Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 15 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Divya Thotawatte

In a bid to assist women looking to purchase their own dream apartment, Hatton National Bank (HNB) recently announced its partnership with John Keells Properties to introduce mortgage packages for female customers hoping to invest in its latest condominium project Tri-Zen.

|

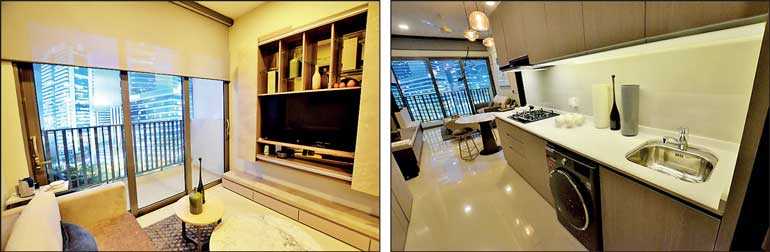

The TRI-ZEN show apartments are available for viewing at Vauxhall Street, Colombo 2 |

|

Nayana Mawilmada, Head of Sector at John Keells Properties |

|

Dilshan Rodrigo, Chief Operating Officer, Hatton National Bank |

|

Nadeem Shums, Head of Sales at John Keells Properties |

|

Kanchana Karunagama, Chief Manager Head of Personal Financial Services of HNB |

With a vision to support Sri Lankan women playing an increasingly greater role in the urban professional workforce, HNB recently introduced mortgage packages exclusive for female customers who are interested in investing in Tri-Zen, the 53-storey development project which is scheduled to be completed by 2023. The apartments are located in Union Place, Colombo, to provide investors the convenience of living in the heart of city where they can have easy access to their workplaces, schools, recreational areas, shopping, hotels, supermarkets, etc.

Providing a practical and economical solution to the modern woman, the apartments are not only affordable but also equipped with smart interior and design, with ‘smart home’ features to help consumers in their everyday life activities. Tri-Zen consists of 891 apartments ranging from 471 square ft. to 1041 square ft. across three towers, with apartment prices ranging from Rs.23 million to Rs.62 million.

JKH Property Group Head of Sales Nadeem Shums said that Tri-Zen is optimised for daily living with a smart interior design and technology built from the ground up to suit the busy lifestyles of the consumers.

“You can just enter the apartment by pressing a passcode, or just open the door from your mobile app. Therefore wherever you are, you can just go on the app, and open the apartment doors while you can also switch on/off the air conditioners, television, and lights through the app. These are some of the smart tech features included in the ‘smart home’ apartments,” he explained.

The smart interior is also set to make the space efficient and usable in an effort to prevent waste of space.

“Just imagine if you could spend three to four hours of your day relaxing, at the pool, or pretty much doing whatever you want rather than being stuck in traffic. This is the problem a lot of people face today if you’re living 10-15 km away from the city; you spend at least three hours of your day on the road, and that actually works out about to three years of your life that we spend in a vehicle,” he said.

Tri-Zen is to solve this problem while promoting the idea of ‘living in the heart of the city’ by giving an opportunity to live in the heart of Colombo with many facilities at relatively considerable prices.

JKH Property Group Sector Head Nayana Mawilmada also stated that the concept of living in the city is promoted not only to add to the convenience of investors, but also to reduce the usage of private vehicles to smaller everyday trips around the city.

In response to the growing interest in Tri-Zen by female investors, HNB, together with John Keells Properties, has introduced a long-term consumer borrowing package specifically for their female customers. The housing loan package resulting from the partnership offers funding of up to 80% of the purchase price of the apartment unit, payable with loan tenures going up to 25 years and grace period of five years for the capital repayment with an interest rate that could be fixed for five or 10 years. With a reservation fee of 5% of the purchase price and a 15% of equity contribution by the investor over the construction period, the apartment can be secured following a three-day loan approval process.

The new affordable and hassle-free HNB home loan package can be obtained through the Bank’s network of 251 branches operating across the country, and two mortgage advisors will be assigned to each buyer in order to further enhance the engagement between the developer and prospective borrowers. Also, a personalised doorstep mortgage advisory service will be made available to guide and assist in the processing and releasing of home loans.

The special insurance package offered by HNB Assurance for women includes a Mortgage Reducing Policy, Loan Protection Cover and Medical Cover while female HNB credit cardholders can also avail offers exclusive for the Tri-Zen development project. Offers include the waiving off of the first year annual fee, a lifetime free credit card depending on the annual spend, year-round discounts at clothing shops, super market chains and on other women-specific products and outlets, a limited time cash back offer based on the amount spent, as well as a limited period 100% interest-free instalment plan of up to 12 months for purchases above Rs. 10,000.

Pix by Shehan Gunasekara