Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 26 April 2016 00:26 - - {{hitsCtrl.values.hits}}

By Sugath Fernando

The date was 20th March 1948, the post Second World War era, a baby boy was born in Bavaria, Germany. His father, an interesting character, was a senior corporal to Hitler’s SS army who later became a spy for the CIA.

The family moved to Panama when the boy was 13, that was in 1961. The boy from Bavaria was a Bachelor’s Degree holder in Law by 1973. The name of the young lawyer may have vanished in history, unnoticed, if not for his small law firm started back in 1977 in Panama. Today his surname is one of the most searched names in net search engines. It is none other than Jurgen Mossack, who planted the seeds for the most controversial law firm of the present day world, Mossack Fonseca.

The law firm of Jurgen Mossack became Mossack Fonseca in 1986, after the collaboration with Ramon Fonseca, then a lawyer with one secretary, who later became an award-winning novelist and a highly-influential politician in Panama.

Mossack Fonseca (MF) and data leak

MF is a legal and professional service firm at the helm of the corporate law services industry with a worldwide office network exceeding 40. As they described themselves, they help company incorporation and provide registered agent services to professional clients (banks, trusts, lawyers). They claim that at any time, the firm does not take possession of client’s money and does not have any direct connection to financial or operational aspects of companies they incorporated. So on the face of it, it was all perfect and okay.

The Panamanian law firm became breaking news to international media with the revelation of the massive data leak of the firm’s operations for 40 years, exposing millions of secret financial dealings of world’s wealthiest individuals and corporates. Since MF is based in Panama, the incident is since famed as Panama Papers in international media. The size of the data leaked is mentioned as 2.6 terabytes (i.e. 2,600 gigabytes).

For a comparison, the data breach by Edward Snowden famously known as WikiLeaks is believed to be 60 gigabytes, most still remaining undisclosed. The data from MF shows details of 11.5 million files of 214,000 offshore companies. These companies were incorporated in 21 offshore jurisdictions with individuals and corporate linked to these spreading all over the world.

The revelation is the end result of a year-long investigation conducted by Washington-based International Consortium of Investigative Journalists (ICIJ) and German newspaper Suddeutsche Zeitung together with more than 100 various news organisations based on the encrypted data given by an anonymous source to the German newspaper back in 2015.

The report shone a spotlight on the shadowy face of wealthy individuals and corporate multinational entities, the other face – the face which is hidden form common public. The ICIJ report shows how Mossack Fonseca & Co facilitated thousands of people and entities to abuse world financial systems to evade taxes, hide wealth, overcome international embargos and possible money laundering.

Yet it is to be noted that the offshore industry and use of tax heavens is a well-established international business segment and many other firms facilitate and provide such services. Hence it is not justifiable to conclude that the silver bullet has struck the devil at last. Offshore shell companies are used for a variety of perfectly legal business requirements.

MF was able to continue the business for 40 years because it is legal in the international business arena even at a time when tough US measures are in place to prevent money laundering, tax evasion and sanction lists. It is the world regulatory system which provides loopholes to law firms like MF to act in a supposedly-improper way and whether the firm intentionally manipulated the system or failed to exercise efficient Know Your Customer (KYC) and Customer Due Diligence (CDD) practices is a tricky and grey area to be investigated.

Further, MF provides services to professional clients such as banks. Hence the Ultimate Beneficial Owners (UBO) forward their requests to MF through a well-established and strictly-regulated industry. According to ICIJ, more than 500 banks work with MF and registered nearly 15,600 shell companies through them. It includes most if not all the big names in the banking industry, such as HSBC UK and its affiliates (creating around 2,300 shell companies), Union Bank of Switzerland (UBS), Société Général Bank, Credit Suisse, Royal Bank of Canada, Commerzbank, etc. Hence it is not realistic to assume that major banks in the industry just jumped into facilitating cover-up operations of unlawful activities of their wealthy clients, just for a few thousand dollars of commission, ignoring the regulator risk of billions of dollars in fines and reputational damage.

It may not be the case for 100% of the cases which have emerged. However it is important to note that most of the said big names in the banking industry paid millions of dollars as fines in order to come to a settlement with the US Justice Department and avoid criminal prosecutions against them, for wilfully helping US citizens with tax evasion as near as December 2015.

Shocking revelations and global response

The world witnessed a number of major financial scandals and corporate fiascos during the year 2015 such as the emergence of Malaysia’s 1 Malaysia Development Bhd (1MDB) scandal, Petrobras Scandal and Operation Car Wash of Brazil and FIFA corruption scandal. So where do the findings of Mossack Fonseca fit in? The answer is not complex. We may say it is an all-in-one solution for all scandal details.

The details expose names of 140 politicians and public officials including 12 current and former world leaders, together with thousands of other wealthy individuals and corporate entities. Evidence showed how MF facilitated structuring a network of offshore companies to evade tax and international embargos. The prime destinations they have used for camouflage wealth from regulatory watch dogs are tax heavens such as British Virgin Islands (BVI), Panama, Bahamas, Seychelles and Niue. The 11.6 million documents proved that the face we see in most wealthy and powerful people is not the real face. It is interesting to see the effects when their other face comes to light.

One of the initial aftermaths of the data leak which caught global attention was the stepping down of the Prime Minister of Iceland on 5 April. The PM, Sigmundur David Gunnlaugsson, came to power in 2013 promising a tough stance against the country’s international creditors and fraudulent tax evaders using offshore companies. Ironically it was revealed that his wife is an owner of an offshore company called Wintris Inc., which bought $ 4.2 m worth of bonds from three major banks which collapsed in the 2008 financial crisis (Landsbanki, Kaupthing Bank and Glitnir Bank). Wintris Inc is also an international creditor of Iceland which is claiming its money back.

World football governing body FIFA was one of the hot topics in global media in recent past. The new Head of the governing body, Gianni Infantino, was in the spotlight for his dealings at the European football governing body, UEFA. Further, FIFA independent ethics panel member Juan Pedro Damiani resigned over his business relationships with three men accused of major bribery and corruption incidents relating to FIFA.

Spain took its place in the developing saga on 15 April. The Industrial Minister, Jose Manuel Soria, resigned from his ministerial post and Parliamentary seat as pressure escalates after his name was revealed in the Panama Papers with connections to offshore companies. Soria continuously denied the allegations against him, until documents emerged with his signature on them proving the facts.

The Prime Minister of Malta, Joseph Muscat, faced a no confidence vote due to alleged offshore links of his Chief of Staff and Energy Minister, each having an offshore company in Panama and a trust in New Zealand. However the PM managed to secure a comfortable victory on 18 April.

Two-time US President and husband of Democratic frontrunner for presidential nomination, Bill Clinton, is also under scrutiny. Although his name is not appearing anywhere in the Panama Papers, names closely associated with Clinton appear in the Panama Papers. One such name is Canadian mining billionaire Frank Giustra, whose name was mentioned in the 2015 NY Times bestselling book ‘Clinton Cash’. (It is worthwhile to read this book or have a general idea via the internet about the content, to understand the true face of the so-called ethical gentleman.)

Another name is famous financier and commodity trader Marc Rich, who was indicted on 65 criminal counts in the US and was given a presidential pardon a few hours before then President Bill Clinton left office on 20 January 2001.

The Russian President also came under accusation although his name does not appear in the Panama Papers. The papers showed offshore links of President Putin’s best friend Sergey Roldugin and suspicious operations of Bank Rossiya headed by Yury Kovalchuk, who is widely considered as Putin’s personal banker. The total value of these operations is considered to exceed $ 2 billion. President Putin at his Annual Question & Answer session on 14 April accepted the data as correct but dismissed any fraudulent activities. He was quoted in international media saying: “They are (Panama Papers) not accusing anyone specifically,” “They are just muddying the waters.” [Some analysts argue that, in fact Russia’s RFM (Russian Financial Monitory Service) is behind the data leak. RMF, which is only answerable to the President, is widely accepted as the most powerful institution in the world for financial monitoring. The German newspaper which got the 2.6 terabytes of data claims they received it from an anonymous source and Mossack Fonseca claims that the data leak was not an inside job.]

British Prime Minister David Cameron was also dragged on to the stage through his late father’s offshore links such as Blairmore Holdings in Panama and Blairmore Asset Management in Geneva. The PM accepted in Parliament that he profited from selling Blairmore shares. The funds were not reported as illegal in any instance, yet questions were raised on ethical grounds.

There is an exhaustive list of names including the Prime Minister of Pakistan, President of Azerbaijan, and members of China’s elite ruling council (the Politburo Standing Committee) and so on.

The reaction of global regulatory bodies and governments are also playing a vital role in the present global arena. Banking regulators play the lead role given the financial sensitiveness of the issue. In the banking industry, the first CEO to step down was Michael Grahammer, the CEO of Hypo Landes Bank, Austria. Austrian authorities are investigating Hypo Bank and Raiffeisen Bank about their dealings with offshore entities. A Supervisory Board Member of ABN Amro banking group, Bert Meerstadt, also resigned as his name was exposed in Panama Papers.

UK regulator Financial Service Authority (FSA) gave a 15 April deadline for all the banks to reveal their dealings with offshore entities and tax heavens. Swiss regulator Finma launched an investigation on law firms in Geneva and banks such as Credit Suisse Group and UBS for their alleged connections with offshore shell companies. In Sweden, Nordea Bank, the biggest Scandinavian bank, is under investigation for facilitating tax evasion through shell companies. Swiss Police raided UEFA, the European football governing body’s headquarters, after its former Head and present FIFA President Gianni Infantino’s name was exposed in the Panama Papers relating to a telecast rights deal.

The period between 12 and 14 April was full of events for the world press. EU officials asked multinational companies to disclose more data regarding tax arrangements with European countries. Big names in the corporate world, Amazon, Apple, Google, brewery company Anheuser-Busch and Starbucks are under investigation by the European Commission for their tax practices. The foundation was laid down for the largest tax investigation in world history on 13 April, when tax officials of 28 countries met in Paris. It was followed by a special meeting on 14 April by big five economies of Europe (Germany, UK, France, Italy and Spain) during the IMF’s Spring sessions in Washington. An information sharing plan was discussed to crack down on tax evasion at the meeting.

Tax heavens, shell companies: How they do the magic

Governments, financial regulators and institutional set-ups such as OFAC (Office of Foreign Asset Control – US Treasury Blacklist Enforcement Unit) claims that every measure has been taken to prevent fraudulent financial activities in the global financial sector. Yet then how can countries under tough sanctions survive? How has Iran survived and developed nuclear activities? How is North Korea still continuing its nuclear threats? How did Syria fund the continuation of years of war? Anyone can sense the magic is out there, magic which not only can hide billions of dollars but also can make them flow, creating value. The Mossack Fonseca incident opened a window to the common people to have a look at trillion dollar magic.

The most common word to sight in any article or letter regarding Panama Papers is tax heaven. A tax heaven or haven which are used interchangeably refers to a country or geographical region with a very low percentage of personal/ corporate tax levels or no tax at all. Usually such countries or regions incorporate strict banking and financial secrecy laws to attract wealthy individuals and corporate entities. The first place that comes to any person’s mind for secret bank accounts is none other than Switzerland, with its iconic Swiss bank accounts.

Switzerland is a top tax haven in the world supposedly having $ 1.9 trillion of assets which are not reported to home country authorities by depositors. Luxembourg, Hong Kong, Panama, Cayman Islands and British Virgin Islands (BVI) are some other top destinations among more than 30 jurisdictions. A most recent trend for tax heavens can be witnessed in the place we least expect – it is America. The State of Nevada is emerging rapidly as a top tax heaven with its strict secrecy laws and law tax rates.

There are two aspects of manipulating tax liabilities through tax heavens. One is tax avoidance, which is a perfectly legal activity. This is one reason why the public should not jump to conclusions as soon as they notice a name in the Panama Papers. Tax avoidance is taking advantages of loopholes in tax law and legally limiting the tax liability.

One of the two tax arrangements available in tax heavens serves this purpose for multinational companies. [Multi National Entities (MNE) open companies in tax heavens commonly known as mixer companies, with pre-agreed low tax rates with authorities. Global business revenue and profits are directed to this account and pay the lower tax rate. Subsequently funds will be remitted to the mother country of the company. Double tax agreements accommodate MNEs to avoid tax payments as they have already paid tax to the said funds.]

The other aspect is tax evasion, which is an offence. It is purposely not paying taxes or underpayment of taxes to the tax authorities. In serving this purpose together with many other legal (facilitate mergers and acquisitions, pooling investment capital, business development) as well as illegal purposes, tax heavens allow opening of companies or trusts, keeping a non-resident individual or organisation as beneficial owner.

Most of the firms facilitating operations provide shell companies to investors for a very nominal charge. A shell company is a legitimate legal unit, but without actual assets or business operations. They are not listed companies. As they are already registered as legal entities, any person take the legal rights to the company can claim that his company is in the particular business for years. One of the main purposes of trust companies as well as shell companies is to guard the secrecy of the beneficial owner of any asset or wealth. Trust companies are increasingly used in well-developed economies like the USA. For instance, if a Chinese billionaire wants to buy a property in USA, he can form a trust and buy the property in the name of that trust. Even though the Chinese billionaire is the beneficial owner, his name will not come to light as the purchaser of the property.

Shell companies play a prominent role in underground economic activities and money laundering. Money laundering is a process of concealing the origins and sources of wealth earned through unlawful activities (drug trafficking, corruption and bribery) and mixing them with legal financial systems, converting them into legitimate wealth. The process has three steps as placement, layering, and integration. An offshore shell company plays a decisive role in the layering stage. Placement stage refers how the illegal wealth is injected into the legal financial environment. It can be done through financial institutions, currency exchanges, shops, security brokers, casinos, etc. Layering is all about making it difficult to trace the root of laundering activity. Integration stage is mixing previously laundered money into banking system as results of legitimate activities such as property deals, false loan proceeds, elaborated import export invoices, etc. For instance a drug trafficking cartel may start a company in a country with strict corporate secrecy laws and buy assets through the new company. Then they can resell the assets and deposit money in the banking system as sales proceeds. Secrecy laws will safeguard the cartel’s anonymity.

Another legal provision which law firms like Mossack Fonseca capitalised on is the service of nominee manager/director. A nominee manager is also a legal provision which allows the secrecy of the investor or business owner. For instance in US, Limited Liability Companies (LLCs) need to have one or more managers and the list should be published. The real or beneficial owner of any entity can appoint a nominee manager and request him to provide his address, e-mail and phone numbers as company contact details. The general public will see these details in online records. The name of the actual beneficial owner will be hidden from public. A nominee manager or director does not possess any authority or signing power of the company and can be removed any time without restriction by the real owner.

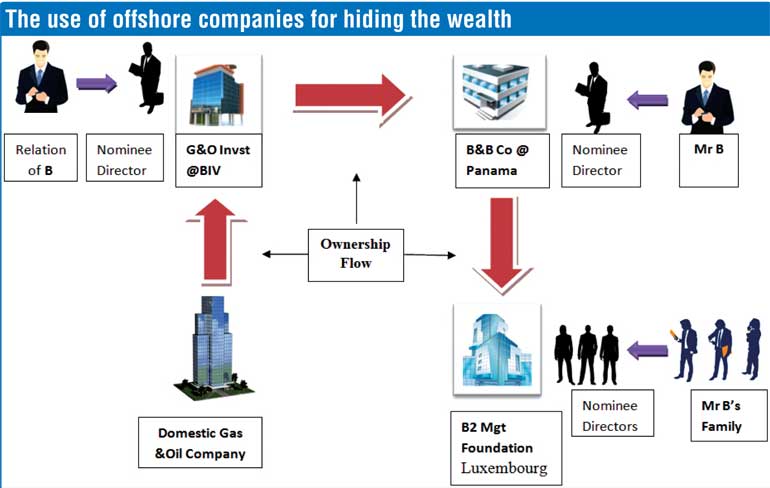

A possible three-layer design which can be used to hide wealth

Mr. B, a politician, is going to receive a bribe of $ 50 m, which he cannot disclose.

He approaches a law firm like MF (may be through a bank) and requests a shell company and creation of a foundation and a separate new company.

B&B Company at Panama (shell company)

B2 Managements Foundation at Luxembourg

G&O Investments at British Virgin Islands (BVI)

Mr. B appoints his family members as directors of B2 company and uses the services of a law firm to provide nominee directors (family member’s name will not appear in published documents).

Mr. B now appoints a distant relation as the Director of B&B company and again uses the law firm’s services for nominee director.

Then Mr. B appoints a distant relation as the Director of G&O company and again uses the law firm’s services for nominee director.

Now Mr. B asks the multinational company which is ready to give him $ 50 m to credit that amount to B2 Management Foundation’s account.

Then Management Foundation at Luxembourg buys shares of B&B company using funds ( B&B shell company is also used by Mr. B, it is just a fund transfer as no share value to B&B). B&B then buys shares at G&O company. Through G&O company, Mr. B purchases shares of highly-profitable companies in his own country, without any risk of his own public getting to know of his fraudulent activities.

The process such as this is structured to dodge financial and tax systems and cannot be a secret for powerful countries and regulators. However the world economic environment has been developed in such a way that is allows the rich and wealthy to camouflage wealth from their own governments’ regulators and public. It is highly doubtful that even a breakthrough like Panama Papers will be able to abolish the entire system developed over decades which specifically involves capital and politicians who ultimately rule the system.