Sunday Feb 15, 2026

Sunday Feb 15, 2026

Saturday, 13 November 2021 00:00 - - {{hitsCtrl.values.hits}}

1.0 Preface

1.0 Preface

1.1 Honourable Speaker, I present today the 76th Budget of the independent Sri Lanka. This is the second Budget of the Government of His Excellency the President Gotabaya Rajapaksa and my maiden Budget speech as the Minister of Finance.

1.2 Honourable Speaker, we are passing through perhaps the most painful period of human civilisation. I doubt if there is anybody who is unable to comprehend this reality.

Nevertheless, we must make every effort to conquer these challenging times.

1.3 Honourable Speaker, I first came to learn the concept of ‘Challenging the Challenges’ for the betterment of the public in my ancestral home in Medamulana. The Rajapaksas have a history of never being daunted by challenges. Mr. D.M. Rajapaksa, who is known as the “the Lion of Ruhuna,” who represented the second State Council in 1936 is known by the entire country. He is my father’s elder brother (loku thaththa).

1.4 Honourable Speaker, my father’s election to the State Council in 1945 was a key political turning point for the Ruhunu Giruwaya. To date, the land and the lives of the people of Ruhuna bears evidence of Mr. D.A. Rajapaksa’s futuristic and visionary patriotism.

1.5 Honourable Speaker, the Hon. Prime Minister Mahinda Rajapaksa who is today in this House, is at the centre of the Rajapaksa Political legacy. The decade from 2005 to 2015 was the most critical 10-year period of Independent Sri Lanka.

1.6 Honourable Speaker, there are three main responsibilities that any elected government must fulfil in any country in the world. They are, national security, development, and social welfare. President Mahinda Rajapaksa is the only leader who fulfilled all three of these responsibilities during the same era. Such leaders are not frequently found on the world’s political arena.

1.7 Honourable Speaker, the 2015 to 2019 period marks the next chapter of our political journey. The continuous harassments we faced during this period have strengthened us. Nevertheless, these painful memories are not forgotten neither by us nor by those who fought side by side with us. It is common to take revenge from one’s enemies after victory. However, we did not let anyone take revenge.

1.8 Honourable Speaker, unshaken and undaunted by the hateful and the violent political environment during the time of the ‘Government of Good Governance’ we dared to create the Asia’s largest and the most successful political movement. That is Sri Lanka Podujana Peramuna. Just 15 months after the formation of this new party we had to face our first election. That was the Local Government Election held on 10 February 2018.

1.9 Honourable Speaker, we were able to gain a landslide victory in this election having defeated strong political camps. Then it was the time of the Presidential Election. By then we had three incomparable political factors which were unavailable to any other political party in the country. The first is the unmatched political leadership of Hon. Mahinda Rajapaksa. The second is a well-organised Sri Lanka Podujana Peramuna. The third is that the victorious candidate who was the overwhelming choice of the people was in our political camp. That is His Excellency Gotabaya Rajapaksa who is now the President of the country.

1.10 Honourable Speaker, amidst a myriad of internal and external challenges, His Excellency the President Gotabaya Rajapaksa marked a landslide victory in the 2019 Presidential Election. 69 lakhs voted for His Excellency Gotabaya Rajapaksa. That was a historic landmark victory with a majority of 13 lakhs of votes.

1.11 Honourable Speaker, subsequently after nine months, in testament to the leadership of His Excellency Gotabaya Rajapaksa, we were able to win the 2020 Parliamentary Election with a historically large majority. The overwhelming response of our people have managed to shake our political opponents.

2.0 Honourable Speaker, this Budget is presented at a time when the world is grappling with 5 major issues.

2.1. The first of which is that more than ever, the social and economic disparities have increased. Or else the rich individuals and companies continue to be richer while the poor is becoming poorer.

2.2. The second is the slow progress of achieving the sustainable goals. This will be even more difficult for developing countries, such as us.

2.3. Increased environmental catastrophes owing to increased global temperature is the third issue. Presently most countries, both developed and developing, are faced with various natural disasters.

2.4. The fourth issue is that assistance from bilateral and multi-lateral institutions are severely limited as was never before in the history. This is mainly due to the developed countries also being beset with a number of internal issues that they have given priority to resolve.

2.5. The fifth issue is the challenge of adapting to the “new normal” that has emerged post the corona pandemic. We are faced with the challenges that arise simultaneously from lockdowns, work from home, price increases, and disruption to global production networks.

2.6 Honourable Speaker, these conditions have had a varying impact on each country. The impact is worse on countries with trade focused economies, such as ours, compared to those economies dominated by the manufacturing sector.

2.7 Honourable Speaker, the opportunity to provide such services both domestically and externally has been curtailed resulting in a loss of income. As a result, the loss of revenue to the country and the Treasury has been unlike any other year before. The loss to the Treasury according to our estimates is over Rs. 500 billion.

2.8 Honourable Speaker, we are living through the history’s most challenging period in terms of people’s lives, livelihoods, sources of income, and job security.

2.9 Honourable Speaker, I strongly believe that, even amidst these challenges, we are equipped with all the necessary strengthens to manage the economy and to overcome such challenges.

3.0 Our Strengths

Honourable Speaker, I take this an opportunity to enlighten this House about our strengths, briefly.

3.1 Bold leadership and political stability

Our country, has the highest democratic political stability in the region. We have an Executive President elected by the people. Our President embodies simplicity, and is a leader, who is honest, makes firm decisions, and is dedicated to the eradication of corruption, fraud, and waste. He is a great strength to our way forward. At the same time, we have a two-thirds majority in the Parliament.

Honourable Speaker, this Parliament is led by Asia’s most mature political leader, Hon. Prime Minister Mahinda Rajapaksa. He is a leader who has rendered an extraordinary service to this nation.

Honourable Speaker, in addition, our country has an independent judiciary and a disciplined public service. We are proud today, than ever before of both the judiciary and the public service.

3.2 Infrastructure at global standards

Honourable Speaker, our infrastructure facilities are of high standard. The quality of our Ports, airports, telecommunications, highways, roads, and electricity supply are very good. Also, through the 100,000 kilometre road project and the 5,000 bridges program, the by-road network will be strengthened further and the entire country will become a single network. Therefore, we are at the forefront of being able to provide global standard infrastructure to local and foreign investors.

3.3 Non-aligned, friendly international relations

Honourable Speaker, we have expanded our diplomatic relations with the bilateral and multilateral agencies as has never been done in our history. The World Bank, the Asian Development Bank, the European Union, the Japan International Cooperation

Agency (JICA), the Kuwait Fund, the French Development Agency, the KfD, Korean International Cooperation Agency (KOICA) the OPEC for International Development, and all agencies aligned with the United Nations are working very closely with us. In addition, I am honoured to state that these organisations are prepared to assist our country immediately in times of need.

3.4 A Healthy, Intelligent Human Resource

Honourable Speaker, we live in a blessed country. Our people possess multiple skills; they are healthy, educated, intelligent, courteous, and appreciative. I am, therefore, proud to say that our human resource is rich with qualities which are not considered in the traditional criteria of human resource development. Therefore, we have the strength to face any challenge. Even during the time of the Covid pandemic, we experienced practically, the importance of having a highly sensitive human resource. As a result, we had the opportunity to provide immediate care to all.

3.5 A nation that is environmental friendly

Honourable Speaker, I am sure that there is almost no nation that loved the environment as much as we do. There is ample evidence to that effect throughout the over 2,500 years of written civilisation. The landscape of Sri Lanka is rich in forests, wetlands, agricultural lands, and coastal and marine eco systems.

Honourable Speaker, its distribution depends on a wide range of climate, topography, and soil types. Our country's ecosystems rich in biodiversity, such as, rainforests and coral reefs could be found in physically defined geographical spaces.

3.6 Vision of a Sustainable Economy

Honourable Speaker, many have thought development and environment to be diametrically opposed. But today, we believe that the integration of development and environment is possible. At a time when the world is moving towards sustainable development, we must also protect our heritage of rich natural resources and biodiversity systems. I wish to inform that the overall economic development strategies of our country are geared by optimally integrating the conflicting objectives of environment and development. We have already announced the program to build a green economy through the “Vistas of Prosperity and Splendour”. The Budget 2022 is an extension of that same concept.

3.7 Priority for national security

Honourable Speaker, we have firmly consolidated peace and national security in Sri Lanka. Extremism or terrorism has no place in this country. Our country is one of the most peaceful and stable countries in the world today. We are reaping the benefits of peace after defeating terrorism. We are happy that we are able to build a better future for our children. However, we are also mindful that we too have to face some of the global threats. We consider it our paramount duty to protect our nation from such threats and to ensure national security.

Honourable Speaker, therefore we will not abscond our responsibility for national security which is the foundation of freedom and prosperity. We have been able to ensure national security in line with the aspirations of the people. There is immense public support for this. Therefore, I am pleased to announce that we have been able to better strengthen ethnic harmony, political and economic stability, elimination of terrorism, and counter-extremism in the country.

3.8 Leader in vaccinations

Honourable Speaker, from May 2020, our Government took drastic measures to prevent the spread of the COVID pandemic. To safeguard our people we even had to lockdown the country completely.

Travel restrictions throughout the island had to be imposed while also enforcing localised isolations. With the third wave, the enforcement of health regulations to prevent the pandemic was intensified.

Honourable Speaker, we strengthened the availability of COVID treatment centres and facilities throughout the country. The vaccination program focused on immunisation, especially in high-risk areas and amongst high-risk populations. The Government worked with various parties to expedite action to mobilise resources to respond to the health and economic challenges posed by the pandemic. We were able to save nearly half a million people who were infected.

Honourable Speaker, we are a Government that walked the talk. Today we have achieved the vaccination targets. Therefore, today we are considered the ‘Vaccinated Nation in Asia’. We owe our special respect and gratitude to His Excellency the President for leading the vaccination program.

3.9 Returning to work defeating COVID

Honourable Speaker, we were able to gain a distinct advantage by the early control of the COVID pandemic. We were able to revitalise the lives of our people and revive critical sectors of the economy, including the tourism industry. Moreover, we believe that this gave us the strength to lead to a post-COVID economic revival ahead of other countries in the region. A large number of people are getting used to their usual way of life. Mobility has returned. Income generating activities have recommenced. Normalcy has returned to the lives of our people. This has led the entire country to turn itself into a busy workplace.

3.10 Local entrepreneurial strength

Honourable Speaker, the work done by the medical, the defence forces, and the public servants who were at the forefront caring for us during the pandemic, was visible. Though was not visible, another force was there, strengthening us. That is our entrepreneurial community. They did not retrench their work forces. They supported the delivery of essential services to the people by maintaining the production chains in every way possible.

Honourable Speaker, the export industries fulfilled their national responsibility. This helped to manage the trade balance. We will provide every support to our entrepreneurs to consolidate as key stakeholders of our economy. A strong entrepreneurial community will ensure that when required they will not hesitate to serve their nation at critical junctures. As such, our Government is determined to provide all possible facilities to them.

Honourable Speaker, we can continue to identify such hidden strengths within us. However, I am not going to elaborate on these further.

4.0 The challenges before us

Honourable Speaker, unfortunately, there are many obstacles before us impeding our journey towards development. We believe there is nothing wrong with portraying them as challenges. I also do not underestimate the importance of making this House aware of these challenges. Therefore, I would like to brief on these challenges.

4.1 International drug mafia

Honourable Speaker, the attempt to involve Sri Lanka in international drug trafficking is at the forefront of all challenges. It is a very dangerous situation. The youth who is to take over the leadership of our country is the main target of the drug mafia. The entire state apparatus, including, the President, the Tri Forces, the Police, Prisons and Rehabilitation officers are bravely fighting against the international drug mafia. We should thank them for that. Sri Lanka has gained international recognition for making great strides in recent times in the fight against drug trafficking.

4.2 Fraudulent business operations

Honourable Speaker, another serious issue which needs to be especially considered is the impact on the lives of the people of this country through the fraudulent business activities of individuals and institutions seeking illicit profits. Especially, through the concealment of goods, creation of an artificial shortage of goods, creation of a black market through high prices are the tragedies faced by the people of this country from time to time. Our fight against those unjust traders has not come to an end.

Honourable Speaker, at times it was necessary to retreat strategically on behalf of the people, but I urge you to not see it as a weakness. We undertake to take action to ensure a fair market place; instead of monopolies a competitive market; a cooperative sector that is on par with the private sector together with the small and medium sized entrepreneurs through the introduction of reforms to create a sustainable solution.

4.3 Forces detrimental to the country

Honourable Speaker, similarly, agents of foreign powers disguised as social activists are exerting a considerable pressure on our society to the extent that, today, such so called activism can overthrow strong and populist governments. It is not possible for a government alone to manage. Therefore, I invite all citizens of this country as responsible citizens to be vigilant about this situation.

4.4 Common global challenges

Honourable Speaker, we, like many other countries in the world are faced with a number of challenges. Disruption to food production chains, climate change, natural catastrophes, energy crises, and fluctuations in international commodity prices over which we have no control, have become common. These cannot be solved only through domestic measures. These require collaborations internationally. Local and international interventions are being looked at. We must also be a partner in these ventures.

4.5 The challenges of rising cost of living

Honourable Speaker, we have been for a long time talking about the frequent fluctuations in the prices of goods and services. Yet every government failed to provide a lasting solution. We must honestly admit it as such. We need to question why there are such fluctuations in prices and quantities in the market. We believe that matters, such as, changes in consumption patterns, inadequate increase in production yield, inability to adapt to modern technology, issues with transportation and storage, the impact of intermediaries, and the asymmetry of information, within the production chain have all contributed to rising commodity prices.

4.6 Obsolete economic tools

Honourable Speaker, we have been unable to achieve an adequate growth in the manufacturing sectors relative to the population dynamics. Attempts to control market prices and supplies utilising traditional tools without correctly understanding these situations will inevitably be criticised. It is my belief that traditional tools are insufficient to control the prices of goods and services. This is why in the recent past our Government faced various criticisms regarding the printing of Gazette notifications. Similarly, some of the measures used to control prices and supply were have created uncertainties.

Honourable Speaker, the Government faced a lot of criticism for failing to increase production without an adequate encouragement being given to the producers, without correctly disseminating information about the supply network, and making decisions without following scientific methods. Therefore, we must at least now, stop, the groping in the darkness.

Honourable Speaker, we have to accept that the increase in prices is due to a shortage of goods, the imposition of import restrictions, the overreliance on imports, the depreciation of the rupee together with the failure to adequately encourage manufacturers. Given the aforementioned, it must be understood that the solutions available to control the behaviour of the goods and services market are both medium to long term.

4.7 Greater emphasis on a trading economy

Honourable Speaker, at present, our economy is tilted more towards the trading sector. For a long time now, imports have been double of exports. This is not sustainable and it is challenging. We will have to transform our economy into an advanced manufacturing economy. The economy should be driven by innovations and within the broad framework envisaged in the ‘Vistas of Prosperity and Splendour’.

Honourable Speaker, we must establish an economy that provides micro to small and medium scale producers and large scale producers uninterrupted access to facilities that allows them to perform. This calls for a change in the traditional laws and regulations. Information and communication access should be broadened. The entire public service should be the facilitator of the production economic process. The Public Service should not be an impediment to the same.

4.8 Challenges of earning foreign exchange

Honourable Speaker, I believe that it was important to discuss about our foreign reserves, management of the foreign exchange rate, and the country’s current debt position. As a Government, we acknowledge that our foreign reserves are being challenged, with the frequent fluctuations in the Rupee, which lead to the imposition of certain restrictions on the use of foreign exchange.

Honourable Speaker, our annual earnings from tourism amounting to almost $ 5 billion did not materialise during the last two years. Adequate foreign direct investments have not flowed into the country. The inflow of worker remittances have also been somewhat limited. Many avenues of earning revenue locally have also been affected. The gap between the export income and the import expenditure is not simply a national challenge during the past several decades, but it is an unsolved economic problem.

Honourable Speaker, although tourism income, worker remittances and the income from apparel and tea exports showed an increasing trend during the decade up to 2018; apart from utilising such inflows to meet the import expenditures, the country has failed to take decisive action required in a middle income country to create an export surplus in goods and services.

4.9 Public debt expansion

Honourable Speaker, the recurring fiscal deficit resulted in the creation of an unbearable stock of debt. The debt to GDP ratio exceeded 100% for the first time during the period 1988-89 due to the island wide insurgency and terrorist activities. The debt to GDP ratio exceeded 100% again several times during the period 1998 to 2004. It indicates that we have borrowed over and above our gross domestic production.

Honourable Speaker, in 2014, when President Mahinda Rajapaksa handed over the country to the previous Government, the total debt of the country stood at Rs. 7,487 billion. It was 72.3% of the Gross Domestic Product. When the present President came to power at the end of 2019, public debt had increased to Rs. 13,032 billion. That is how the Government of Good Governance had created debt.

Honourable Speaker, as such, interest expenditure on public debt has become the single largest expenditure item in the Budget. This is in addition, to the repayments of loans that we have to undertake. Government borrowings from domestic savings and banks have increased, creating limitations for the people to access credit. Interest rates increased. Share of foreign debt reached almost 50% of the total debt stock. A Rs. 1 depreciation of the currency results in the debt stock increasing by Rs. 50 billion. We must understand that one of the key challenges is that the impact the foreign currency market, money and banking activities, interest rates and exchange rates have on each other, resulting in creating complexities in budget management and banking and financial sector management.

Honourable Speaker, we acknowledge that public finances will be severely impacted with all sources of revenue contracting in the face of the COVID pandemic. The Government had to incur a significant cost in curbing the COVID pandemic, while maintaining the public services, on-time payment of public servants’ salaries and pensions, and providing relief to families who have lost their sources of income.

Honourable Speaker, during this period, we settled two international sovereign bonds amounting to $ 2 billion, reaffirming the country's debt servicing capability while providing confidence to the international markets. We protected our banking system. Rs. 300 billion was provided as working capital facilities at a concessionary interest rate to provide relief to small and medium scale industrialists. We also provided relief through the debt moratorium on loans and leasing facilities amounting to almost Rs.700 billion, thus protecting the private sector.

Honourable Speaker, I also would like to remind this House that this Government is responsible for the servicing and the repayment of the debt raised by the previous Government including the debt raised amounting to $ 6.9 billion during only a 15-month period between April 2018 and 15 July 2019.

4.10 Management of foreign reserves

Dr. N.M. Perera, in his 1970/71 Budget speech has presented a deep analysis of the management of foreign reserves in the country and has stated that no government since independence has managed its foreign reserves with a long term view. This is clearly presented in page 5-15 of his Budget speech and I invite the attention of this House to the same. In that he states that instead of building foreign exchange reserves, we have used it for the importation of goods creating a foreign reserve crisis and, thereby, seeking the support of the International Monetary Fund (IMF). From the first IMF facility in 1961, successive governments have resorted to short term assistance from the IMF, and our leaders and financial sector experts have failed in introducing a sustainable long term programme to manage our foreign reserves. The Government of HE the President Gotabaya Rajapaksa, expects to create apart from a foreign exchange reserves a number of other reserves. The first of which is the reserve of water, food, and energy, which are created through the land, water, and the renewable energy which are gifts of nature.

4.11 Identifying potential for exports

Honourable Speaker, we need to explore novel avenues of earning foreign exchange. We cannot solve this problem only by obtaining international loans. Therefore, we must adopt a special programme to encourage the export to earn foreign exchange.

Honourable Speaker, I believe we need to focus on sectors, such as, textiles and apparel, gem and jewellery, rubber and rubber products, as well as, value-added tea, coconut and coconut products, fish and fish products, spices, processed food, fruit and beverages, ornamental flowers and plants, electrical and electronics manufacturing, boat manufacturing, and engineering products and services.

4.12 Inadequate attention on non-debt creating avenues

Honourable Speaker, we expect to expand the contribution of the services sector to compensate the trade deficit. We expect that the expansion of the service sector will contribute to bridge the trade deficit. We need to formulate a special mechanism to encourage exports of services. In particular, we need to upgrade the tourism industry, expand the IT sector, promote opportunities for business process outsourcing, and develop port and airport related services. We have paid special attention to these in this Budget.

4.13 Supplementing imports

Honourable Speaker, we are a country with an abundance of experience over a long period of time in promoting import substitution industries. While we have been successful in certain sectors, there has also been failures due to incompatibilities with the Government policies. ‘Vistas of Prosperity and Splendour’ has created a broad scope for the production of agricultural and industrial goods that are identified as import substitutes.

Honourable Speaker, HE the President has introduced a green economy concept in this regard and we should create a strong import substitution industries through the manufacturing of organic fertiliser, renewable energy, and the production of milk, sugar and medicines. As such we must focus on creating a strong mechanism to improve domestic incomes while saving foreign currency outflows. This will divert a large amount of money otherwise flowing abroad to local farmers, industrialists, and to others working in those fields.

Honourable Speaker, this creates a new space for employment. But at the same time we are faced with significant challenges at the implementation levels.

4.14 Limitation to encouraging Foreign Direct Investment

Honourable Speaker, we have more than three decades of experience in attracting foreign direct investment to the country. But it always remained a challenge. Foreign direct investments flowed into the country as investments into free trade zones and other strategic investments. Nevertheless, we were unable to expand it as expected. We have been able to make some progress in foreign direct investments over the past year and a half. Already investment projects valued around $ 1,076 million have commenced.

Honourable Speaker, however, certain factions in the society and political groups need to comprehend correctly what an investment is, what a selling is and what procedures are to be followed in this regard.

4.15 Common social and economic challenges

Honourable Speaker, underemployment, unemployment, poverty, malnutrition are issues that our society has been facing for a long time. Every government that came to power after independence, has made various attempts to solve these issues. But the results have been far from being satisfactory. Therefore, even today we have to take care of Samurdhi beneficiaries. That is almost 23% of the population. In the year 2021 itself, 20% of the recurrent expenditure of the Government was incurred on social welfare. In the next few decades, we envisage challenges from the change in the demographics of the population with the percentage of elderly population being on the rise.

4.16 The importance of food security

Honourable Speaker, food security is the ability to access safe, nutritious food by all citizens of the country without any trouble. A family is food-secure only if its members are living without starvation or without the fear of being starved. With the emergence of the COVID pandemic, we have become more concerned about food security than ever before. This is because there are people among us whose vulnerability to food security is high.

The most vulnerable include those engaged in the informal sector, those without access to income generating sources, and communities entirely reliant on buying and selling.

4.17 State enterprises a burden to the economy

Honourable Speaker, there are approximately 300 State-Owned Enterprises in our country. These enterprises are engaged in the provision of various products and services. The Government has invested over Rs. 670 billion in these state owned enterprises. In addition, annually about Rs. 75 billion is spent to maintain these entities. Most of these institutions do not provide returns on the investments made by the Government.

Honourable Speaker, so far I have attempted to explain, the socio-economic conditions our country is faced with at the moment.

5.0 Policy synopsis

5.1 Honourable Speaker, I spoke of the challenges that lie ahead of us and the strengths that we possess as a country to overcome such challenges. It is my responsibility to inform this House regarding the basic axioms such as principles, guidelines and laws and regulations that are followed to aptly manage the applicable instruments in the process of developing the country to successfully confront these challenges.

5.2 Honourable Speaker, it comes to leaders, it is said that at times the leader should be ahead of his followers, and at some other times he should be on par with the followers, whilst at certain other times, he should be behind the followers. Wherever the leader is, he should work with commitment, courage and honesty with the common objective of achieving the goals. His Excellency the President, Gotabaya Rajapaksa has followed this tenet to his utmost ever since he was elected as the President.

5.3 Honourable Speaker, we consulted all groups in society dispersed horizontally and vertically in order to obtain proposals for the Budget. We listened to opinions and proposals made by various stakeholders through mass media and social media. We sorted the proposals as those that can be done now, those that are difficult to be done and those that can be implemented in the future. Accordingly, we compiled a set of common policies. When following that set of comprehensive policies, irrespective of certain difficulties that may arise in the short run, it is our collective duty to understand the reality even taking one step backward, so long as the medium term and long term objectives desirable.

Honourable Speaker I wish to remind that the National Policy Framework ‘Vistas of Prosperity and Splendour’ was considered in its entirety in preparing the Budget 2022.

Honourable Speaker, unproductive high expenditures and weaknesses in expenditure controls have resulted, in often governments not being able to properly engage in expenditure management. As a result almost every government has increased tax rates and introduced various taxes considering the low Government revenue. Other than the Government seizing a slice of the income of tax payers, it has not resulted in any increase of the total private and Government revenue. That is why national budgetary policies should be prepared in a way that would bring about a structural change that would enable the increase of total revenue of the country and thereby increase savings and investment.

5.4 Therefore, I would like to present to this august House a series of proposals for expenditure management.

5.4.1 Honourable Speaker, the first one of which is to issue quarterly warrants instead of the annual warrant which is issued by the Minister of Finance authorising the expenditure of Government institutions for the entire year after the passage of the annual Appropriation Bill in Parliament. Accordingly, it is expected to instil financial discipline in the utilisation of the allocations by requiring all Government institutions to prepare their plans relating to procurement, salaries and allowances, debt servicing, development and maintenance well in advance. Commitment control in accordance with the desired objectives and steering the procurement process accordingly, are required by heads of institutions of all expenditure units.

5.4.2 My second priority in formulating the fiscal policy is to inculcate a savings culture amongst a majority of the country. This is to create a conducive environment that enables all citizens - working community, high income earners and entrepreneurs – to save as much as they can and thereby expand their investment capacity. Instead of providing funds for recurrent expenditure, funds for capital expenditure will be made available by the Government for SOEs to enable them to generate income by undertaking public and private construction activities and providing other services.

5.4.3 To improve the business focus and financial discipline of State Owned Enterprises that have become drain on the national economy, based on contemporary benchmarks, focusing on those entities that have been incurring losses continuously and those under-utilised, a multi-disciplinary consultative committee will within a specific time frame propose a strategic way forward.

5.4.4 Assets of many of these enterprises are underutilised. I expect that my fellow Ministers, their secretaries and heads of departments would provide leadership to utilise these assets to the maximum. Except for office buildings that are under construction at the moment, I propose to suspend the construction of new office premises for two years. It is necessary to utilise the allocated capital expenditure for development activities that directly benefit the public, while productively using the existing office facilities. I also propose to include amendments to the Appropriation Bill preventing requests for Supplementary Estimates for 2022 by all Ministries.

5.4.5 I firmly believe that public sector should also contribute in promoting national savings. In this regard, it is also required to reduce Recurrent Expenditure. Hence, I propose to reduce the fuel allowance provided to Hon. Ministers and Government officers by five litres per month, cut down the telephone expenses of Government institutions by 25% and reduce the provisions for electricity by 10% in order to encourage the shift to electricity generated through solar power. Secretaries to ministries and heads of institutions are required to take action to deploy those concentrated in urban areas into the peripheries.

5.4.6 Honourable Speaker, Members of Parliament are now entitled for a pension having served for a period of five years. I propose to extend the five year period to ten years. This proposal is valid for all positions including the presidency for whom salaries are paid from the Consolidated Fund. Legal provisions are required to be formulated to bring this proposal into effect.

5.4.7 The public service in our country covers the entire economy. The efficiency of the public sector has an impact on the efficiency of the private sector as well. We have firmly recognised the importance of transforming the public sector into an efficient service and one that is easily approachable by the public. All Government institutions should become courteous and client-centric. Hence, I propose to prepare a Client Charter for every Government institution. Further, it should be displayed in the premises for the information of the public.

5.4.8 I propose to introduce an appraisal system for the public service based on the satisfaction of clients and Key Performing Indicators (KPI) and thereby motivate them and enhance the efficiency and productivity of the public service to an optimal level.

5.4.9 I reiterate that it is the responsibility of the National Pay Commission to introduce amendments in relation to salaries and pensions of the public service, eliminate anomalies, and to establish salary structures. We must understand that unwanted salary scales and irregularities within the salary structures occur when such institutional structures are disregarded. Hence, I propose to establish a new salary structure for the public service by removing the anomalies in public service salaries with effect from the next financial year. Salary administrative procedures will be simplified by granting the salary increment on the due date without the need of appraisal reports for all Government employees, except for those who are subject to disciplinary action.

5.4.10 I propose to establish an Integrated Results Based Management System to follow up the achievements of anticipated progress as per the plans prepared by integrating the national development priorities as well as priorities in areas related to those priorities, while monitoring the progress of development objectives, aims and targets that Sri Lanka expects to achieve within the 20222024 Medium Term Budgetary Framework and to implement that system through the five (5) National Coordinating Sub-Committees currently established by consolidating Ministries.

5.4.11 Life expectancy at birth has increased. At the same time, the elderly population is on the increase. Sri Lanka is almost on par with developed countries as per the quality of life indices. As a result, elders have the capacity to remain in active service for much longer than before. It is very important to productively utilise their experience and skill set. Therefore, I propose to extend the retirement age of public service to 65 years in order to strengthen the labour force.

5.4.12 I propose to modernise the Samurdhi movement considering the practical social context. Without restricting the Samurdhi movement solely to a poor relief programme, I expect to transform it as a rural development movement that ensures economic revival and food security, while integrating with modern trends. I assign the responsibility in this regard to the senior management of the movement. I propose to select beneficiaries for social welfare and assistance programmes under a rational and scientific mechanism.

5.4.13 It is also planned to restructure the Samurdhi banking movement which is the nearest financial service provider that fulfils the financial needs of the rural community. I propose to convert Samurdhi banks as one-stop shops that provide all services and facilities including financial facilities and financial advice for the development of micro and small enterprises.

5.4.14 To make the Cooperative movement stronger, I propose to swiftly commence the implementation of the required restructuring activities to conduct proper investigations into alleged frauds on depositors of cooperative and rural banks, assist such depositors by reimbursing financial damages, if such frauds have occurred.

5.4.15 The management of all State-owned media institutions is entrusted with the responsibility of substantively reviewing the business focus and financial discipline of such institutions and achieving the required results by implementing a strategic plan within a short period time.

5.4.16 I propose to expand the business focus of the Sri Lanka Insurance Corporation to move into sectors that has previously not been looked at ensuring a competitive market in which everyone could to get an insurance policy, within a new insurance system. I propose to amend relevant laws in order to amalgamate life and property insurances of Sri Lanka Insurance Corporation.

5.4.17 It is expected to avoid deficiencies that occur or can occur in charging custom duties by updating the HS code system currently being used by Sri Lanka Customs, while also introducing advanced technological tools globally used in customs operations to Sri Lanka Customs. In addition, a Single Window System will be established to facilitate the import-export process by integrating all institutions that work with Sri Lanka Customs into one system. I propose to grade the exporters and provide free customs facilities to exporters with a high grading.

1766 HS codes are subject to regulations by the Import Controller. Importers are faced with a number of issues as they are required to get clearances from a multitude of agencies. At the same time, as a large number of HS codes are subject to CESS the cost of import and export has increased. Excluding the HS codes pertaining to liquor, cigarettes, motor vehicles and domestically produced agricultural products, the Custom duties and CESS rates would be simplified together with the licensing mechanism for imports, the custom clearances will be provided once such imports have been cleared by the Standards Institution and the quarantine authorities.

5.4.18 I propose to strengthen the Consolidated Large Tax Payer Unit of the Inland Revenue Department established bringing in an integrated administration of all the units connected to the 80% of the Government tax revenue which is derived from 20% of the tax payers.

Honourable Speaker, the Revenue Administration Management Information System (RAMIS), which was initiated by Hon. Prime Minister Mahinda Rajapaksa in 2013 and launched in July 2018 but the full implementation has been somewhat slow due to various reasons. Arrangements are being made to implement the system by expeditiously attending to matters that were delayed in the recent past due to COVID-19. Integration of all banks and financial institutions with Lanka Clear by using the online tax payment platform should be made an element of tax administration. I also propose to expeditiously introduce amendments to the tax law in relation to the use of digital identification numbers and other legal requirements.

Honourable Speaker, Treasury records indicate that due but uncollected tax revenue is over Rs. 200 billion. It amounts to around 1.5% of the GDP. Taxpayers evade payment of due taxes resorting to various mechanisms. Further, although tax evaders are sent a notice of tax assessment by Inland Revenue Department, there is a belief that the payment of due taxes can be evaded by paying a certain penalty to the Department. In order to change these practices, I expect to establish legal provisions to apply technological processes to tax administration.

5.4.19 As proposed by the 2021 Budget, I propose to implement the Special Goods and Services Tax, for which legal provisions are already drafted, with effect from January 2022 to cover all goods and services covered by the Act.

5.4.20 The serious lapses in the mobile and the internet signal network were evident during the COVID-19 pandemic. I propose to install a country wide telecommunication network expeditiously covering all 10,155 schools in the country using Fibre Optic technology, for which the required financial and technological assistance is proposed to be provided to the Telecommunication Regulatory Commission.

5.4.21 Although three-wheeler service is vastly spread around the country, contributing immensely to the service sector in particular, as of now there is no mechanism to regulate the three wheeler service. The need for regulating the service has arisen due to its massive expansion related issues. To that effect, I propose to establish a Three-wheeler Regulatory Authority and to make decisions including the three-wheeler charges and service standardisation through the Authority.

5.4.22 We have taken into account gender, racial and other cultural differences and demographics in preparing the budgets, allocation of funds and implementing budget proposals by ministries, departments, corporations and statutory bodies. I propose that monitoring mechanisms adopted by each Ministry also reflect these factors at its implementation level.

5.4.23 As per population projections, there is a need for a unique social safety programme for safeguarding the rapidly ageing population. To this effect, I propose to establish a contributory pension scheme for senior citizens who do not currently receive pensions.

5.4.24 There is a considerable number of differently-abled persons in Sri Lanka. They should also have access to equal opportunities, equal privileges and equal responsibilities in the society. Therefore, in line with the Article 12 of the Constitution of the country which spells out that all citizens are equal, I propose to introduce an Act on Rights of the Differently-abled. I further propose to launch a programme for the development of their entrepreneurship and skills.

5.4.25 I propose to introduce an inclusive programme to address the issues on children and mental health development having identified the basic issues faced.

5.4.26 Sri Lanka should immediately move towards an economy which is more tilted towards the production economy, synergising on the opportunities in the service economy. We should create a trend where the educated young generation of our country strive to become entrepreneurs and employment providers by changing their mentality of pursuing job opportunities. Accordingly, it is proposed to not to charge the business registration fees in the year 2022 in order to provide an impetus for new start-ups.

5.4.27 It is proposed to amend the Finance Act to simplify the complex processes currently in place for new business registration process adopted by the Board of Investment, Department of Foreign Exchange and Export Development Board and to consolidate fees levied by various institutions in this regard.

5.4.28 I propose to take action to review issues, requirements and deficiencies in relation to the production of fruits, vegetables, fish based products, liquid milk and commercial crops and to expand local and international market-oriented products in order to promote production economy.

5.4.29 While identifying the deficiencies in the sector of growing flowers and foliage, I propose to implement a new programme to provide necessary knowledge, to encourage flower growers and to promote export-oriented production. I entrust the leadership of this task to the Department of National Botanical Gardens which is under the Ministry of Tourism.

5.4.30 I propose to facilitate and encourage the private sector to produce medicines of highest quality in Sri Lanka targeting the international market by further promoting steps already taken with regard to pharmaceutical production and linking with companies of international repute. I further propose to expeditiously implement the proposals of the committee already appointed, comprising of all stakeholders on a mechanism to keep the pharmaceutical prices stable.

5.4.31 I propose to start the production of the raw materials required both domestically and internationally by the apparel industry thereby opening a new avenue of entering the international market. At the same time, I propose to implement a rapid programme to promote the local handloom and the Batik production industry with the aim of generating an income of $ 1 billion by 2025.

5.4.32 I propose to further enhance the steps currently taken to increase Sri Lanka’s share of gems and natural mineral resources in the global market. Given the capacity to increase the income generation, it is proposed to make Sri Lanka a main centre for the purchase of gems in the world market.

5.4.33 Our country is recognised globally as a top brand in the production of related rubber goods. As such, I propose to restrict the importation of rubber related products and to promote investments in the production of rubber-related finished products instead of exporting rubber as a raw material.

5.4.34 Action will be taken to remove obstacles in purchasing raw materials for the production of electrical and electronic appliances and promote investments of the private sector to achieve targets of the international market. So as to promote renewable energy, ensuring the reduction of the use of carbon emitting fuel and foreign currency outflows, I propose to encourage the local manufacture of equipment and appliances required for the generation of renewable energy.

5.4.35 To facilitate the necessary environment for promoting Sri Lanka as a centre for wellness tourism, required action will be taken to link our country to the global wellness tourism industry which is estimated to value more than $ 700 billion. Further, required action will be taken to promote different forms of tourism such as event tourism that focuses on events such as exhibitions and conferences, destination tourism and homestays in order to provide the benefits of the tourism industry to the general public.

5.4.36 I propose to formulate a new programme for establishing new Ayurveda treatment centres and promoting traditional indigenous medicine and natural treatment methods.

5.4.37 I propose in line with the policies of sustainable development with the objective of enhancing health and nutrition of our citizens to expand the capacity of the organic fertiliser production of special categories of fertiliser for targeted cultivations/crops through the provision of the required technical expertise at Grama Niladhari Division level.

5.4.38 I propose to promote the diversification of agricultural products and value added agricultural products so as to generate foreign income.

5.4.39 I propose to establish hi-tech agro parks in order to produce new agro-entrepreneurs by providing uncultivated lands to women and youth under a special basis and thereby expand the extent of cultivated lands in agriculture and plantation sectors.

5.4.40 I further propose to introduce new laws on the usage of lands owned by plantation companies as well as those of both public and private ownership to ensure the maximum utilisation of buildings and other assets.

5.4.41 Our Government is always committed to safeguarding the farmers. But, a clear law in this regard has not been formulated yet. There should be a national programme that protects the interest of farmers, ensures an appropriate price for agricultural produce, enhances the productivity of agricultural sector and manages risks in agriculture while ensuring its safety.

In this regard, it is required to focus our attention on the conservation of soil and water resources, management of damages to wildlife and ensuring food safety. Strategies should be formulated to enhance the productivity through genetically engineered agricultural produce, whilst also preventing likely damages from such produce. Therefore, I propose to draft a Green Agricultural Development Act that protects the traditional knowledge of our farmers, safeguards their right to own lands and right to the distribution of water and ensures the participation of the farmers in the decision making process.

5.4.42 Sri Lanka is positioned at the centre of Asia. The nave routes connecting East Asia to West Asia lies in close proximity to Sri Lanka. This positioning will strengthen our global economic operations. This was identified for the first time under the Five Hubs strategy presented by ‘Mahinda Chinthana’ policy statement in 2010. As such, I propose to make Sri Lanka Asia’s hub.

Naval hub

5.4.42.1 Given Sri Lanka’s position on the navel route connecting East Asia to West Asia, the country could be developed to not only as a hub for bunkering, provision of food and supplies but also as a point of crew rotation. In addition the country could also undertake ship repairs.

The Colombo Port has already become the navel hub for entrepot trading in South Asia. Once the construction of the East and the West Terminals at the Colombo Port is completed, entrepot trading is expected to expand. Accordingly it is expected to develop Colombo Port as an Entrepot Hub, the Trincomalee Port as an Industrial Port, Galle Port as a Tourist Port and the Hambantota Port as a Service Port.

When considering Sri Lanka’s strategic position in the world along with already developed infrastructure of ports, there is every opportunity to establish Sri Lanka as an international free port. Hence, I propose to introduce necessary legal provisions under a new Finance Act to establish free ports. Further, I propose to simplify the strict rules currently in place with regard to registration of ships and to facilitate and increase focus for this purpose and thereby I propose to transform Sri Lanka which is physically located as a naval hub to be a central as a naval hub in the global context.

Aviation hub

5.4.42.2 Although Dubai and Singapore are considered as the Asia’s aviation hubs, their position creates issues especially in long haul flights. However, Sri Lanka’s position as the centre-point will make such long haul flights becomes shorter and much more comfortable. At the same time, Sri Lanka could also be the hub for India which has the world’s second largest population. The shortest route to Africa, where millions of Indians live, from India lies through Sri Lanka.

Currently the second runway is being constructed at the Bandaranaike International Airport, while also improving the infrastructure facilities for the provision of services. While the Mattala Airport is being developed to be more attractive for tourists as well as for cargo transportation and it is also expected to construct a hospital and hotels in close proximity.

Energy hub

5.4.42.3 Singapore accounts for 25% of the global bunkering in the world, in spite of not having a drop of oil within its shores. Singapore imports crude oil and produces fuels such as petrol, diesel, bunkering oil, and aviation fuel together with a number of by products such as bitumen, plastic and nylon for export.

Leveraging on the strategic positioning Sri Lanka also has the potential to become Asia’s energy hub, through the import crude oil and export petroleum products. The unutilised Trincomalee Tank Farm, with a storage capacity of eight million barrels of oil is extremely crucial in this context.

Two new Refineries focused on exports, are planned to be established in Hambantota and Trincomalee. At the same time, the potential to generate electricity from renewable sources such as wind, ocean waves and Solar exceeds Sri Lanka’s energy requirement. As such Sri Lanka has the opportunity to produce and export Green hydrogen from the surplus of renewable energy.

Commercial hub

5.4.42.4 Given Sri Lanka’s proximity to the two of the largest markets in the world being India and China, has created an opportunity for the country to be a trading place for their goods. In addition, the country could also provide professional services such as Banking, Insurance, Arbitration and legal services together with a developed securities and a financial sector market.

Knowledge hub

5.4.42.5 Two millennia ago, Maha Vihara in Anuradhapura was the knowledge hub of Asia. For many, not only in Asia but also in Europe, who were looking for knowledge Sri Lanka was a final destination. With the aim of attracting foreign students, academics and researchers, we expect to develop the infrastructure facilities and the standards of the Universities. We have a unique opportunity to share knowledge on Buddhism, indigenous medicine, meditation and eco-friendly lifestyle with the rest of the world.

5.4.42.6 I propose to amend laws and regulations that impede the inflow of foreign exchange earned by young free-lancers through development and upgrading of new software through IT knowledge and artificial intelligence and new innovations.

There is a need for public and private entities to improve their, businesses, products and services in line with new technology. Therefore, digitalisation is no longer an option. It is proposed to use technologies such as blockchain to strengthen internal systems by improving the efficiency, operational efficacy, expenditure management.

Conventional banks should transform themselves adopting technology matching the speed of change in new technologies. Innovations are required in a fast evolving market place. As such, it is proposed to encourage banks to convert their branches into smart banking units using digitalisation. Therefore, the Central Bank is requested to introduce the required laws, regulatory framework including on capital requirements, licensing, etc.

To boost a techno-entrepreneurship driven economy, the Budget 2021 proposed the establishment of techno-parks of which two are already being set up in Kurunegala (Rathgalla) and Galle (Akmeemana) while by 2023, three new techno-parks are proposed to commence in Habarana, Nuwaraeliya (Mahagasthota), Kandy (Digana).

5.4.43 I propose to carry out an in-depth analysis and review on the procedures followed by the Board of Investment in attracting Foreign Direct Investments (FDIs) to Sri Lanka. I propose to expeditiously look into whether conditions currently imposed to facilitate attraction of FDIs should be relaxed and to identify suitable methods and to formulate a programme for this purpose.

5.4.44 I propose to submit a Special Finance Bill to ensure the safety of local and foreign exporters, to ensure the safety of transactions of foreign current accounts and to simplify the conditions that are imposed by the Central Bank on exports with regard to foreign currency conversions and transfers.

5.4.45 Our Government has always been keen on reducing district level disparities identified in education and health facilities. Private sector, too, always contributed in this regard. In order to further enhance these efforts, I propose to provide the required lands and tax concessions to encourage investors to establish an international school and a hospital in every district.

5.4.46 I propose to obtain investments through public-private partnerships and local and international sources to implement mixed development projects comprising of shopping malls, financial services, hotels, office facilities, cinema halls, entertainment centres, apartments, etc. using lands, owned by Department of Railways, that are currently not being utilised in a productive manner.

5.4.47 I propose to decentralise the monitoring of all infrastructure development projects of the Government to continuously maintain the commitment of the contractors on work zone management, safety of the community and workers and environmental sensitivity and to expeditiously and productively implement such projects.

5.4.48 To fast track the public investment programme, maintaining efficiency, effectiveness and transparency, the Procurement Processes will be modernised including through the introduction of a more decentralised process and also the e procurement process. The new processes will be benchmarked to those processes already followed by multilateral agencies such as the World Bank and the Asian Development Bank. At the same time, to remove legal impediments to promote investments standing Investment Committee will be set up.

5.4.49 In order to increase income from foreign remittances, I propose to further improve the existing facilities to provide knowledge, skills and other requirements for going overseas for employment and to enhance opportunities available in this regard by consulting the Ambassadors of other countries.

5.4.50 Focusing on ongoing green projects and programmes for achieving sustainable development goals, I propose to initiate discussions with interested foreign stakeholders to obtain green bond financing facilities and to respond to climate change through those projects. I propose to encourage state as well as private sector banks to develop this type of financing facilities.

5.4.51 It has been observed that the incidence of disasters such as landslides have gone up due to the increase of natural disasters with the global climate change. Therefore, I propose to make it mandatory to obtain recommendations for all constructions including private houses, factories and common amenities from relevant institutions.

5.4.52 As per the Trade Union Ordinance, No. 14 of 1935 and the Amendment Act, No. 24 of 1970, when a Government employee obtains the membership of a professional association relevant to his service, obtaining the membership of another Government professional association is not permitted. Further, integration, consolidation and centralisation of several professional associations of different services is also not allowed. I propose to remove such limitations through an amendment to the Trade Union Ordinance.

6. Development of the national economy

6.1 Honourable Speaker, I view every expenditure incurred by the Government as an investment in the people. Public interests are met by such investments. It generates assets. Those assets could become the fixed resources with long-term benefits to the people of the country. Or else, those assets could convert to monetary value with short-term benefits. We refer to this as the essence of the Government's financial management program.

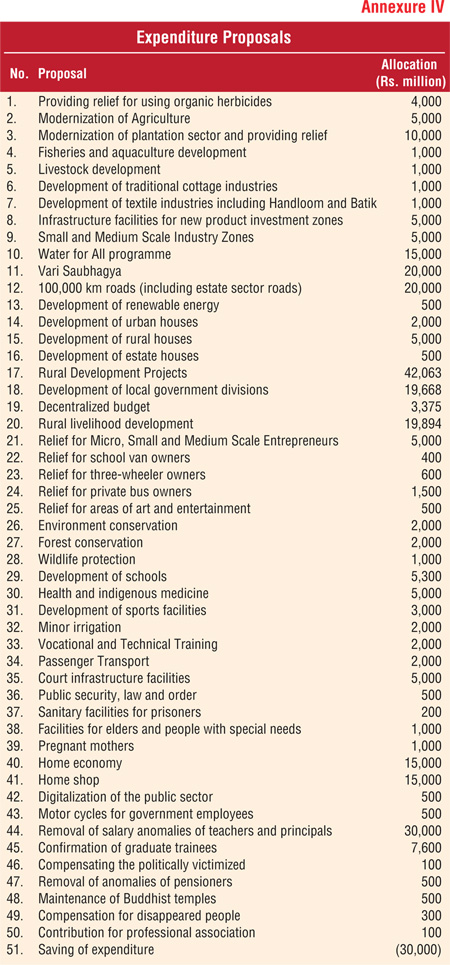

6.2 Honourable Speaker, accordingly, from now I will now present the Expenditure Proposals or the Investment Plan of the Government Financial Management Program for the Fiscal Year 2022.

6.3 Honourable Speaker, on 07 October, 2021, we presented to this House the Appropriation Bill on Government Expenditure. It outlines the major expenditure heads the Government expects to spend from the National Budget in the coming year. This is a tradition. We must protect it. While remaining within that tradition, we expect to further strengthen those expenditure heads. Within these Expenditure Proposals, or the Investment Plan, we expect to line up the development of the country through 10 key sectors.

6.4 Manufacturing economy and livelihood development

Honourable Speaker, in 1960, Sri Lanka's economy was better than that of Singapore and Malaysia. In 1961, the economy of Singapore was only $ 0.76 billion. At that time, the economy of Sri Lanka was at $ 1.44 billion.

Honourable Speaker, however, in 2020, Singapore's Gross Domestic Product was at $ 340 billion. Sri Lanka's Gross Domestic Product was only $ 81 billion. This highlights the extent of how much our economy is lagging behind.

Honourable Speaker, as such, what we need now is to move away from regressive policies and embark on a rapid economic development which fulfils the aspirations of the entire population.

Honourable Speaker, if we use the right economic management strategies, we can move forward similar to other emerging economies.

Honourable Speaker, we expect to strengthen the economy by facilitating the creation of new products, expansion of existing diversification, and value addition in order to increase the contribution to the Gross Domestic Product from the agricultural, service, and industrial sectors.

For this, we have considered the entire spectrum from small scale production to large scale production. For that, it is necessary to encourage small and medium scale enterprises through the coordination between the private and public sectors. We have prepared a well-designed program for that.

6.4.1. Agriculture sector

Honourable Speaker, more than 80% of our population is employed in the agricultural sector. As the manufacturing economy develops, the agricultural sector will inevitably take precedence. Therefore, the Government has decided to invest in the agricultural sector as has never been done before. We have identified a number of issues in the agriculture sector which need to be addressed by the Government.

Among them are;

• Unsettled land ownership

• Water inadequacy for crops

• Lack of access to high quality seeds

• Fertiliser problems

• Unnecessary administrative laws and regulations

• Lack of agricultural extension services

• Inadequate use of modern technology

• Lack of agricultural machinery and equipment

• Damages caused by animals and natural disasters

• Lack of adequate marketing facilities

• Underdeveloped internal infrastructure for rural agricultural products

• Lack of adequate and expeditious financial credit facilities for agricultural activities

6.4.2. Relief for farmers to encourage the usage of non-toxic weedicides

Usage of alternative weedicides and doing away with high-toxic chemicals are good agricultural practices to adopt. Therefore, in order to promote the usage of alternative weedicides, Rs. 4,000 million is allocated. As such, to minimise weeds and the use of weedicides in the preparation of lands for cultivation, it is proposed to provide a Rs. 5,000 grant per hectare up to a maximum of 2 hectares.

6.4.3. Promoting the use of organic fertilisers

The ‘Vistas of Prosperity and Splendour’ was formulated after a serious discussion with the people. Accordingly, a clear people's mandate was given to guarantee their right to a toxic-free diet. The development of a country relies upon working on long-term goals and objectives and not on short-term solutions. Therefore, we are committed to realise these objectives. We stand ready to support the farming community in this regard.

As such, within the larger organic economic framework, instead of the chemical fertiliser subsidy from the 2021/22 Maha season, every farmer will be provided with startup working capital to produce solid and liquid fertilisers, organic pesticides instead of chemical pesticides, and further financial support will also be provided to support farmers to incur additional expenses to remove weeds without using chemical weedicides. For this purpose Rs. 35,000 million is already allocated.

6.4.4. Introducing new agricultural technology

Honourable Speaker, in comparison to the developed countries in the world in terms of agriculture, we need to rapidly modernise the agricultural sector. For the introduction of new agro-technologies, I propose to allocate Rs. 5,000 million augmenting the already allocated Rs. 17,005 million in the Appropriation Bill.

6.4.5. Plantation sector

Honourable Speaker, to conquer the international market, our aim is to build a value-added plantation crop industry which is equipped with modern technology. Through that we expect to, increase foreign exchange earnings, and increase the planters’ income

In order to reap the maximum benefits of the plantation industry, it is necessary to ascertain the drawbacks in tea, coconut, rubber, cinnamon, pepper, coffee, citrus, vanilla, cardamom, cloves, and other export crops.

Accordingly, priority should be given to,

• Replantation of crops

• Gap filling

• New cultivations

Ensuring water supply can increase the productivity of these crops. In addition, we seek to encourage private investment and strategically win over the export market.

I propose to allocate a further Rs. 10,000 million for this purpose in addition to the amount allocated under the Appropriation Bill.

6.4.6. Fisheries and aquatic sector

Honourable Speaker, presently,

• Fisheries products,

• Fish farming in fresh water reservoirs,

• Brackish-water prawns cultivation,

• Ornamental fish farming, and

• Fish farming in domestic ponds are becoming vital sectors as an industry in our economy.

I am also delighted to state that our ornamental fish are in great demand in Europe and America. Even during the pandemic, the Government fulfilled all requirements to facilitate these exports. Amenities will be expanded to encourage the production of processed fish, dried fish, Maldive-fish, and canned fish.

Honourable Speaker, the fisheries and aquatic sector has a potential for further development.

Accordingly, in 2022, it is expected to release 196 million fingerlings into the 200,000 hectares of freshwater reservoirs and expect yield around 125,000 metric tons worth about Rs. 18,000 million. Numerous programs to develop and construct the fishing anchorages and fishing harbours are already underway.

I propose to allocate a further Rs. 1,000 million for these purposes in addition to the amount currently allocated under the Appropriation Bill.

6.4.7. Livestock sector

Honourable Speaker, Sri Lanka has already self-sufficient in eggs and poultry. Over a long period of time, the Government has implemented a series of programmes to meet the protein requirement of the public. As a result of such programmes, we could considerably increase the production of eggs and poultry. We were even able to export poultry in 2021.

But, it is apparent that we should strive harder with regard to milk production. We are spending a hefty fortune for importing milk powder. Therefore, we expect to increase milk production and enhance the consumption of fresh milk.

Further, in encouraging medium and large scale private sector investors to engage in the production of milk, eggs and poultry, the cost of raw materials and machinery should be minimised.

Accordingly, there is a need for further investment in the livestock sector. For this purpose, I expect to allocate Rs. 1,000 million in addition to the allocation already made under the Appropriation Act.

6.4.8. Traditional cottage industries

Honourable Speaker, from the olden times, Sri Lanka had been enriched through an agro-based culture. Our people were always engaged in creative arts whenever they got spare time. As a result, those creative arts developed as traditional cottage industries. We have already identified around 273 villages around the island such as Handessa, Thalagune, Thiththagalla, Paraduwa and Bambagahadeniya which are dedicated for industries such as rattan, Dumbara mats and brassware.

Honourable Speaker, these traditional industries embody our pride and identity. There are a number issues relating to their production. Among those, lack of raw materials is the main issue.

Honourable Speaker, it is required to infuse modern technology to these products, while enhancing their quality. It is our responsibility to remove the impediments that hinder the entry of their products into national and international markets.

Therefore, we have entrusted the responsibility of protecting and promoting of traditional cottage industries to a Ministry established just for that purpose. Therefore, I propose to allocate another Rs. 1,000 million in addition to the already allocated provisions for the development of traditional cottage industries including rattan, clay-based products, brass, lacquer, masks, coconut shell, jewellery, stone carving, flax fibre and Dumbara patterns.

6.4.9. Textile industry including handloom and batik

Honourable Speaker, in the past, Sri Lanka was also famous for textile industry like other countries such as India and China. Handloom industry is also a traditional industry with a long history. This industry was directly affected by the collapse of the tourism industry in recent times.

Similarly, Sri Lankan batik industry also accounts for a long history. It is a heritage of Sri Lanka. But, only a few people are seen to be studying the art. The high price of raw materials required for this industry could be one reason for this. However, there is a group of people among us who loves the art. There are a considerable number of people engaged in the art as a profession or as means of self-employment. A high demand for products of these industries can be created in local and international market through a well-planned approach. We have targeted an export income of $ 1 billion for handloom and batik products by 2025.

Hence, I propose to allocate Rs. 1,000 million for the development of textile industries including handloom and batik.

6.5 Investment zones for new products

Honourable Speaker, when basic human needs of food, air and water are met, they want an improved lifestyle. We have the opportunity to meet such demands. After meeting the domestic demand of those products, we can earn considerable foreign exchange by exporting these products. Therefore, we have paid attention to manufacturing products aimed at both the local and foreign markets and the re-export of products after value addition.

By doing so, we are striving to build an export oriented economy. We will create an integrated mechanism between the public and private sectors, we will assign annual targets for each export sector and intervene regularly to solve issues faced by exporters in meeting such targets.

Accordingly, there are number fields identified to enhance production. Amongst them, the following production sectors are important:

• Organic fertiliser production industries

• Pharmaceutical production

• Production of raw material for textile and apparel industry

• Rubber industrial products

• Export based agro-processing

• Livestock

• Agricultural equipment and machinery

• Fisheries and aquaculture development

• Production of chemical materials

• Electric and electronic appliances and IT products

• Production of sports equipment

• Steel and heavy metal industry

I invite the private sector to invest in these sectors. It is our responsibility to provide basic infrastructure for these investors. As such, we will provide land, electricity, water, access roads both internal and external, in establishing new investment zones and for which Rs. 5,000 million will be allocated.

Honourable speaker, we have identified the following areas to be developed as proposed investment zones for new products for each identified production sector:

• Organic fertiliser production – all agricultural districts

• Pharmaceutical production – Oyamaduwa, Millaniya and Arugambokka

• Production of raw materials for textile and apparel industry – Eravur, Monaragala, Puttalam and Kilinochchi

• Export based agro-processing zones – Mattala, Elpitiya, Hambantota and

• Jaffna

• Livestock production zones – Nawalapitiya, Wariyapola and Polonnaruwa

• Fisheries and aquaculture development zones through private investment - Puttalam, Mannar, Hambantota, Jaffna, Kokkadichole

• Production of chemicals – Paranthan, Pulmudei and Eppawala

• Investment zones for the production of electric and electronic appliances and IT based products – Henegama, Sooriyawewa, Kundasale and Homagama

• Manufacturing sports equipment – Hambantota and Sooriyawewa

• Steel and heavy metal industry – Mirijjawila

6.5.1. Small and medium scale enterprises at regional and district levels

Honourable Speaker, together with the provision of necessary facilities for large scale entrepreneurs under the investment zones for new products as mentioned above, it is also the responsibility of the Government to provide the required facilities to small and medium scale entrepreneurs.

There is a higher tendency to establish these small and medium scale enterprises in Colombo, Gampaha and Kalutara districts within the Western Province.

Therefore, necessary action are being taken to provide basic required facilities such as land, electricity, water, roads and fences to encourage them to establish their industries outside Western Province and shift industries from cities to villages.

Therefore, the Government has directed its attention to establish small and medium scale industries at divisional and district levels. A number of direct and indirect employment opportunities at divisional level will get created under this programme. I propose to allocate Rs. 5,000 million for this purpose.

6.6 Basic infrastructure development

Hon. Prime Minister Mahinda Rajapaksa kick-started making ‘Vistas of Prosperity and Splendour’ a reality by presenting the 2021 Budget. He stated the following in the Budget speech 2021.

“During the discussions HE the President has had with the people of the country at the time of the drafting of the ‘Vistas of Prosperity and Splendour’ policy document and after the formation of the new Government, we noted that the people do not demand subsidies or anything free from the Government. They unanimously requested rural schools to be provided with teachers of English, Science, Technological Studies and Sports with their children’s education in mind. They called for development of the rural hospitals for their basic healthcare needs. The children demanded that school playgrounds and proper sanitation facilities. Villagers requested rural roads to be built according to accepted standards in a way that they can carry out their day to day work. They also requested safe drinking water. They requested the Government to rehabilitate tanks and canals enabling them to be self-reliant in improving their livelihood activities. They requested us to protect their properties and children from wild animal attacks. Attacks from these infrastructure facilities, requests were also made to provide electricity, telecommunication and technology to the village. They requested a methodology to make their produce directly available in the market, and to obtain financing for their economic and social activities without any difficulties.”

Honourable Speaker, the basic infrastructure requirements are the foundation of development. This Government hope develop such infrastructure under 5 sectors.

6.6.1. Water for all