Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 20 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By Sashini Koralage

As members of a leading financial professional services firm, we have engaged with a multitude of businesses ranging from manufacturing, trading to services for SMEs, PLCs to MNCs. One thing we have noticed, is that they all undertake endless efforts to boost their topline. However, for some ‘strange’ reason, the same pace of growth is not reflected in the bottom-line.

According to our understanding from a very realistic point, the key reason behind this problem is, that a majority of the leaders of businesses in Sri Lanka have failed to embrace and act upon achieving ‘profitable growth’, but are crawling towards achieving ‘just-growth’. Simply because they look at the dimensions of products, channels, and customers individually, and do not consider the overall impact of these on the profitability of the business.

Taking out the rotten apples

Achieving profitable growth is not an easy task. The strategy of achieving this lies on looking at the organisational performance at a holistic level as well as obtaining visibility and understanding of the minute details that form the products/services and customer segments of the business. What most leaders fail to see is, how much the business is losing out in terms of profits in the struggle to achieve more customers and piling on the number of products sold-the ‘illusion’ is created. The more customers the business has and the more products they sell, the happier everyone is.

But when the business reaches to a particular peak, the leaders start fidgeting-Why? The profit margins and contributions slowly begin to decline. There could be a number of reasons that may lead to this result, which are mostly market pressures. The ever increasing competition, where the business is forced to sell the products and services at low margins or contributions, and customers increasing their demand for product quality and features. So when the leaders start to feel the heat from all these, they scratch their heads wondering ‘how can I sell my products/services at a low price with better quality, and still make profits?’

To solve this diabolical problem, the management jumps at the first option that waves at them-‘Cost cutting’ initiatives. Does it solve the problem? Yes, of course, but only for a short period of time. These initiatives will fall into the ‘tailing effect’ and eventually bring the business to square one. The reason being, typical cost cutting projects are short term focused and do not have the in-depth visibility and strategic alignment which will result in increasing the cost of one process or department while trying to reduce the cost of another. Therefore, the key to profitable growth is not cutting costs here and there, but identifying where and how costs are being incurred in the business and managing them.

So, where does the answer lie in the quest of achieving profitable growth? Well, it’s important to forewarn that, this will involve making tough decisions. If a business is to thrive through the constraints that are put forward from the market, in terms of declining profit margins and increasing customer demand, the leaders have to make some tough decisions by planning and prioritising to ensure the baseline of the business is intact. To enable such decision making, the leaders need access to robust information to identify where exactly the resources may be underperforming and to focus on products and processes that are ‘true sources of value’ which could add competitive advantage.

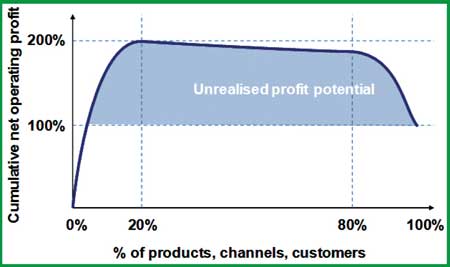

Therefore, it is of utmost importance that the leaders obtain an accurate image of the profitable products and/or services or even more detailed, the processes and/or customers. The best way to explain this, is by using the diagram.

Consider a typical B2B or B2C organisation. At the inception, the number of products/SKUs (Stock Keeping Units) or services, customers and channels are limited, with healthy profit margin increase. As the business develops, the number of products/services will be increased while the customers and channels will also expand in conjunction with the above. The cumulative net operating profit margin will also hike up. With the profitable growth achieved, the leaders will further expand the product/service offerings addressing wider customer segments and distribution channels. Which, if not managed well, will result in a gradual reduction in the cumulative profit. Ultimately, the cumulative profit will take a dive. With the industry experience both locally and globally, this scenario is observed in many businesses.

The graph illustrates this story. In the haste of growth and expansion, in terms of products, customers and markets, it is often seen that generally 20% of the products or services that a business sells enhances profitability. 40-60% are breakeven, while 20-40% cause a decline in profitability. On top of this, the lack of visibility and accuracy of cost information is making things worse. Even though cost accounting practices are being undertaken by many businesses, it is only taken as an input when deciding the margin and the price to stamp on the products/services. In companies that take a few more steps further into considering cost information in to decision making, often follow inaccurate cost allocation practices which result in providing wrong signals to the management. For example, standard products are often wrongly burdened by a part of the costs of specialised products, which would result in wrong management decisions.

Therefore, the lack of visibility into the product-line profit margins, inadequate usage and reference of cost reports, is leading the business towards declining profitability. The business fails to make the correct decision between making a sale of Rs. 500,000 at a profit of 25% and making a sale of Rs. 1 million at cost or a loss. Of course, there could be strategic reasons for some loss making sales, but the management needs access to exact, accurate information and have control over the decisions being made with justifications.

Serving every Tom, Dick and Harry

What about the customers? One could argue that, as long as the business has continuous demand from an increasing customer base, won’t the company be profitable? Well, not exactly, because every customer is not profitable. The key is identifying the “A-customers”. To do that, the management needs to analyse the activities performed for various customers, and often, these activities are ‘not solely related to the sales volume that the customer represents’. There may be customers who require special packaging, demanding fast service, too frequent orders, small quantity orders and often changes to orders. Those are some of the symptoms of a costly customer. Think about your business. Are there instances where serving customer A would make a significant profit while serving customer B would increase the topline growth but at a very high cost? If yes, is there a worthy strategic purpose behind it? Or simply because you fear the customer will be snatched up by your competitor?

This is where most businesses fail to decide between the trade-off of serving a customer at a loss vs. letting him go to a competitor so that the business could focus on serving one or more profitable customers. A simple approach of cost cutting will not facilitate such decision making. So take off the old pair of shades and put on a new pair to see more than what you have been seeing on the surface.

It’s not about the ‘cost’: Seeing beyond the obvious

Unlike mere cost cutting projects which shall address immediate issues, a cost transformation process will provide the accessibility and visibility to robust cost data by considering the organisation at a holistic level. Multiple operating departments are assessed and re-engineered to deliver the most by incurring less. This will enhance the management visibility of the addressable cost base across a multitude of functions across the value chain of the business. It is this complete and enhanced view of profit that needs to be created and instilled into profitable growth decisions.

Significant indications about where a company is wasting its resources and where it should be spending more to boost a competitive edge are buried deep within the business. Putting those clues together effectively requires intelligence from a fresh perspective to push away from the traditional frame the company has been operating in.

One of the most recent success stories on Cost Transformation comes from BT (British Telecom Group), a global telecom services provider. In a recent article named “Lessons from the cost transformation behind BT’s turnaround” (CGMA magazine, May 2015), where the group finance director explained how the cost transformation assisted in providing ‘an insight to take a step back and decide what was important and identify what it could do to change the profile of the business’.

This change will provide the management the correct focus and insight into what (client/product) drives cost, and related profitability by highlighting incorrect allocations leading to accurate pricing decisions. This shall also provide a basis for organisational performance management and business intelligence.

“Successful organisations make habits of things others don’t like to do, or don’t find time to do” – Don House

Without a doubt, real cost transformation takes energy and commitment to implement, not only from the top management but from the functional support staff as well. Done right, cost transformation makes cost containment a part of the company’s DNA.

(The writer is Associate Consultant, Management Consulting, KPMG in Sri Lanka.)