Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 28 August 2017 00:10 - - {{hitsCtrl.values.hits}}

With land and house prices seeing unprecedented appreciation in 2017 alone, Sri Lanka has emerged as Asia’s new destination for attractive real estate returns with its prime beachfront land, seaside condos, high-end luxury serviced apartments and more.

From holiday destination to property hotspot location

Given the uncertainty of Brexit and other global developments coupled with a slowdown in traditional property markets i.e. Malaysia, Singapore and China, the Indian Ocean island paradise of Sri Lanka has become the new ‘sexy’ destination for property investors. Over the years, Sri Lanka has established a track record for handsome returns and high rental yields while providing investors the best of price, location and property choices.

Real Estate – really good returns

Real estate has proven over time to be a sound asset class for capital preservation andwealth creation. Its tangible, physical nature gives investors a solid assurance over paper assets while rental allow for passive income. Financing can be secured to facilitate ownership. Land can be developed while refurbishments to completed homes will yield better capital returns ranging 20%-200%.

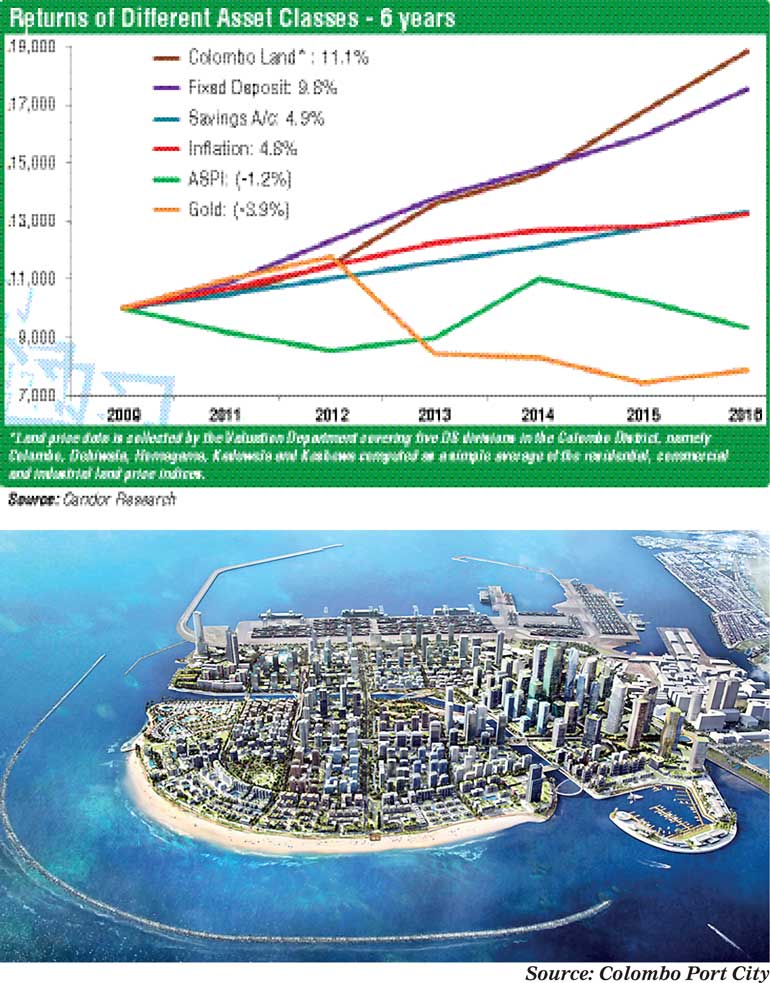

In Sri Lanka, real estate has far outperformed any other asset class since 2014.

According to research by Candor Group, properties in Sri Lanka, (specifically in the Colombo city area) have yielded better returns than any other investment class.

Right place, right time – At the epicentre of dynamic growth

The end of the civil war in 2009 marked a ‘renaissance’ for the island. Supported by massive rebuilding, surging tourism and increased foreign investor confidence, according to the World Bank, Sri Lanka’s growth is set to accelerate to 5.1% by 2019. GDP per capita rose from $ 2,819 to $ 3,835 – by 36% from 2010-2016. Based on this trend, the World Bank could soon classify Sri Lanka as an ‘upper middle-income country’ on par with Malaysia, Thailand, Maldives and Brazil.

Mega infrastructure projects are also having a multiplier effect on local real estate values. These include the Hambantota Port, the Colombo Southport construction as well as works for an additional terminal at Bandaranaike International Airport. The latter will see passenger capacity expand 150% to 15 million from its current six million.

The $ 3 billion Northern Expressway and other road projects will open up new opportunities while enhancing connectivity and accessibility nationwide.

Investment opportunities abound in 20-30 year growth market

An indication of the sterling growth is evident in the rise of property values in recent years. Leading property website LankaPropertyWeb.com’s House Price Index shows that average apartment prices in Colombo (for a 3-bed) have appreciated 6.2% in 2017 and land prices even higher based on asking price values. An apartment will see rental yields of 6-8% typically.

In comparison to real estate, other investment options have been slow or unexciting.

Leverage on local knowledge and insight to start investing successfully

Rather than go it alone, get the best of local knowledge and insight to reap profitable rewards from Sri Lanka’s property boom (and other investment options) at the ‘Investor Forum Sri Lanka’ on 30 August held at Kingsbury Hotel.

Listen to Candor’s Ravi Abeysuriya, JLL’s Sunil Subramanian and Liang Thow Ming, CSMO of CHEC Port City and other experts share on the best investment options available at the moment; organised by LankaPropertyWeb.com and RB Realtors & Consultants. For more information, please visit www.LankaPropertyWeb.com/events.