Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 16 October 2017 00:55 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

For the world’s leading manufacturer of smaller commercial jets, Embraer of Brazil, the timing to explore prospects in Sri Lanka seems perfect. There are many reasons for this. Firstly, the overall positive outlook for the aviation industry in Asia. Secondly, the renewed push by the current Government to effectively harness Sri Lanka’s strategic geographic location towards becoming an aviation hub. Another reason is the ongoing restructuring of SriLankan Airlines with a focus on a lower operating cost and improved viability.

“Sri Lanka is among a select few countries in Asia Pacific where we see clear and definitive opportunities,” Embraer’s Asia Pacific Vice President for Commercial Aviation Cesar Pereira and Regional Sales Director Fernando Mainardi told the Daily FT in an interview.

Pereira and his Regional Sales Director Fernando Mainardi were in Colombo last week on an official visit to explore opportunities as well as make courtesy calls on aviation industry stakeholders.

“With our own research, as well as given Sri Lanka’s future promise, we are very positive about growth opportunities here,” he added during the interview at which Brazil’s Colombo-based Counsellor Bruno Pereira A. De Abreu was also present.

Since its inception in 1969, the Sao Paulo- and New York-listed Embraer has delivered over 8,000 aircraft and says every 10 seconds one of its jets takes off somewhere in the world transporting over 145 million passengers annually. Its aircraft operate in over 90 countries, including 17 in Asia Pacific, a region which has over 330 Embraer aircraft in service. Embraer holds global market leadership in the 70-130-seater aircraft.

A 146-seater Embraer E195-E2 aircraft/

Pereira said Sri Lanka’s strategic geographic location makes it an attractive hub in South Asia and connects the region to the rest of the world. “Given this advantage and the Government’s progressive policies towards realising the hub status, Sri Lanka is naturally attracting a lot of attention, including from Embraer,” he added.

The Embraer executives stressed that since Asia was a key driver of tourism and an engine for global growth, Sri Lanka’s potential to be a hub can be fast-tracked. “Colombo has the potential to be an aviation hub similar to Dubai or Singapore,” they added.

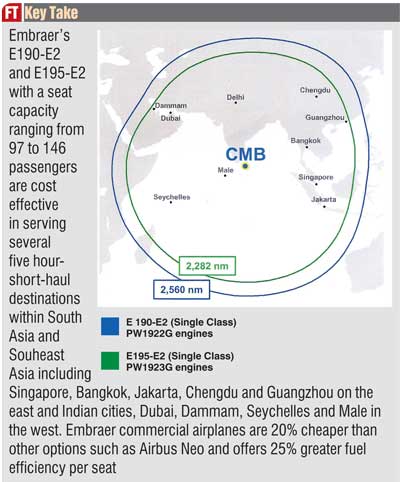

They said that Embraer’s E190-E2 and E195-E2, with a seat capacity ranging from 97 to 146 passengers, are cost-effective in serving several five-hour short-haul destinations within South Asia and Southeast Asia including Singapore, Bangkok, Jakarta, Chengdu and Guangzhou on the east and Indian cities, Dubai, Dammam, Seychelles and Male in the west. During the interview, Embraer showed its own research and analysis of this advantage.

Cheaper with greater fuel efficiency

“Using the right equipment (aircraft), and with it the frequency, is key to improving the connectivity business and optimising the route network of an airline and in the case of Sri Lanka, the national carrier SriLankan Airlines. This is more so if an airline is keen to feed regional traffic to the hub,” Pereira emphasised.

Whilst acknowledging that SriLankan Airlines is undergoing an important restructuring program aimed at improving its operations, Embraer’s executive said its commercial airplanes are 20% cheaper than other options such as Airbus Neo and offers 25% greater fuel efficiency per seat. “Given SriLankan Airlines plans to enhance regional traffic, we believe Embraer is a good value proposition,” Pereira added.

Embraer’s visit also comes at a time when the Government and SriLankan Airlines are exploring the best options to deal with the expensive orders of the long-haul Airbus A350-900s aircraft. Four were cancelled at a cost of $ 100 million and an equal number remain in SriLankan’s liability.

For nearly two decades SriLankan has had an all-Airbus fleet thereby making it reluctant to opt for another brand. Pereira said that 20% lower operating cost as well as other benefits are good enough reasons to manage the complexities that may arise by operating two different brands of aircraft. Embraer has multiple customers using dual fleet.

Airlines in the Asia Pacific operating Embraer commercial aircraft include Japan Airlines, Fuji Dream Airlines, Virgin Australia, Airnorth, Mandarin Airlines, NovoAir, Myanmar National Airlines, China Southern Airlines and China Eastern Airlines while among the major airlines in Europe and the US are British Airways, Lufthansa, Air France (Regional), KLM, Finnair, American Airlines, JetBlue and Delta Airlines.

It operates a Regional Distribution Centre for Asia Pacific in Singapore, and the company also maintains field support representatives in Australia, India and Japan.

To explore opportunities locally, Embraer is also harnessing the strong bilateral ties between Sri Lanka and Brazil. Unlike some of the other leading aircraft manufacturers, Embraer customers can also benefit from more favourable financing from Brazil’s Exim Bank, according to Brazil’s Colombo-based Counsellor Bruno Pereira A. De Abreu. He said that Embraer had previously visited Sri Lanka to explore opportunities in the defence aircraft segment.

In the third quarter Embraer delivered 25 commercial and 20 executive jets. It has firm orders worth $18.8 billion as at end September. Year-to-date, Embraer delivered 137 airplanes. Out of this total 78 aircraft were sold to the commercial aviation segment. In the same period, 59 aircraft were delivered to the executive aviation segment. In the Asia Pacific region, Embraer has 64 E-Jets to be delivered between now and 2025. Commercial aviation accounts for 62% of Embraer’s revenue whilst the group’s other businesses include executive aviation/jets and defence and security.

It accounted for an over 80% share of 2014’s new 70-130-seater jet orders from US carriers in 2014 and new commercial agreements in China have the potential to give Embraer a 90% share of aircraft up to 100 seats in the Asian giant’s domestic fleet.

According to a report on Nasdaq.com, Embraer expects total market deliveries of 6,400-2,300 jets in the 70-to-90-seat segment and 4,100 units in the 90-to-130-seat segment by 2035. The 70-to-130-seat worldwide fleet in service is anticipated to increase from 2,670 jets in 2015 to 6,690 by 2035, making it the fastest-growing segment. Embraer is listed on the stock exchanges of Sao Paulo and New York, and is also on the BM&BOVESPA Corporate Sustainability Index (ISE) and the Dow Jones Sustainability Index (DJSI).

– Pix by Ruwan Walpola