Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 6 April 2016 00:00 - - {{hitsCtrl.values.hits}}

The BMICH, the only well-equipped international conference hall in Sri Lanka, a gift from the people of China, shows the level of friendship and cooperation it maintains with Sri Lanka

By Deeptha Kulatilleke

It is estimated that there are well over 750 Chinese investments around the world of $ 100 million or more since 2005 (excluding bonds). The combined value of China’s global investment and construction activity since 2005 is estimated at $ 1.1 trillion, and is predicted to top $ 3 trillion by 2025. When it comes to Foreign Direct Investment, Chinese investors have shown a preference to large developed economies and some oil rich African countries.

China-US diplomatic relations were established in 1978 following a series of bilateral economic cooperation initiatives. A very high proportion of Chinese investments has reached the USA under the regimes of successive US Presidents such as Nixon, Reagan, Clinton and Obama with Head of State level visits taking place. Since 2005, the United States has drawn $ 90 billion in Chinese investment (excluding bonds), the largest amount of any recipient country.

No relationship will be as important to the twenty-first century as the one between the United States, the world’s great power, and China, the world’s rising power.

China’s development is directly transforming the lives of one-fifth of the world’s population while influencing billions more. China’s rapid economic growth, expanding regional and global influence, continued military modernisation, and uneven human rights record are also shifting the geopolitical terrain and contributing to uncertainty about China’s future course. After over 35 years of “engagement,” the United States and China have a relationship that was truly unimaginable two generations ago.

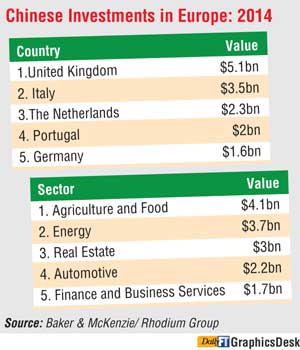

After the US, Chinese investments have spread rapidly to Europe. Chinese presence in Europe has shown a tremendous growth in the recent past. Chinese investments have doubled in 2014 in Europe after a dip in 2013. UK, Italy, Netherlands, Portugal and Germany are among the leading destinations of Chinese investments.

China had implemented far-reaching reforms of its outbound FDI policy framework in October 2014 that abolished regulatory approvals for most outbound investment transactions. Official statistics for overseas investment activity suggests that these steps have contributed to a significant rebound in outbound flow of investments. One of the notable investments in Europe that took place in 2014 was ChemChina’s buyout of Italy’s Pirelli tyres.

Since the turn of the century the four countries which have attracted the most Chinese investment are the United Kingdom ($ 16 b), Germany ($ 8.4 b), France ($ 8 b) and Portugal ($ 6.7 b) followed by Italy ($ 5.6 b), The Netherlands ($ 4 b), Hungary ($ 2.6 b), Sweden ($ 2 b), Spain ($ 1.5 b) and Belgium ($ 1.2 b).

While 70% of the investment over the last decade has gone to those economies which emerged relatively unscathed from the crisis, the last three years have also seen significant Chinese interest in the privatisation of state-related industries such as utilities or logistics in countries including Portugal, Italy and Spain.

Chinese investors are clearly taking opportunities when they arise in markets going through difficult times but they also see great benefit in investing in more stable countries, where there are strong existing economic ties to China through trade and tourism. Chinese investments in the EU are spread across a wide range of sectors. For the entire period of 2000-2014, the top recipients of Chinese capital were energy ($ 17 b), automotive ($ 7.7 b), agriculture ($ 6.9 b), real estate ($ 6.4 b), industrial equipment ($ 5.3 b), and information and communications technology ($ 3.5 b).

Prior to 2011, EU market entry was primarily motivated by trade facilitation considerations and the desire to access technology in sectors such as automotive and industrial equipment. In 2011-2012, the drive to technology and other competitiveness-enhancing assets increased, but energy and materials became the major drivers of investment activity as State-owned firms were seizing opportunities to buy into European mining firms, energy assets and utilities. In 2011 and 2012, Chinese firms spent a combined $ 11 b in Europe on fossil fuel, renewable energy, and utility assets.

This changed radically in 2013 and 2014 as Chinese investment in energy assets collapsed to $5 billion for both years combined as the appetite of state-owned firms for foreign energy assets declined and sweeping changes to the resource-intensive growth model, and renewable energy projects became less attractive due to cuts in feed-in tariffs in many European economies.

On the upside, commercial real estate has made up for some of the declining energy investment. From virtually zero before 2013, Chinese investment in European commercial real estate surged to $ 2.8 b in 2013 and $3bn in 2014, not including future development costs. A downturn in the Chinese domestic market in 2013 and 2014, and the boom in the overseas Chinese population during the same period – tourists, student, and emigrants – were the major drivers for outbound real estate FDI. Policy liberalisation for outward investment by institutional investors such as sovereign wealth funds and insurance companies also contributed to greater real estate investment.

Other industries that have exhibited above-trend growth in 2014 compared to previous years are finance and business services, agriculture and food, and transportation and infrastructure. Finance and business services in the EU received over $ 2 b investment, mostly in the last two years, driven by financial liberalisation in China and new business opportunities related to the internationalisation of the Chinese currency, the renminbi (RMB).

Though starting from a small base number, investments in food more than quintupled in the last three years, with several large acquisitions motivated by the desire to acquire know-how, technology, and brands to feed the fast growing food market in China. Investments in transportation and infrastructure also reached more than $2.4bn through the end of 2014. The uptick in commercial airline and port services investments was fuelled by increasing Chinese tourism, trade, and business activities in Europe.

While investment into the EU reached new heights in 2014, most observers would agree that Chinese investment still has plenty of room to grow further. Both the commercial and political reality support a positive outlook on sustaining elevated levels of Chinese investment in coming years.

The trend is already continuing into 2015, with Chinese investors acquiring well known leisure brands Club Med and Louvre Hotels Group for $ 4.3 b and $ 1.5 b respectively.

China and UK cooperation

Britain is China’s second largest EU trading partner, while China is Britain’s fourth largest trading partner. Britain is the second largest recipient of China’s foreign investment within the EU and the second largest EU investor in China. Bilateral trade between the two countries in 2014 rose by 15%.

The State visit undertaken by the Chinese President to the UK in October 2015 was a significant milestone in UK-China bilateral relations. The UK Government, which earlier made attempts to give lessons about democracy and human rights to Chinese dignitaries who visited UK on official visits, this time followed the Ronald Reagan type economic diplomacy giving the message that human rights issues do not pose barriers to enhanced trade and economic cooperation.

The Chinese President was accorded the highest honour with a red carpet welcome. Both the Queen and the Chinese President travelled in the Jubilee Royal carriage to Buckingham Palace while almost all the British Royal Family members participated at the State banquet in honour of the Chinese President. He also addressed a joint session of the UK Parliament. The Chinese President also joined the British Prime Minister to a traditional pub lunch at the request of the Chinese President.

The visit took place during a time when the UK was facing a steel crisis due to alleged dumping of cheaper Chinese steel to the European market. TATA Steel has announced that it was preparing to sell their Port Talbot Plant in South Wales which would results in thousands of people without jobs. The UK Government is desperately looking for a commercial buyer to continue steel production without a facing a major crisis.

It is now clear that the British Treasury rather than the Foreign Office runs China policy. Under its new bureaucratic masters, the UK’s China policy has become steely, self-interested, and, to some degree, very consistent. Britain joined the China-led Asia Infrastructure Investment Bank in 2015, despite irritating their key ally the United States in doing so. Chancellor Osborne too for the second time visited China with a business delegation.

Taking a trade delegation to such an area basically conveys one point: no matter how intense the concerns about human rights and security, trade has to go ahead when it comes to China. Britain’s Conservative-led Government has been courting China, the world’s second-largest economy, for years. When Xi’s predecessor, Hu Jintao, paid a State visit to Britain in 2005, the countries announced $1.3 billion in trade deals.

Prime Minister David Cameron has said the visit of the Chinese President to the UK heralds a “golden era” between the two countries and that China could count on Britain to be its best partner in the West. That would mean Beijing choosing London as its bridge to Western financial markets, which it has demonstrated sealing ground-breaking agreements that would deepen bilateral financial and economic ties.

Deals worth over 30 billion pounds ($46.4 billion) were signed during the four-day visit of Chinese President Xi Jinping to Britain in October 2015. According to media reports, these agreements would be in industries including retail, energy, financial services and aerospace and which would create 3,900 jobs in Britain.

One major deal formalised was for China to take a key role in a 24.5-billion pounds project to build Britain’s first new nuclear power station in decades, Hinkley Point C in southwest England. French utility EDF Energy has reached an agreement with Beijing’s China General Nuclear Corporation and China National Nuclear Corporation to take a 33.5-percent stake in the project according to media reports.

The deals have sparked accusations from some quarters that Britain is pandering too much China to secure investment.

Plunging world steel prices and a strong pound have pushed Britain’s steelmakers into crisis. TATA Steel said the layoffs at plants in northeast England, Scotland and South Wales were in response to “a shift in market conditions caused by a flood of cheap imports, particularly from China, a strong pound and high electricity costs”.

According to Chancellor Osborne, thousands more pupils will be learning Mandarin in British schools by 2020 as the Government has provided necessary funding. He wants to give more young people the opportunity to learn a language that will help them to fully integrate in the global economy. London Mayor Boris Johnson also has said that the British children should be taught the Chinese language Mandarin as standard in schools. Johnson, who is studying Mandarin himself, suggested Britons should be learning as much as possible about China as the East Asian giant continues to expand its global influence.

He said children would grow up naturally knowing about China’s importance and when quizzed on whether they should learn Mandarin as standard in schools, he said: “Why not? Absolutely. My kids are learning it, so why not? Definitely, definitely.”

The opportunities for cultural, educational and ‘people to people’ exchanges are also enormous. Shakespeare, Agatha Christie, Harry Potter and other classic and modern British icons are well known cultural imports in China. Britain’s knowledge of modern Chinese culture is not yet as good as it should be, but enormous queues for exhibitions such as the British Museum’s exhibition of the Xi’an terracotta warriors show deep interest in Chinese classical culture, while China’s rise will produce increasing knowledge of China’s modern achievements. More Chinese students study in British universities than from any other foreign country, for example.

Lessons for Sri Lanka

Sri Lanka, displaying its economic diplomacy, signed the historic Rubber-Rice barter trade agreement with then Communist China and maintained her relations with China as truly friendly countries. What other developed countries have now contemplating in doing with China, Sri Lanka did decades ago. The BMICH, the only well-equipped international conference hall in Sri Lanka, a gift from the people of China, shows the level of friendship and cooperation it maintains with Sri Lanka.

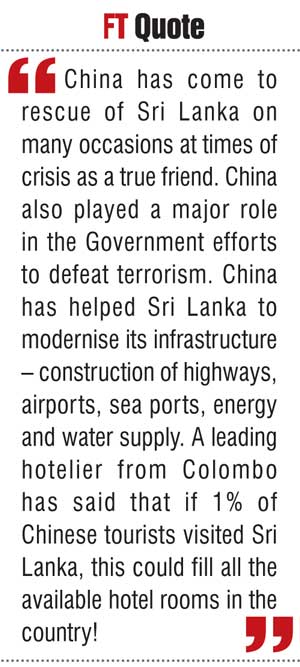

China has come to rescue of Sri Lanka on many occasions at times of crisis as a true friend. China also played a major role in the Government efforts to defeat terrorism. China has helped Sri Lanka to modernise its infrastructure – construction of highways, airports, sea ports, energy and water supply. A leading hotelier from Colombo has said that if 1% of Chinese tourists visited Sri Lanka, this could fill all the available hotel rooms in the country!

The visit undertaken by the Prime Minister of Sri Lanka to China is important as it would provide an opportunity to conduct bilateral trade and economic cooperation initiatives according to a well-thought-out plan for the future.

As far as the writer is aware, there is only one Foreign Service officer who is fluent in Mandarin and he is now serving at the Sri Lankan Mission in Malaysia. Even at this late stage, it is important to provide more officers involved in foreign affairs and trade with training in Mandarin if Sri Lanka is to make a meaningful impact on Sri Lanka-China trade and economic relations.

(The writer is the former Head of the Commercial Section of the Sri Lanka High Commission in London.)