Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 21 February 2018 00:00 - - {{hitsCtrl.values.hits}}

Whilst Sri Lanka is grappling to understand how to structure the Government to run the country, the reality is that the pressure on the consumer purse is taking the country to the wire. Let’s accept the reality – Sri Lanka has voted for change and policymakers are not accepting this verdict and are holding the country to ransom.

It’s very sad for the country when we must now be working towards making Sri Lanka a 100 billion economy at 7% plus growth and working towards operationalising the FTA with Singapore that is coming to effect on 1 April.

If one does a deep dive, we see how the overall consumption in Sri Lanka of the Fast Moving Consumer Goods (FMCGs) has declines right across 2017. As per AC Nielsen data, from -3% in Q1 to -2.5% in Q2, then in Q3 the decline is stronger at -3.5% and 2017 ended with Q4 declining by a staggering 8.5%. This sure does not augur well for a country on an economic reform agenda to drive economic growth.

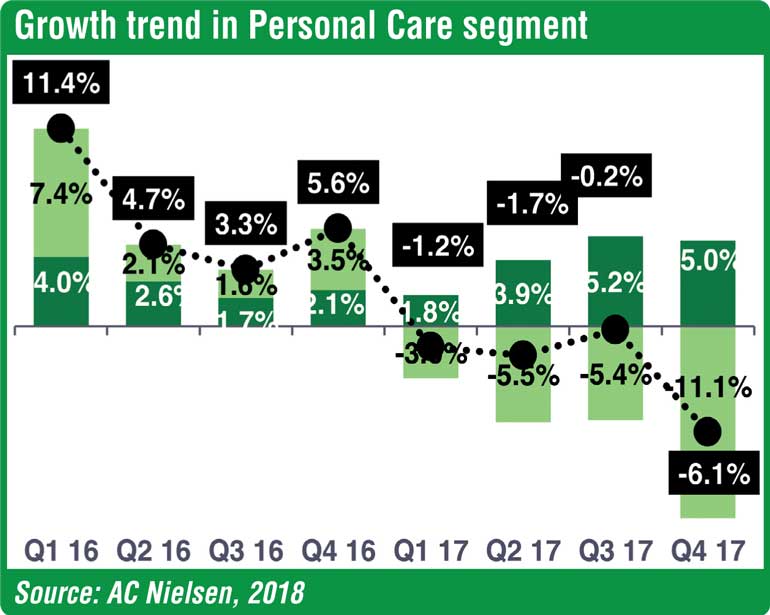

What is more worrying is the segmental performance of personal care which has declined by 3.1% in Q1 to 5.5% in Q2 whilst in Q3 the trend becomes acute with a decline of 5.4%, and in the final quarter the performance of -11.1% means that the lifestyle of the consumer is severely affected.

The voter turnout of over 70% was a clear indication of the protest on the way the current Government was being run. Policymakers are yet figuring out how to adjust to this decision, which only states how ‘product oriented’ the Government currently is as against being ‘market driven’.

If one analyses the issues in doing business, the increase in taxes comes out as the first reason, with 100% of the respondents stating the same whilst the second key issue effecting business is inflation, with 69% of the respondents stating the same as a pressing issue as at December, 2017. Maybe the remittances dropping by 7% can be a cause for the consumption to drop in families where a person is working overseas (like the Middle Eastern workers) and the change of behaviour at the household end.

The problem from a Government point of view is that quarter after quarter in 2017 the above two indicators – taxes and inflation – were cited as key business issues and the issue kept worsening right throughout 2017 but was not addressed by the policymakers; which is why the drastic behavioural change at the 10 February local government election. What is worrying is that after almost two weeks there is no response to voters other than meetings on an hourly basis at the cost of a taxpayers’ money.

Whilst there are allegations and counter allegations on the reason for the current status quo, what people are forgetting is that Sri Lanka has to service a $ 3.8 billion debt in 2018 and $ 4.2 billion in 2019.

The Central Bank Governor has already issued an official statement that unless we have a Government taking control on the road map, Sri Lanka is heading towards faltering on our global commitments which has never happened before in history.

In this backdrop, we see the non-action at policy level is now hitting the private sector P&Ls. The first is the blue-eyed sector of Sri Lanka – tourism which is worth $ 4 billion. The industry is virtually in the red as the room stocks have increased whilst the costs have spiralled to a point where the ROI does not make sense for an organisation to continue its operations in the sector.

The acid test is where we see there are three tourism properties on sale in the city, whilst in the eastern belt of the country there are almost 1500 entities in the market shopping around. Whilst the reality is seen by the industry, the policymakers keep highlighting the amazing arrival numbers which shows how distant the policymakers are to the reality of the country.

If I am to single out another industry in this same status quo, it is the tea industry which is worth $ 2 billion. The arbitrary ban on the weedicide glycophosphate has virtually throttled the industry and Sunday papers reported that one of the most respected chairmen of the Sri Lanka Tea Board (whom I personally know) had resigned, stating one of the reasons being the issue of glycophosphate.

Whilst research cannot justify the ban, Sri Lanka continues to uphold the decision which once again indicates the gap between the policymakers and the reality. We continue to be product driven rather than being consumer driven.

Whilst the world is moving forward, aggressively driving Free Trade Agreement agendas, Sri Lanka is at a crossroads on what the economic policy should be post-LG elections. Whilst the FTA with Singapore is positive, there has to be significant policy changes to be actioned if we are to make use of the opportunity for the advantage of the country from 1 April. But the reality as at now is that the country is on a wait-and-see mode.

The author was the head of Sri Lanka’s key economic policymaking entity, the National Council For Economic Development( NCED), when the country registered a GDP growth of 7% plus during the years 2007-2009 and thereafter went on to serve the United Nations(UN). Currently he is a Board Director in many private sector organisations.