Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 3 January 2022 00:00 - - {{hitsCtrl.values.hits}}

|

The Ceylon Association of Shipping Agents (CASA) has called for urgent resolution of the prolonged forex crisis warning that the shortage and uncertainty is severely impacting the shipping industry and exports.

The Ceylon Association of Shipping Agents (CASA) has called for urgent resolution of the prolonged forex crisis warning that the shortage and uncertainty is severely impacting the shipping industry and exports.

“The shipping industry is a clear example of globalisation, where it is through the industry that goods produced in one corner of the world are able to be consumed in the other corner. The shipping industry plays a pivotal role in any economy, as it is through the shipping industry that countries are able to export and import goods and in turn earn foreign exchange. The industry plays a pivotal role in the Sri Lankan economy due to our strategic location advantage. Sri Lanka aspires to be a maritime hub in the region and is currently positioned as an important transshipment hub in the global maritime industry,” CASA said in a statement.

“However due to the dollar shortage currently prevalent in Sri Lanka the shipping industry is facing many challenges,” it added.

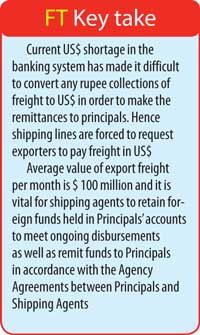

CASA said being the global industry shipping is, many of the payments related to the industry are made in US$. Global shipping lines need the speed and flexibility of being able to collect freight and make other vessel related payments in US$. The current US$ shortage in the banking system has made it difficult to convert any rupee collections of freight to US$ in order to make the remittances to principals. Hence shipping lines are forced to request exporters to pay freight in US$.

Furthermore, shipping agents operate US$ accounts on behalf of their principals to which Principals send inward remittances to meet vessel disbursement costs. These costs include Port and Terminal charges, payment for Bunkers, deployment of on-board security teams, feeder freight and other supplies some of which are paid in US$, however agents have been facing many difficulties in making US$ payments to vendors and also remitting these payments to principals in the last 2-3 months due to the non-availability of US$.

An adverse effect of the delay in paying the principal would be, shipping lines receiving limited allocation for Colombo exports and instead that allocation being provided to regions where collections could be repatriated easily and without delays, which in turn would mean that exporters will be unable to ship out good to meet client deadlines and in the long run lead to losing the space allocations to other regions and Sri Lankan exports will be adversely affected.

Shipping lines could also insist that payment terms be changed from prepaid to collect basis which would once again reduce the bargaining power of the exporter in Sri Lanka, and adversely affect the freight rate reducing the competitive advantage the local shipper has in global context.

Furthermore, Duty free supplies such as ships stores, bunkers, bonded stores are mandatorily paid in US$ as well as Cash to Master is mandatorily paid to ships in ports of Sri Lanka in US$.

There is also a buildup of containers within the port of Colombo due to the delay in import clearance owing to restrictions on LC facilitations.

CASA said the average value of export freight per month is $ 100 million and it is vital for shipping agents to retain foreign funds held in Principals’ accounts to meet ongoing disbursements as well as remit funds to Principals in accordance with the Agency Agreements between Principals and Shipping Agents.

“Therefore, it is vital that Sri Lanka facilitates the repatriation of funds to shipping lines and enable US$ payments to vendors of shipping lines to avoid the cyclical effect of losing the export income to the country in order to maintain the competitive advantage which has been gained through the years,” CASA added.