Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 11 November 2022 00:00 - - {{hitsCtrl.values.hits}}

By an IPS Research Team

Sri Lanka’s economy is at a critical juncture where urgent steps are needed to improve the country’s fiscal position. The Institute of Policy Studies of Sri Lanka (IPS) has maintained that increasing tobacco taxation has undeniable health and fiscal benefits. In this context, policy solutions, such as taxing tobacco which can be leveraged to boost government revenue without threatening economic growth, are essential. This blog argues that the 2023 Budget should introduce a model of indexation which automatically links tobacco taxation rises with the size of the economy and inflation. This would raise substantial additional revenue from the excise tax on cigarettes.

Sri Lanka’s economy is at a critical juncture where urgent steps are needed to improve the country’s fiscal position. The Institute of Policy Studies of Sri Lanka (IPS) has maintained that increasing tobacco taxation has undeniable health and fiscal benefits. In this context, policy solutions, such as taxing tobacco which can be leveraged to boost government revenue without threatening economic growth, are essential. This blog argues that the 2023 Budget should introduce a model of indexation which automatically links tobacco taxation rises with the size of the economy and inflation. This would raise substantial additional revenue from the excise tax on cigarettes.

The right time to raise taxes

The current economic crisis and the intense pressure on the health system mean there is no better time to raise tobacco taxes in Sri Lanka. Among the benefits of increasing tobacco taxes are the generation of additional revenue for the Government, widespread support among the public for an increase in tobacco taxation, and the reduced burden on Sri Lanka’s struggling health system.

A tax targeting a ‘sin product’ like tobacco will contribute to the government’s ongoing efforts to help raise revenue without increasing the costs of essential goods at a critical time for the economy. According to a poll conducted by the Alcohol and Drug Information Centre (ADIC) in September 2021, 91.5% of respondents said they would support increasing tobacco taxation to boost government revenue. Accordingly, this is a tax move the government can introduce, which will have a near-universal public endorsement. Further, driving down tobacco consumption by increasing prices, particularly of the most harmful cigarettes, will reduce tobacco-caused illnesses and ease pressure on the health system when Sri Lanka’s healthcare system is facing severe medical shortages due to the economic crisis.

A complex tobacco taxation system

Taxation is internationally recognised as the most cost-effective means to reduce tobacco consumption, given the revenue generated by tobacco taxation. The World Health Organization Framework Convention on Tobacco Control (WHO FCTC) recommends simple, inflation-adjusted taxes to reduce tobacco use and prevalence. In the past, in line with these global best practices, Sri Lanka has taken several positive measures to control tobacco use, including tax increases leading to significant revenue boosts for the government as public health benefits for the population.

Sri Lanka, however, has complex tobacco taxation practices in place. Cigarettes in Sri Lanka are taxed at five different excise duty rates based on the length of the cigarette. Moreover, in Sri Lanka, tobacco taxation has not kept pace with inflation and per capita income, which has made cigarettes more affordable. This has resulted in adverse health outcomes and deprived the government of considerable revenue, which could have been invested in key priorities.

Introduce a single tax for cigarettes

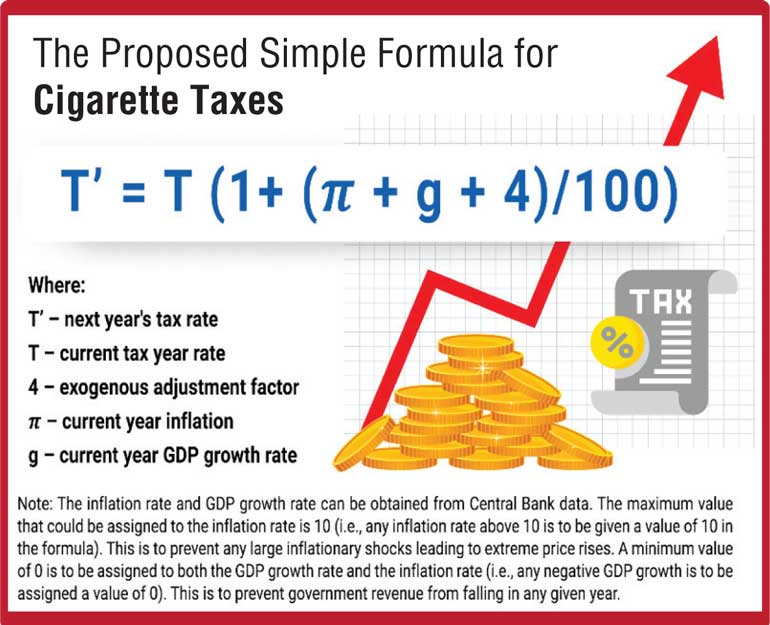

To help mitigate the current fiscal difficulties, an ongoing IPS study recommends the introduction of a single tax for cigarettes of all lengths (along with regulation restricting the length of cigarettes to 84 mm the longest cigarette sold in the market at present), which is adjusted annually according to inflation and GDP growth of introducing a single tax for cigarettes, irrespective of their length, will make cigarettes less affordable to youth and the poor (See Figure 1 for further information). For example, if a single tax were implemented in 2021, all cigarettes would have cost at least Rs. 57, reducing the affordability of all cigarettes. Thus, the formula would ensure that taxes are raised consistently and that cigarettes remain unaffordable to the most vulnerable, namely the young and the poor.

The risk of substitution to beedi is a common argument used to oppose increasing cigarette taxes. An ongoing IPS study, however, provides a counterargument through a cross-price elasticity analysis, which reveals that if cigarette prices rise, tobacco smokers are unlikely to substitute cigarettes with beedi.

Benefits of introducing a taxation formula for cigarettes

Revenue gains: IPS estimates that the Government could have earned close to Rs. 23.6 billion in additional excise tax revenue if a single excise tax for cigarettes of all lengths was introduced according to the formula in 2021.

Health benefits: Increasing taxes is the most effective way to reduce tobacco consumption. This will help to reduce adverse health outcomes of smoking, ease pressures on the health system, lower health costs associated with tobacco use, and reduce the unfavourable effects on household incomes from tobacco consumption. IPS estimates that had a single tax for all cigarettes had been in place since 2018, the number of cigarettes sold would have fallen by almost 157 million sticks. Further, the current price is highly affordable and could incentivise the youth to start smoking, leading to additional burdens on the health system. As such, introducing regulations to restrict the length of cigarettes to 84 mm would ensure cigarettes remain unaffordable.

Public support: A tax increase targeting a ‘sin product’ helps to generate revenue without increasing the costs of essential goods. As such, this tax increase is likely to be widely supported by the public.

Way forward

Given the current economic crisis and considering that cigarette taxes have not been revised systematically over time, the Government could use this opportunity to introduce a simple formula to raise taxes to attain the twin benefits of improved health and fiscal outcomes.

(Link to original blog: https://www.ips.lk/talkingeconomics/2022/11/10/taxing-tobacco-why-the-2023-budget-should-increase-tobacco-taxes/)