Sunday Apr 20, 2025

Sunday Apr 20, 2025

Monday, 27 May 2024 02:09 - - {{hitsCtrl.values.hits}}

Indian bunker markets are now amply supplied with very low sulphur fuel oil after four months of shortages, according to traders, with VLSFO prices declining accordingly.

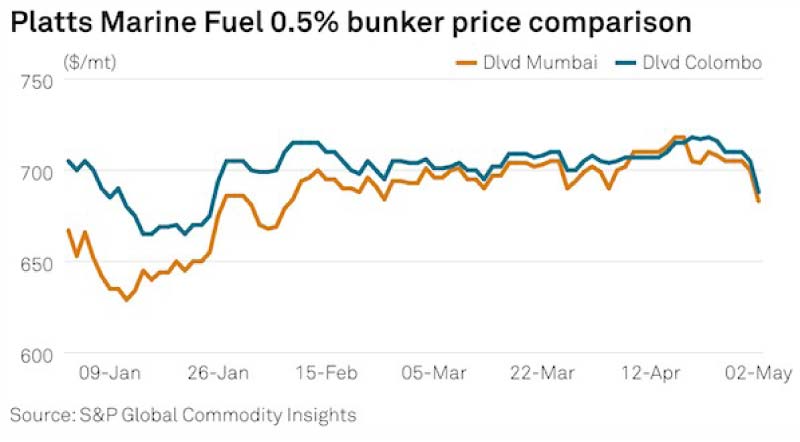

Platts, part of S&P Global Commodity Insights, assessed 0.5% marine fuel oil delivered to Mumbai at $ 683/mt CFR on 2 May, down $ 22/mt week on week, while in Kochi prices fell to $ 668/mt, down $ 28/mt. In Sri Lanka, prices at Colombo were assessed at $ 688/mt, down $ 22/mt week on week.

“Products are available across all the ports, I think supplies will remain consistent now and the gap we have seen over the past four months won’t be there,” an official at Hindustan Petroleum Corp. Ltd. told S&P Global.

“HPCL is very keen to pump more quantities of VLSFO into the market this year and we have already started it from this month,” the official said. “We will be processing more and producing more for the market.”

A Kochi-based bunker supplier said: “We have product available in Kochi. The vessel Hafina Raven recently dropped 9,000 mt of product. We’re also getting a parcel of 12,000 mt and other suppliers will be bringing more product as well, so we’re good for the month of May.”

Another supplier said availability had improved at almost all Indian ports, with supplies arriving in the last week of April. “We will have around 20,000 mt of product available soon,” the supplier said. “Once there’s a month’s worth of stocks, the replenishment cycle gets back in place. We’re expecting a demand revival in May.”

Weak India bunker demand in April

Bunker demand in India in April was initially slow due to unavailability of supplies, with inquiries being redirected to Sri Lanka. However, the number of inquiries rose in the last week as the ample supplies were delivered at major Indian ports.

“Demand was always there but because of the consistent supply shortages over the past three months, a few of the inquiries were repeatedly being diverted to other ports,” a Mumbai-based supplier said. In terms of volumes, there was a bit of slackness in the market which was purely because of the perception of product not being available.”

A Vishakhapatnam-based trader said there has been a notable increase in demand in May compared with previous months.

“Many vessels that were calling on East Indian ports for bunkering had no other option but to take bunkers in Sri Lanka as the supplies had run out here,” the trader said.

HSFO demand

Traders said demand for high sulphur fuel oil was increasing across India due to its prompt availability and price advantage over other grades.

“One reason is that we have seen long voyage vessels, mostly Capesize, calling via the Atlantic to the Indian Ocean, some of them from West Africa, who are taking larger volumes of HSFO,” a Gujrat-based trader said. “Scrubber-fitted vessels from the container segment are also taking longer routes, which has pushed up demand. Additionally, the vessels taking refined products to Europe have also been taking larger quantity of bunker fuels.”

Bunker calls and ship-to-ship transfers at Indian ports in the first 30 days of April were more than double year on year at 982 total operations, according to the data from S&P Global Commodities at Sea.

“High sulphur demand coming from scrubber-fitted vessels has grown a lot as the supplies have become more consistent, and high sulphur also has a pricing advantage,” another supplier said. “We’re expecting a further increase in demand across India, especially in Kandla, Kochi and Mumbai.”

“The east coast have been seeing an increase in demand for HSFO since March as it is being increasingly sought by vessel owners,” the Visakhapatnam-based trader said. “We were supplying it more frequently even when other grades like LSMGO were being quoted on a best endeavour basis.”

Shortages

Traders said that as an increasing number of Indian states implement a policy mandating lower sulphur content for furnace oil used as industrial fuel, it has increased demand for low sulphur heavy stock, which is derived from the same production stream as VLSFO. At the same time bunker demand in India rose as ships started to avoid the Red Sea. The simultaneous increase in demand posed a challenge for refineries, forcing them to strike a balance between supplying both, which led to VLSFO shortages in the Indian market.

“Demand from the Industrial segment is picking up in India as the sulphur limit has now been reduced to 1%,” a refinery official told S&P Global. “It represents a substantial market, significantly larger than the marine fuels segment. So in that sense refineries have a choice to sell LSHS there rather than producing costlier VLSFO.”

“Every state is bringing in regulations now,” the official said. “The policy has been there for eight years but the implementation has just started. Demand is coming in bits and pieces for refineries margins on bunkers are very thin compared to LSHS.”

Market participants are closely observing the developments around the growth of the LSHS market in India.

Sri Lanka demand stable

Continued shortages of bunker fuels at Indian ports and consistent inflows in April kept bunker sales volumes at the Sri Lankan ports of Colombo and Hambantota stable. According to a Bunkerworld survey, bunker volumes in Sri Lanka in March rose 33% month on month. However, total bunker calls at Sri Lankan ports fell to 228 in April from 246 in March, CAS data showed.

“With the Red Sea situation since December volumes have increased at Sri Lankan ports by 70% - 75%,” a Sri Lanka based trader said. “Some of the major shipping lines like Maersk, CMA CGM, and especially MSC, have increased their volumes.”

Bunker calls and ship-to-ship transfers at Sri Lankan ports in April more than doubled year on year to 228 operations from 99 in April 2023, according to CAS data.

“Another reason could be that suppliers in Colombo have been importing product back-to-back, which oversupplied the markets and kept prices at competitive levels,” the trader said.

Another Colombo-based trader said HSFO sales in Colombo rose as many suppliers imported product and started offering at competitive levels. “Overall demand [for all grades] could be around 72,500 mt, slightly lower than 76,000 we did in March,” the trader said.

“For this month we’re expecting similar demand,” the trader said. “We had a few inquiries which had to be filled in April last week but were shifted to this week due to berthing issues in Colombo.” he stated.

Inflows from Fujairah and Singapore are expected to remain intact for May. However, traders said they will keep a close eye on recent replenishments at Indian ports as many inquiries were diverted to Colombo when India was suffering from shortages.