Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 2 April 2018 00:00 - - {{hitsCtrl.values.hits}}

A general view of the world’s largest cruise ship of Royal Caribbean Cruises, the 362-metre-long, Symphony of the Seas REUTERS

With the positive global outlook on cruise tourism and the target to achieve 50,000 tourist arrivals via sea voyage in 2018, the Government of Sri Lanka has taken few positive initiatives to grow cruise tourism in the country. It was noted that a Parliamentary Sectorial Committee on Transport and Communication has been appointed to provide recommendations to develop the industry and provide necessary concessions to passengers.

Sri Lanka has seen a gradual increase in cruise ship arrivals from 18 visits in 2011 to 46 visits in 2017. Last year saw the arrival of ‘World Dream’, the newest luxury cruise ship belonging to Dream Cruises, with a length of 335 metres, berthing at the East Container Terminal in Colombo Port.

It was also noted that the Tourism Ministry is working hard to target the higher end of the tourism market including cruise tourism to boost the revenue per visitor. These initiatives by all government institutes will help Sri Lanka to capitalise its excellent geo strategic location, and will enable Sri Lanka to become a fully-fledged maritime hub.

There are many developments required to make Sri Lanka a more attractive location for passenger vessels and this article will address some of these main developments. Let’s start with the global and regional outlook

Cruise Industry – The Global and Regional outlook

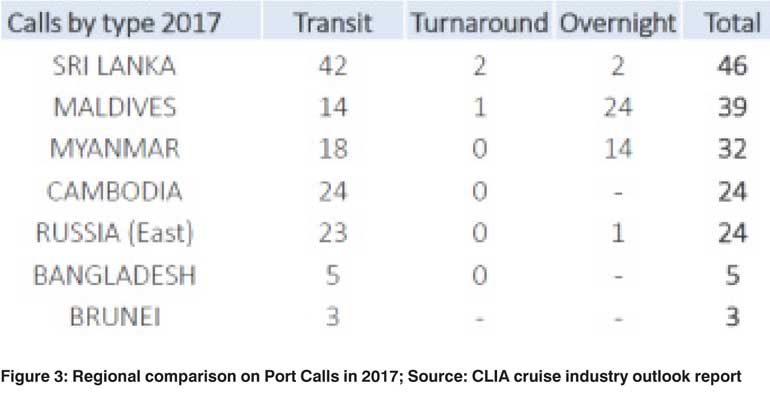

Demand for cruising has increased 20.5% in the last five years and close to 11.5 million passengers are reported from the United States of America. Over 50% of the cruise capacity is from Caribbean and Mediterranean sectors and close to 10% from Asia. A recent survey done by Cruise Lines International Association (CLIA), forecasts close to 27.2 million cruise passengers in 2018. River and small ship cruising continues to gain traction among travellers, specifically the Millennials and grandparents travelling with grandchildren sans their parents are also in the rise. 33% of cruisers surveyed who have taken a cruise within the past three years, have a household income less than $80K which shows how increasingly affordable cruise tourism has become.

The cruise industry in Asia is growing rapidly. As many cruise lines deploy more capacity to the region, including brand new, large cruise ships purpose-built for Asian consumers, government authorities, cruise lines, destinations and industry stakeholders need to understand the trends, the overall potential for cruise tourism growth and associated infrastructure needs.

The region is culturally rich and diverse in destination offerings, with vivid contrasts between old and new, boasting some 25,000 islands and 37 UNESCO World Heritage sites. Besides appealing to visitors from beyond the region, Southeast Asia is also home to a large and emerging middle class, which constitutes a promising source market for cruise ship deployments.

Between 2013 and 2017, cruise capacity has increased across all metrics. The number of ships deployed in Asia grew 53% since 2013.Similarly, the number of cruises and voyages within and through Asia increased at a 25% Compound Annual Growth Rate (CAGR).

Passenger capacity almost tripled from 1.51M passengers in 2013 to 4.24M passengers in 2017.The cruise industry is bringing more cruise visits to destinations in Asia. Destinations with the greatest growth in total port calls this year are Japan, China and Thailand with 852, 306 and 218 additional calls, respectively.

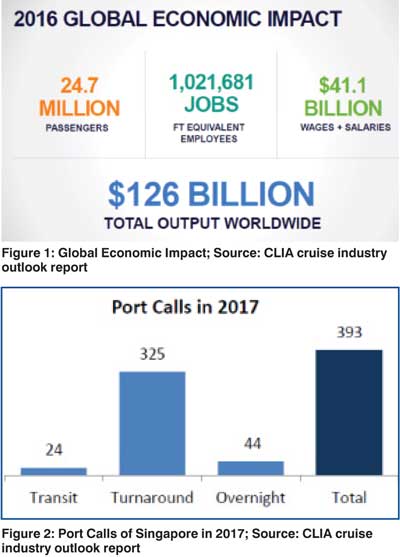

Sri Lanka has also recorded a 21% Year on Year growth in 2017 with 46 ship arrivals recorded in the year. Over the last 4 years, Sri Lanka has recorded a CAGR of 15.3%.

However Maldives has recorded a 255% YOY growth and a CAGR of 44.3% growing at a rapid pace.

Current challenges and developments

Cruise ships are getting larger in size and also the numbers of passengers are between 2500-3500. The top 50 cruise ships in the world are over 300 metres long and can carry over 3000 Passengers. If Sri Lanka is to attract cruise ships, the Port of Colombo must be able to provide an exclusive area in the harbour for this activity, by providing more tangible docking and terminal facilities to accommodate larger ships.

Apart from this it is important to look at the types of facilities which should be provided to passengers. With the trend of ageing population and the increasing disposable income possessed by them, it is important to provide facilities such as wheel chair access and clean wash rooms.

The Sri Lanka Ports Authority (SLPA) plans to convert the Bandaranaike Quay (BQ) of Colombo port into a “fully-fledged international cruise terminal,” to cater to these requirements. Under the project the Bandaranaike Terminal of Colombo which is being used only for general cargo handling at present, is due to be developed as a fully equipped Central Cruise Terminal.

In 1991 the Port of Singapore Authority built the Singapore Cruise Centre(SCC), a cruise terminal located in the south of Singapore and was later upgraded in 1998.It comprises of two terminals, namely the International Passenger Terminal (IPT), and the Regional Ferry Terminal (RFT).The IPT handles international cruise ships, and has two berths of 310 metres and 270 metres with a height limit of 52 metres. With a draft of 12 metres, it can handle most of the largest cruise ships in operation today. It underwent an upgrade in 2005 to improve its passenger handling facilities. In total, SCC handles a throughput of over 7 million cruise and ferry passengers a year, of which about 950,000 are cruise passengers.

A well-coordinated approach which brings together the Inbound Tour Operators, Cruise Ship Agents, Ports Authority, Department of Immigration and Emigration and the Department of Tourism is required to reduce bureaucracy and red tape in the industry. Ease of customs and immigration procedure is a key factor that needs urgent attention. Initiatives such as arranging Customs and Immigration clearance online will provide convenience to the tourist giving them more time to explore the country. This will also limit the number of officers boarding the ship and create a paperless and efficient process for all parties concerned.

CASA, the voice of the shipping industry, has already held joint meetings with different government bodies to reengineer the process and will continue to be in consultation with the government bodies sharing best practices of the industry and concerns of all stakeholders. These initiatives will help to develop a standard operating procedure in line with industry best practices and a Code of Conduct which will improve transparency.

Positioning Sri Lanka as a lucrative destination is an urgent need to ensure more cruise ship arrivals. Any cruise operates with limited port calls and to add Sri Lanka as a destination they will most probably have to drop a less attractive port from its portfolio. Therefore a joint initiative by the Industry, Sri Lanka Tourism and the SLPA has become a need of the hour.

As seen on figure 2, about 82% out of the total port calls of Singapore are turnarounds. A turnaround port is the embarkation and disembarkation port; in other words, a port where a large amount of passengers embark and disembark from the cruise ship. More turnarounds will affect the country’s economy positively due to many activities involved in it, hotel stays, airport transfers, luggage handling and various other ancillary service.

However as seen on figure 3, only 4% of the total calls of Sri Lanka are Turnaround and the majority is on transit. 42 out of 46 total cruise calls are same day transits where passengers engage in sightseeing in Sri Lanka within the same day of arrival and return back to the ship. This entails minimum activity and very little foreign exchange earnings to the country. In contrast, over 60% of cruise ship calls in Maldives are overnight transits which increase the likelihood of travellers spending more in the country.

The cruise market is one of the fastest growing segments in the travel and tourism industry and can make a significant contribution to a destination’s economy. As cruise lines are increasingly looking for new destinations, cruise tourism can offer opportunities to Developing countries with harbour facilities and an interesting hinterland. Therefore it is important to keep the costs at a minimum and be lucrative as a destination to attract more cruise lines.

The concept in Singapore and Hong Kong is for cruise ships to use the ports as a hub, and Singapore handles over 1.5m cruise passengers per year. The tour operators and tourism in general, will get a huge boost if this concept is successful in Sri Lanka. There are other benefits that Sri Lanka could exploit by bringing in large numbers of high spending tourists, similar to other countries such as Europe, North America, Caribbean, and East Asia where it is a huge business, Sri Lanka could also compete if a tourism oriented infrastructure is provided, with duty free shopping and other commercial activities.