Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 13 November 2017 00:00 - - {{hitsCtrl.values.hits}}

The Government’s vision 2025 has made a key policy proposal to make Sri Lanka an Indian Ocean hub. At the same time, port capacities in Colombo, Hambantota and Trincomalee will be expanded to maintain the competitive advantage to increase transshipment activities.

Without the owners and operators of the global shipping industry and logistics industry in Sri Lanka, as a country will not move on to the next phase of shipping and logistics (as agency business is a 3rd party service provider only).

Government also targets other maritime industry related services and to promote greater volumes of containers to be transshipped via terminals in Sri Lanka where public money has been used to develop such ports, country needs to promote more loose cargo and consolidations cargo as well as entrepot trade.

Sri Lanka or other regional countries are not mega ship owners and do not have the global scale or capital to develop shipping activities as this industry is very capital intensive. Therefore, it is essential to create the conducive environment for global operators in shipping and logistics to be given a choice and a free hand to provide services to the regional countries as well as Sri Lankan exporters and importers and make Sri Lanka a maritime hub rather than a transshipment location.

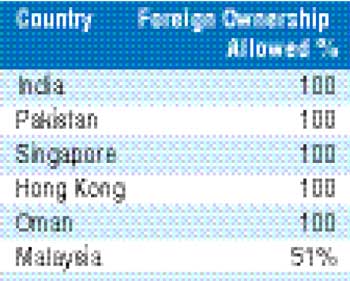

The Government’s policy is to be the most liberal economy in South Asia. Already the two major maritime economies of South Asia, namely India and Pakistan have fully liberalised the shipping sector, just as the hub of Singapore and the other regional competitor has a very liberal environment in the Middle East.

The choice of having an agency or not should be the wish of the owner of the business who brings in vessels to port of Sri Lanka and regional cargo to Colombo. The Government does not want to restrict the global operators of ownership as it may deter them to look at Sri Lanka seriously if Government ensures agencies by law, which amounts to a protectionist measure.

The Government believes the owners and operators have the freedom to decide on what their cost and what their operating model would be, that freedom would make Sri Lanka a competitive and an attractive choice to invest and relocate regional headquarters which will over a period with their expertise to transform the location advantage to a real meaningful logistics hub.

Presence of global operators will create new opportunities for the local industry partners and the country’s overall economic freedom will be reflected positively. On the other hand, with liberalisation comes better options for local exporters and importers as they will have direct dealings without third parties which will eliminate costs such as commissions, etc. and when global presence is increased the multiplier effect to the economy would be greater as time passes. The critical mass will also increase to become a stronger distribution centre in the Indian Ocean.

The liberalisation process not only gives choice but new opportunities for trade and trade agreements with increase connectivity. Serious players of the world will come to Sri Lanka for the long term partnership with the country. Others will still have agencies and joint ventures as they wish. This policy is a commitment by the Government to make Sri Lanka a true Indian Ocean hub.In the Middle East, Salalah is 100% owned by Maersk, Dubai is a different model with a sleeping partner and a no tax regime. But there will be a regular tax for these companies who will have ownership as proposed.

India is trying its best to compete on trans-shipment with us and now not only shipping is liberalised, but even terminals are offering equity to shipping companies, while aviation too is fully liberalised.

Potential wins

Initial prize of attracting Maersk or another leading shipper to establish its South Asia hub in Colombo Port. That would go well beyond its limited activity with its present JV arrangement with a local shipper. A lot of jobs created.

That anchor investment would attract other leading shippers to do the same, thereby creating a critical mass.

And that would attract the top 10 freight forwarders. It would persuade DHL to take another look at Sri Lanka as a regional hub, for example. Beyond that, Sri Lanka could approach Amazon and other warehousing for e-commerce.

This would form the core of a maritime-cum-logistics hub as these anchor investments create an ecosystem of supporting services – financial, legal and other professional services.

A maritime-cum-logistics hub would be a boon to competitive local companies with relevant service-support skills, and allow some of the bigger competitive companies to go global.

Production and service standards would improve massively from their present woeful state, with more transparency and less corruption.

It’s of a piece with Port City, linking up the port and airport, a hub around the airport – i.e. part of bigger Megapolis plans.

It would be the beginning of Sri Lanka’s insertion into global value chains beyond garments. The big prizes are in services, not manufacturing, especially with the “servicification” of GVCs.

Sri Lanka would be copying Dubai and Singapore’s maritime-cum-logistics hub strategies that are key parts of their overall success stories.

Without this happening, there is no hope for Sri Lanka’s Indian Ocean hub strategy.

These would be the gains, set against defending the existing cartel to benefit a handful of businesses, SLPA and unions in the port.