Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 3 January 2019 01:44 - - {{hitsCtrl.values.hits}}

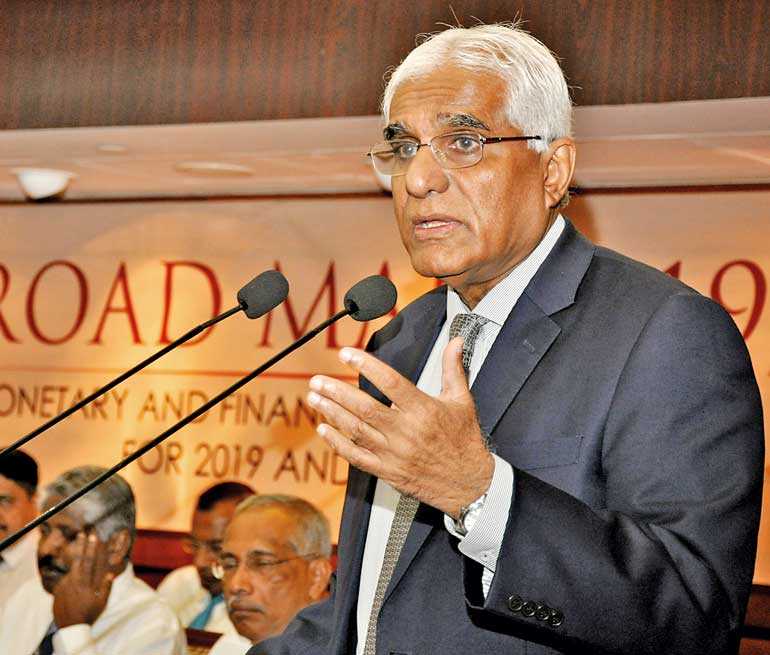

Road Map 2019, which outlines the monetary and financial sector policies for Sri Lanka this year and beyond, was presented by Central Bank Governor Dr. Indrajit Coomaraswamy on Wednesday. Given below is the Governor’s Road Map address in full:

Your Excellencies, members of the Monetary Board, Senior Deputy Governor, Deputy Governors, Assistant Governors and officials of the Central bank, distinguished invitees, ladies and gentlemen, it is a pleasure for me to warmly welcome you to the presentation of the Road Map of the Central Bank of Sri Lanka, which articulates the broad direction of monetary and financial sector policies for the period 2019 and beyond.

I am also pleased to mention that we are continuing with our tradition of sharing the future direction of policies through the twelfth Road Map of the Central Bank of Sri Lanka. The Road Map is a well received and important policy document which delivers several benefits to all stakeholders of the economy.

We expect that this announcement would guide and shape your own policies and plans effectively which will ultimately contribute to the overall economic development of the country and better living standards for our people.

Let me begin by explaining our policy stance and our assessment of the economy over 2018. The Sri Lankan economy faced heightened challenges in 2018, emanating mainly from the global economic, financial and geo-political developments that adversely affected the external sector. There were also several domestic challenges. Political uncertainties, especially during the last quarter of the year, amplified challenges to overall macroeconomic stability.

Sub-par economic growth continued in 2018 following subdued growth in 2017. Favourable weather conditions supported a rebound in the agriculture sector while the expansion in services activities has been broad-based.

However, industrial activities slowed in 2018 mainly due to the slowdown in the construction sector. Consumer price inflation remained low in 2018 in spite of temporary ups and downs due to volatile food prices and administrative price adjustments. In response to the tight monetary policy stance pursued by the Central Bank in the past two years, monetary and credit growth decelerated in 2018 from the higher levels observed in 2016 and 2017. An adequate expansion in domestic credit flows driven by demand from the private sector was witnessed during the year.

Being guided by these developments as well as considering impending risks and challenges, we followed a cautious approach in relation to the monetary policy conduct in 2018. Taking into account the favourable developments in inflation and the inflation outlook, as well as the subdued performance in the real economy, the Central Bank signalled the end of monetary policy tightening that commenced at end 2015, by reducing the upper bound of the policy interest rates corridor in April 2018. Nevertheless, considering the impact of global developments that affected external sector stability of the economy, the Central Bank maintained a neutral monetary policy stance in the ensuing period.

The sustained high deficits of rupee liquidity in the domestic money market compelled the Central Bank to reduce the Statutory Reserve Ratio (SRR) applicable on all rupee deposits of commercial banks in November 2018, while increasing policy interest rates to neutralise the impact on interest rates due to the permanent liquidity injection arising from the reduction in SRR. We followed this cautious approach with the broad aim of stabilising inflation at mid-single digit levels and anchoring inflation expectations to enable the economy to reach its potential in the medium term.

In the external sector, the growth in export earnings was outpaced by the expansion in import expenditure, although earnings from tourism, workers’ remittances, foreign direct investment (FDI) and debt related inflows to the Government helped cushion the balance of payments (BOP) to some extent.

The BOP experienced significant pressure on account of foreign exchange outflows caused by tightening global financial conditions and the strengthening of US dollar in view of monetary policy normalisation, particularly in the United States, as well as the widened trade deficit. Similar to the pressure that was observed in other emerging market economies, these developments resulted in a sharp depreciation of the Sri Lankan rupee particularly during the second half of the year.

The Central Bank intervened in the domestic foreign exchange market at times to prevent disorderly adjustments in the exchange rate, while allowing demand and supply forces of the forex market to determine its level and direction. The Government and the Central Bank introduced several short-term measures to address the pressure in the external sector, although the external sector developments once again highlighted the need for structural reforms to boost the tradable sector, particularly by enhancing merchandise and services exports in the medium to long run.

The external sector was also affected by political instability during the latter part of 2018. Political developments, compounded by concerns regarding fiscal slippage in the lead up to the elections, were significant causal factors in the decisions of all three major rating agencies to downgrade Sri Lanka’s sovereign ratings. This, in turn, negatively affected investor confidence.

However, such downgrading only on the premise of heightened political uncertainty and anticipated rather than actual fiscal slippage cannot be justified as there was no solid evidence of a deterioration in macroeconomic policies or fundamentals. This was evidenced by the good progress made in completing the fifth review of the Extended Fund Facility (EFF) of the International Monetary Fund (IMF) until 26 October 2018.

Sri Lanka continued to receive the assistance under the EFF and we received the fifth tranche of the program in June 2018. We look forward to the successful completion of the IMF EFF program in 2019. We are optimistic that the staff level agreement reached in principle with the IMF on the fifth review will proceed to the next level.

Although the Government continued its efforts towards fiscal consolidation, the performance on the fiscal front was rather mixed in 2018. Lower than expected revenue collection is likely to challenge the achievement of the targeted budget deficit for 2018. However, the primary balance is expected to record a surplus for the second consecutive year in 2018. This would be only the third time since 1955. Continued fiscal consolidation remains essential to build on the achievements already realised in the fiscal sector and to support the conduct of monetary and exchange rate policies without any fiscal forbearance.

As announced in last year’s Road Map, the Central Bank is progressing towards implementing flexible inflation targeting (FIT) as its new monetary policy framework by 2020. We have taken several policy initiatives to facilitate the transition to FIT during 2018. While maintaining appropriate policy coordination with the Government, we initiated the drafting of necessary legal amendments to strengthen the mandate of the Central Bank to maintain low inflation, while strengthening its autonomy, transparency and accountability.

During 2018, we were also able to implement several policy measures with a view to maintaining a stable financial system with subdued macroprudential concerns, while increasing the resilience of the financial system to global and domestic shocks. In order to strengthen the legal and regulatory framework of the financial institutions, a new Banking Act is being drafted, while also initiating amendments to other legislation related to the financial sector. Resolution actions for distressed companies were taken in the form of imposing stringent regulatory actions such as restriction on business as well as suspension and cancellation of licences. Consolidation will be encouraged both in the banking and non-bank sectors through steady increase in capital requirements. Priority will be attached to achieving sustainable structures in both the banking and non-bank sectors in an orderly manner. It is our intention to send out the clearest possible signal that there will be no regulatory forbearance.

We also continued to take measures to strengthen the payment and settlement infrastructure in line with our statutory responsibility of developing an efficient and stable national payment and settlement system capable of catering to the country’s growing payment needs. To promote digital payment mechanisms in the country, a national standard for QR code based payments was introduced during 2018, while progress was made in establishing the National Card Scheme. The Central Bank also continued to perform its currency management function to facilitate smooth transactions in the economy, while taking measures to preserve the quality of currency notes in circulation.

Priority was also attached to strengthen the Central Bank’s agency functions in 2018. Public debt management was carried out in a way that the Government’s financing requirements were met at the lowest possible cost with a prudent degree of risk, while aiming to maintain debt sustainability. There was continued focus on sustaining the transparency and efficiency of the auction system for Government securities as well as on developing a viable medium term debt management strategy. In consultation with Government, we also initiated actions to implement liability management exercises on future debt obligations based on the newly-enacted Active Liability Management Act (ALMA).

The liberalisation of foreign exchange transactions was advanced with the introduction of the Foreign Exchange Act No. 12 of 2017 (FEA). Procedures for inward capital flows were further simplified and streamlined for smooth transferring of funds for investment, while limits for outward capital flows were enhanced in selected areas giving local investors access to a wider global market.

|

Central Bank Senior Deputy Governor Dr. Nandalal Weerasinghe |

As a facilitator, the Central Bank continued its development finance and regional development activities during 2018 with the broad aim of enhancing inclusive and balanced economic growth and financial inclusion in the country. Progress was made in formulating the National Financial Inclusion Strategy. Further, the Central Bank worked towards improving Sri Lanka’s global position with regard to the implementation of Anti-Money Laundering and Countering the Financing of Terrorism regulations and we entered into new MOUs with several Government bodies and institutions during 2018. We are working towards Sri Lanka being removed from the Financial Action Task Force’s (FATF) ‘grey list’ by mid-2019.

A number of measures have also been taken in the pursuit of greater accountability and transparency. In particular, following the recommendations of the Presidential Commission of Inquiry to Investigate, Inquire and Report on the Issuance of Treasury Bonds, measures are being taken to strengthen several laws applicable to the Central Bank. Measures were also taken to reform the operations relating to the issuance of Government securities, introduce a new investment policy framework for the EPF, strengthen internal audit and introduce the code of conduct for employees and the members of the Monetary Board. The procurement process for several forensic audits is underway, and forensic audits are to be conducted by entities with global practice.

In a challenging global and domestic environment, the Central Bank is steadily improving its policy frameworks to mitigate possible risks and thereby achieve its broad objectives of economic and price stability and financial system stability. Our actions would be effective and yield desired outcomes only if certain conditions are met, especially the commitment of the Government to macroeconomic stability. Given the prevailing low growth trajectory, growth promoting policies and structural reforms are much needed priorities for the Government. This must, however, be done without disrupting the fiscal consolidation process. For this to happen, the enabling environment must be created for the private sector to play a more active role. We need consistent and predictable policies from the Government and a more dynamic and entrepreneurial mindset from businesses.

The Government’s initiatives aimed at improving the economic and social infrastructure of the country, enhancing productivity, up- scaling skill levels of the labour force as well as expanding domestic production capacity are vital elements to support an accelerated and sustainable level of economic growth, while maintaining a continued low inflation environment. Timely implementation of consistent and coordinated policies in a coherent manner is also essential to ensure the realisation of the expected outcome of such policies. In this context, this Road Map intends to set the basis for strong policies and credible frameworks to achieve macroeconomic stability with the support of the Government and private sector stakeholders.

The outline of the Road Map 2019 is as follows:

Section 2: The Central Bank’s monetary policy strategy and policies for 2019 and beyond

Section 3: The Central Bank’s policies related to the financial sector performance and stability in 2019 and beyond

Section 4: Policies Related to Ancillary and Agency Functions

Now, let me elaborate further on these aspects.

Monetary policy strategy and policies for 2019 and beyond

The Central Bank conducts monetary policy in an increasingly forward-looking manner with the aim of maintaining inflation at low and stable levels in the medium-term, thereby supporting the economy to reach its potential.

In 2018, the Central Bank conducted its monetary policy in a challenging environment with rapidly evolving adverse global conditions as well as several upside and downside risks on the domestic front. New developments in the global economy in the wake of rate hikes in the United States and the economic normalisation in most advanced economies have demanded monetary authorities around the world to adjust their monetary policies accordingly. The Central Bank of Sri Lanka also had to consider domestic developments, such as the depreciation pressure on the currency due to capital outflows and the widening trade deficit, subpar economic growth, deceleration in monetary aggregates and credit, moderate levels of inflation as well as continuing deficit liquidity conditions in the money market.

The tight monetary policy stance pursued by the Central Bank, since end 2015, by way of raising the Statutory Reserve Ratio (SRR) and policy interest rates yielded the desired outcomes, especially on demand driven inflation and trends in money and credit aggregates compared to 2016 and 2017.

Such developments, in particular, the favourable developments in inflation, inflation outlook and the trends in the monetary sector, in an environment of lacklustre growth performance, induced the Central Bank to signal the end of the tightening cycle in early April 2018, by way of reducing the Standing Lending Facility Rate (SLFR) by 25 basis points. Nevertheless, global economic conditions and the pressure on the exchange rate has compelled the Central Bank to maintain a neutral monetary policy stance since April 2018.

In the conduct of monetary policy, market based policy tools, particularly policy rates and open market operations (OMOs) were widely used, while the SRR was also used as a tool of injecting liquidity to the market on a permanent basis. In view of the large and persistent shortage in rupee liquidity, the Monetary Board decided to reduce SRR applicable on all rupee deposit liabilities of commercial banks to 6% from 7.50% in November 2018.

The reduction in SRR released a substantial amount of rupee liquidity to the banking system, which could have led to a reduction in interest rates and excess aggregate demand. Therefore, in order to neutralise the impact of the SRR reduction and maintain its neutral monetary policy stance, the Central Bank raised policy interest rates simultaneously.

Since the announcement of the transition towards FIT, we have broadly maintained low levels of inflation in spite of some occasional upticks and downturns due to various demand and supply shocks stemming from the external and domestic fronts. Benefiting from prudent and proactive monetary policy measures that were also supported by several macroprudential measures, monetary expansion was contained at desired levels, thereby supporting the maintenance of low levels of inflation during 2018.

As you all know, the Central Bank has an unblemished track record of maintaining single digit inflation continuously for a decade. This also shows the Central Bank’s strong commitment to price stability, which it considers to be of utmost importance to create an enabling environment for the economy to achieve an accelerated trajectory of economic growth, to uplift the standards of living of the people. The Central Bank will be resolute in preserving this achievement of a low inflation environment going forward irrespective of domestic and international challenges that we may face in future.

This is the prime reason why the Central Bank has embarked on a mission to upgrade the monetary policy framework with a view to strengthening the ability of the Central Bank to deliver sustained price stability amidst a rapidly evolving environment characterised by elevated uncertainty. During the year 2018, significant progress was made towards the transition to FIT in terms of initiating necessary amendments to the Monetary Law Act (MLA) with a view to establishing a strong Central Bank mandate, building effective fiscal monetary coordination and further improving technical and institutional capacity.

Let me elaborate on a few important areas in relation to the progress towards FIT. Last year, we highlighted the need and the importance of strengthening the existing mandate of the Central Bank to perform its key tasks related to price stability. It is widely accepted that a strong legal mandate is an essential prerequisite for the successful adoption of FIT as it is considered the linchpin that holds the entire framework together. Hence, as an important step, the approval of the Cabinet of Ministers was obtained in principle to introduce comprehensive amendments to the MLA, particularly in the areas of strengthening Central Bank independence and facilitating the adoption of FIT as the monetary policy framework, in addition to other amendments to improve governance of the Central Bank, strengthen financial sector oversight and also to boost fiscal-monetary coordination.

Accordingly, the Central Bank, assisted by legal experts from the International Monetary Fund (IMF), is in the final stages of drafting the revisions to the MLA, which will address long standing concerns, such as the focus on non-core and quasi-fiscal activities, monetary financing as well as limits to Central Bank autonomy by way of clearly demarcating the powers and functions related to monetary policy. In addition, the remit of price stability will be elevated to the status of the prime objective of the Central Bank.

The revised legislation will also facilitate institutional arrangements for setting inflation targets and improvements to monetary operations, as well as macroprudential tools. These legislative amendments would not only improve the overall focus of the mandate but would also boost the credibility of the Central Bank through an enhanced governance framework and autonomy as well as greater accountability and transparency of the Central Bank. We expect to submit the amended MLA to the Cabinet of Ministers and the Parliament for approval this year.

Another important element in our transition towards FIT is improving the skills, capabilities and capacities of our staff as well as the systems and procedures to establish a solid framework for forward-looking monetary policy conduct. A key step towards this advancement was when we partnered with the IMF, four years back, to develop a comprehensive, model-based Forecasting and Policy Analysis System (FPAS) to enhance the monetary policy decision making process. Substantial progress has been made in this regard, yielding a marked improvement in the modelling and forecasting capacity of the Central Bank, thereby enhancing the forward-looking monetary policy decision making process. The details of this modelling framework are in the public domain now.

Going forward, the Central Bank will focus on devoting resources towards further improving technical capacity and infrastructure, which would help generate timely and reliable model-based projections for macroeconomic analyses. The Central Bank has already planned to launch a number of new surveys and compile an array of new indicators to support monetary policy analysis. We continuously endeavour to improve the existing data collection and compilation efforts. These include several production trends related early warning indicators, upgraded price indices, extension of PMI surveys to sectors that need focused attention, and several digitalisation initiatives.

We are also in the process of further expanding the household sector Inflation Expectations Survey (IES) beyond the Colombo District through the Country-Wide Data Collection System (CWDCS) with the intention of improving its coverage and precision.

As we have highlighted on many occasions, strong commitment and the support from the Government is essential towards adopting FIT as the framework for monetary policy. It is heartening to note that the Government has recognised FIT as the prospective monetary policy framework for Sri Lanka and it has been adopting policies aimed at fiscal consolidation in the medium to long run. We welcome Government’s efforts related to revenue based fiscal consolidation, which is aimed at raising revenues, while rationalising expenditure of the Government.

We expect that implementing the new Inland Revenue Act, improving tax administration supported by the full roll-out of the RAMIS system and improving tax compliance will be instrumental in raising revenues. In addition, introducing measures to rationalise expenditure, strengthen public debt management through the enactment of the Active Liability Management Act, No. 8 of 2018 (ALMA) and introduce required reforms to State Owned Enterprises (SOBEs) as well as reinforce the Medium Term Debt Management Strategy (MTDS) aiming to contain the exposure of foreign currency liabilities were all encouraging moves by the Government.

Similar to other country experiences, the inflation target in the FIT framework is expected to be decided jointly by the Government and the Central Bank. Hence, the FIT framework requires these two institutions to work together, as there should be no misalignment between fiscal and monetary policy.

The Central Bank will continue to resort to active OMOs to manage liquidity in the money market, thereby guiding the short-term market interest rate, which is the key operating target to navigate inflation in the targeted range. I wish to emphasise the fact that OMOs are a strategy to manage market liquidity to align short term market interest rates with the policy stance and not a mechanism to print new money by purchasing or holding Treasury bills by the Central Bank as wrongly interpreted by some analysts.

A clear distinction must be made between such OMOs, widely practiced by central banks, and monetising the fiscal deficit through the central bank purchasing Treasury bills issued on behalf of the Government. Further, we have implemented several measures to provide more information to market participants thereby facilitating an efficient price discovery process in the financial markets.

The Central Integrated Market Monitor (CIMM) system was introduced in January 2018. The system captures vital market information from the call money, the Government securities and the foreign exchange markets. Daily liquidity estimation was further improved with the implementation of the liquidity reporting system through the CIMM. Further, a policy intervention by way of restricting non- bank primary dealers from participating in OMO auctions was made in the money market with a view to strengthening the signalling effect of OMO auctions. Non-bank primary dealers continued to enjoy access to standing facilities and the intra-day liquidity facility. Meanwhile, at the most recent policy rate adjustment, we narrowed down the policy rate corridor to 100 basis points with a view to reducing the volatility in overnight interest rates.

Looking ahead, we are in the process of exploring the feasibility of a single policy rate instead of the current corridor system to give clearer signals on the interest rates, reduce volatility in the call money rate and increase the transparency in the monetary implementation process. Also, the hair cut policy relating to the pricing of securities will be reviewed in line with international best practices to ensure smooth operations in the money market. We will be looking into expanding money market activities in a comprehensive manner by introducing new instruments such as Interest Rate Swaps (IRS) and non-deliverable forwards (NDF).

In order to improve the competitiveness of the banking sector, the Central Bank is also planning to introduce a more cost reflective alternative benchmark interest rate, which will be based on the marginal cost of banks.

Although we do not consider the exchange rate as an objective of monetary policy conduct, a market-based exchange rate remains key instrument to facilitate the inflation targeting framework. To this end, the Central Bank will continue to follow a more market-based exchange rate system, allowing the exchange rate to act as the shock absorber in the envisaged FIT framework. The FIT framework brings about a qualitative change in the pass-through of the effects of currency deprecation onto the overall rate of inflation. By adopting forward looking and proactive monetary policy formulation, the cost-push effects of depreciation can be countered by managing aggregate demand through interest rate adjustments to ensure inflation remains within the targeted range.

Being guided by this principle, since September 2015, we have allowed greater flexibility in the exchange rate. However, during 2018, we saw a significant depreciation of the exchange rate amidst global market conditions, particularly with the surge in capital outflows, increased pressure on the current account as well as excessive speculation in the market. During such times, we need to ensure orderly adjustment in markets. Hence it was necessary for the Central Bank to intervene in a prudent manner without sacrificing much of our reserves.

Going forward, the Central Bank will continue to adopt an exchange rate policy, with cautious interventions at times of excessive volatility in the forex market. This policy is also designed to maintain the competitiveness of the exchange rate and support the rebalancing of the current account, thereby supporting a gradual build-up of foreign exchange reserves as an external buffer.

Due to the reversal of foreign capital flows in view of rising global interest rates, the country’s ability in financing the current account deficit through financial flows, while strengthening reserves, would be a challenging task. Without achieving a sustainable deficit in the current account and attracting long term, non-debt creating financial flows in the form of Foreign Direct Investments (FDI), the external sector will remain vulnerable even in the medium and long term. Hence, a rapid boost in exports and FDI should be the priority for policymakers, without which the external sector will remain vulnerable to short-term domestic and external shocks.

A significant growth of merchandise exports of at least 10% with annual FDI flows in the range of $ 2 to 3 billion, supported by healthy earnings in the services sector and continuing contributions from workers’ remittances are needed to ensure a gradual rebalancing of the current account and a strong financial account. Hence, sustained measures are needed to improve investor confidence to ensure that short term vulnerabilities are not translated into long term structural deficiencies.

Foreign reserve management activities of the Central Bank will continue to be based on a model based Strategic Asset Allocation (SAA) framework, which was developed with the support of the Reserve Advisory and Management Program (RAMP) of World Bank. This methodology is expected to ensure that foreign reserves are managed with the objective of ensuring an adequate level of liquidity, a reasonable return in comparison to the benchmarks and to exploit any active strategies with the view of making an excess return if the market conditions permit. Further, the Central Bank is in the process of introducing a superior alternative USD/LKR reference rate for the benefit of all stakeholders, including foreign investors.

As you are aware, in view of the deterioration in the BOP and to support the Government’s reform agenda, Sri Lanka obtained a three-year Extended Fund Facility (EFF) from the IMF, in 2015, and we have already received five tranches of this Facility. Although the developments over the past weeks have delayed the progress that Sri Lanka has been making under the IMF Program, we hope to keep the IMF Program on track this year. While this will categorically support the country’s external sector, the reforms would also help boost investor confidence and productivity of the economy.

These are key drivers in enhancing growth of the economy. As inflation targeting involves managing and anchoring inflation expectations effectively, transparency of monetary policy, particularly in terms of plans, objectives and decisions, is of utmost importance. Hence, as transparency is achieved through effective communication, as a prospective inflation targeter, the Central Bank is very conscious of the need for a well devised communication strategy.

Accordingly, a number of initiatives have already been taken by us to enhance the communication strategy. We have enhanced the analytical value of the regular monetary policy press releases with the support of the IMF, while maintaining clarity, simplicity and enhancing the forward looking approach. In addition, we have initiated programs on educating, particularly journalists and other stakeholders, regarding FIT. Further, several measures are in the pipeline, including the issuing of regular Monetary Policy Reports, which will be developed into Inflation Reports in the future and expanding the public awareness outreach program, which will be implemented during next two years as set out in the road map for FIT.

As another important step, we re-commenced publishing an advance release calendar for regular monetary policy announcements last year. Continuing this practice, we wish to present the advance release calendar for monetary policy announcements for the year 2019 as set out below.

Currently, although the global economy is somewhat less robust than it was in the first half of 2018, the pace of global growth remains strong pointing to further normalisation of monetary policy in major economies. This has necessitated most emerging market economies to adjust their monetary policy in view of addressing economic imbalances associated with capital flows, currency depreciation, trade wars, etc. Taking such trends into consideration and responding to domestic economic developments, we will continue to remain vigilant in formulating our monetary policy to ensure sustained economic and price stability in Sri Lanka.

Financial sector policies for 2019 and beyond

In fulfilling the responsibilities entrusted by the MLA, the Central Bank continues to foster a vibrant, resilient and strong financial sector, which facilitates economic growth through efficient allocation of resources. In pursuit of this, the Central Bank acts as the apex regulatory and supervisory institution of the financial system. It seeks to promote dynamic and stable financial institutions, while facilitating an efficient payment and settlement system.

In 2018, the financial sector performed well amidst challenging market conditions in the domestic as well as the global environment. Asset growth of the banking sector was at favourable levels with the improvements in liquidity and capital levels, while financial outreach also strengthened during 2018, despite the slowdown observed in the non-bank financial sector.

Strengthening the regulatory and supervisory framework of the banking sector remains at the centre of our financial sector policy. During 2018, the regulatory and supervisory framework pertaining to licensed banks was further strengthened with the introduction of an array of policy measures in line with international standards and best practices. During 2018, the Central Bank issued Directions on Basel III liquidity standards and Directions on leverage ratio. The Directions on leverage standards are also being issued. In addition, the Central Bank issued Directions on foreign currency borrowings by licensed banks with a view to promoting transparency and further strengthening risk management aspects of foreign borrowings by banks.

Meanwhile, to strengthen risk management, the Central Bank issued Directions on financial derivative transactions of licensed banks. A regulatory framework for appointment of agents was also issued. The Direction largely focuses on the approval and selection process of agents, responsibilities of banks, permitted activities, risk management and oversight, customer protection and dispute resolution.

Further, adoption of Sri Lanka Financial Reporting Standards 9 on financial reporting of financial instruments is another progressive policy measure adopted in line with international best practices. The Central Bank also issued guidelines to banks on the adoption of SLFRS 9 in consultation with the Institute of Chartered Accountants of Sri Lanka for consistent and prudent application of standards.

The Central Bank has already initiated drafting a new Banking Act with a view to further strengthening the regulatory framework pertaining to licensed banks. The overall mandate for supervision and regulation, strengthening corporate governance, digital banking, consolidated supervision, resolution, monetary penalties/fines, ring-fencing, mergers, acquisitions and consolidation, subsidiarisation of foreign banks and differentiated regulatory frameworks for a tiered banking structure are the key policy aspects to be factored into the proposed Act. In addition, the Banking Sustainability Rating Index (BSRI) will be implemented from 2019 for risk based supervision and planning the supervisory calendar.

As banks are frequent targets for cyber-attacks and other information security threats, a road map and a consultation paper were issued to improve technology risk resilience in the banking sector in line with international standards and best practices. A Banking Direction in this regard will be issued in 2019.

As the regulator, we believe that share ownership in banks needs to be broadbased to strengthen corporate governance and to avoid ownership concentration, dominance in the boards, conflict of interest and risks associated with related party transactions. Therefore, the existing requirements on share ownership will be reviewed and certain additional measures will be brought in. In addition, fit and proper assessment criteria for appointment of directors, CEOs and key management personnel of banks will be strengthened further to appoint the most suitable and qualified individuals to the top positions in banks. Only persons with proven track records of good conduct and financial integrity would be considered for such appointments.

Moreover, a broad-based policy on employment of expatriate staff considering the needs for external expert contribution will be introduced. Considering the significant developments in the banking environment and the professional accounting/auditing landscape, the minimum criteria for appointment of external auditors has already been reviewed and the panel of qualified auditors will be amended accordingly.

With a view to further strengthening the market conduct and practices of treasury operations of licensed banks, the Central Bank intends to establish a new regulatory framework to ensure that treasury operations of licensed banks are carried out prudently and in line with the international best practices. The Central Bank will also formulate a crisis preparedness plan for the banking industry, to minimise the adverse impact on troubled banks and mitigate spillovers. A consultation paper will be issued to banks in this regard.

As we firmly believe in the need for strengthening inter-regulatory cooperation and collaboration, a Memorandum of Understanding was signed between the Central Bank, Securities and Exchange Commission and Insurance Regulatory Commission on risk based consolidated supervision where the Central Bank will be the lead regulator.

As we have reiterated on many occasions, market driven consolidation will be facilitated with the objective of promoting strong and dynamic banking and non-bank financial institutions to meet financial needs of the economy more effectively, while safeguarding the stability of the financial system.

The performance of Licensed Finance Companies (LFCs) and Specialised Leasing Companies (SLCs) slowed down significantly during 2018 due to low credit growth, declining profitability and increasing nonperforming loans. The slowdown in the sector was also a result of moderate economic growth and the impact of natural calamities, such as floods and drought conditions that prevailed in 2017 and the first half of 2018. Policy measures taken to curb excessive demand for vehicle imports also impacted the sector significantly.

Several regulations were introduced to strengthen non-bank financial institutions during 2018. A financial customer protection framework was introduced to protect customer interests and to strengthen customer confidence in the sector.

A new capital adequacy framework for LFCs and SLCs was implemented with a view to fostering a strong emphasis on risk management and to encourage ongoing improvements in the risk assessment capabilities of the sector. In terms of the new framework, companies with assets over Rs.100 billion are required to maintain higher capital adequacy ratios.

Moreover, a new Direction on Outsourcing of Business Operations was introduced to standardise outsourcing arrangements. A Direction was issued to regularise the valuation procedure of the LFCs and SLCs regarding immovable properties. In the interest of depositors and stability of the system, several resolution actions were taken in relation to distressed companies during 2018, including cancellation of some licences and introducing regulations on winding up LFCs.

Going forward, the sector needs to cope with enhancement of the minimum capital requirement and higher loan loss provisioning with the introduction of Sri Lanka Financial Reporting Standards 9. Further, the change in the regulatory posture of the Central Bank will result in early interventions against noncompliant, distressed and high risk LFCs. This will include regulatory actions, such as the restriction of business through deposit and lending caps as well as suspension and cancellation of licences. Further, guidelines are expected to be issued applicable for financial reporting of LFCs and SLCs. We will also consider issuing directions on the ownership limits.

Also, capital levels of the sector are expected to be strengthened as a result of enhanced capital requirements. The LFCs and SLCs, which are unable to comply, will be encouraged to consolidate on a voluntary basis. Non-compliance will result in restrictions on deposit and business expansion and, where necessary, winding up of businesses. Therefore, it will be necessary for LFCs to give priority to capital augmentation plans in the near future. There will be no regulatory forbearance in this respect.

Initiatives are being taken to resolve remaining distressed companies, as per the provisions of the Finance Business Act (FBA), No.42 of 2011. Licenses of two distressed companies were cancelled and the settlement of the liabilities of existing depositors under the Sri Lanka Deposit Insurance and Liquidity Support Scheme (SLDILSS) is currently underway. Amendments are proposed to the FBA to facilitate expeditious resolution actions in respect of distressed finance companies.

During 2018, the Central Bank continued its efforts to strengthen the payment and settlement infrastructure of the country, while developing an efficient national payment and settlement system, which is capable of catering to the growing payment needs of the economy.

Let me mention some of these initiatives briefly. Approval has been granted to LankaClear (Pvt) Ltd to implement a National Card Scheme (NCS) under the brand name ‘LankaPay’ in partnership with an international card scheme. This system was launched 2018 with a licensed commercial bank commencing to issue LankaPay cards.

As a result of the emergence of new payment technologies across the globe and the interest shown by local institutions to keep abreast of these technologies, the National Payments Council, which is the consultative committee on payment and settlement systems, appointed two committees to study developments in the Financial Technology (FinTech) sector and Blockchain technology. As per the recommendations made by the FinTech Committee, a National Quick Response (QR) Code Standard for Local Currency Payments branded as ‘LANKAQR’ was issued to all financial institutions and operators of mobile phone based electronic money (e-money) systems to facilitate QR code based payments. Similarly, with regard to Blockchain technology, an inter-industry working committee is preparing a framework for a Blockchain based shared know-your-customer (KYC) solution.

Further, the Central Bank appointed a taskforce to study on virtual currency schemes to examine regulatory steps that need to be taken to ensure system stability and the safety of public funds. In addition, several regulations were issued, in 2018, to ensure safe and efficient payment and settlement systems in the country.

As for future plans and policies, the Central Bank will focus on promoting digital payment mechanisms to establish a less-cash society with a view to reducing cash management costs while enhancing safety and convenience. Accordingly, we will facilitate the implementation of a National Transit Card and Infrastructure Framework for ticketing and fare collection for the purpose of introducing a nationally accepted transit card for the country to be used in bus and rail transport. We will also continue to adopt measures to promote the usage of digital payment mechanisms by way of encouraging financial institutions to enable digital payment methods and creating awareness among general public on digital payment options and their benefits.

It is also planned to establish a regulatory sandbox to enable introducing innovative FinTech products, while ensuring compliance with regulatory requirements.

It is expected that these policies and measures will create the necessary environment for Sri Lanka to move into virtual banking and benefit from advanced technologies. We therefore, invite financial institutions to join these initiatives without delay.

It is also a notable fact that the Sri Lankan financial system has become more interconnected and complex than ever before and more susceptible to shocks. Accordingly, the Central Bank recognises the importance of a more comprehensive macroprudential approach, which goes beyond supervision at individual firm level to look at broad market and economic factors that could have a material impact on the overall financial stability of the country.

As we have already mentioned, stability of the financial system was preserved in 2018 amidst challenging market conditions with the help of timely macroprudential measures in addition to microprudential supervision and regulation. In this regard, a number of measures were taken by the Central Bank and the Government to address the emerging systemic risks affecting financial system and macroeconomic stability. The imposition of Loan to Value (LTV) ratios on motor vehicle related lending, imposing margins on Letters of Credit (LC) on the importation of selected vehicle categories and non-essential items were among the policy measures taken by the Central Bank to mitigate emerging risks. The Central Bank will continue to resort to macroprudential measures to stabilise the overheating sectors in the economy, which can undermine system stability. We expect to incorporate provisions for a stronger macroprudential framework into the proposed amendments to the Central Bank law.

There are new areas that we are looking to operate under the macroprudential surveillance framework of the Central Bank. These include analysing trends in banking sector and non-banking sector exposure to the corporate sector, assessing the impact of dynamic provisioning frameworks on the banking sector, analysing financial sector exposure to the household sector, evaluating the possibility of introducing Escrow accounts to safeguard the residential property buyers and to achieve long term stability of the real estate market as well as commencing multivariable stress tests for LFCs covering credit, market and liquidity risks.

We have recognised risk management as a key strategic priority of the Central Bank, and we are in the process of implementing an Enterprise-wide Risk Management (ERM) Framework, which is intended to promote a culture of informed risk-taking at all levels. Accordingly, the Risk Governance Framework and the Risk Management Policy of the Central Bank were approved by the Monetary Board in 2018, and relevant committees were formed and meetings were convened to make the framework functional. We expect to develop Risk Registers and implement an Incident Reporting Mechanism in 2019.

With regard to financial risk management, we will further strengthen the risk management framework of the fund management activities. With the growing priority being attached to achieving the Sustainable Development Goals (SDGs) as well as promoting greener and climate friendly growth activities by providing productive and sustainable investment, the Central Bank initiated a process of promoting sustainable finance practices in Sri Lanka in 2017. Accordingly, with the view of providing policy direction to the financial sector, the Central Bank is in the process of developing a ‘Road Map for Sustainable Finance in Sri Lanka’.

For this process, we are obtaining the technical assistance from International Finance Corporation of the World Bank (IFC-WB) and financial assistance from the United Nations Development Program (UNDP). Going forward, we intend to launch the ‘Road Map for Sustainable Finance’ during 2019 which would serve as a reference for all stakeholders in formulating their own sustainable finance policies.

Policies related to ancillary and agency functions

In addition to our core functions, we have effectively performed several ancillary and agency functions as well. We have performed these functions to support the smooth functioning of the economy and the financial system, thus contributing to strengthen the broader economy.

Currency management

The Central Bank has the exclusive right to issue currency notes and coins on behalf of the Government. During 2018, we continued to perform this function as per our mandate. In spite of increased use of technology driven non-cash modes of payment, demand for currency notes and coins increased in 2018 in line with the expansion of the economy. In 2018, we launched a new coinage and issued a commemorative currency note and a coin. Further, we have introduced policy measures against wilfully altered, defaced or mutilated currency notes in order to preserve the quality of currency notes in Sri Lanka. We also conducted an array of awareness programs for the general public on our clean note policy.

Going forward, to improve currency operations and processes, the construction of a new secure storage facility has been initiated at the Centre for Banking Studies premises in Rajagiriya. The facility is expected to be operational from 2019. As a medium-term solution to redesign the current operational flow with the introduction of new machinery and equipment. We plan to issue a new note series, in 2021, with a view to enhancing the quality of currency notes. We are also planning to establish a proper mechanism to distribute coins and to introduce coin vending machines. Further, we intend to enhance contingency storage capacity for currency with selected Regional Offices, while introducing a stronger monitoring system for Cash in Transit (CIT) companies.

Public debt management

As the fiscal agent of the Government, we continued to issue, service and manage public debt during 2018 with transparency and prudence and initiated several policies to ensure that the Government’s financing requirements are met at the lowest possible cost with a prudent degree of risk, while ensuring debt sustainability.

During 2018, we encountered several challenges in Government debt management due to interest rate normalisation in the US, the skewed Government financing requirement as well as uncertainties in the political sphere. These factors affected the Government’s borrowing cost and imposed pressure on achieving targets under the Medium-Term Debt Management Strategy (MTDS), particularly towards the latter part of 2018 with the upward adjustment in yield rates and market preference for short to medium term maturities.

The new Treasury bond issuance system, which was introduced, in July 2017, was reviewed at the end of first quarter of 2018 taking into account the performance of the issuance system and the feedback from market participants to further enhance the efficiency and transparency of the issuance process of Government securities. Several improvements, including an enhanced market based acceptance arrangement as a prerequisite for the activation of phase III are to be introduced to the Treasury bond issuance system, by the end of the first quarter of 2019.

Further, the auction calendar for Treasury bonds and Treasury bills was published by the Central Bank on a rolling basis with the view of improving transparency and predictability of the primary auction process and the Government securities market in general.

We are contemplating taking several measures to develop market and debt management practices in 2019. With the passage of the Active Liability Management Act (ALMA), in March 2018, we have laid the groundwork for liability management exercises in the domestic and foreign market. In consultation with the Ministry of Finance, we have already earmarked actions to implement liability management techniques on future debt obligations and the proceeds mobilised would be maintained in a ring-fenced arrangement to meet future debt liabilities.

With the view of enhancing the transparency and tradability in the secondary market, measures are being taken to introduce a new primary issuance system for Treasury bills. A distinct electronic trading platform, with a central counter party (CCP) arrangement for Government securities, along with required legal reforms to deepen and broaden the secondary market for Treasury bills and Treasury bonds, as well as a mechanism to disseminate secondary market information on debt instruments through the proposed e-trading platform and a clearing house are to be established.

In addition, the Medium Term Debt Strategy (MTDS) is to be further streamlined with the assistance of multilateral agencies. Further, we will introduce amendments to the Local Treasury Bills Ordinance (LTBO) and Registered Stock and Securities Ordinance (RSSO) to ensure smooth and efficient functioning of the debt management system. In view of the increased volatility in global financial markets, we also intend to reduce the threshold for foreign investment in rupee denominated Government securities from 10% of the outstanding Government securities stock at present to 5%.

Management of the Employees’ Provident Fund In discharging powers and duties vested with the Monetary Board in relation to the largest superannuation fund in Sri Lanka, Employees’ Provident Fund (EPF), the Central Bank has strived to improve the services provided to its stakeholders, while ensuring the enhancement of the return to members and the safety of the Fund.

During 2018, the EPF continued its fund management activities to enhance returns by aligning the investment strategy with market conditions. Also, several measures were taken to improve the overall risk management framework of the EPF with a view to enhancing accountability and the transparency of investment activities. As a part of this process, new Investment Policy Statement and Investment Guidelines were introduced. The governance structure of the EPF risk management was also strengthened through the establishment of an EPF Investment Oversight Committee in addition to the EPF Investment Committee to monitor investment activities.

With the assistance of the Asian Development Bank (ADB), EPF carried out a Business Review with the objective of streamlining and improving its current activities. In addition, the actions pertaining to procuring a new ICT system to automate EPF activities were continued with the assistance of Word Bank. With a view to facilitating web based services, we developed the EPF website and it is expected to be launched shortly. Real time validation of member details and the member account updating procedure were continued through online banking systems of LCBs in 2018.

Going forward, EPF expects to generate the highest level of risk adjusted return through different investment strategies, while adhering to the new Investment Policy Statement and Investment Guidelines. The Fund, as a long term institutional investor, is seeking to capitalise on new market opportunities and instruments through a comprehensive investment diversification process.

Foreign exchange management

The liberalisation of foreign exchange transactions was advanced with the introduction of foreign exchange Act No. 12 of 2017 (FEA). Accordingly, procedures for inward capital flows by foreign investors were further simplified and streamlined while limits on outward capital flows by residents were further broadened in selected areas. The new regulatory measures also include the relaxation on foreign exchange transactions, which enable general permission to Authorised Dealers to transfer enhanced eligible migration allowance in order to overcome procedural delay.

We are in the process of reviewing stakeholders’ feedback on the new regulations, orders and directions issued in 2017 under the FEA and intend to revisit those with a view to further simplifying the regulations to improve clarity.

We intend to take actions to revisit liberalised capital transactions based on the analysis of macroeconomic dynamics supported by policy oriented research. We also plan to review the criteria in granting permission for money changing businesses to increase healthy competition among market players and reduce informal market activities. The monitoring function will be strengthened further by developing a new real time foreign exchange reporting and monitoring system to capture data on foreign exchange sales and purchases.

With a view to obtaining all data pertaining to cross border and internal transactions in foreign currency, we intend to put in place a comprehensive International Transactions Reporting System (ITRS).

Meanwhile, as there are no clear provisions under the FEA to combat unauthorised and unlawful activities involving foreign exchange, several enforceable sanctions are expected to be introduced into the FEA to enable the Department of Foreign Exchange to strengthen its surveillance of unauthorised foreign exchange market activities.

Financial Intelligence Unit

We will also act towards strengthening the national Anti-Money Laundering and Countering the Financing of Terrorism policy framework of the country. Considerable progress has been made in completing the Action Plan agreed with the FATF, and our expectation is that Sri Lanka will be taken off the FATF’s ‘grey list’ by mid-2019.

We have also expanded our reach by way of entering into Memoranda of Understanding with several agencies such as the Securities and Exchange Commission, Insurance Regulatory Commission and the Department of Motor Traffic. Moving ahead, several progressive policies will be adopted with the coordination of all stakeholders to deepen financial intelligence services.

Regional development

With a view to enhancing inclusive and balanced economic growth through effective credit delivery and financial inclusion in the country, we continued to develop and implement new development finance policy strategies during 2018.

We continued to coordinate, facilitate and implement various refinance, interest subsidy and credit guarantee schemes, while providing a range of credit supplementary services. Individuals and the Micro, Small and Medium Enterprises (MSME) scattered across the country were served by providing affordable finance through these schemes.

To increase the level of financial inclusion, a series of financial literacy and skill development programs were also conducted, with a special focus on those who have not accessed the formal financial sector. We intend to continue these initiatives in 2019 as well.

Most importantly, we initiated actions to develop a National Financial Inclusion Strategy (NFIS) for Sri Lanka with the aim of promoting a more effective and efficient process to improve financial inclusion across the country. In this regard, the Central Bank signed a Cooperation Agreement with the IFC in January 2018. As a part of the NFIS, an island-wide survey was conducted to understand the overview and landscape of the current level of financial inclusion and financial literacy across the country.

NFIS is expected to be launched by Mid-2019 to bring in financially excluded segments to the formal financial sector thereby promoting inclusive and balanced economic growth, while encouraging MSMEs in Agriculture, Industry and Services sectors by ensuring access to affordable financial services for production oriented economic activities.

Concluding remarks

Ladies and gentlemen, we have come to the conclusion of my speech.

At the outset, I mentioned that our country faced several difficulties during 2018 which threatened macroeconomic stability. However, in retrospect, I can record that the Central Bank and the Government decisively intervened and implemented several policy measures to mitigate the impact of such challenges and uncertainties. It is evident that these measures have helped us to withstand certain shocks that we faced and to ensure broader stability of the economy in spite of some sectoral imbalances.

Nevertheless, we do acknowledge that several challenges and threats still prevail and there is a plethora of impending risks that may exert further pressures on overall macroeconomic and financial system stability. We believe that pre-emptive and effective policy measures would help us to mitigate those challenges and guide our economy and the financial sector in the right direction and ultimately achieve the price, economic and financial system stability to create a conducive enabling environment to improve the living standards of our people.

We stand ready to pursue policies and introduce any course corrections if they become necessary in today’s volatile and uncertain world. Before I conclude, it is my solemn duty and responsibility to convey my deep sense of gratitude and appreciation to several individuals and parties who constantly supported the efforts of the Central Bank. First and foremost, I am extremely grateful to His Excellency the President and the Honourable Prime Minister for their leadership and guidance. I would also like to thank Honourable Minister of Finance for his support, especially to strengthen the independence of the Central Bank while ensuring the close coordination between the Ministry and the Central Bank.

Further, I owe a special debt of gratitude for the ample support and fruitful discussions and inputs from the Members of the Monetary Board of the Central Bank. My sincere appreciation goes to Secretaries to the Treasury who served as ex-officio members of the Monetary Board during 2018. I am also grateful to Mrs. Manohari Ramanathan, Mr. Chrisantha Perera and Mr. Nihal Fonseka whose unstinting support, as members of the Monetary Board, was extremely invaluable and substantive. I am also grateful to Senior Deputy Governor Dr. Nandalal Weerasinghe, and the Deputy Governors, Mr. K.D. Ranasinghe, Mr. S.R. Attygalle and Mr. H.A. Karunaratne. Their support and contribution in terms of highly professional advice and excellent technical expertise helped me to effectively discharge the duties as the CEO of this iconic institution. I would also like to acknowledge the extraordinary service rendered by former Deputy Governor, Mr. C.J.P. Siriwardana, who retired from the bank service last year.

I am also thankful to the members of the Monetary Policy Consultative Committee, Financial System Stability Consultative Committee as well as the Monetary Board Advisory Audit Committee for their valuable views and suggestions, which helped us immensely in better calibrating our policies and operations.

Last and most importantly, I would also like to express my sincere gratitude to the Assistant Governors, Senior Heads and Heads of Departments, particularly the Director of Economic Research and the Staff of the Economic Research Department for their effort in producing t