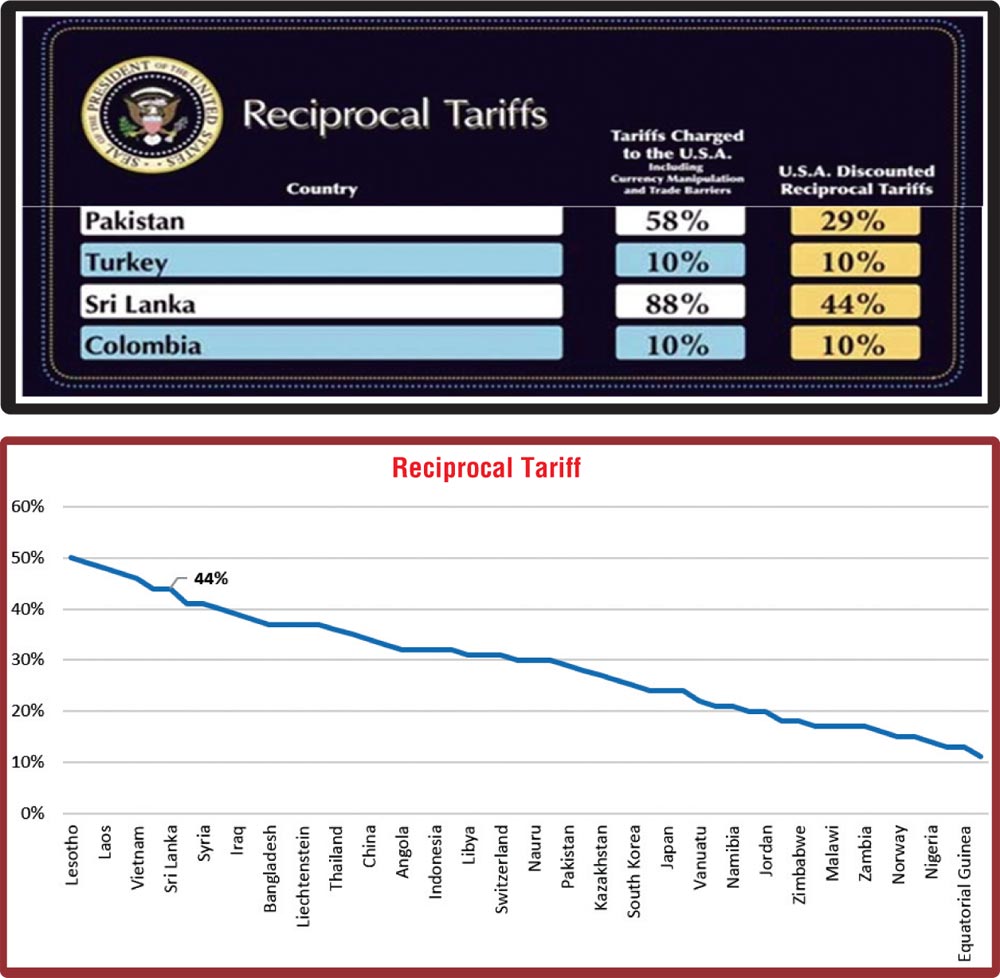

The recent economic measures introduced by the United States have had a profound impact on global trade, with Sri Lanka being one of the most affected nations. Under President Donald Trump, a series of “reciprocal tariffs” were implemented to address perceived unfair trade practices by several countries, including Sri Lanka. These tariffs, which range from 11% to 50%, are expected to have a lasting effect on Sri Lanka’s economy, particularly its export sectors and stock market. Notably, Sri Lanka is among the top 10 countries affected by these tariffs, facing a rate as high as 44%.

The recent economic measures introduced by the United States have had a profound impact on global trade, with Sri Lanka being one of the most affected nations. Under President Donald Trump, a series of “reciprocal tariffs” were implemented to address perceived unfair trade practices by several countries, including Sri Lanka. These tariffs, which range from 11% to 50%, are expected to have a lasting effect on Sri Lanka’s economy, particularly its export sectors and stock market. Notably, Sri Lanka is among the top 10 countries affected by these tariffs, facing a rate as high as 44%.

Highest reciprocal tariffs

Among the nations facing the highest tariffs, Lesotho and Madagascar stand out with a 50% tariff. Sri Lanka, Myanmar, and Laos also face hefty tariffs of 44%. Other countries affected include Vietnam (46%), Cambodia (49%), Syria, and the Falkland Islands (41%). Countries such as China, India, Malaysia, and Thailand face tariffs between 30% and 40%. On the lower end of the spectrum, Cameroon (11%), Mozambique (16%), and Malawi (17%) face comparatively lower tariffs. These tariffs are intended to reduce the US trade imbalance with these countries, potentially affecting their economies, with Sri Lanka being one of the hardest hit.

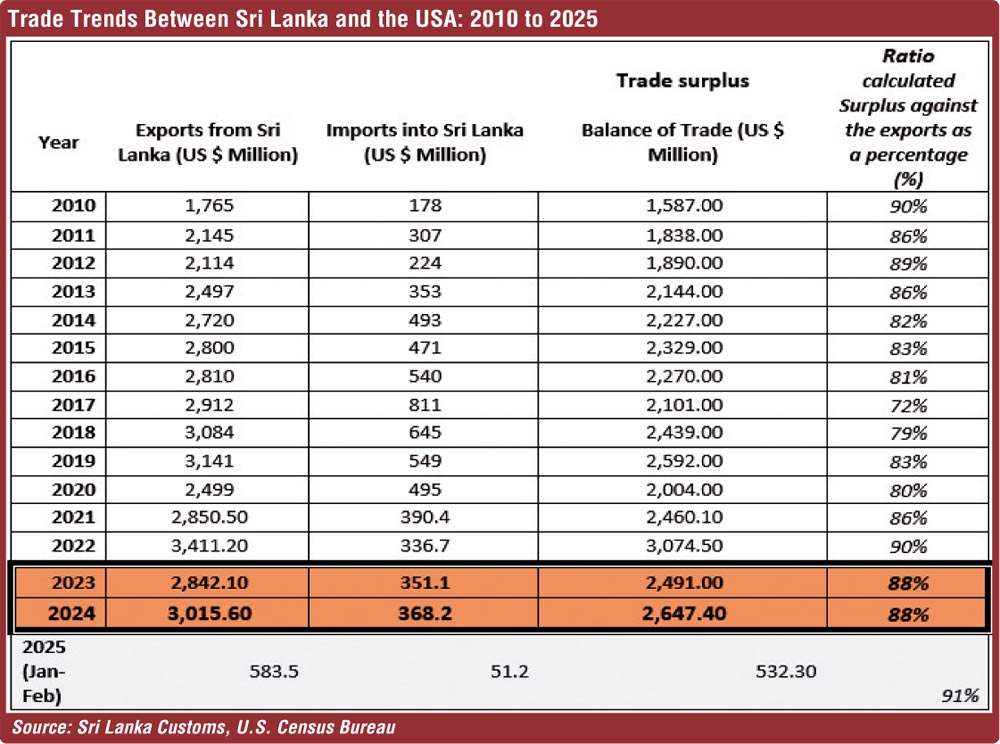

US-Sri Lanka trade

In 2023, Sri Lanka had trade surplus with the United Stets, amounting to approximately $ 2.49 billion. US exports to Sri Lanka totalled $ 351.1 million, while imports from Sri Lanka reached $ 2,842.1 million. For 2024, US exports to Sri Lanka are expected to rise slightly to $ 368.2 million, while imports from Sri Lanka are forecast to increase to $ 3,015.6 million, resulting in a projected trade deficit of $ 2.65 billion. Early estimates for the first two months of 2025 suggest the trade deficit will persist at $ 532.3 million.

Ratio calculation

Surplus against the exports as a percentage = (Trade surplus / export revenue) * 100

Surplus against the exports as a percentage = ($ 2.65 / $ 3,015.6) * 100 = 88%

Key export products to the US

However, the US tariffs present a significant challenge to the competitiveness of these products, particularly in the apparel sector, one of Sri Lanka’s largest export industries.

Sri Lanka’s top imports from the United States

Sri Lanka’s top imports from the United States

1. Animal feed

2. Pharmaceutical products

3. Electrical and electronic products

4. Manufactured products

5. Yarn

6. Plastics and chemical products

7. Meat, fish, and dairy

8. Telecommunication equipment

9. Motor vehicles and parts

10. Aircraft parts

Impact of US tariffs

The US tariff system has already begun to impact Sri Lanka’s stock market, with the Colombo Stock Exchange (CSE) experiencing a sharp decline following President Trump’s announcement on 2 April 2025. Investors, particularly those with exposure to companies reliant on US exports (such as MGT, TJL, HELA), are concerned about the adverse economic effects.

The broader economic implications of the US tariffs

1. Export challenges: Higher tariffs will make Sri Lankan goods more expensive in the US market, potentially reducing demand.

2. Employment risks: The apparel sector, which employs around 300,000 people in Sri Lanka, is particularly vulnerable. A downturn in exports could lead to significant job losses.

3. Foreign exchange: A reduction in exports will likely affect Sri Lanka’s foreign exchange earnings, potentially destabilising the currency.

4. Foreign reserves and the exchange rate will be impacted, leading to higher import prices in the local market, which will contribute to inflation. At the same time, the cost of production in Sri Lanka will rise, causing an increase in the price of export goods in the global market. This, in turn, may reduce the demand for Sri Lankan goods in foreign markets. Sri Lanka needs to adopt several strategic measures.

5. Diversify export markets: Reduce reliance on the US market by exploring new markets in Europe, Asia, and the Middle East.

6. Improve competitiveness: Invest in product innovation and quality to remain competitive despite tariff increases.

7. Engage in diplomatic efforts: Actively engage with US authorities to negotiate more favourable trade terms.

8. Domestic support: Introduce policies to support affected industries, including financial assistance and retraining programs for displaced workers.

Apparel sector

The apparel sector, which constitutes a significant portion of Sri Lanka’s exports to the US, is particularly vulnerable to these changes. The 44% reciprocal tariff could make Sri Lankan garments less competitive, especially compared to countries like Bangladesh (37% tariff) and Vietnam (46% tariff). This could lead US buyers to seek alternative sources, further challenging the Sri Lankan industry.

The US tariffs present a complex challenge for Sri Lanka’s economy, particularly for the apparel sector. However, by adopting a strategic approach—diversifying markets, enhancing product competitiveness, and strengthening trade relations with other regions—Sri Lanka can mitigate the impact and ensure long-term growth. As the global trade landscape continues to evolve, Sri Lanka’s ability to adapt and navigate these challenges will be critical in ensuring sustained economic stability.

Sources:

https://www.srilankabusiness.com/pdfs/market-profiles/2024/usa-2024.pdf

https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/

https://export.business.gov.au/pricing-costs-and-finance/tariffs-taxes-and-duties/us-tariff-changes-support-for-australian-businesses

(The writer is a Research Officer in the Research Division of the Parliament of Sri Lanka, specialising in policy analysis and economic research since 2012. Currently pursuing a PhD in Economics at the University of Colombo, his work integrates governance, development, and sustainable growth. He holds a BA in Economics (Hons) from the University of Jaffna (2001) and an MA in Economics from the University of Colombo (2006), complemented by postgraduate diplomas in Education (Open University of Sri Lanka, 2012) and Monitoring & Evaluation (University of Sri Jayewardenepura, 2021). An educator since 2009, Muralithas has taught economics at the University of Colombo and the Institute of Bankers of Sri Lanka (IBSL). Email: [email protected].)