Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 11 May 2020 00:00 - - {{hitsCtrl.values.hits}}

|

Emirates Airline and Group Chairman and Chief Executive Sheikh Ahmed bin Saeed Al Maktoum

|

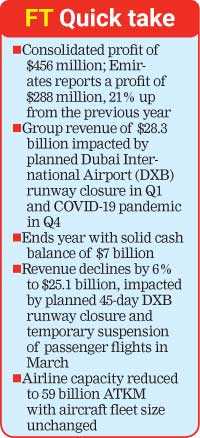

The Emirates Group yesterday announced its 32nd consecutive year of profit against a drop in revenue mainly attributed to reduced operations during the planned DXB runway closure in the first quarter (1Q), and the impact of flight and travel restrictions due to the COVID-19 pandemic in the fourth quarter (4Q).

The Emirates Group posted a profit of AED 1.7 billion ($456 million) for the financial year ended 31 March, down 28% from last year. The group’s revenue reached AED 104 billion ($28.3 billion), a decline of 5% over last year’s results. The group’s cash balance was AED 25.6 billion ($7 billion), up 15% from last year mainly due to a strong business performance up to February and lower fuel cost compared to previous year.

Due to the unprecedented business environment from the ongoing pandemic, and to protect the group’s liquidity position, the group has not declared a dividend for this financial year after last year’s dividend of AED 500 million ($136 million) to the Investment Corporation of Dubai.

Emirates Airline and Group Chairman and Chief Executive Sheikh Ahmed bin Saeed Al Maktoum said: “For the first 11 months of 2019-20, Emirates and dnata were performing strongly, and we were on track to deliver against our business targets. However, from mid-February, things changed rapidly as the COVID-19 pandemic swept across the world, causing a sudden and tremendous drop in demand for international air travel as countries closed their borders and imposed stringent travel restrictions.

“Even without a pandemic, our industry has always been vulnerable to a multitude of external factors. In 2019-20, the further strengthening of the dollar against major currencies eroded our profits to the tune of AED 1 billion, global airfreight demand remained soft for most of the year, and competition intensified in our key markets.

“Despite the challenges, Emirates and dnata delivered our 32nd consecutive year of profit, due to healthy demand for our award winning products and services, particularly in the second and third quarters of the year, combined with lower average fuel prices over the year.

“Every year we are tested on our agility and ability. While tackling the immediate challenges and taking advantage of opportunities that come our way, our decisions have always been guided by our long-term goal to build a profitable, sustainable, and responsible business based in Dubai.”

In 2019-20, the group collectively invested AED 11.7 billion ($3.2 billion) in new aircraft and equipment, the acquisition of companies, modern facilities, the latest technologies, and employee initiatives, a decrease following last year’s record investment spend of AED 14.6 billion ($3.9 billion). It also continued to invest resources towards supporting communities, environmental initiatives, as well as incubator programs that nurture talent and innovation to support future industry growth.

At the 2019 Dubai Air Show in November, Emirates placed a $16 billion order for 50 A350 XWBs, and a $8.8 billion order for 30 Boeing 787 Dreamliner aircraft. With first deliveries expected in 2023, these new aircraft will add to Emirates’ current fleet mix, and provide deployment flexibility within its long-haul hub model. In line with Emirates’ long-standing strategy to operate a modern and efficient fleet, these new aircraft will also keep its fleet age well below the industry average.

dnata’s key investments during the year included the significant expansion of catering capabilities in North America with the opening of new operations in Vancouver, Houston, Boston, Los Angeles and San Francisco. dnata also completed the purchase of the remaining stake in Alpha LSG to become sole shareholder of the UK’s biggest inflight catering, on-board retail and logistics company.

Across its more than 120 subsidiaries, the group’s total workforce remained nearly unchanged with 105,730 employees, representing over 160 different nationalities.

Sheikh Ahmed said: “In 2019-20, we were steadfast with our cost discipline while investing to expand our business and revenues opportunities. Through ongoing reviews of our work structures and the implementation of new technology systems, we’ve improved productivity and retarded manpower cost increases. As the pandemic hit, we’ve taken all possible measures to protect our skilled workforce, and ensure the health and safety of our people and our customers. This will remain our top priority as we navigate a gradual return to operations in the coming months.”

He concluded: “The COVID-19 pandemic will have a huge impact on our 2020-21 performance, with Emirates’ passenger operations temporarily suspended since 25 March, and dnata’s businesses similarly affected by the drying up of flight traffic and travel demand all around the world. We continue to take aggressive cost management measures, and other necessary steps to safeguard our business, while planning for business resumption. We expect it will take 18 months at least, before travel demand returns to a semblance of normality. In the meantime, we are actively engaging with regulators and relevant stakeholders, as they work to define standards to ensure the health and safety of travellers and operators in a post-pandemic world. Emirates and dnata stand to reactivate our operations to serve our customers, as soon as circumstances allow.”

Emirates performance

Emirates’ total passenger and cargo capacity declined by 8% to 58.6 billion ATKMs at the end of 2019-20, due to the DXB runway closure capacity restrictions and COVID-19 impact with a complete suspension of passenger services as directed by the UAE government during March.Total operating costs decreased by 10% over the 2018-19 financial year. The average price of jet fuel declined by 9% during the financial year after last year’s 22% increase. Including a 6% lower uplift in line with capacity reduction, the airline’s fuel bill declined substantially by 15% over last year to AED 26.3 billion ($7.2 billion) and accounted for 31% of operating costs, compared to 32% in 2018-19. Fuel remained the biggest cost component for the airline. Despite continued strong competitive pressure and the unfavourable currency impact, the airline reported a profit of AED 1.1 billion ($288 million), an increase of 21% over last year’s results, and a profit margin of 1.1%. Profit would have been higher without a loss of AED 1.1 billion ($299 million) due to fuel hedge ineffectiveness at year end. Overall passenger traffic declined, as Emirates carried 56.2 million passengers (down 4%). With seat capacity down by 6%, the airline achieved a Passenger Seat Factor of 78.5%. The positive development in passenger seat factor compared to last year’s 76.8%, reflects the airline’s successful capacity management and positive travel demand across nearly all markets up until the outbreak of COVID-19 in the last quarter. An increase in market fares and a favourable route mix was completely offset by the strengthening of the dollar against most currencies and left the passenger yield unchanged at 26.2 fils (7.1 cents) per Revenue Passenger Kilometre (RPKM). Emirates closed the financial year with a healthy level of AED 20.2 billion ($5.5 billion) of cash assets.

Revenue generated from across Emirates’ six regions continues to be well-balanced, with no region contributing more than 30% of overall revenues. Europe was the highest revenue contributing region with AED 26.1 billion ($7.1 billion), down 8% from 2018-19. East Asia and Australasia follows closely with AED 24.1 billion ($6.6 billion), down 9%. The Americas region recorded revenue growth at AED 14.6 billion ($4.0 billion), up 1%. West Asia and Indian Ocean revenue increased by 4% to AED 9.8 billion ($2.7 billion). Africa revenue decreased by 4% to AED 8.7 billion ($2.4 billion), whereas Gulf and Middle East revenue decreased by 8% to AED 7.7 billion ($2.1 billion).

Emirates SkyCargo continued to deliver a solid performance in a highly competitive market, contributing to 13% of the airline’s total transport revenue.

With the lingering weakness in air freight demand over most of the year, Emirates’ cargo division reported a revenue of AED 11.2 billion ($3.1 billion), a decrease of 14% over last year. Freight yield per Freight Tonne Kilometre (FTKM), after two consecutive years of growth, declined by 2%, largely impacted by the reduction in fuel price, and a strong dollar.

Tonnage carried decreased by 10% to reach 2.4 million tonnes, due to the capacity reduction with the retirement of one Boeing 777 freighter and reduced available belly-hold capacity in the first and last quarters of the year. At the end of 2019-20, Emirates’ SkyCargo’s total freighter fleet stood at 11 Boeing 777Fs.