Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 13 December 2017 00:00 - - {{hitsCtrl.values.hits}}

It was quite disheartening to see the tourism numbers for November 2017 dropping to 167,511 visitors at 0.2% growth against last year and cumulative performance at as at end-November recording 2.5% growth with 1.87 million visitors.

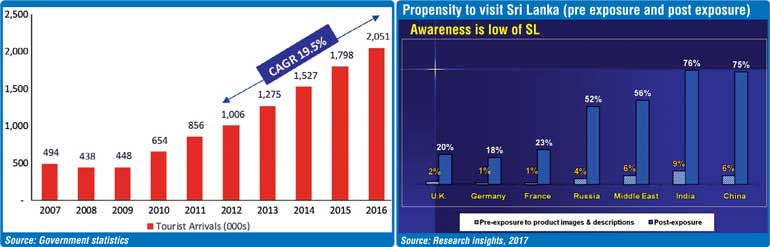

Sri Lanka Tourism has been the focus industry since the cessation of hostilities in the country in 2009, growing at CAGR growth of 19.5% but due to poor leadership from policymakers in the last three years the sector has become a case study to the world on how pent-up demand levels out leaving the industry totally in the lurch due to an absence of new product development and demand generation activities.

If we analyse the performance in November, Western Europe, which is the largest regional market for Sri Lanka, registered 45,903 tourists, a decline of 1.4%.

The UK with 13,645 visitors grew marginally by 2.2% whilst the all-important German market continued its decline and nosedived by -11.5% compared to the previous year to 9,891 tourists. The French market followed suit registering -4.6% to 5,574 tourists which reflects how Sri Lanka is losing its attractiveness in key traditional markets from which we attract winter tourists.

South Asia, the second largest regional source of tourists, has also declined to 45,061 tourists, recording a decline of 2.7% which does not augur well when the world is focusing on getting their numbers from South Asia. The once popular destination for Chinese travellers, who have visited the country in droves ever since 2009, has also slowed to recording just 19,237 tourists, marking a marginal growth of 3.5%, which tells us that things are just not working out for Sri Lanka given that in all of the above markets outbound traveller numbers reflect strong growth. This means Sri Lanka is losing its share of other markets, namely Thailand, Malaysia, Mexico, the Philippines, Myanmar and even Indonesia.

Sri Lanka has also lost favour in strong markets for Ceylon Tea like Russia and Ukraine, with numbers declining by 12.3% to 18,636 tourists whilst the Middle East has crashed by 30.4% to 5,066 travellers. The silver lining in all this is that more US and Australian tourists have picked Sri Lanka as a tourist destination but this will also iron out in the near future due to the absence of a share of voice.

Whilst policymakers continue to harp on the magic four million number of visitor arrivals and we see sporadic below-the-line activity reported in the media by Sri Lanka Tourism, the view from the private sector is that the ground reality is not understood. In fact Sri Lanka will be way off the target set for 2017. The private sector view is that we should not chase behind tourist numbers but focus on attracting quality tourists.

When the Yahapalanaya Government came to power the industry expected more private sector-driven marketing strategies to be implemented but sadly the Government has failed miserably, leaving the industry today with lower revenue per tourist whilst the escalating cost of food and beverages has squeezed profits to the extent that now the private sector is putting its shutters up through cost-cutting strategies while some are planning to take salary cuts at the management end. What is deplorable is that policymakers continue to engage in activities without understanding the problem.

In marketing best practices we have a basic theory called the marketing mix. Let me just focus on the 4Ps rather than the extended marketing mix of 7Ps. The 4Ps are now taught even for the O› Levels in Sri Lanka. They constitute Product, Price, Place and Promotion.

If we take Sri Lanka, we yet have a ‹Product› which the consumer finds attractive - wildlife, beaches, culture, adventure, history, Ayurveda, historical pageants like the Kandy Perahera, ethically-manufactured tea and affable people just to name a few, not forgetting the fantastic hotels, even though the last key new product developed by  Sri Lanka Tourism came way back in 1972 with the Elephant Orphanage in Pinnawala.

Sri Lanka Tourism came way back in 1972 with the Elephant Orphanage in Pinnawala.

Incidentally, competitor destinations like Malaysia, Singapore and Thailand develop new products every three-four years to keep the brand contemporary. On the ‹Price› front private sector-driven businesses are changing to meet customer requirements but there has been a debate on the pricing of entry fees to key sites like Sigiriya and wildlife parks but in my view it is not a burning issue. Sri Lanka is ideally located through the ‹Place› attribute of the marketing mix although the need to increase flights to Sri Lanka is a need that has been identified.

The key weakness in the marketing mix is ‹Promotion›. The overall share of voice of Sri Lanka as a tourist destination is almost zero. Competitor destinations like Malaysia, Singapore, Thailand, Seychelles and the Maldives invest between $ 15 and $ 50 million annually on the destination marketing campaign. Some countries have as many as three campaigns a year but on identified ‹Positioning›.

Sri Lanka›s cumulative expenditure for the last 10 years does not stack up to a year’s marketing bill of the Maldives.

What is said is that Sri Lanka has money to the tune of Rs. 4-5 billion in the bank account dedicated to promotions which has not been used. The latest blow to the industry was the much talked about digital marketing campaign becoming a non-starter and it has now been taken from the dedicated tourism entity and given to a dedicated agency of the Government which is not the answer.

When the Yahapalanaya Government came to power, a private sector approach was taken and a technical committee was appointed by the ministry which consisted of eminent independent individuals like the President of the Sri Lanka Institute of Marketing, Chairman of the Export Development Board, Additional Secretary of the Ministry of Defence (who had worked in the foreign service for 20 years), the Additional Secretary of the ministry, the Marketing Director of the Tea Board and a top procurement expert from the Government with the Chairman of the entity being a marketer by profession.

To bring in absolute professionalism, the first tender floated was a ‘creative pitch’ so that with limited financials we could get the best from advertising agencies to develop a strong ‘positioning campaign’.

Only the top seven global advertising agencies were shortlisted to submit proposals with a clear brief. A month before proposals were submitted, the Board was devolved in October 2015 whilst the tender was cancelled one day before the submission date of the proposals. All the seven ad agencies were up in arms as each of them may have spent Rs. 10-15 million on the proposals made.

Today still no traction has been witnessed with this endeavour. Around November 2017 the board members and the then Chairman of 2015 were invited by policymakers to understand how this project could be resurrected and a clear way forward could be devised. The private sector is currently closely watching how this move will pan out at least now. At the same meeting in November 2017, it was clearly mentioned by the then Chairman and Board members that the above was only a creative tender and subsequently the lucrative media tender would have to be floated but for that one must follow strong financial governance as the money involved would be large, something which was also noted. Let’s see how things evolve given that the environment as we speak is sadly not conducive for ethical work.

A point to note is that the above campaign is almost six-nine months away from its launch. This means that the launch can only happen at the end of 2018. This also will be on the assumption that things will work as per the tender procedure and that no interference will come in such as what was observed in 2015. I guess time will tell.

Even though the digital campaign has been tasked to be done for a separate entity, in absolute professionalism what the country requires is cutting-edge creativity rather than just some content on Facebook or YouTube. It’s sad that policymakers cannot understand this reality.

As we speak, the industry is in a Catch-22 situation. The costs escalation and overall rates dropping due to entrenched price competition is taking the industry to the wire. There are many properties in the market for sale whilst the big brands are aggressively driving in launch agendas. Unless some serious focus comes into the sector the indications are that many companies will be heading the Kodak way.

Way back in 1880 George Eastman founded the Eastman Kodak Company. By 1884 Kodak had become a household name after Eastman replaced glass photographic plates with a roll of film that he believed was successful because it was a user-friendly product that would be “as convenient as the pencil”.

By 1963 Kodak had become the industry standard with sales topping $ 1 billion made by launching into new product lines such as cameras and medical imaging and graphical arts, and it quickly rose to $ 10 billion by 1981.

In period between the 1980s and 1990s Kodak encountered problems with market share, revenues, competitors and a technological explosion which greatly threatened the survival of its business. By 2005, the company hit a negative bottom line. From a loss of $ 1.2 billion that year the company reeled to a $ 0.3 million loss in 2012, and on 19 January that year, the inevitable happened and the company filed for bankruptcy. The company can be classified as an organisation which refused to change with the times and on 19 January 2012 it finally decided to bite the bullet and file for Chapter 11 protection. The lesson to the world was that if we do not change, we perish.

1) What Kodak should have done was invest in digital photography to capture market share and move away from the dying traditional photography. If one holds on to a product for the love of it and its heritage value it is called being Marketing Myopic. Sri Lanka Tourism policymakers must understand if we don’t change with the times by positioning the company based on competitors and use new techniques of communication nationally we will take this industry to the wire. Some are already there and are selling their properties.

2) There must be a company culture which is based on innovation and ideas that can lead to a basket of probable new products. Some call this the new product pipeline. Sri Lanka Tourism on the national end must develop some new products just like Dubai, the Maldives, Thailand and Singapore.

3) A practice seen in the world of business is where a fusion of technologies is taking shape. For instance, refrigerator companies are merging with computer technology to offer the world a smart fridge. It is said that Apple is joining with watch manufacturers to launch the first Apple iWatch, which is interesting. Maybe Sri Lanka Tourism must link with the tea, apparel, rubber and gem industries and see how integrated communication can propel the country forward.

4) There is no point in launching new products and a promotional campaign unless it is tracked on the impact it has had with consumers. This was not done by Kodak and it is a key lesson for Sri Lanka Tourism. The current below-the-line activity must be evaluated for effectiveness and so should future campaigns.

Just like Kodak what Sri Lanka Tourism requires is just going back to the basics, which in this case are the basics of the marketing mix and understanding the practices followed by other brands and destination marketing campaigns.

[The writer is the President/CEO of an international property development company and a visiting faculty member in tourism at the University of Colombo. The thoughts expressed in the article are strictly his own].