Saturday Feb 07, 2026

Saturday Feb 07, 2026

Monday, 16 January 2017 01:14 - - {{hitsCtrl.values.hits}}

China’s massive export engine sputtered for the second year in a row in 2016, with shipments falling in the face of persistently weak global demand and officials voicing fears of a trade war with the United States that is clouding the outlook for 2017.

China’s exports fell 7.7% in 2016 from a year earlier, while imports slid 5.5%, leaving the country with a trade surplus of $509.96 billion, official data showed on Friday.

The world’s largest trading nation could be heavily exposed to U.S. protectionist measures if President-elect Donald Trump follows through on campaign pledges to label it a currency manipulator on his first day in office and impose heavy tariffs on imports of Chinese goods.

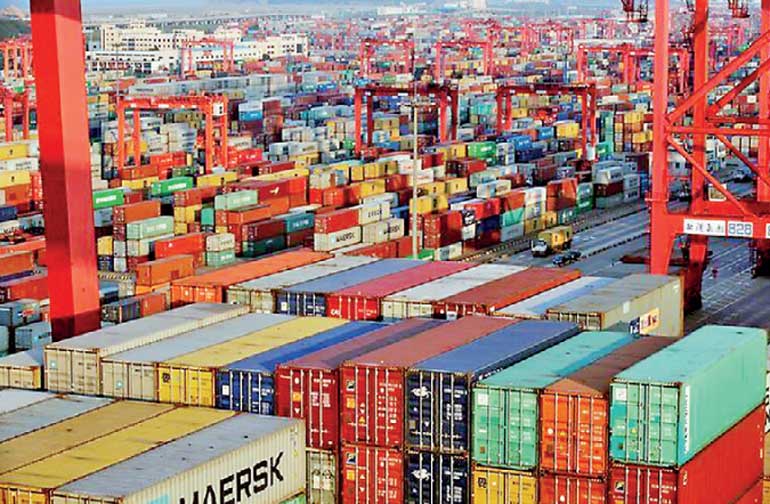

Container boxes are seen at the Yangshan Deep Water Port, part of the Shanghai Free Trade Zone, in Shanghai, China - REUTERS

Container boxes are seen at the Yangshan Deep Water Port, part of the Shanghai Free Trade Zone, in Shanghai, China - REUTERS

Even if Trump takes no concrete action immediately, analysts say the spectre of growing U.S.-China political tensions is likely to weigh on the confidence of exporters and investors worldwide.

Trump may limit the growth of China’s exports by imposing greater trade protectionist measures, China’s customs agency said on Friday.

“The trend of anti-globalization is becoming increasingly evident, and China is the biggest victim of this trend,” customs spokesman Huang Songping told reporters, adding it will be difficult for the country’s foreign trade to improve in 2017.

“We will pay close attention to foreign trade policy after Trump is inaugurated president,” Huang said. Trump will be sworn in on Jan. 20.

China’s trade surplus with the United States was $366 billion in 2015, according to U.S. customs data, which Trump could hammer on in a bid to bring Beijing to the negotiating table with Washington, economists at Bank of America Merrill Lynch said in a recent research note.

A sustained bilateral trade surplus of more than $20 billion against the United States is one of the three criteria used by the U.S. Treasury Department to designate another country as a currency manipulator.

On Wednesday, China may have set off a warning shot to the Trump administration that it is prepared to push back. Beijing announced even higher anti-dumping duties on imports of certain animal feed from the United States than it proposed last year.

“Instead of caving in and trying to prepare voluntary export restraints like Japan did with their auto exports back in the 1980s, we believe China would start by strongly protesting against the labelling with the IMF, but not to initiate more aggressive retaliation (such as selling U.S. government bonds from their official reserves) immediately,” the BofA Merrill Lynch Global Research report said.

“That said, even a ‘war of words’ could weaken investor confidence not only in the U.S. and China, but globally.”

December exports fell by a more-than-expected 6.1% from a year earlier, while imports beat forecasts slightly, growing 3.1% on strong demand for commodities from coal to iron ore which has helped buoy resources prices globally. Analysts polled by Reuters had expected December exports to have fallen 3.5% on-year, a contraction from an unexpected 0.1% rise in November that had raised hopes that sluggish global demand was bottoming out. Imports were expected to have grown for a second month but at a slower pace of 2.7%, after soaring 6.7% in November.

China reported a trade surplus of $40.82 billion for December, versus November’s $44.61 billion.

While the export picture has been grim all year, with shipments rising only one month in 12, import trends have been more encouraging, pointing to an increase in domestic demand starting around mid-year as companies imported more raw materials from iron ore to copper to help feed a construction boom.

“Trade protectionism is on the rise but China is relying more on domestic demand,” said Wen Bin, an economist at Minsheng Bank in Beijing.

Weak exports have forced China’s policymakers to rely on higher government spending and massive lending to boost domestic demand this year, at the risk of adding to a huge pile of debt.

But worries are mounting that the red-hot property market may have peaked, meaning China may have less appetite this year for imports of commodities such as copper and steel for construction work.

BEIJING (Reuters): US President-elect Donald Trump may limit the growth of China’s exports by imposing greater trade protectionist measures, China’s customs agency said on Friday.

China is the biggest loser in the anti-globalisation trend, customs spokesman Huang Songping told reporters, adding it will be difficult for China’s foreign trade to improve in 2017 due to rising costs and other factors.

The challenges China faces in trade are not short-term but its economy can handle them, he said, adding he hopes that US-China trade cooperation will continue.

China, the world’s largest trading nation, could be heavily exposed to protectionist measures this year if Trump follows through on campaign pledges to brand it a currency manipulator and impose heavy tariffs on imports of Chinese goods.