Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 14 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Ms.Gagan Singh

This year has been very important for Sri Lanka because of the presidential and the parliamentary elections held recently. The outcome of the elections reassures people that whatever the perceived uncertainties the market witnessed are over.

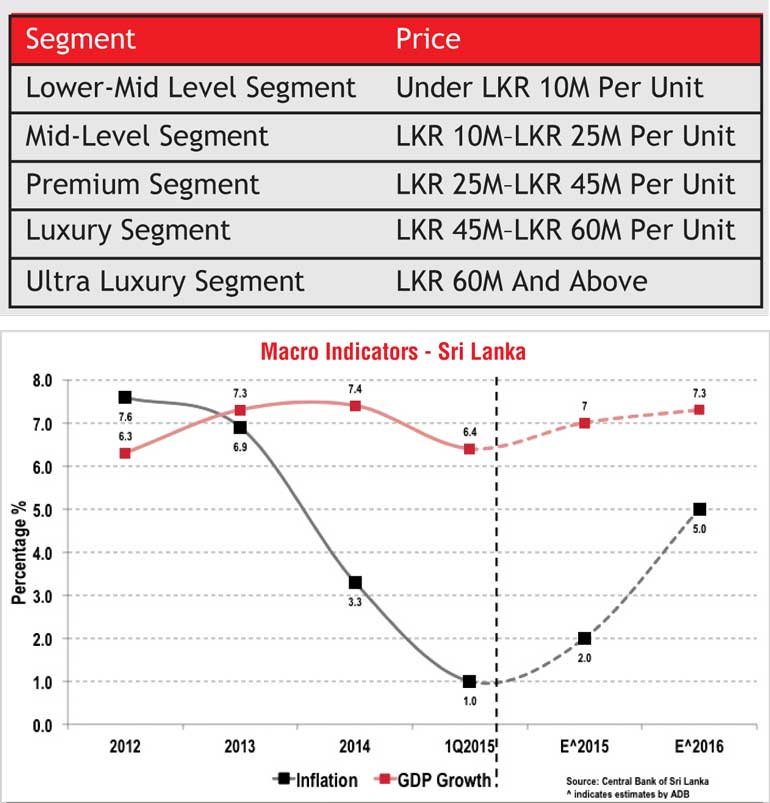

Sri Lanka’s GDP has been growing by a little above 7% for the past couple of years and the Asian Development Bank estimates the faster expansion in the construction industry is one of the reasons for the consistency. The business-friendly approach by the Government is expected to continue to boost construction activity, which eventually shall take projected GDP growth to 7.3% by end-2016, up 30 bps from the expected 2015 estimation.

The International Monetary Fund estimates that in 2014 GDP per capita was $ 3,558, which is an 8% growth y-o-y. This indicates that income per individual is increasing, hence the potential of consumers seeking branded items and the desire to patronise branded retail malls is high. During the remaining quarters of 2015, consumption is expected to increase with the increase in GDP.

Currently, inflation is at very low levels, which bodes well for interest rates in the near-to-medium term. Higher disposable income is expected to be channelled towards real estate investments. The luxury residences will be amongst the beneficiaries.

As we understand Sri Lanka has a growing number of High-Net-Worth Individuals (HNWIs), most of the developers of luxury residences that we approached claimed local buyers account for more than 60% of their sales, with Non-resident Sri Lankans accounting for the remainder.

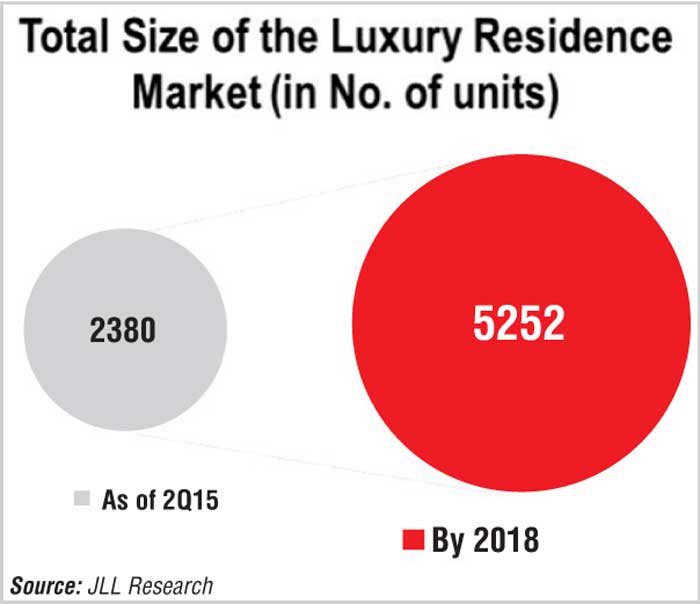

Local buyers, who are affluent, have travelled widely and patronise luxury designer brands. For them, it is not just prestige, but also the private, smart, elegant form of living that they expect. They prefer to interact with a community of individuals who are like-minded, but like to have their private space within that ambience, restricting themselves to the recreational facilities that are provided in the complex. The luxury developments consider and fulfil these aspects; the result is the segment is doing well. Out of the total size of the luxury market of 2400 completed units, 98% of these are sold. It clearly emphasises a notable demand for the quality product. It is expected that by 2018 the luxury residential market is set to be double the size of today’s and the demand is expected to grow.

The other category of those looking at luxury residences is the Non-resident Sri Lankans, the individuals who are eager to settle in their home base. The affluent individuals are seeking prestigious lifestyles and prime locations, the young urban rich segment looking for future investments.

Interestingly, the growth of foreign remittances from 2009 to 2014 increased from $ 3,330 million to $ 7,000 million according to the Central Bank statistics. This clearly indicates the country promises growth opportunities to both residents and Non-resident Sri Lankans.

Residence segments

The market for luxury residences in the current scenario is heading towards consistent noticeable growth. Many developers are planning to finish their projects in the medium-term horizon, and all developments are centred on the Central Business Development area – Colombo 1 with Fort, Colombo 2 Slave Island, Colombo 3 Colpetty – and Rajagiriya, an upcoming residential location.

As the luxury market in Colombo is in its early growth stage, the definition of luxury is hazy and subjective; however, JLL has categorised residences as per the price segments in the following manner:

As per the latest data of 2Q15, of the 10 residential projects completed over recent quarters, 95% of units were sold. The 16 projects that are under construction have been witnessing sales traction. Most of the projects have their own unique propositions to offer, but it is worth noting the developments by Shangri-La and Cinnamon Life. These mammoth size projects, which offer more than 400 units, are located in the CBD areas of Colombo.

A development by AVIC, a well-known developer, is entering into a JV with a Chinese firm to incorporate the global luxury standards in their project Astoria located at Colpetty. The other well-known developers are sprawled within the limits of Colombo 3, 4 and 7, and in the fast-developing commercial zones of Rajagiriya and Nugegoda. Noteworthy developers, such as John Keells Holdings, Fairway and Colombo City Centre, are relying on the advantage of anchoring clients through their trust, long-standing brand name and working relationships in the local context.

It is imperative that the Government takes urgent steps to curb red tape and come out with single-window clearances. What is required is a simplification of the approval process and a tax-friendly environment, particularly with regard to land acquisition. The emergence of the retail and office sectors will contribute to well-rounded development, including the luxury residences environment.

Developers need to ensure they are reaching the right audience and diligent care needs to be taken so that the quality supply meets the demand. Luxury apartments as a product need to be marketed well, emphasising their unique selling propositions. The new Government that recently came into power aims to attain complete transparency in all transactions. Higher transparency will lead to a higher inflow of investments. Investors are likely to be more open for market activity, helping the luxury residences segment to flourish.

The writer is the Chairperson – Jones Lang LaSalle Sri Lanka