Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 15 February 2017 10:17 - - {{hitsCtrl.values.hits}}

By C. Ramachandra, F.C.A.

I have been perusing your articles published in the media propounding and pontificating on governance. I refer to your recent letter to the President and members of the Council of the Institute of Chartered Accountants of Sri Lanka appealing to “safeguard the Auditor General’s independence, integrity and professional position” and your other recent article captioned ‘Independence, sustainable development and the role of professionals’.

In the context of the grave misconception regarding the Auditor General and the Minister of Finance, I cite the following Sections 42(2) and 43(3) of the Monetary Law, under which the Central Bank was established. These two sections amply clarify the mischievous misconception.

“42. (2) The Auditor-General shall submit an annual report on the accounts of the Central Bank to the Minister in charge of the subject of Finance who shall lay such report before Parliament.”

“43. (2) The Auditor-General shall at such intervals as may be fixed by the Minister in charge of the subject of Finance furnish to him reports setting out the results of the examination of the accounts of the Central Bank.”

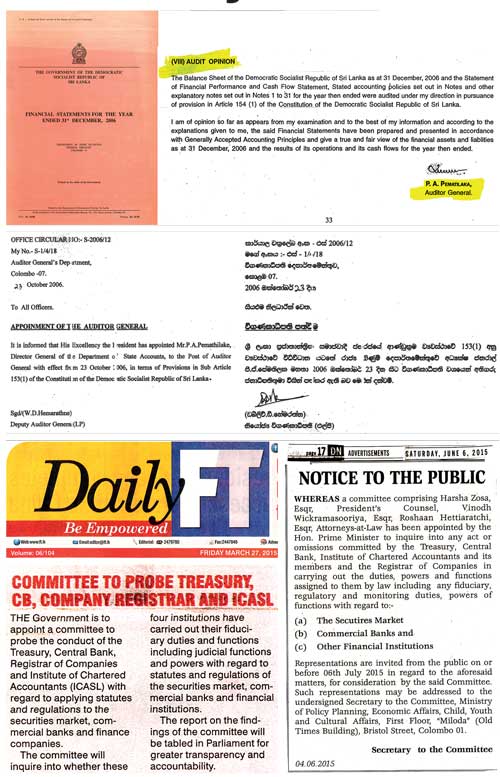

On 23 October 2006, Mr. P.A. Pematilake, who had been the Director General of the Department of State Accounts, had been appointed Auditor General by the then President, as disclosed in the circular scanned below.

Notwithstanding such a fact, is it not appalling that Mr. P.A. Pematilake had certified the State accounts for the year ended 31 December 2006, as the Auditor General, as scanned below, in effect auditing his own accounts? You were silent then and also at the Institute of Chartered Accountants, where he was a Member of the Council.

In view of the erosion of governance and professional conduct in the financial sector, including the stock market scandals of pumping and dumping, the Prime Minister appointed a committee to inquire into the conduct of, among others, the Institute of Chartered Accountants, as per the newspaper report and notice scanned below.

Did the President and Council of the Institute of Chartered Accountants give evidence before this Committee of Inquiry? If not, why? Is the proposed removal of the President of the Institute of Chartered Accountants, as an ex-Officio Member of the Securities and Exchange Commission, and the close supervision of auditors, a result of widespread fraud and corruption and stock market manipulations, where auditors have been negligent or culpable?

In view of your passionate interest in the conduct of the Institute of Chartered Accountants, I wonder whether you appeared in the interest of the causes you espouse and gave evidence before this committee of inquiry? If not, why did you not do so?

There has been scathing criticism on the conduct of auditors with large-scale fraud disclosed and auditors found to be reckless, negligent and collusive. In some instances they were even removed by Court.

What did the Institute of Chartered Accountants do to enforce disciplinary inquires as per its Act enacted by Parliament and take action against such miscreant auditors to protect the public? Though you regularly write extensively, here again there has been a deafening silence on your part. Why?

Some of the privatisations carried out while you were a Member of the Public Enterprise Reform Commission had been scandalised, with allegations of defrauding the Government.