Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 17 July 2017 00:05 - - {{hitsCtrl.values.hits}}

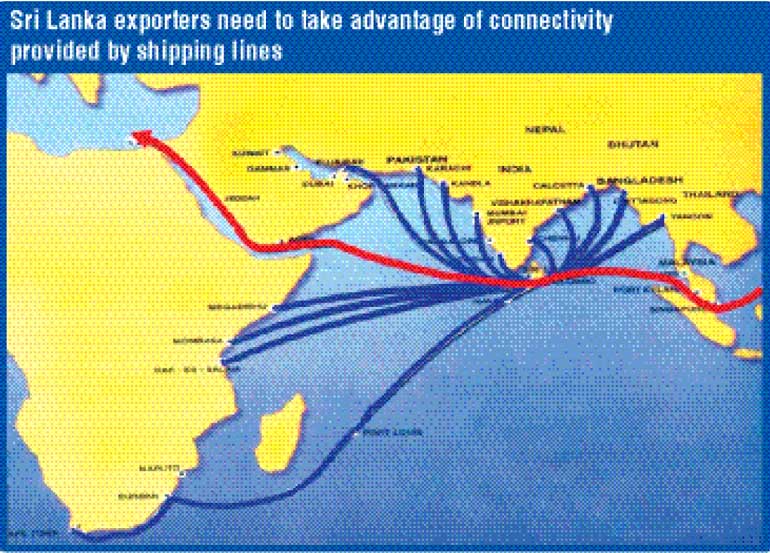

There has been much talk about Sri Lanka’s enviable location along one of the busiest shipping routes in global trade; between the booming markets of Asia and the developed, high income ones of Europe. This gives us a distinct advantage as a global transportation hub but have we leveraged it as effectively as we could have?

International trade (exports plus imports) now forms a smaller share of the Sri Lankan GDP than ever before. Back in 2005, trade accounted for close to 80% of GDP; by 2015 this had fallen to a paltry 55%. Compare that to some other leading regional economies that are doing well: Vietnam’s trade-to-GDP ratio is now around 170%, Malaysia’s is 150%, Thailand’s is 120% and Singapore is 350%. Exports as a percentage of GDP have also been dropping rapidly over the years. According to the World Bank that figure has fallen from 33% in 2000 to 15% in 2014. These figures all indicate the degree to which trade drives these growing economies. Sri Lanka is a small country with a small domestic market. Without external trade, it cannot achieve high growth. So this low and declining trade-to-GDP ratio needs to be reversed.

The largest contributor to Sri Lankan exports is garments. In 2016 was approximately 15.75% of exports were from the textiles and garments sector, followed by tea with 13% and rubber products with 7% (as terms of TEUS). The country has shifted from an agriculture export oriented country more toward Manufactured Exports; however we have been overly focused on garments with lack of development in other areas of Finished Good Exports. Exporters need to start realising the potential and head towards the right direction. 2016 and the first Quarter of 2017 have shown steps in the right direction.

According to World Shipping Council rankings Colombo port is Ranked 33 among top 50 container ports and as per Alpha Liner Research, Colombo is ranked as 27th container port in the world. The Colombo port has increased volumes handling over 5.7 million TEUs in 2016 with over 75% being transshipment TEUs. This is an increase of 10% from 2015 (5.18 million) and 16% increase from 2014 (4.91 million).

Colombo has become South Asia’s topmost ‘container transshipment’ hub. Transshipments increased from 3.2 million in 2013 to 4.35 million in 2016. Our Transshipment volumes have been the main reason for Colombo being a must stop for the top 20 lines. This has presented a fantastic opportunity for shippers to reach and compete in international markets. Without this advantage of transshipment volumes, the connectivity and reach available to Sri Lanka would be much lower and costs higher.

The Chinese-run Colombo International Container Terminals (CICT) has increased port capacity and throughput significantly; handling over 2 Mill TEU’s in 2016 and has received some of the largest vessels playing the Asia Europe routes. Credit should also be given to the infrastructure investments by the Govt/SLPA in building the Breakwater and providing the platform for such world class facilities to emerge.

Sri Lanka is expected to attract an increasing share of trans-Indian Ocean trade as well. According to estimates by KPMG, the Asia-Pacific freight industry is set to grow at around 12% each year, and the Port of Colombo already seeing around a 15% annual growth in transshipments. Sri Lanka has a strong feeder network covering major ports of India, Bangladesh, Pakistan, Maldives and Africa. The major growth areas in transshipment could be to Africa and the Gulf, and also from the East Coast of the Indian subcontinent port of Bangladesh and other Indian ports which presently only do approx. 30% of their trade via Colombo Hub, the rest been done by services covering Singapore and Malaysian hub ports. The share via Colombo can only be increased by concerted efforts to improve the product and also by ensuring that Sri Lanka as a hub is more customer-focused.

Shippers also have the benefit of lower freight rates available in Sri Lanka compared to many other countries as the rate is inclusive of THC for quite some time. Although this should help shippers be internationally competitive with their exports, there has not been any significant increase in exports. In fact, the earnings from exports have fallen from 11.1 m in 2014 to 10.3 m in 2016.

Driven from the growth of the shipping industry, shipping related infrastructure has developed significantly; from container yards and warehousing facilities to efficient transportation systems, which have all made shipping more connected and efficient today. According to figures from the Central Bank of Sri Lanka (CBSL), the transportation sector (mainly shipping related) accounted for 11.6% of the country’s total GDP in 2015, generating Rs. 1.3 trillion ($ 8.1 billion), up 1.6% from the year before.

Sri Lankan exporters need to make use of these advantages available to promote their products in international markets. The Shipping and Maritime Community will continue to play its part in helping shippers leverage on the strengths of our strategic position.