Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 24 October 2024 00:24 - - {{hitsCtrl.values.hits}}

The 9th Executive President of Sri Lanka Anura Kumara Dissanayake

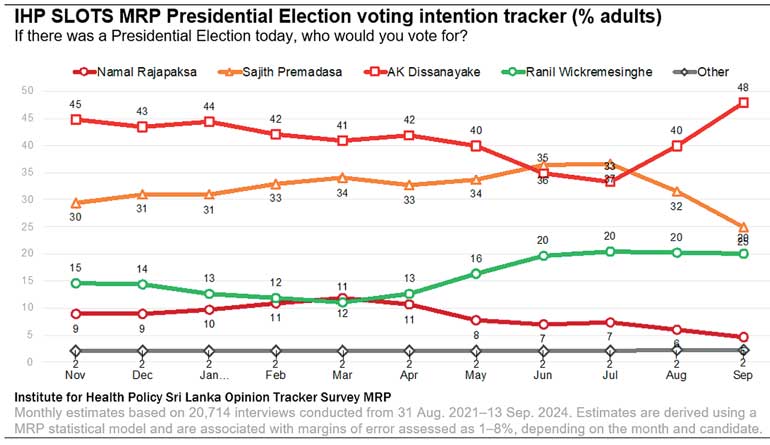

The voting trend of the Presidential candidates

One could not ask for a better market place than the recently staged Presidential election – 17.4 million consumers (voters), targeted essentially by four brands (though there were 38 Presidential candidates registered). Each brand had the stipulation of Rs. 1.8 billion within a two-month period. Given that Sri Lanka is an island nation, it was a ‘perfect market place’. All candidates had the freedom to travel, freedom to use any medium of communication. The candidate that secured the highest share was declared the winner. Let me pick up the key lessons for businesses.

One could not ask for a better market place than the recently staged Presidential election – 17.4 million consumers (voters), targeted essentially by four brands (though there were 38 Presidential candidates registered). Each brand had the stipulation of Rs. 1.8 billion within a two-month period. Given that Sri Lanka is an island nation, it was a ‘perfect market place’. All candidates had the freedom to travel, freedom to use any medium of communication. The candidate that secured the highest share was declared the winner. Let me pick up the key lessons for businesses.

Lesson 1: Entrenched competition

If we analyse data trends on the top four candidates what we see is entrenched competition. 36%, 32%, 28% and 3% was the market share predicted as at August, 2024. This is the first time that Sri Lanka had experienced three brands fighting to be the President of Sri Lanka with such a small parity in between them. Each of the brands had their own themes: Puluwan Sri Lanka by brand RW, Economic development with governance was brand Sajith’s view and brand AKD’s theme was Anti corruption drive and understanding ground realities. Brand AKD started at just 22% voter base way back in February, 2022 and went on to garner a 43% by September, 2024 to be the victor.

The implications to business: is that we must know the ‘Consumer Reality’ when developing strategies. Vision and aspirations are great but without understanding the consumers purchasing attributes (especially in a country where there is an economic fallout) is a sure recipe for disaster. In brand marketing ‘Usage and Attitude studies’ is a must at least once in three years and tracking purchasing habits with retail or consumer panel data must be a way of life. Especially the gains and loss analysis as it tells you at a regional level to which brands you are losing consumers or acquiring the same.

Lesson 2: Marketing spend

Latest data reveal that from Institute for Democratic Reforms and Electoral Studies (IRES) state that Brand SJP had incurred the highest share of voice at 1.58 billion (TV 1.41 b, Radio 37.3 m and Radio 113.8 m) rupees whilst Brand Dilith had spent 838 million (TV 808 m, Press 24 m and Radio 6 m). Brand RW had spent Rs. 613 million whilst Brand AKD 271 million. These are rack rates spent between 15 August and 18 September.

The implications to business: All elements of the marketing mix must be balanced in the overall brand proposition that you offer a consumer. Promotional support only does not attract a consumer to pick a brand. For instance even with a 48% overall Share of Voice (SOV) by brand Sajith the market share was 32%. On the other hand, brand AKD with a share of voice of only 8% was able to get a 43% market share. It’s a classic case study that a brand who understands a consumer and develops a correct product, even with a low marketing spend can get a higher consumer acceptance.

Lesson 3: Exit poll

A very interesting piece of data. The Exit poll that was done by a professional research agency for a fee by a particular candidate has revealed that Brand AKD was at 31%, Brand RW was at 17%, Brand Sajith at 27% whilst the undecided segment was 23%. However, when the final tally came Brand AKD had got 12% of the swing vote from the undecided segment. Which means that there is another 11% that can be moved to Brand AKD at the Parliamentary elections in November. So technically getting a 50% is possible and hence over 113 seats in Parliament.

Implications to business: it’s absolutely important to be data driven in today’s business world. If not you will end up wasting money when a consumer segment cannot be moved to your brand. One must do a deep dive to a regional analysis of the numbers based on your consumer research data so that you will know where your strongholds are for your company brand as against competitors and in which markets that consumer switch is easier.

Lesson 4: Take competition seriously

If we analyse the Presidential elections 2024. There were 13.3 million people who voted. From which the top two brands garnered 9.9 million votes. Which means that 3.3 million people voted for the other brands. From which only 0.2 million decided to give their 2nd preference- To be specific the preferential votes for the brand AKD and brand Sajith received was 105,264 and 167,867. Which means almost 92% from the 3.3 million voters said they don’t want the brand AKD or Sajith.

Implications to Business: we must know that there is a concept called solus brand users. These are brands that are strongly loyal to one brand. In today’s market where 83% of consumers’ income is less than expenditure, the segment of Solus consumers is declining rapidly as people move brands due to price. Hence, we must face reality and be very conscious when taking price increases.

Lesson 5: Three million did not vote

It’s strange but almost three million eligible voters did not vote. 2.6 million of them are in the Middle East. The others are daily wage earners, fishermen and some are working away from home and due to transport issues did not vote. I guess postal voting for the general public must be introduced

The implication to business is that we must understand ‘internal customers’ and the implications they have on the overall brand promise to customers. Especially, in the service industries we must be very conscious of the brand health of the staff as they are the silent salesmen.

Lesson 6: Writing on the wall

If we study Brand RW, as early as March 2024 the market feedback on his acceptance was weak. Only 17% had an income above expenditure. Almost 83% we’re struggling to put food on the table. However, it was only in June, 2024 that he realised the market reality. The product rhetoric changed to addressing cost of living issues and then his rating picked you from 12% to 28% during a short time period. But the corruption allegations overrode the good news. Namely, the Visa scandal impacting the visitor arrivals to get hit by sixty thousand or 128 million dollars coupled by the Passport issue took brand RW to the wire.

The business implications is that we must understand what the non core issues in our business are. In today’s world people are wanting a basic product. Let’s deliver the core product without any frills. Do not let the consumers get distracted by unnecessary brand activations that do not add value to the core product.

Lesson 7: Brand Sajith win?

If Brand UNP was seriously wanting to develop the next leader, the best opportunity was the Presidential elections 2024. Given that Brand RW had achieved all what he wanted to achieve in his forty year plus political career. He could have put his party before himself and fielded one ‘Green’ Candidate. If so, brand Sajith would have garnered 6.6 million votes or around fifty percent of the share.

Implications to business is that it’s sometimes prudent to launch fighter brands so that regionally you have brands from your own company at different price points. This can help you protect your consumer base. Many brands are practicing this business strategy in Sri Lanka. Some are having the same product at different prices due to undercutting.

Lesson 8: Parliamentary elections

Whilst the Presidential elections have come to a close the next challenge is for the current Government to get the 113+ votes in parliament so that policy reforms can be done. As of now the brand AKD buzz is very positive. Given that there are no strong brands in the Brand AKD group, the best option is to drive a mother brand strategy – Malimawa. Make the brand so strong that any product will be purchased by the voter.

Implications to business: This is a good strategy but then not a single product must falter. If it happens it affects the total brand portfolio.

Conclusion

Let’s be proud of Sri Lanka. Since the last quarter, 2023 the economy has been growing at a 4.7%+ trajectory. The first half year performance in 2024 is touching a 5% GDP growth. All our neighbours are sinking – Pakistan, Bangladesh and recently Maldives are in a financial crunch. Sri Lanka Tourism must hit five billion dollars whilst we must develop the exports industry to be $ 25 billion. Penetrating the $ 2.3 trillion Indian market is key as the Indian economy is booming at a 6% plus GDP growth. We have an FTA and a Comprehensive Economic Partnership Agreement (CEPA) to be signed with India. Sri Lanka must be a corrupt free nation. Everyone must support.

(The thoughts are strictly the author’s personal views and do not link to any organisation he serves in Sri Lanka or the South Asian region. He is an alumni of Harvard University Executive Education.)