Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 28 June 2021 00:00 - - {{hitsCtrl.values.hits}}

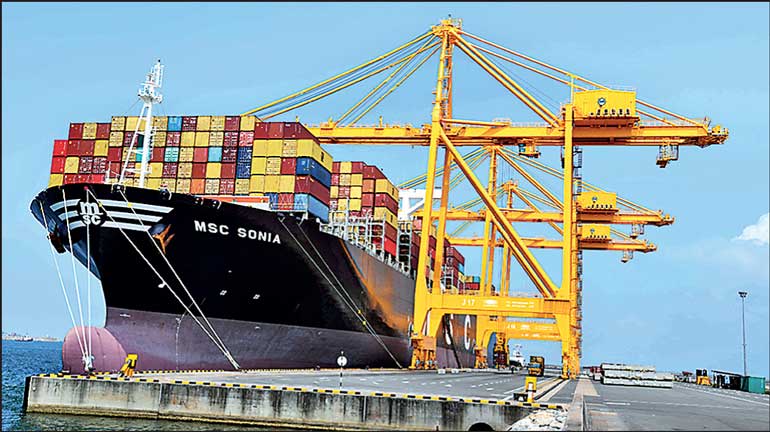

The Colombo Port East Container Terminal

By Ceylon Association of Shipping Agents

The need to enhance deep water terminal capacity in Colombo Port has been discussed in many platforms during the last few years due to the surge in container volumes from the Indian Sub-Continent as well as the new port developments which are taking place in India.

We have seen a growth in container volumes at the Port of Colombo whenever capacity is added. It is very visible when comparing the Port statistics from 2017 to 2018, where we saw an increase of nearly 13.5% with CICT being in full operation.

Without any capacity being introduced in 2019, the volumes increased only marginally. The volume increase between 2018 and 2019 was only 2.6% due to the Port of Colombo reaching saturation point. In 2019 the Port could only handle 7.2 million TEUs.

These results show that adding capacity at a brisk pace is the most important factor for Sri Lanka to retain its position as the best connectivity port in South Asia

The only deep water terminal in Sri Lanka is CICT with a depth of 18 m and the existing facilities have reached saturation for 6th generation container mega carriers. Even though shipping lines are interested in bringing more volumes to Colombo they’re unable to do so due to inadequate berths with deep draught.

As a result of this the local trade could lose out in terms of opportunity cost, volume that could be handled, knock on income, additional services and all the economic benefits that could accrue to the country as a result of more ships being served.

Immediate next steps

We have been informed that for the operationalisation of ECT, the SLPA has already floated tenders for the procurement of ship to shore gantry cranes, rail mounted gantries, straddle carriers as well as for the civil works to extend the berth to 1,200 metres.

It is of utmost importance that the tender deadlines are met and the tender awarded to the successful bidder without any delay so that the container handling equipment could be delivered at least by end-2022. Any delay will result in the commissioning of the ECT to handle the larger vessels being delayed thereby resulting in Colombo losing out on attracting the newer services and usage as a transshipment hub.

The urgent equipping and fully operationalising ECT will ensure additional capacity is added to the Port of Colombo which is now congested as the current capacity is about 8.0 million TEUs (handled in 2019 – 7.2 million TEUs). A further delay means that the current volume is in danger of moving to Indian/or other regional ports.

Urgently addressing this matter will enable the Port of Colombo to regain the lost volume due to the congestion caused by the COVID-19 pandemic. It will also ensure that the Port of Colombo will have berths to handle deep-draught large vessels, maintain Colombo’s role as the transshipment hub of the Indian Sub-Continent and create other opportunities for the shipping industry (bunkering, crew transfers, ship supplies, etc.)

In the short term SLPA should also optimise operations in the existing facilities of ECT. The crane productivity needs to be increased to 25 moves per hour with current cranes, employ dedicated yard equipment and Terminal Operations System (TOS) at ECT, procuring additional dedicated prime-movers for quay-side and yard operations or outsource same, improve the speed of ITT movement at ECT as currently delays are experienced. Setting up of a central operations centre to coordinate all operations between terminals and pilot station is also a need of the hour.

Fast tracking ECT also means the opportunity to garner new business and focus on creating customer centricity. To regain confidence, it will be of utmost importance to contract long-term support of the shipping lines to commence moving volumes through ECT and POC. Moreover, it is of utmost importance to set up a strong marketing team to meet with the lines and negotiate on guaranteed berthing, productivity and tariff matters, commence online dialogue with shipping lines through agents, implement ‘Free Terminal’ (free of customs intervention) concept in ECT which will encourage lines to bring in large quantities of cargo for storage and re-handling in the terminal on transshipment status.

Opportunities as a regional transshipment hub

Increase in regional transshipment volume is also demanding for more capacity. India and Bangladesh are Port of Colombo’s primary transshipment markets. The key drivers are the size of the import/export volumes at these ports and proximity to the Port of Colombo. The import/export volume of India stands at 12.31 million TEUs and is expected to grow at a compound annual growth rate (CAGR) of 7.9% (2015 to 2041). 23% of India’s transshipment volume is handled via port of Colombo.

Similarly, 33% of Bangladesh’s transshipment volume is handled via port of Colombo and the import/export volume is expected to grow at a CAGR of 9.5%. Therefore, it is of utmost importance that the port of Colombo is able to handle the surge of transshipment cargo in the coming years.

Conclusion

CASA has always been committed to positioning Sri Lanka as a maritime hub and has continuously advocated policies to this effect. We have taken up the urgency of developing and operationalising the East Container Terminal in many forums as the transshipment hub status that Colombo holds is at stake due to the current capacity crunch. Many regional ports are increasing capacity and operational efficiencies which will affect the competitiveness of Colombo if we don’t act fast.

With the change in the hierarchy of the SLPA, CASA urges the Government and all authorities to expedite the procurement of equipment, extension of the berth and fully operationalise the East Container Terminal.