Saturday Feb 28, 2026

Saturday Feb 28, 2026

Monday, 18 March 2024 00:17 - - {{hitsCtrl.values.hits}}

Global shipping companies’ short-term profitability will benefit from increased freight rates, which exceed the costs of re-routing following persistent attacks on commercial vessels in the Red Sea, Fitch Ratings says.

“We do not expect structural shifts in the shipping sector as a result of these disruptions,” it added.

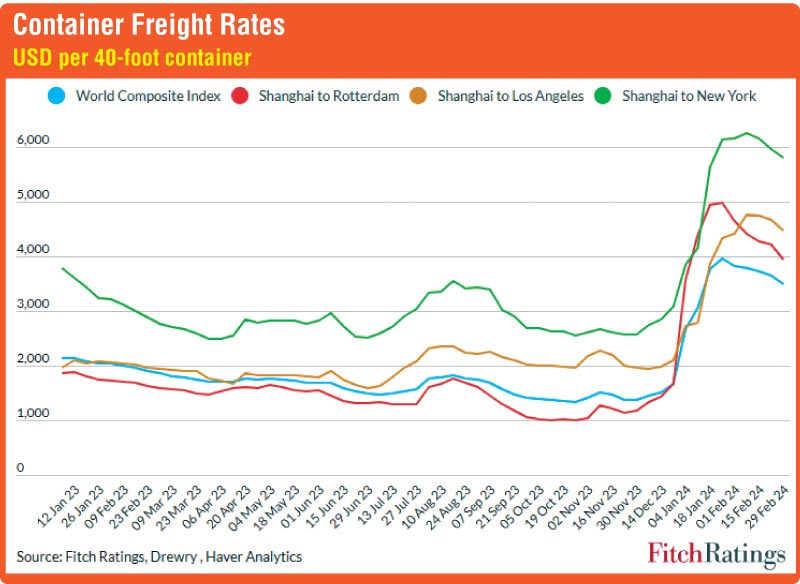

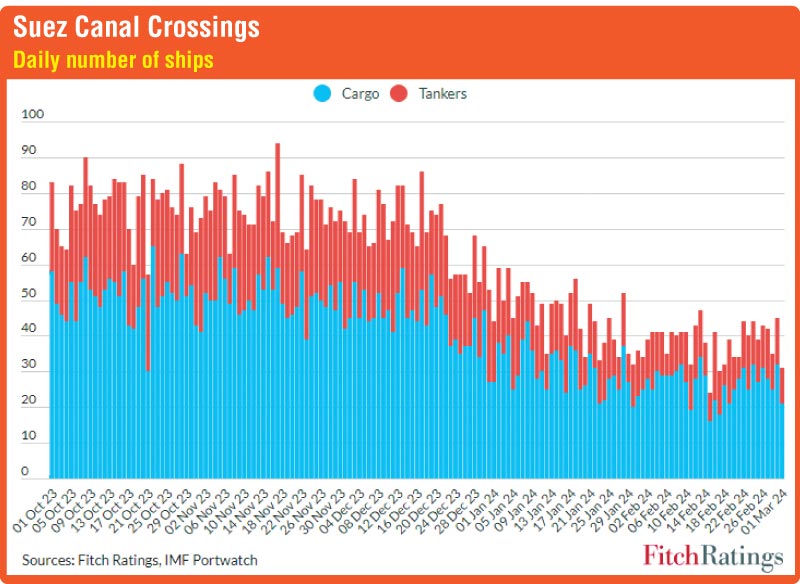

Nearly half of all cargo ships and tankers have been diverted away from the Suez Canal to alternative routes around the Cape of Good Hope following attacks on commercial ships in the Bab-el-Mandeb Strait. Container freight rates have surged as a result, with the World Container Index rising by 151% since early October 2023. Rates on Asia–Europe routes have increased by 284%, and more than doubled on other main East–West lanes.

Fitch said Red Sea disruptions have persisted beyond our initial expectations in December 2023, with no sign of abatement. Re-routing around Africa has increased transit time for container movement on the Asia–Europe route by about 50%, absorbing capacity in the container shipping sector. While operators have some flexibility to offset the longer routes by increasing vessel sailing speed, low excess capacity means other measures, such as the use of idled fleet or delaying planned vessel scrapping, have a limited impact on capacity absorption. However, scheduled deliveries of new ships in 2024 will restore overcapacity, according to Maersk. Increased vessel chartering demand will also help maintain schedules.

“We do not believe that the Red Sea disruptions, or those in the Panama Canal due to drought, point to a structural shift in the sector, although they could keep freight rates higher for longer. Furthermore, operating cost inflation, higher port charges and the rising costs of environmental regulation compliance will support freight rates slightly in the medium and longer term. The impact of shipping disruptions on rates and supply chains seems to have steadied for now. We maintain our view that the nature and implications of these disruptions are significantly different from those in 2021–2022, which were related to broader supply-chain issues, including port congestions, a pandemic-related decline in port efficiencies, and container dislocations,” Fitch added.

The recent container rate hikes exceed the additional costs of re-routing, and will boost near-term profitability for container shipping companies and vessel lessors. We estimate that shipping companies’ operating costs on the affected routes have increased by about 50%, which is significantly lower than the actual rate increases. The current spot rates will also affect contract prices, leading to higher average rates for the year and providing temporary relief to container shipping companies from what might have been a weak 2024 due to lower demand for goods and eased industrial supply-chain issues. A resolution of the Middle Eastern conflict and a recovery of Suez Canal crossings to pre-conflict levels could reduce freight rates and shipping companies’ profits.

Shipping disruptions underline the vulnerability of global trade to route chokepoints, which could limit the visibility of shipping costs and undermine the reliability of shipping schedules. While industry leaders, such as Maersk, are trying to incorporate reliability into their service offering, some factors remain outside their control.

Maersk and Hapag-Lloyd have recently entered into a new long-term agreement called Gemini Cooperation, effective from February 2025. It aims to reduce the number of port calls per region to strategic hubs and to use a hub-and-spoke model to service smaller ports, therefore shortening voyage times and increasing reliability.