Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 13 January 2020 07:02 - - {{hitsCtrl.values.hits}}

Port of Colombo

The Port of Colombo is ranked the world’s number one container growth port among the top 30 container ports in container handling for the year 2018. It has also recorded a 13.5% growth for the year 2018, over the same period compared to the previous year, reaching the 22nd position from 23rd amongst global container ports, according to Alphaliner Monthly.

Being the first time in history that the Port of Colombo has topped a global maritime ranking, it is also a significant achievement. With this growth, the Port of Colombo has leapt ahead of many other Asian, Middle Eastern and European Ports.

However, retaining this leadership position is going to be a challenge for Sri Lanka, due to the fast growth of other regional ports. India is rapidly investing in their port sector, particularly a Deep Water Terminal in Vizhinjam, which will affect transshipment volumes from India. Therefore CASA, the voice of the Lankan shipping industry, thought to highlight the challenges it will face in the new year.

Expediting the East Container Terminal

The only deep water terminal in Sri Lanka is CICT, with a depth of 18m, the existing facilities of which are reaching saturation point for sixth generation container mega carriers. The Colombo International Container Terminals (CICT), a joint venture operated by China and Sri Lanka at the Colombo South Terminal in the Port of Colombo, said that it handled a total of 2.9 million TEUs (Twenty-Foot Equivalent Units) or 40% of the volume at Colombo Port in 2019. CICT said in a statement that the terminal has seen an 8.6% increase in throughput compared to 2018, and a 322% increase compared to 2014. Strong growth at CICT has helped the Port of Colombo increase its total throughput by 2.6% in 2019.

A second deep water terminal is an evident requirement for Sri Lanka for it to become a true maritime hub in Asia. It would be prudent for the SLPA to plan not only to operate the present 440m of the ECT by expediting the installation of cranes and other container handling equipment, but also to commence the rest of the ECT’s construction. With shipping lines operating larger ships (lengths exceeding 350m) on the main East-West trade lane, only two vessels over 360m long can be accommodated presently in the Port of Colombo at any given point in time. This should at least grow to four if we are to attract multiple East-West services to the Port of Colombo. If we are unable to attract these services we may run the risk of losing the competitive advantage of being a vibrant transshipment hub.

Improve Ease of Doing Business and digitalisation

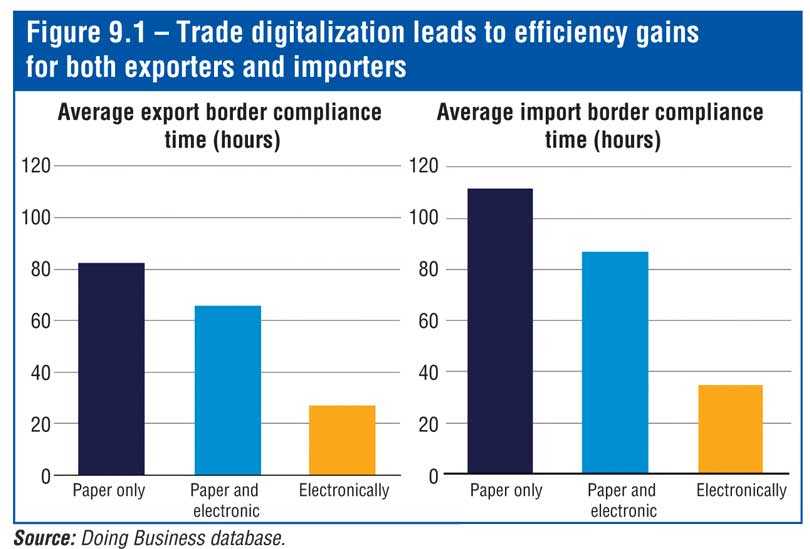

Trade is the engine of economic growth for any country. Therefore, countries around the world strive to improve cross-border efficiencies and enable international trade to happen immaculately. The Government of Sri Lanka (GoSL) identified the need to reform its trade policies and practices to support a business-friendly environment, promote private sector growth and use Sri Lanka’s strategic position to benefit from Foreign Direct Investment (FDI), which would provide much-needed support for better export performance. Digitalisation initiatives such as the Single Window and the Port Community System would undoubtedly drive growth in the maritime sector.

A National Single Window (NSW) is a facility that allows all parties involved in trade and transport to lodge standardised information and documents with a single-entry point to fulfil all import, export and transit related regulatory requirements. The fruitful creation and implementation of the Trade Information Portal (TIP) is therefore a key attribute in the making and deployment of the NSW. Although there have been initiatives in the recent past by individual organisations such as SL Customs and the terminals with regard to automation and systems modernisation, there are significant shortcomings affecting the effectiveness of border management, including a lack of sufficient co-ordination between various Government bodies. No progress was made on the National Single Window, which remains a concern among the industry

The World Bank has come up with a number of performance indices used to benchmark the performance of countries in key dimensions such as the Logistics Performance Index (LPI) and Ease of Doing Business. They measure, among others, the time taken for documentation and border compliance as well as the costs of exporting and importing. Sri Lanka has achieved an overall ranking of 99 on the Ease of Doing Business index, whereas Singapore has successfully achieved the overall ranking of second.

It is common to note that Customs administration becomes the point of focus when the subject of trade facilitation is discussed. Although the functions and activities of Customs administration is an essential component towards facilitation, a view from a supply chain perspective helps to understand the various dependencies among other players, procedures and processes, as well as linkages between these parties, such as private sector traders, transport providers, service intermediaries and other public sector regulatory bodies. This has resulted in many countries making efforts to exploit digitalisation in to drive efficiencies through automation, paperless trade, electronic data interchange, cashless transactions etc.

The Fourth Industrial Revolution, through digitalisation and the leveraging of innovation, technology, data and the Internet of Things, is set to revolutionise the service industry. This will shift established modes of production and consumption, generating welfare and productivity gains and offering new opportunities. Therefore, it is imperative that we consider whether we are ready as a nation to face this revolution and the demands that come with it.

However, in driving towards this, the following should be in place:

A single entity with the necessary legal mandate to take ownership of and drive such an industry-wide digitalisation initiative. Some countries have been highly successful with a government agency driving the project directly under a minister, whilst in other cases Public-Private Partnerships have proven successful.

Ensuring the active participation of all stakeholders to achieve a common objective with consistent monitoring at the highest level and continuous improvement.

A standard operating procedure put in place to ensure that the expectations and obligations of stakeholders are clear in order to conform to and comply with them.

Necessary support for capacity building, focusing on research expertise, domain knowhow, digitalisation and funding and establishing co-operation among the public and private sectors.

Other ancillary services

Apart from the port infrastructure, there are many other areas which need attention in order to develop this ecosystem. Without these ancillary services, a concept of a hub is just a dream. A successful hub requires a full range of ancillary port and marine services at competitive prices in order to attract mainline and feeder operators, casual callers and vessels specifically for services even without cargo operations.

The Government should promote maritime-related ancillary services by creating a climate that would encourage investors, by offering incentives and non-bureaucratic regulatory infrastructure for these services at world class standards and regionally competitive rates.

The ancillary services include the following: Bunkering, Marine Lubricants and Freshwater Supply, Off Shore Supplies and Ship Chandelling, Slop Disposal Facility, Salvage and Towage, Ship Repair and Ship Building, Ship Layup, Services to Cruise Ships and Yachts, and Maritime Security Services.

The bunkering industry provides the shipping industry with the fuel oil that the vessels consume. The quality of the fuel oil provided will ensure the safe operation of vessels. Ship bunkering is a key support service that a maritime hub can provide for the global shipping industry. If a ship can carry less bunker on a voyage it can accommodate more cargo, which means it can take in less bunker at turnaround ports and refuel whilst on voyage at a strategic location.

Sri Lanka is located at such a strategic location in the Indian Ocean, and can provide bunkering and other services to thousands of ships plying along the south coast connecting East-West global trade. This is where Hambantota Port is situated, and it can provide both in-shore and off-shore bunkering and ship services as a profitable business. For this purpose, the private sector should play a greater role and be allowed to set up operations for distribution and market development. The turnover and the revenue generated by this activity would contribute significantly to the Sri Lankan economy.

For the bunkering industry to succeed, it is necessary that the industry has access to good supply vessels, storage facilities and a competitive product. At present, there is limited land-based storage capacity to store bunkers and supply from the JCT Oil bank’s pipeline. Enhancing this storage capacity is key to enabling bunker operators to buy larger volumes and leverage lower prices in order to supply a competitive price in the region. Currently, there are many restrictions on operating floating storages and other bureaucratic restrictions which inhibit the growth of bunker volume from Sri Lankan ports.

Another major requirement is having a refinery capacity which can supply excess product for the bunkering industry. Sri Lanka urgently needs to expand its refinery output/ capacity to fuel the bunker supply.

Salvage operations is also an important aspect of the maritime industry, with high revenue potential not only to the salvers, but also to the ports, transporters, insurance surveyors and everyone involved in the chain. The Government must encourage practitioners to handle vessels in distress in Sri Lankan waters and ports.

Salvage services are also essential in ensuring that maritime casualties in Sri Lankan waters do not cause damage to the environment, fauna and flora or the coast. Search and Rescue facilities have to be maintained by the Government as well. It should encourage the development and promotion of salvage and towage businesses and provide necessary incentives to encourage Sri Lankan entrepreneurs to invest in this industry. The Government will also need to ensure that minimum salvage and Search and Rescue facilities are maintained in and around Sri Lankan waters.

The Government should encourage the development and promotion of Ship Chandelling and off-shore supplies to ships. The present facilities available in bonded stores are only for liquor and cigarettes. As a result, a large range of ship supplies normally requisitioned by vessels have to be purchased by chandlers in the open market at rates which include import duties and other local levies. This makes supplies from Sri Lankan chandlers uncompetitive for ships calling at Sri Lankan ports. The existing bonding facilities need improvement and enhancement to accommodate all products.

Maritime policy

The need for a National Maritime Policy has been highlighted in many forums as an urgent initiative needed to ensure long-term growth in the sector. In light of our geologically strategic position on international maritime trade routes, Sri Lanka is in need, more than ever before, of robust policies to garner its benefits. The adaptation of a national maritime policy would ensure the sustainability of the country’s maritime and logistics’ landscape. A national policy for maritime and logistics sectors was drafted by a committee comprising industry experts covering all the fields in the maritime industry. The document was presented to the former Minister of Ports and Shipping and Southern Development Sagala Ratnayaka by former Ministry Secretary Dr. Parakrama Dissanayake at the Ministry last year. It is advisable that this document is revisited and implemented, as a lot of effort was put in to develop this well-thought-out road map for the maritime sector.

Conclusion

It is important that the Government initiates discussion with all stakeholders and work on these main areas required to achieve Sri Lanka’s maritime aspirations. More importantly, an implementation body with a legal mandate needs to be put in place to ensure that policy is executed without delay. The main point that needs to be stressed is that a maritime Hub consists of several elements, primarily capacity and physical infrastructure, quality ancillary services, and Ease of Doing Business – all of which need to be addressed simultaneously in order to attract more vessels, more revenue and more investment to Sri Lanka.