Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 10 June 2019 00:00 - - {{hitsCtrl.values.hits}}

The purpose of this note by the Economic Research Department of the Central Bank of Sri Lanka is to educate the general public on the Central Bank’s intended move to a flexible inflation targeting framework for the conduct of monetary policy by the year 2020. The note explains the historical evolution of monetary policy regimes in Sri Lanka, and the reasons for adopting various monetary and exchange rate policy regimes from time to time. At present, flexible inflation targeting is considered the international best practice of Central Banking, and subject to several conditions, flexible inflation targeting enables the maintenance of low inflation on a sustainable basis, thereby helping economies to achieve a high and stable growth path. The note concludes by articulating expectations for Sri Lanka under the proposed flexible inflation targeting regime and clarifies a number of misconceptions in relation to the Central Bank’s view on the determination of the exchange rate as well

1. Introduction

With the objective of institutionalising the achievement of maintaining single digit inflation for a continued period of over 10 years, the Central Bank of Sri Lanka has announced the adoption of flexible inflation targeting as its monetary policy framework by 2020. Following international best practices, the proposed flexible inflation targeting framework is expected to establish the maintenance of price stability as the prime objective of the Central Bank, and ensure independence of the Central Bank while holding it accountable for achieving this objective.1

The Central Bank has conducted numerous programmes to educate the general public on the efforts to adopt flexible inflation targeting as its new monetary policy framework. These include public lectures and articles on the evolution of central banking in Sri Lanka, awareness programmes for journalists, and updates through the Central Bank Annual Reports over the past few years. Accordingly, the proposed flexible inflation targeting framework is increasingly gaining recognition as a landmark reform that could ensure price stability and thereby contribute to improving Sri Lanka’s economic prosperity. The purpose of this article is to further explain the evolution of monetary policy and central banking in Sri Lanka and articulate the key features of the proposed flexible inflation targeting framework.

Central banks around the world are typically mandated to conduct monetary policy in order to maintain price stability in their respective economies.2 Price stability means maintaining the general price level in the economy at low and stable levels. It is widely accepted that price stability is an essential requirement for high and sustained economic growth and increased wellbeing of the general public. Monetary policy, by controlling the cost and availability of money, seeks to maintain price stability in an economy.

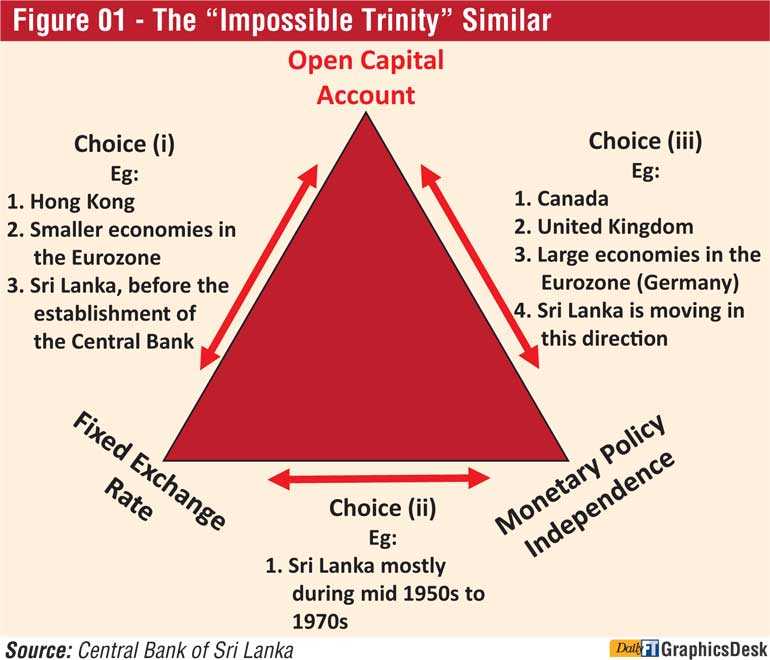

Cross country practices of conducting monetary policy vary, depending on their macroeconomic and financial market conditions. Hence, different types of monetary policy regimes can be observed in today’s world. Further, monetary policy frameworks have been evolving over time, in response to economic and financial crises as well as increasing trade openness and global financial integration. In determining the monetary policy framework, a monetary authority is expected to abide by the condition of “impossible trinity”, i.e., the choice between independent monetary policy, fixed exchange rate, and capital account openness.

The transmission of monetary policy depends on these macroeconomic and financial market conditions, the choice of monetary policy frameworks. The monetary policy transmission mechanism is defined as the process through which economic activities are affected by monetary policy decisions. According to the “impossible trinity” condition, a country cannot have a fixed exchange rate, an open capital account and independent monetary policy (ability to move the domestic interest rate freely) simultaneously. If the capital account is closed, monetary policy penetrates into domestic demand, regardless of the exchange rate regime. On the other hand, with free capital mobility, transmission of monetary policy depends on the exchange rate regime.

Based on the concept of impossible trinity, at least three different monetary policy combinations can be made by countries depending on their macroeconomic and financial market conditions as follows:

i. Maintaining an open capital account and a fixed exchange rate, while forgoing monetary independence

ii. Independent monetary policy with a fixed exchange rate, along with capital controls

iii. Maintaining an open capital account and monetary independence, with a flexible exchange rate

Choice (i) above is essentially a fixed exchange rate regime, which could include a Currency Board arrangement, a dollarised economy, or a hard peg. Choice (ii) involves capital controls, which have become increasingly unpopular over time. Choice (iii) allows the exchange rate to float with capital account openness, while enabling the Central Bank to conduct monetary policy independently. Monetary policy regimes under Choice (iii) include inflation targeting, whereas monetary targeting could be conducted under both Choices (ii) and (iii) with varying success. Some countries attempt to conduct monetary policy using interim combinations, such as managed floating exchange rates and partially controlled capital flows as well [See Figure 01].

Similar to many other countries, Sri Lanka’s monetary policy framework evolved from Choice (i) and moved towards Choice (iii) during the past 70 years. The Central Bank of Sri Lanka is of the view that flexible inflation targeting under Choice (iii) is the most suitable monetary policy framework for Sri Lanka. However, it is worthwhile to briefly discuss the evolution of monetary policy regimes in Sri Lanka during the past 70 years, before outlining the features of the proposed flexible inflation targeting framework.

2. Currency Boards vs. central banking

a. Transition from the Currency Board to the Central Bank

Prior to the establishment of the Central Bank of Sri Lanka (Ceylon) in 1950, the Sri Lankan monetary system was a Currency Board system, whereby the Currency Board would automatically issue or retire Ceylon rupees against an equivalent value of Indian rupees lodged with the Reserve Bank of India. Further information on the Currency Board system during this period can be found in the following documents:

1. Report on the Establishment of a Central Bank for Ceylon, Sessional Paper XIV – 1949, November 1949. (The Exter Report)

2. Gunasekera, H.A.de S., “From Dependent Currency to Central Banking in Ceylon: An Analysis of Monetary Experience 1825-1957, London, 1962.

The reasons cited in the Exter Report for the establishment of a Central Bank in place of the Currency Board are primarily twofold: first, the need to establish an independent monetary system which can issue currency and create deposits against domestic as well as foreign assets; second, the need to establish an institution with powers to control the expansion and contraction of credit by commercial banks. In relation to the first reason, Exter shows that, “as the role of the Currency Board must remain purely passive, it cannot influence the money supply in any way and thus relieve the pressure to which rapid swings in the balance of payments may at times subject the economy.”

With regard to the second reason, Exter further explains that “demand deposits subject to transfer by cheque have in most countries of the world become a more important form of money than actual currency, and variations in the volume of demand deposits resulting from changes in the cash positions or in the credit polices of commercial banks frequently have more profound economic effects than variations in the supply of actual currency.”

These arguments are still valid for Sri Lanka, and a Currency Board arrangement is not appealing for a small open economy like Sri Lanka where the relative share of domestic demand in aggregate demand is very high, as this system shall only be credible if the Central Bank holds sufficient foreign exchange reserves to cover the country’s gross monetary liabilities consistently. At this stage of development, such a return to a Currency Board will result in an agonising macroeconomic adjustment and a sharp reduction in social welfare, thus rendering this arrangement a non-option. Further, with the low level of external reserves with large external debt service payment requirements, a mild external shock can trigger a collapse in a Currency Board arrangement. In the context of such shocks, instead of exchange rates and interest rates, the adjustment is expected in terms of prices and wages, which could be more costly to the public.

Although there was renewed interest in establishing Currency Boards after the collapse of Soviet Russia, Argentinian currency crisis and Asian financial crisis, these efforts were mainly aimed at taming inflation by introducing a non-discretionary policy regime. It is for the same purpose that some countries adopt a currency of another country at times, which is known as dollarisation. However, even vociferous proponents of Currency Boards, such as Steve Hanke, have acknowledged that “monetary discipline can be delivered if a monetary authority has either a credible internal or external anchor. It must be stressed that these anchors are mutually exclusive: one or the other, but not both. An internal anchor requires a monetary authority to have a well-defined monetary policy. For example, this could be an inflation target or a target for money supply growth.”3 In other words, what could be achieved by establishing a Currency Board in place of a Central Bank, could be achieved under well-structured monetary targeting or inflation targeting as well.

b. Exchange rate based monetary policy regimes

Broadly speaking, from the time of the establishment of the Central Bank of Sri Lanka in 1950 until the adoption of open economy policies in 1977, Sri Lanka has followed a fixed exchange rate regime. Capital controls were non-existent in the initial years where there were no balance of payments concerns, but controls were introduced soon in the 1950s. The international monetary system under the Bretton Woods agreement, which was essentially a pegged exchange rate system, was followed by Sri Lanka until its collapse in the early 1970s.

The pegged exchange rate system continued in Sri Lanka until the introduction of the managed floating exchange rate regime in 1977. Under the fixed exchange rate regimes, the Central Bank did not have any control over domestic inflation, as domestic inflation was directly linked to foreign inflation and therefore there was no need for an explicit monetary anchor to manage inflation. However, the fixed exchange rate system worked well only as long as Sri Lanka earned sufficient foreign exchange to meet expenditure on imports.

During periods of export booms particularly in the early 1950s, Sri Lanka enjoyed significant foreign exchange earnings arising from the external factors rather than domestic export promoting policies. In general, during most periods, the Central Bank had to support the exchange rate peg by restricting the use of available foreign reserves and imposing severe import restrictions. The Central Bank also failed to satisfy its multiple stabilisation and development objectives prevailed at the time.

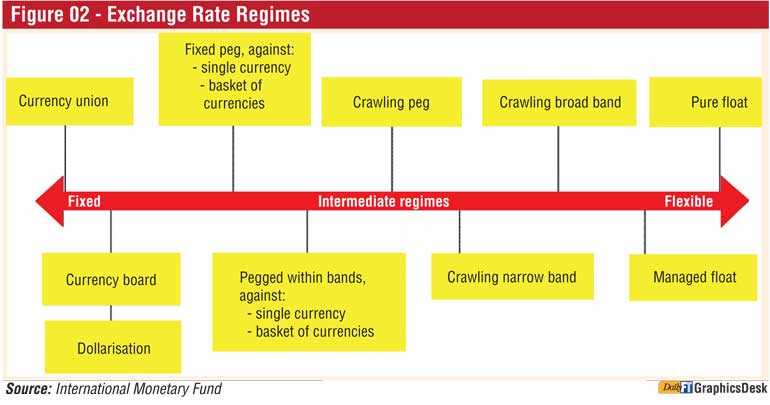

The managed floating exchange rate system introduced in 1977 made the monetary system more complex. Even after the introduction of monetary aggregate targeting in early 1980s, the exchange rate remained a nominal anchor. With expanding twin deficits, it was increasingly becoming difficult to manage the exchange rate, and the Central Bank experimented with numerous permutations of managed floating exchange rate regimes including “soft peg” arrangements such as crawling pegs and crawling bands [See Figure 2 for the Spectrum of Exchange Rate Regimes]. These efforts, which often resulted in a loss in international reserves of the Central Bank, culminated with Sri Lanka announcing a floating exchange rate regime in January 2001 and the subsequent amendment to the Monetary Law Act to streamline the objectives of the Central Bank.

Further details of the evolution of exchange rate regimes in Sri Lanka and the Central Bank’s current view on exchange rate management can be found in the following articles:

1. Weerasinghe, Nandalal, “Olcott Oration 2017 – Evolution of Monetary and Exchange Rate Policy in Sri Lanka and the Way Forward”4

2. Gunaratne, Swarna, “Determining the Exchange Rate – Exchange Rate Regimes in Sri Lanka”, 60th Anniversary Commemorative Volume of the Central Bank of Sri Lanka: 1950-2010, 2011.

3. Central Bank of Sri Lanka, “Exchange Rate and Economic Impact of Depreciation”, December 2016.5

In the modern world, only a few countries practice exchange rate targeting as the monetary policy framework as it requires a sizeable international reserve to support the credibility of the regime. Exchange rate targeting is defined as the process through which a Central Bank intervenes in the market so as to maintain the exchange rate at a desired level or a predetermined target. Singapore presents itself as a success story with the exchange rate being used as its key monetary policy instrument in its monetary policy conduct.

As an economy that is heavily reliant on external trade and finance, with both imports and exports far exceeding the country’s GDP, the exchange rate has historically played a pivotal role in determining inflation in Singapore. Moreover, as Singapore operates a managed floating exchange rate regime, it has greater control over the exchange rate, particularly in the form of direct interventions in the domestic foreign exchange market. The exchange rate is allowed to fluctuate within a policy band, thereby allowing for it to act as a cushion against short term volatilities arising from imperfections in the real economy.

Under this exchange rate based monetary policy framework, Singapore can ensure exchange rate stability while allowing for greater capital mobility, but has no control over domestic interest rates and money supply. While alleviating the impact of short term macroeconomic pressures, the exchange rate based monetary policy framework has also ensured that the exchange rate remains aligned with Singapore’s macroeconomic fundamentals.

Furthermore, greater fiscal discipline, flexible factor markets, robust financial system as well as innovation, have supported and led to the success of Singapore’s exchange rate based monetary policy framework.

However, such an exchange rate based monetary policy framework may not be suited for a country like Sri Lanka as the country is experiencing persistent current account deficits and fiscal deficits with relatively large debt service payment requirements. Also, channelling efforts to maintain the exchange rate at a particular level would be at the expense of the country’s limited foreign exchange reserves. Moreover, the success of such a framework would require strong macroeconomic fundamentals such as fiscal surpluses, robust product, factor and financial markets, as well as greater policy stability and consistency.

c. From monetary targeting to flexible inflation targeting

With the abandonment of the fixed exchange rate regime that was followed by Sri Lanka until 1977, interest rates and monetary aggregates, which had played a secondary role in Sri Lanka’s monetary policy framework until then, assumed a greater role. In early 1980s, Sri Lanka introduced a monetary aggregate targeting framework of monetary policy. This involved the use of policy instruments of the Central Bank to manoeuvre the operating target of reserve money (base money/high powered money) and the intermediate target of broad money in order to achieve the objectives of monetary policy.

The annual monetary programme required under this framework is explained in the Annual Report of the Central Bank of Sri Lanka in 1982 as follows: “Having taken into consideration the real growth, estimated rate of price increase and increased monetisation of the economy, the desired monetary targets were set with a view to maintaining the consistency between financial and real output flows in the economy. The monetary targets were then translated into a permissible level of credit to the private sector by commercial banks after allowing for the impact of the behaviour of the external sector and the credit requirements of the Government.”

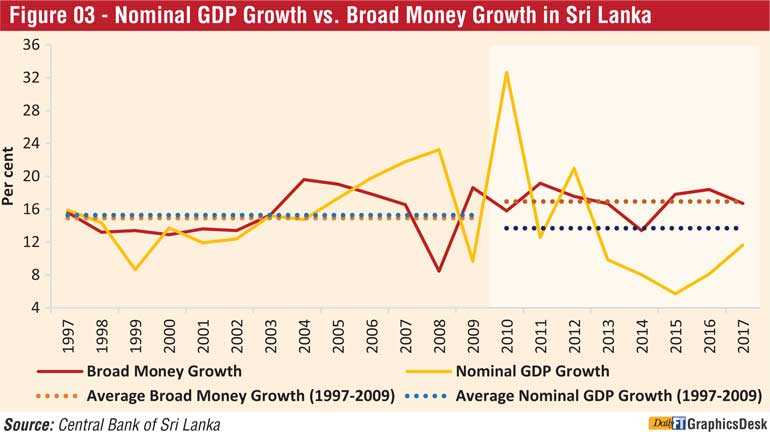

Although inflation spiked at times during some periods under the monetary targeting framework with managed floating or free floating exchange rates, following strict monetary targets at times enabled the Central Bank to bring back inflation to tolerable levels in general. For instance, the implementation of strict quarterly reserve money targets when inflation peaked at levels over 28% in 2008, enabled a rapid disinflation during a short period of time. At the same time, the requirements for the successful implementation of monetary aggregate targeting, namely a close relationship between nominal GDP growth and broad money growth and a close relationship between money growth and inflation, were visible until around 2009.

However, the gap between nominal GDP growth and broad money growth has widened notably since 2009. Even at times of high money and credit growth, inflation has remained in single digit levels. The ability of the Central Bank to contain inflation in single digits for a continued period of over 120 months, i.e., 10 years, in spite of relatively high average money and credit growth can be partly attributed to technological innovations which have changed the behaviour of the general public. However, it is likely that the efforts of the Central Bank to anchor inflation expectations around mid-single digit levels through active communication and commitment to maintaining inflation at such levels have contributed significantly towards this achievement.

As the eventual breakdown of the relationship between monetary aggregates, inflation and GDP growth [See Figure 03] was anticipated in line with developments in several other advanced and emerging market economies, by late 1990s and the beginning of 2000s, the Central Bank had commenced an internal process to upgrade the monetary policy formulation and implementation process while strengthening research on alternative monetary policy frameworks.

In addition to moving to a floating exchange rate regime and streamlining the objectives of the Central Bank, the upgrades included the introduction of the Monetary Policy Committee (which is a technical committee that makes monetary policy recommendations to the Monetary Board), strengthening the independence of the Central Bank by expanding the membership of the Monetary Board, commencing active open market operations and a policy rate corridor approach, signalling the changes in the monetary policy stance based on policy interest rates, announcing the monetary policy stance through a regular press release based on an advance release calendar, enunciating broad policies of the Central Bank for the medium term through an annual Road Map announcement, establishing a Monetary Policy Consultative Committee to obtain views of the private sector and academia, commencing an inflation expectations survey, encouraging the Department of Census and Statistics to update the inflation index and publish core inflation and continued strengthening of modelling and forecasting capabilities of technical staff of the Central Bank. With these developments, the Central Bank has gradually moved to a de facto inflation targeting regime of monetary policy. The Central Bank has announced that its target for monetary policy is to maintain inflation around 4-6%, which is considered to be a suitable range of inflation for an emerging market economy to support sustained economic activity.

The Central Bank projects key macroeconomic variables such as inflation and GDP growth in relation to its potential and uses the monetary policy instruments, mainly policy interest rates, to address sustained deviations of inflation from the target range. The interest rate in the short term interbank money market acts as a key operating target for the conduct of monetary policy and open market operations are used to steer this short term interest rate along a desired path.6 The exchange rate is allowed to float freely without maintaining a peg or a target exchange rate, and the Central Bank intervenes in the domestic foreign exchange market to curb excessive volatility, which typically arises from domestic and global speculative activity, and to build up its international reserve.

The Central Bank continues to monitor several other macroeconomic indicators, including movements in reserve money, broad money, credit disbursements, market lending and deposit rates, benchmark yield curve, balance of payments developments, nominal and real exchange rates, fiscal developments, leading indicators for real sector developments, headline inflation, core inflation, food and non-food inflation, administered price adjustments, etc., to help guide monetary policy decision making within this data driven forward looking approach to monetary policy. The recent developments in relation to the monetary policy making process are explained in the following articles:

1. Central Bank of Sri Lanka Annual Report 2015, Box Article 10: “Modifications to the Monetary Policy Framework in Sri Lanka”

2. Central Bank of Sri Lanka Annual Report 2016, Box Article 1: “Model Based Approach to Monetary Policy Analysis in Sri Lanka”

3. Amarasekara, C., Anand, R., Ehelepola, K., Ekanayake, H., Jayawickrema, V., Jegajeevan, S., Kober, C., Nugawela, T., Plotnikov, S., Remo, A., Venuganan, P., and Yatigammana, R., “An Open Economy Quarterly Projection Model for Sri Lanka”, IMF Working Paper, June 2018.

In 2017, the Central Bank announced its intention to officially adopt flexible inflation targeting as its monetary policy framework in the medium term. This was then endorsed by the Government of Sri Lanka, which has already provided the approval of the Cabinet for supporting amendments to the Monetary Law Act, and also the International Monetary Fund (IMF), which incorporated inflation targets into Sri Lanka’s Extended Fund Facility (EFF) programme and provided technical assistance for modelling and forecasting, for assessing Sri Lanka’s readiness for inflation targeting as well as for drafting of amendments.

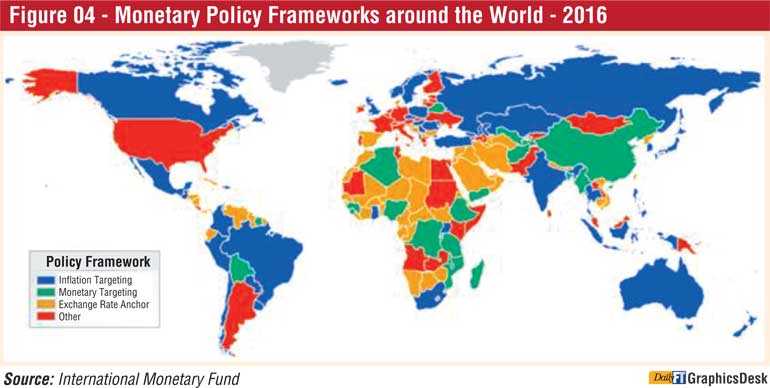

Flexible inflation targeting is currently considered the “state of the art” of Central Banking globally [See Figure 04]. In practice, no country practices “strict inflation targeting”, while “flexible inflation targeting” appears to be the practical adaptation of inflation targeting. According to Lars Svensson, “flexible inflation targeting means that monetary policy aims at stabilising both inflation around the inflation target and the real economy, whereas strict inflation targeting aims at stabilising inflation only, without regard to the stability of the real economy.”7

Flexibility thus refers to the inherent gradualism of implementation of policy in order to minimise adverse effects on the real economy whilst bringing inflation back to target levels in case of deviations. Accordingly, flexible inflation targeting involves forecasting inflation for a medium term horizon, identifying forecast deviations from target levels, analysing the causes of such deviations, and taking proactive monetary policy action to address such future deviations gradually.

The Central Bank is given independence to conduct monetary policy with the aim of achieving the envisaged inflation targets, while it is also held accountable for its action. This rule based framework enhances credibility of monetary policy, thus allowing additional welfare gains for the entire economy. This is because the financial market and the general public are assured of inflation being maintained at the targeted level on average, thus requiring only little adjustment in policy interest rates by the Central Bank to bring back inflation to target levels.

The Central Bank of Sri Lanka is now in the process of finalising its move to adopting the flexible inflation targeting framework described above by 2020.8 It is expected that price stability will become the prime objective of the Central Bank while financial system stability will remain a core objective. Independence of the monetary policy decision making bodies of the Central Bank will be strengthened by removing Treasury representation and expanding the involvement of independent members in these bodies. However, a mechanism will be established for fiscal and monetary policy coordination, as both policies are equally important to improve the overall wellbeing of the public and to maintain policy consistency.

A framework agreement is expected to be signed with the Government, setting the inflation target periodically. Financing of fiscal deficits by the Central Bank will be prohibited and the existing provisional advances will be gradually wound down. However, the Central Bank will continue to be allowed to transact in Government securities in the secondary market for liquidity management purposes. The Central Bank will pursue a flexible exchange rate policy that will act as the first line of defence to dampen the impact of external shocks.

The Central Bank will retain its authority to intervene in the foreign exchange market at times of undue volatility and to build up international reserves to be maintained as a buffer for coverage of imports and future debt obligations. The Central Bank will be accountable to the Parliament and the general public in relation to its actions. Periodic public reporting is expected, which will enhance transparency of monetary policy action. In the meantime, the Central Bank will strengthen its supervisory and regulatory framework to ensure financial system stability while supporting market development, as monetary policy signals are better transmitted to the economy through deeper and more liquid financial markets.

As elaborated above, a Central Bank’s decision on a prudent monetary policy framework, which includes exchange rate policy, depends on the country’s macroeconomic fundamentals. Furthermore, this choice evolves over time with changes in macroeconomic conditions and theoretical and practical innovations in Central Banking. This is true for Sri Lanka as well, and the current conditions and the expected solutions to longstanding macroeconomic issues have prompted the Central Bank of Sri Lanka to adopt flexible inflation targeting by 2020.

This is a policy decision taken after careful analysis, and it is expected that flexible inflation targeting will enable the country to institutionalise its achievement of a decade of single digit inflation within a transparent and accountable framework. It is worth noting that in Sri Lanka, time and again in the past, inflation has often been highlighted as “public enemy number one”. It is to tame this public enemy of inflation on a sustainable basis that the Central Bank is continuing to work on, thus removing one key barrier that could hinder the country’s progress.

In the near future, the Central Bank of Sri Lanka intends to publish further articles under this series on the Conduct of Monetary Policy and Central Banking in Sri Lanka, with a view to educating the general public.

Footnotes

1 In addition to the introduction of flexible inflation targeting, the amendments to the Monetary Law Act are expected to strengthen the financial supervisory and regulatory framework and improve governance of the Central Bank.

2 Other goals of monetary policy could include high levels of economic growth, low unemployment and stability in the exchange rate.

3 Hanke, Steve, “Sri Lanka: Slaying the Bogey of Inflation Perspective”, Sunday Island, 10 February 2008.

4 https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/press/Olcott%20Oration%20Evolution%20of%20M onetary%20and%20Exchange%20Rate%20Policy%20and%20%20the%20Way%20Forward.pdf

5 https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/otherpub/Information_Series_Note_20161 203_Exchange_Rate_and_Economic_Impact_of_Depreciation_e.pdf

6 At times, open market operations of the Central Bank are misrepresented as “money printing”. For an accurate description of the money supply process, see Gunaratne, Swarna, “Money Printing; Is there a proper control?”, 2018 (https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/otherpub/Article_on_Does_Central_Bank _of_Sri_Lanka_Print_Money_with_a_Proper_Control_e.pdf)

7 Svensson, Lars, “Flexible inflation targeting – lessons from the financial crisis”, September 2009.

8 A flavour of the current internal discussions on technical features of the new monetary policy framework can be found in the Central Bank of Sri Lanka Annual Report 2018, Box Article 09: “Choice of the Inflation Target for Flexible Inflation Targeting (FIT) in Sri Lanka”