Friday Feb 13, 2026

Friday Feb 13, 2026

Wednesday, 19 December 2018 00:00 - - {{hitsCtrl.values.hits}}

Colombo’s condominium market has reached an inflection point. In 2010, fueled by prospects of future demand for high rise living, developers scrambled to invest in real estate on an unprecedented scale. Today, the initial exuberance has dried and the infant stage has passed whilst the market awaits a new set of enticing possibilities and challenges.

We observe three big changes happening in the condominium market:

Luxury condo sales are stagnant

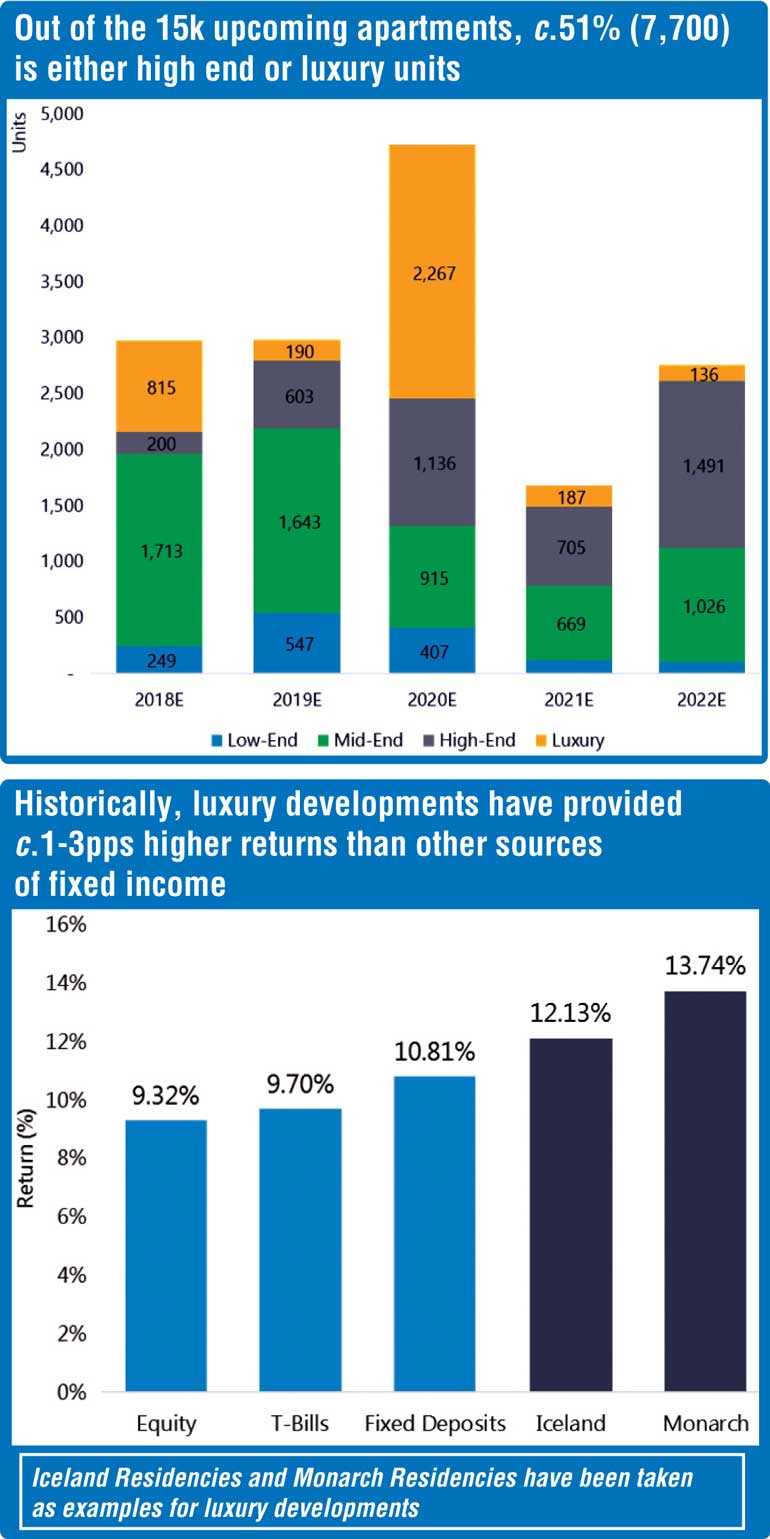

Sales of luxury condominiums are plateauing. The average absorption of luxury condominiums is 45%, significantly below other price bands. Despite the languid conditions, the existing supply of luxury condominiums units is expected to double by 2022 (existing supply is estimated at 1,500).

The future influx of luxury condominiums is significant. Our studies show that luxury condominium constitute almost 51% of the upcoming total units in the next three years. The material slowdown in luxury condo sales in the current year has also affected gross rental yields, which has dropped c.81bps to 5.62%. CAL believes that capital appreciation levels similar to previous years (c.9.5% Cagr) may not be experienced with the excessive supply buildup in the luxury segment. Even though the demand remains low. And historically luxury developments have provided a yield c.1-3pps higher than other sources of fixed income.

Whilst demand has slowed and more supply is expected down the line it is unlikely the prices of condominiums to experience a sharp decline. We believe a price crash may not occur as a number of factors may cushion the industry. Especially projects backed by deep-pocketed parent companies can sustain the same price levels for a longer period despite the low absorption rate. Also as asignificant portion of sold condos are equity funded, slow demand is unlikely to translate into an asset bubble.

Despite the criticism on affordability, Sri Lankan luxury condos are selling at a discount to regional peers, although Colombo is ranked higher based on the quality of living.

Demand exists. Affordability not so.

Colombo, the commercial capital of Sri Lanka, accounts for a majority of economic activity within the country. It is also the hotbed for the educational institutions, medical facilities, and corporate offices. The convenience and time-savings associated with an urban landscape, drive more people to move into the city. In fact our analysis shows that a household moving to Colombo may save c.88 days annually in travel time and also save Rs. 475k in travel costs.

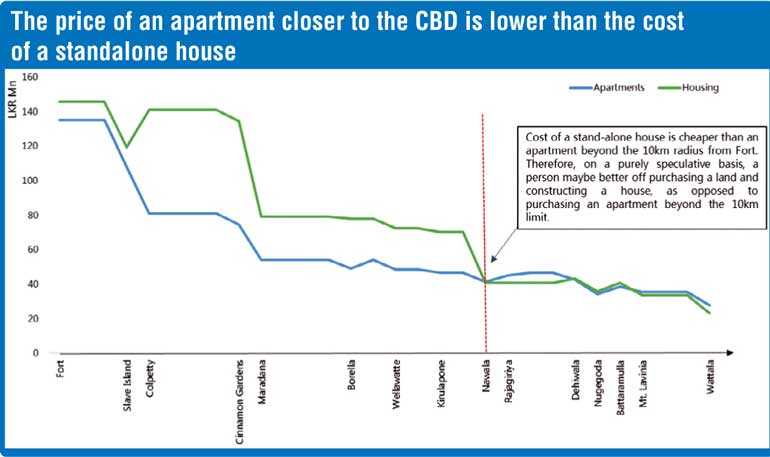

Given the shortage of land and the resulting sky-high land prices, building a standalone house has become an exercise of luxury, exclusive only to the super-rich. This will demand an inevitable shift in how people perceive their housing requirements from standalone housing to condominiums especially if they wish to locate in Colombo. In fact, building a standalone house is no longer the inexpensive choice. Our estimates show that the price of a condominium gradually becomes the cheaper option than a cost of constructing a standalone house from scratch as it moves its location towards the Colombo business districts away from the suburbs.

Whilst these factors justify condominiums as an inevitable and optimal choice for most prospective homeowners, the question of affordability is less apparent. Among consumers, there is an ever-growing preference towards vertical living but due to lack of affordability, only a few can actually buy a condominium. We observe this as a phenomenon of ‘latent demand’ – a desire or preference which a consumer is unable to satisfy due to lack of affordability. Our estimates show that even the wealthiest top 10% of the urban population may struggle to afford an apartment in the Colombo business district.

Opportunity gap in mid-tier condos

Some developers are solving the affordability conundrum by catering efficient product specs at the most optimal price. For example, John Keells Group’s Trizen, a development project with 891 units located in the heart of Colombo offers one-bedroom apartment units starting at 470sq.ft. Access Engineering’s Marina Square’ apartment units start at 565sq ft. Developers opine that Sri Lankans still prefer larger apartments but over time we believe that eventually, consumers will move to smaller apartment sizes with people preferring proximity rather than space.

CAL is of the view that a few players have already played into the ‘close proximity – affordable’ market. and. Prime Residencies too is a firm player in this market, with several small projects of 20-30 units beginning at 800sq ft.

Construction and funding costs – An impediment to affordability

Profitability of condominium developers is affected due to a number of reasons including high construction cost on the back of import duties and funding costs. Therefore, they may find it difficult to offer affordable residential condominiums within city limits for upper-middle-class executives. CAL believes that the removal of para-tariffs on construction materials could facilitate affordable pricing of apartments. Moreover, structured financing solutions such as parent supported loans or balloon payment schemes could help reduce funding difficulties faced by potential buyers.CAL believes that developers should not only focus on the high valued condo projects but focus on the requirement for apartments by providing affordable units within Colombo. A young couple of executives who may commute to work every day from the suburbs will want a dwelling within Colombo. The availability of units at Rs. 20-30 m will be the most likely option for them, with an average salary of 150k-200k and possible savings of Rs. 5-10 m to deposit as down payment.

With the BPO/IT market expected to grow at a c.11.5% Cagr, and with c.558k vehicle coming into the city daily, the requirement for an apartment unit would be indispensable. Considering the market prospects, CAL is of the view that sub 1,000 sq.ft. apartments within the metropolitan area could have an effective demand from buyers who value closer proximity over the apartment size. Newer generations of the country may be less concerned about the size of a unit but are sensitive to the overall price of an apartment. Regional peer data shows that sub 1,000 sqft category is popular among urban cities and Sri Lanka is likely to follow suit.